Purchase Price Split in Childcare and Preschools

Purchase Price Split in Childcare and Preschools

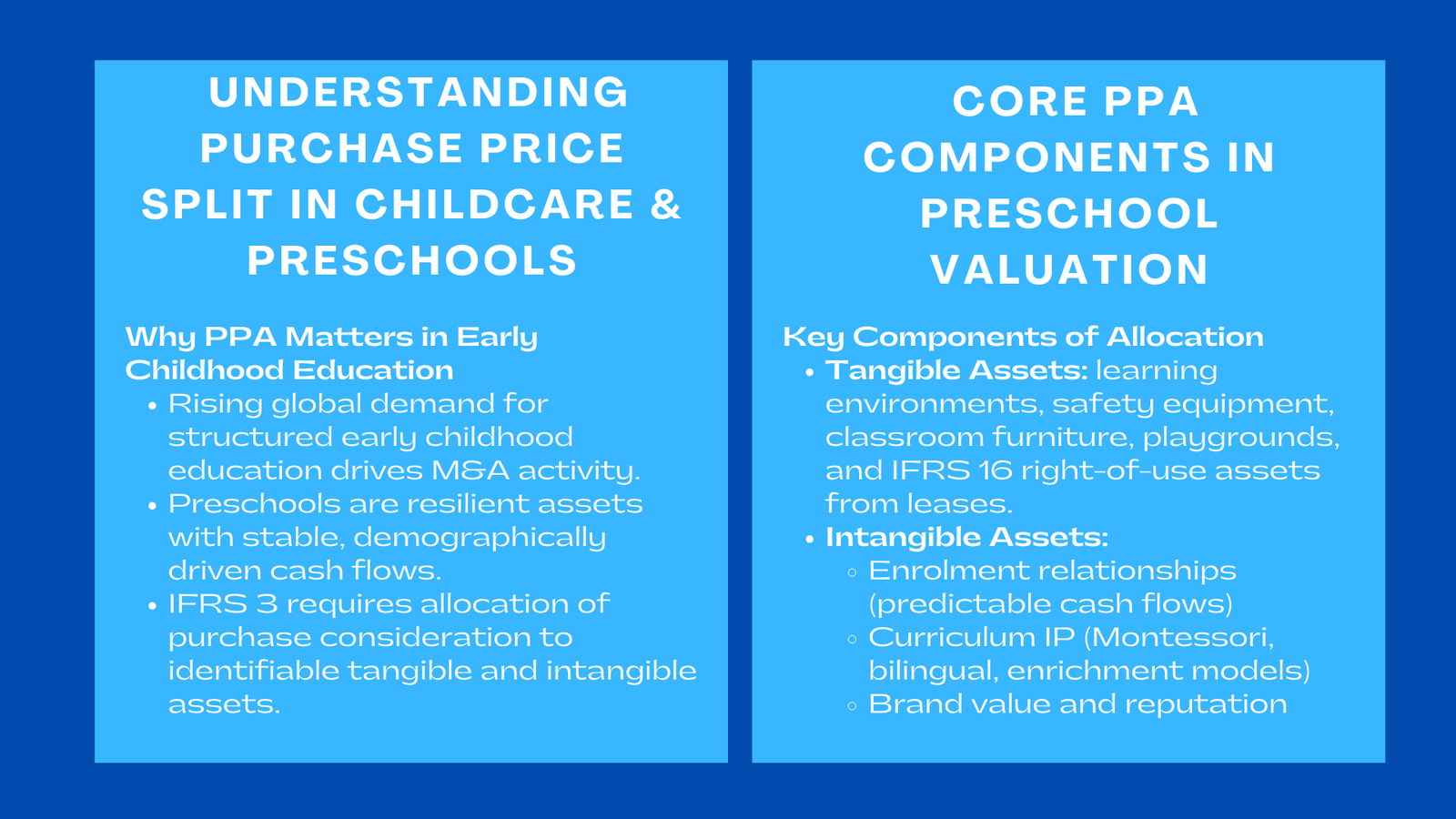

The childcare and preschool purchase price allocation has gone through an enormous transformation in the past decade as the need for organized early childhood education is growing worldwide. Governments as well as private operators and education-focused investors, have shown increased interest in the acquisition and development of preschools owing to their stable revenue models, demographic-driven demand and long-term growth prospects. In many areas, childcare centres and preschools are considered to be recession-resistant, resilient assets as early education is so critical and the importance of quality standards of child development is so high.

When a preschool or childcare centre is acquired, the financial transaction results in an important financial reporting it has to undertake under IFRS 3: purchase price allocation. This process provides the assignment of consideration paid to identifiable tangible and intangible assets instead of being credited to goodwill. Because preschools exist in highly regulated settings with respect to child safety regulations, licensing requirements, curriculum, and parent trust, a unique appreciation of how education functions and the intangible sources of value that help sustain these businesses is required for their valuation.

The need for a precise purchase price allocation is especially important for, for example, preschool groups that are expanding through acquisitions, and for investors who are entering the education sector for the first time, as well as for early childhood operators who are professionalising their governance and reporting practices. The allocation process not only ensures compliance, but also provides a mode of transparency on what is really the driving force of the financial performance in early childhood education institutions.

Unlike asset-heavy industries, preschools derive much of their value from soft assets such as curriculum quality, parental trust, brand recognition, teacher expertise, long-term enrolment stability in the preschool and both the community and psychological assurance that parents place on a safe, nurturing educational environment. These elements are not well reflected in the financial statements prior to acquisition, but they are what provide the economic value of childcare centres in the long-term.

Preschools are also in an industry where regulation compliance is merely strict and it directly affects resignation. Child to staff ratios, regulatory accreditation, safety inspections, licensing status, and conformity with national education standards are all economically impacting. A preschool that has a strong track record of regulations will have greater value because it will have minimum disruption to operations and also improves trust with parents. At the same time, one with regulatory weaknesses may need to invest more or may be subject to operational risk with a resulting impact on their purchase price allocation.

For these reasons, the purchase price allocation in the preschool sector needs to be detailed in a balanced way that finds a trade-off between educational, regulatory, and financial considerations while also meeting the early childhood IFRS reporting expectations.

Understanding Purchase Price Allocation in the Preschool Sector

IFRS 3 and Its Application to Early Childhood Education

The international financial reporting standard (IFRS) 3 requires acquirers to identify identifiable business combination purchase price and fix it onto identifiable fair value assets and liabilities. In the case of preschools, this would be the identification of the assets that were not in the balance sheet of the seller including enrolment relationships, brand value, teacher training systems, curriculum intellectual property and regulatory licenses, which is why many institutions rely on purchase price allocation training under IFRS 3 Singapore to ensure proper valuation and compliance.

There is also a distinction of identifiable intangible assets and goodwill as stipulated by IFRS. There should be separate recognition of an asset when it is based on the legal or contractual rights or when it can be separated and sold separately. Numerous preschools satisfy such requirements by currently having operation licenses, long term lease on childcare premises and proprietary teaching resources and also by established reputation amongst the community.

The early childhood IFRS reporting is associated with even more focus on compliance as the pre-schools have the preschool governance systems that can be more regulated in comparison to other service-oriented business. Legism on child safety, the facilities, qualification of staff, inspection systems, and accreditation all have a direct effect on economic feasibility and thus should be incorporated in the PPA.

The Nature of Economic Value in Childcare and Preschools

The value created by the preschools is the quality of education which is combined with the regular school attendance, parental trust and teacher competency. In a preschool the brand identification, the stability of the students enrolment and the quality of its relations with the families are likely to be the most economically meaningful assets. A preschool with a high wait list, good reputation in the community, specialized curriculum or high end education model usually has higher chances of cash flow prospects in the long term and therefore this should be reported under fair value measurement.

The preschools are of service nature, and therefore the human capital of the institution is at the centre of business. Even though the IFRS refuses to acknowledge the recognized assembled workforce as a detachable intangible asset, the teacher and staff competency contributes significantly to the value addition. As a result, goodwill is caused by the quality of the faculty, internal systems used by the school to develop its teachers, and the school culture rather than intangible assets which the school recognizes.

Core Components of Purchase Price Allocation in the Preschool Sector

Tangible Assets: Facilities, Equipment, and Learning Environments

In preschools, tangible assets fail to constitute a significant percentage of the overall enterprise value but are needed to conduct business. These assets comprise playground structures, classroom furniture, security systems, learning materials, building improvements, safety equipment and other physical factors to ensure those meeting the child welfare standards. The valuation they have is based on their evaluating condition, replacement cost, regulatory compliance and correspondence with licensing requirements.

A large number of preschools do not have property ownership and have their operations based on long-term lease arrangements. Under these circumstances, the right-of-use asset that is identified in IFRS 16 will enter in the PPA analysis. Adjustments in fair values are the terms of the lease, clauses of escalation and suitability of the premises to the childcare activities.

Intangible Assets: The Heart of Preschool Valuation

Preschools usually have the vastness of their intangible assets as a large part of their value. These immaterial assets go hand in hand with qualitative education, regulatory control and parent associations.

The customer relationships that are based on enrollment constitute one of the most valuable intangible assets when it comes to preschool valuation. The constant enrolled customer base and the presence of periodic fee arrangement generates predictable cash flows that are comparable to the subscription-based revenue models. The economic value of these relationships is exhibited by parent trust, their satisfaction, waitlist strength, likelihood of renewing and community engagement.

Another important intangible asset is usually curriculum intellectual property. Structured instruction mainstream, special, bilingual education programs, Montessori systems with high enrichment modules held in preschools have curriculum holding that may be identifiable separately on the condition that they satisfy the IFRS identifiability requirement. These resources are the ones that distinguish the preschool among the competitors and act as part of competitive advantage.

The value of the brand is significant in terms of price allocation during purchases in pre-school. Parents tend to establish childcare providers with reputation on safety, standards of teaching, and school identity. Strong brands are recognized to establish trust over a period and thus charged higher fees hence the importance of brand-related intangible value toward an essential constituent of fair value.

Other important intangible assets are also regulatory licenses and accreditations. A preschool can not exist in the market as it is not allowed to conduct without the standards of licensing. Such licenses are economically important in that they minimize operational risk as well as the centre can make a profit as soon as it acquires them.

Goodwill: Capturing Community Trust, Educational Culture, and Future Potential

Any un- classifiable goodwill of the purchase price is a result of allocating values on identifiable assets. Goodwill in the preschool market is an indication of the community trust, philosophy of education, expertise of staff, pedagogical culture and synergies, which are expected due to the takeover.

Goodwill too constitutes the element of business stability, reputation within parent networks as well as the capacity to sustain strong internal processes that aid student engagement and operational stability. A preschool becoming part of a larger group of education has the potential to produce some of the gains in the anticipated resources, including increased curriculum services, administrative backup, improved marketing solutions, or technological resources. These synergies are created in the goodwill and add to the economic expectations in the long-term.

External Factors Influencing Purchase Price Allocation in Childcare and Preschools

Regulatory Standards and Government Oversight

One of the most regulated sectors in the service industry is the early childhood sector, and therefore, this has a direct effect on valuation. The inspection outcomes of government and records of compliance, child safety, renewal of permits, and qualification of teachers all influence the fair value of assets. Preschools that have a good track record of regulation are expected to fetch more because of low risk of operation. On the other hand, centres needing regulatory redistribution or facility renovations could be subjected to an allocation of purchase prices down.

Demographic Trends and Parental Behaviour

The parental expectations, the local population patterns, household income levels, and the presence of other potential childcare providers influence the enrollment demand in the preschools. The demographic growth, urbanization, more parents working, and high educational preference to early childhood development influences the predictability of cash flows in the future. These demographic aspects determine the assumptions of the valuation of intangible assets and the goodwill.

Educational Quality and Reputation Dynamics

The qualitative aspect is very sensitive in preschool valuation. Parental-decision is influenced by the perceived quality of teachers, existence of strong leadership, consistency in curriculum delivery and safety culture. Since reputational assets are very difficult to create in a brief time, the presence of high community embeddedness could result in a premium value in a preschool. On the other hand, preschools which have experienced management change, complaints of low quality or taint of reputation may experience lower valuation of the intangible assets.

Conclusion to Purchase Price Split in Childcare and Preschools

This is a deep analysis process and involvement of purchase price allocation in childcare centres and preschools is quite complex and needs knowledge of educational operations, regulatory frameworks, parental behaviour and value creation that are not tangible. Since preschools are largely dependent on enrollment stability, trust-based relationships, as well as curriculum assets, regulatory licenses and brand recognition to provide them with much of their economic value, PPA is very crucial in effectively illustrating the actual framework of the purchased business.

Strict and documented allocation of purchase price guarantees adherence to early childhood IFRS reporting besides giving the investors and the operators insight into the value drivers that promote sustainability of performance over a long period. With the early childhood IFRS reporting further development of the sphere of early childhood education in the global context and the increased demands of parents on the high quality of the acquired programs, the role of the clear valuation and the equal share of the purchase price in the parental demands will only develop. Disciplined PPA practices in the preschools will be in a better place to ensure that they are financially clear, sustain investor confidence, and provide consistent and high-quality educational experiences to children and families.