advantages Business Owner’s Guide to Purchase Price Allocation (PPA)

advantages Business Owner’s Guide to Purchase Price Allocation (PPA)

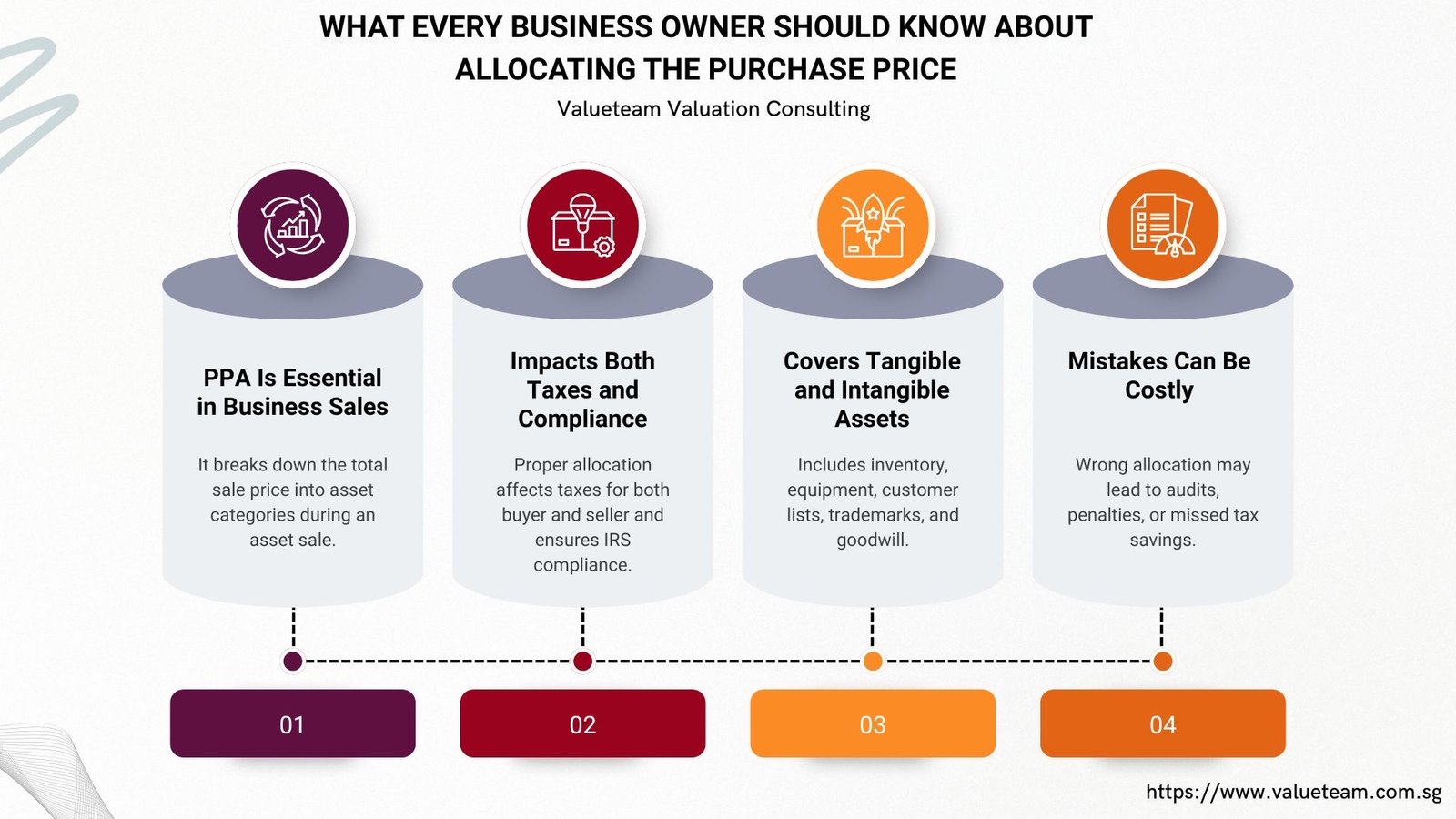

Introduction: What Every Business Owner Should Know About Allocating the Purchase Price

Purchase Price Allocation (PPA) is one of the concepts that you cannot risk skipping by when you are buying or selling a business and the method mainly involves the sale of an asset purchase price allocation Singapore.Although this can appear as a technical accounting phrase, it is important to know how to calculate the total sale price into individual assets in order to manage the tax bill and remain within the standards of the IRS.

Basically, PPA involves allocating the aggregate purchase price on the assets being sold such as the inventory, equipment, trademarks, customer lists, and goodwill. To both the taxing and selling parties, this is allocated in the manner in which gains can be considered taxed as well as the deductions claimed to be lost. When done right you will save money when done wrong you will instance audits, fines, or lost deductions.

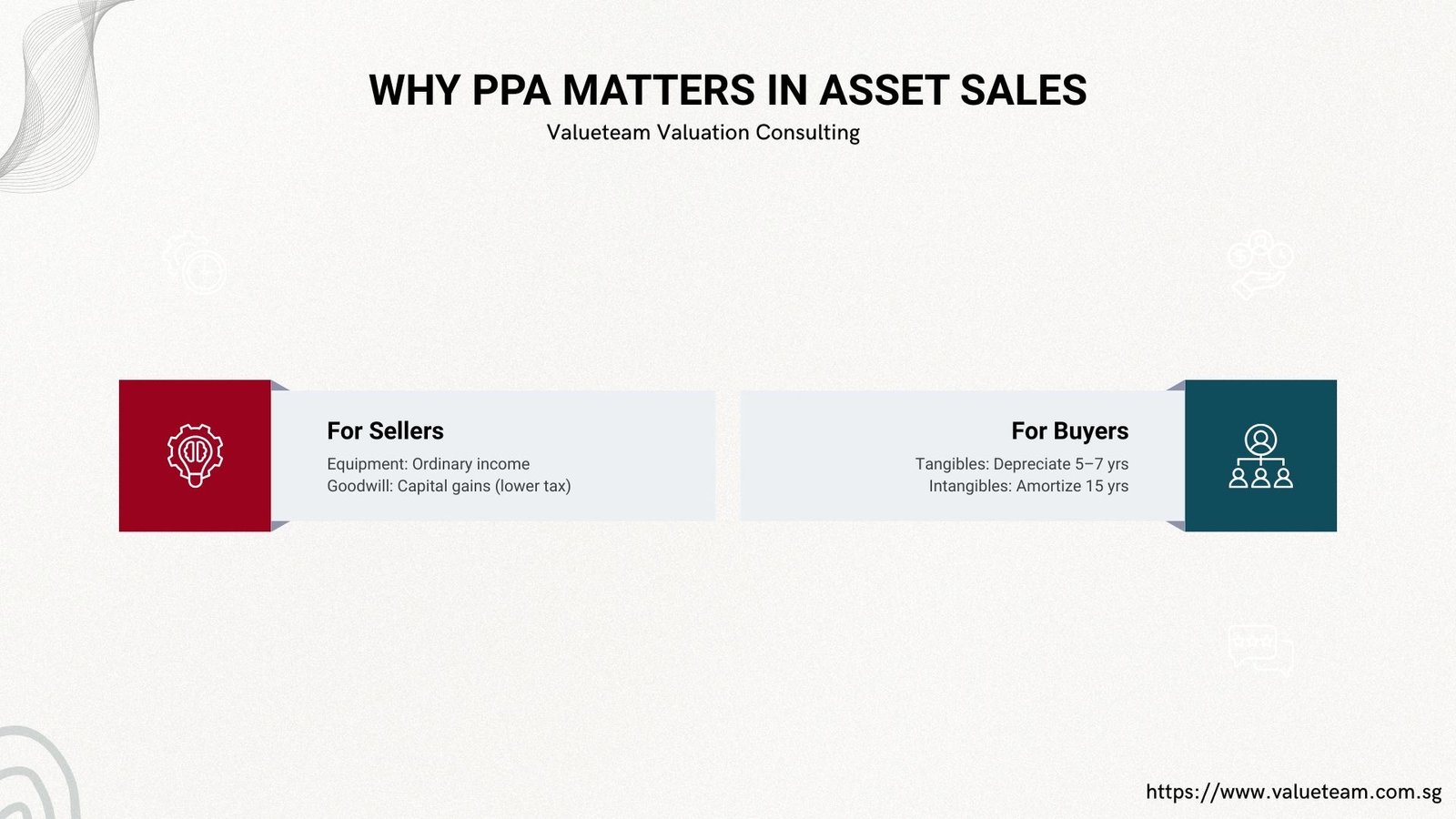

Why PPA Matters in Asset Sales

In an asset sale allocation of purchase price Singapore the buyer buys specific assets of business rather than shares or equity stock of business. That is to say, every asset obtained should be allocated a price in the entire transaction. This is required by the IRS under the Internal Revenue Code, Section 1060, and both parties are reported on the same allocations by the use of IRS Form 8594.

Here’s why it matters:

To sellers, certain taxable property can be taxed at higher ordinary income tax rates may include depreciation recapture, as well as goodwill, which is generally taxed at lower long-term capital gains tax rates.

To the buyers, allocations influence the rate at which the buyers will be able to recoup the cost of the asset through the depreciation or amortization. Depreciation of tangible assets may be done at 5 to 7 years old whereas in Section 197, intangible assets should be amortised within 15 years.

A well-designed PPA may favor both parties- when negotiated keenly and to be in good documents.

How Business Owner’s Guide to Purchase Price Allocation is Allocated

The IRS mandates that the total price of purchase should be allocated in seven asset classes as specified in a sequence:

Class I- Cash and bank deposits.

Group II -Marketable securities.

Class III – Accounts receivable.

Class IV – Inventory

Classes V -Tangible property or machinery, motor vehicles, and equipment.

Class VI – Intangible assets which include licenses, customer lists or non-competitive agreements.

Class VII -Goodwill and going concern value.

The buyer and the seller have to arrive on an agreement as to the extent of the purchase price that will be applicable to many of the classes. These sums are to be reported and are to be declared to the IRS in the official document 8594, which is going to be delivered to each of the sides together with tax returns on the required year of sale.

Common PPA Mistakes to Avoid

PPA can be deceitful otherwise. The following are the pitfalls that occur:

Overselling to Goodwill- This can be favorable to the seller since there will be reduced capital gains tax, however, there are reduced depreciation avenues by the buyer.

Omission of Intangible Assets – The omission can result in misstatements and audit risk by not recognising such things as customer lists or trade names.

Misclassifying Inventory or Equipment- It may cause recapture tax or mismatching of the business between the buyer and seller.

Form 8594 Filings which do not match Mismatched Form 8594 Filings: In case the buyer and the seller file different allocations, the IRS has the right to raise a red flag over the deal.

A smart way of preventing these problems is to hire a tax advisor to help make sure that your PPA will word in your best interest except when subject to a close to certain scrutiny.

Tips for Getting Right PPA

Otherwise, whether it’s selling or buying, these are just some suggestions on how to purchase or sell PPA correctly:

The Negotiation of the Allocation Must Be done Early on- PPA cannot be treated as an appendage. Concur on the allocations when negotiating deals have them well spelt out in the purchase agreement.

May (employ a Qualified Appraiser or Accountant) – This is particularly true of intangible assets; when you are audited you will be safe when you have commissioned a professional valuation.

Liaise with Legal and Tax Teams- ensure that each of the parties has the same documentation such as the asset purchase agreement and Form 8594.

Maintain Meticulous Records -In case the IRS decides to show up, you will be required to support the fair market value of each property.

Conclusion: Why Strategic PPA Matters in Every Asset Sale

Purchase price allocation in the sales of assets is not only a mere tax thing but also a financial decision in PPA Singaporeone that can greatly affect the two people who are involved in terms of transaction. To sellers, it may impact the classification of the received income as well as the rate on which it is being quoted. It has an impact on future deductibles and general ROI on the part of buyers.

With a clear standard of what PPA entails and the time taken to negotiate and put it down in writing, not only can IRS problems be prevented but also can you claim possible tax deductions. You should consider PPA as a long-term tactic part of the agreement regardless of the reasons you may have whether it be a period in which a small business is going to sell or you are an entrepreneur in need of buying your next deal–the results will be smarter and limits will be avoided.