Importance of PPA in Mergers and Acquisitions

Learn the Importance of PPA in Mergers and Acquisitions

In mergers and acquisitions (M&A), the size of the deal, the strategic reasoning, or competitive advantages of the mergers and acquisitions tend to be in the headlines. But, behind the successful transaction always comes an important post closing activity which determines how the deal will be reported, in terms of tax, and the perception created: Purchase Price Allocation (PPA). Although it seems to be a technical accounting requirement, PPA has big impacts on both financial reporting and tax planning.

When properly completed, it not only makes sure that it is in compliance with the accounting standards but can also affect future profitability, cash flows and shareholders value. Many businesses rely on expert PPA valuation consulting Singapore as part of their efforts in understanding M&A valuation process Singapore and ensuring accuracy during M&A valuation due diligence Singapore.

Understanding Purchase Price Allocation in the M&A Context

Purchase Price Allocation is carried out by assigning the total amount paid on the acquisition date to the individual assets acquired and assumed liabilities in the acquisition based on their individual fair values at the acquisition date. The residual value of the purchase price, in excess of net fair value of assets, is recognized in the form of goodwill. Business combinations require the application of PPA under IFRS 3 Business Combinations or ASC 805 US GAAP.

PPA is necessary to the acquisition of the company to make sure that the purchased entity is reflected in its true economic picture by the financial statements used by the acquiring company. In the absence of it, all the consideration may be categorized as goodwill and oblige stakeholders to lose the understanding of the value of tangible and intangible assets acquired. PPA can be useful in providing this transparency where the value of the purchase is divided into what can be identified as components e.g. inventories, property, intellectual property and customer relationships etc. Entering into PPA pre-conditions subsequent accounting treatments such as depreciation and amortisation and testing of impairment.

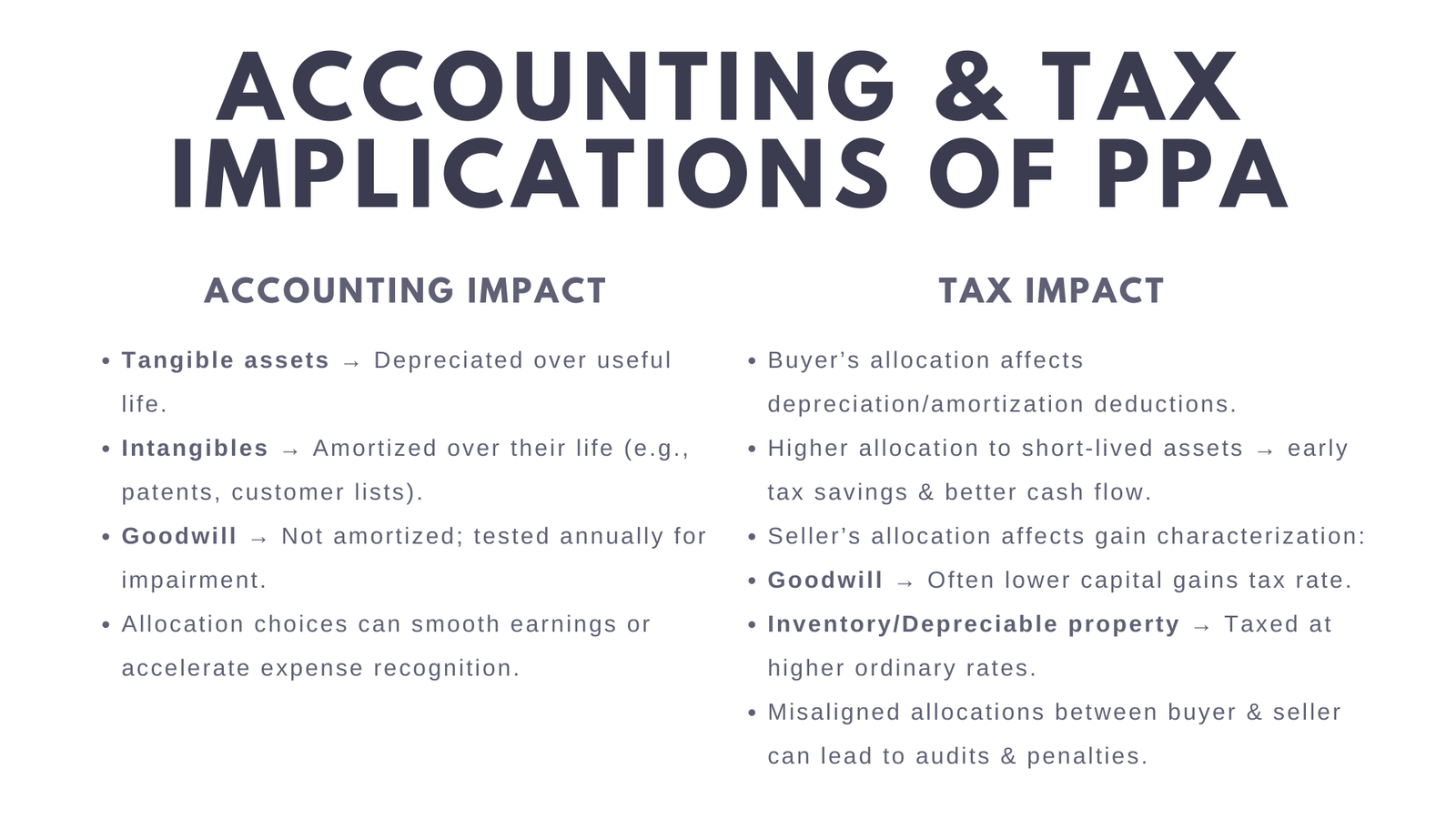

Accounting Implications: Beyond Compliance

On the accounting perspective, PPA has a huge implication to the balance sheet of the acquirer and the effects which will occur on the income statement in the years to come. Every kind of asset listed in the allocation has its own way of accounting. Tangible assets like buildings or machines are depreciated during the useful life of such assets Intangibles such as patents, list of customers, or computer software are depreciated over their life. Although goodwill does not get amortized under IFRS as well as US GAAP, it is exposed to an annual impairment test.

As an element, PPA influences the reported incomes with regard to accuracy. Just to give an example of this, assigning a higher value to those assets which have shorter depreciation or amortisation periods will recognize expenses in the short term, and this would reduce the reported profits, and can also reduce the taxable income. Allocation to long-lived assets or goodwill causes expenses to be amortized over longer periods, smoothing out the income statement of the company, but this may postpone tax advantages.

Good PPA also improves comparability and credibility reporting. Investors and analysts will use the specific disclosure of allocations to determine whether or not the management paid a fair price and to understand what assets will create returns in future. Badly done PPA may cause misstatements, restatements, or impairment charges that destroy the confidence of the investors.

Tax Implications: Structuring for Optimal Outcomes

Whereas so much of accounting standard is tied into fair value reporting, the thinking of the tax authorities is more in the line of what is the taxable gain by the seller and what is the tax basis to buyers. In such jurisdictions like the United States, the treatment of purchase price allocation has both short-term and long-term tax implications on both parties with implications reported on forms like IRS Form 8594.

Buyers are affected by the allocations that will determine their basis of the individual assets that will determine the depreciation and amortization deductions. Increased allocations of value to assets that are subject to accelerated depreciation can generate meaningful short-run tax savings after the acquisition that lead to enhanced cash flows. Customer relationships or patents are intangible assets which may be amortized on fixed bases resulting in deductions over a long period.

There is an impact on the character of gain to sellers by virtue of the allocation. The same allocation to capital assets like goodwill may be subject to lower capital gains tax rates whereas allocations to the inventory or depreciable property may lead to ordinary taxation at a higher rate. Tax payers see these contradictory incentives of tax and PPA tends to become an area of bargaining, each party is seeking to have an allocation which benefits them most in a tax sense.

Since tax authorities need balanced allocations, so that allocations made by both parties are equal, there is always a need to align things. The differences may lead to audits, penalties or corrections that reduce the value of the transaction. This necessitates an early negotiation and preparation of the allocation documentation as an essential process in transaction planning.

The Strategic Intersection of Accounting and Tax in PPA

The dual character of PPA to fulfill both accounting and tax duties gives the opportunity to align the strategies. Although accounting is based on fair value, there are flexibility in the way valuations are carried out particularly in intangible assets that cannot have an active market. This is very flexible hence can be utilized to strike a balance between financial reporting objectives and tax efficiency provided that allocations are supported by ample documents.

To give an example, one acquirer would recognize and capitalize more intangibles as opposed to a high residual on goodwill. The accounting benefits of this are that it offers additional reporting and results in decreasing chances of goodwill impairment. Tax-wise, it gives rise to amortizable assets that generate deductions in the long run. On the same note, fair value assessment of tangible assets as per the accelerated depreciation policies may be able to increase early cash flow without undermining the honesty of finances.

It is all about planning integration among the accounting, tax and deal teams. The greater financial strategy of the acquirer, the need of cash, and the integration plans should be the basis of decisions made regarding allocation. These considerations should also, in global transactions, consider the denoting of the local taxation regulations and the international accounting norms, making sure that allocations are both optimized and compliant.

Goodwill: Residual Value and Risk Management

The single highest amount in a PPA most often is goodwill, the premium paid to a PPA over synergies, market position or other advantages that cannot be segregated. Goodwill may be an indicator of optimism in the long term value of the acquisition but it is risky too. Due to the fact that goodwill is not amortized it happens to be present in the balance sheet until it gets impaired which might happen when the expected synergies are not materialized.

The threat when the potential impairment charges can take place is high when the goodwill balance is also high, and this may impact the earnings and the views of investors negatively. Effective PPA aims at reducing the presence of goodwill residue through the identification and valuation of tangible and intangible resources. This method is more reliable to understand what has been acquired, and it forms assets with a benefit of amortization or devaluation treatment adding to the shift of relying on goodwill as the broad category.

Documentation, Valuation, and Audit Defense

PPA will have to be aided by valuation work and documentation that is solid because the stakes are high. Allocation by tax authorities and the audit may be contested, especially when they seem to benefit the tax position of one party or where value-at-risk involves assets whose prices are not within the market norms. Use of formulae such as relief-from-royalty in determining a trademarks value or multi-period excess earnings in relation to customer relationships, which are recognized methodologies, can give defensible backing to independent valuations.

Documentation must not only contain the result of the valuation but also details of the assumptions, sources of data and methods employed. This will provide an evident audit trail and a good faith process of allocating that can be said to be traveled according to standards and tax regulations. Such documentation may be a matter of life and death in the event of dispute or audit and is therefore important to prepare.

Conclusion: PPA as a Critical Deal Component

Purchase Price Allocation is something much more than a postscript of an M&A deal. It will be a vital link between the price paid in the negotiations of a deal and the current economic and tax reality of the deal. In accountancy, it influences the balance sheet, the earning and allows open reporting. On tax, it identifies future deductions, sets an impact on the tax liability of the seller, and can heavily alter the amount of money in deals.

PPA can help ensure that accounting and tax goals work together, that investor confidence is boosted and that the most value is obtained as a result of a transaction when approached strategically. It involves accountants, tax advisors, valuation experts and deal teams to align so that allocations will be correct, defendable and also strategic.

PPA is the key that can be overlooked with the severe expense of M&A in the competitive and already highly scrutinized world of M&A. There is no need to fear the accounting and the tax complexity of this requirement, and with proper management of the process, without error, the companies can make this an advisory of long-run values.