Best PPA Essentials for SMEs in Singapore

Best PPA Essentials for SMEs in Singapore

Introduction: Understanding PPA in Small Business Deals

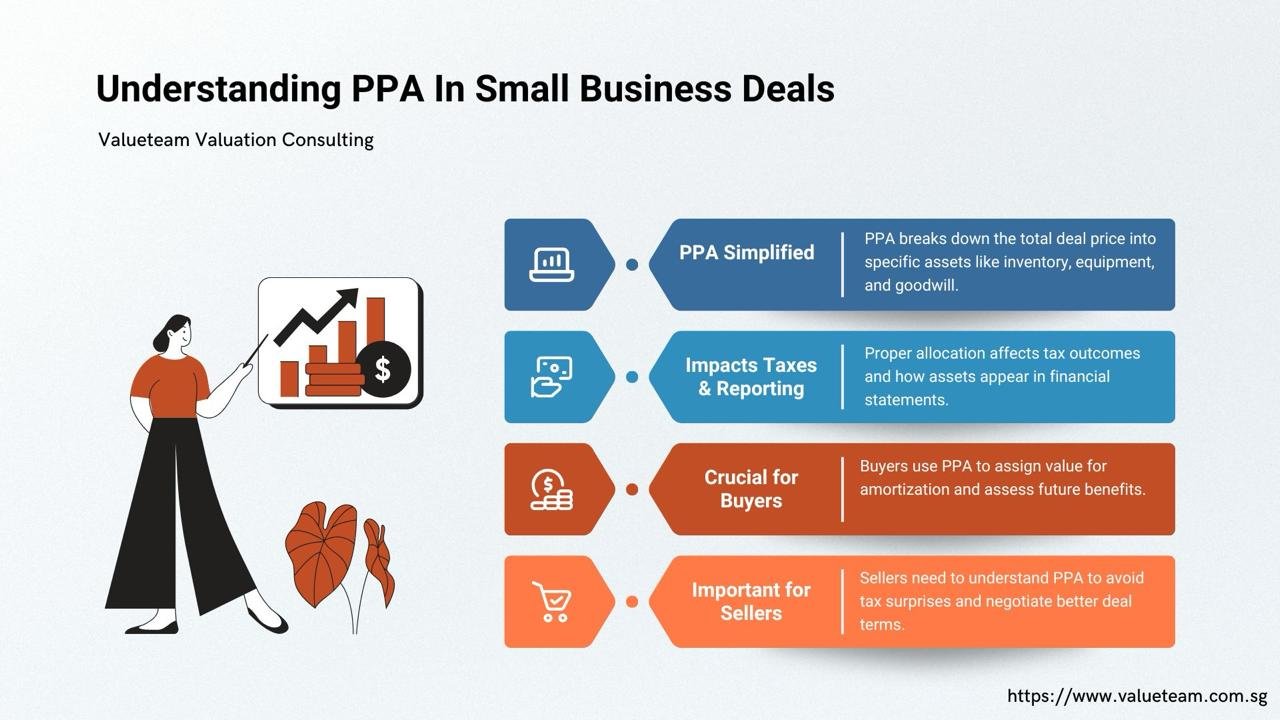

This is because, when you are a small business owner and you have considered either selling your business or you are taking a business purchase, you have surely heard of the term called Purchase Price Allocation, a term also known as Purchase Price Allocation, or, PPA, as it is commonly referred to. It can be considered accounting speak, but it has a huge connection to the way you pay taxes, advanced financialreporting standards and compliance, and even the valuation of your business after the deal.

In straight terminologies, PPA (Purchase Price Allocation) Singapore refers to the process of disaggregating the total prices paid in a business acquisition to the actual assets being acquired such as in terms of inventory, equipment, customer lists and goodwill. Playing the roles of both a buyer and a seller, the knowledge of the manner in which this price is divided will determine whether you close a brilliant bargain or a purchase failure.

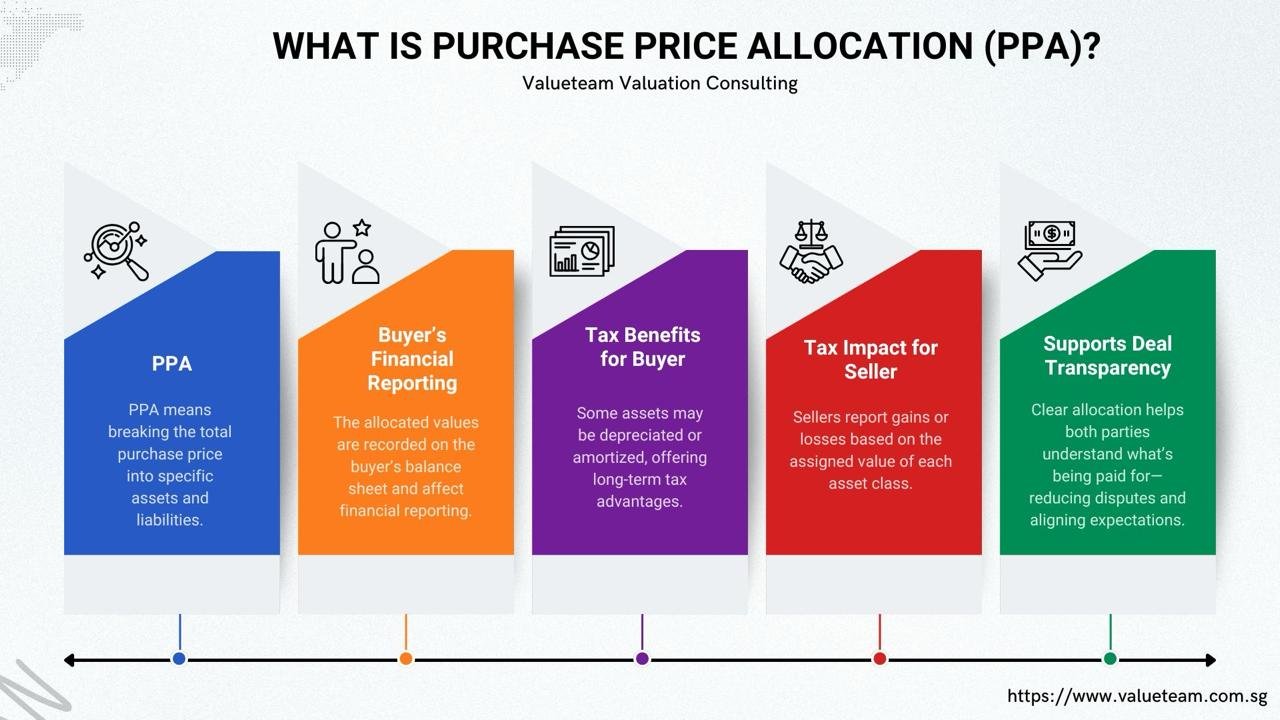

What Is Purchase Price Allocation (PPA)?

In a case where a single business buys out another one, the acquirer does not simply pour in some hefty amount of money and consider the process over with. The initial cost of purchase must be apportioned overgrown individual assets and liabilities comprising gauged company. They could be either physical such as office equipment or property and intangible such as the relationships of employees with customers or brand names.

The purchaser accounts these values on the balance sheet it releases them, and according to the identical manner at which they are set, they can either be depreciated or amortized over due course- agreement that deterrents some taxes. Contrarily, the sellers record profits or losses as well depending on the worth of each asset category.

Why PPA Essentials for SMEs in Singapore

You may also be thinking that PPA is a process that applies to large companies, or even complicated mergers which is not true. Even an acquisition between two SMEs has to be in accordance with accounting standards and tax standards. Failure to distribute the purchase price properly might get you into a foreign with the taxing bodies or certain unforeseen expenses in the future.

This is why the owners of small businesses need to care:

Tax consequences: The treatment of the price between assets such as inventory or goodwill can significantly have an impact on the amount of tax you will pay (or save).

Standard compliance: Reporting should be done correctly on such standards as the International Financial Reporting Standards 3 and local taxation regulations.

Transparency in the post-deal: When a sale occurs, investors and other stakeholders would desire to view clean books and justifiable valuations.

Common Asset Classes PPA in Singapore

PPA generally classifies the assets into particular classes. Common ones in case of small businesses would involve:

Inventory: Products out of storage. Profits in this case can be treated as ordinary income taxable to the seller.

Physical property: Furniture, fixtures, vehicles, and equipment- these are depreciable within a specific amount of years.

Intangible assets: Intangible assets are e.g. customer lists, brand name, proprietary software or license. This is usually amortized between 5-15 years.

Goodwill: This is the difference of excess of the fair value of assets. Goodwill is not amortized, which requires both the test of impairment once a year.

The breakdown of the connections among these buckets of value in your business will enable you to better plan and eliminate tax surprises.

Best Practices for Small Business PPA in Singapore

You could not identify yourself as a financial expert, but there are some practicable things that you could undertake to make sure that your PPA is properly managed:

1. Collaborate with an expert counselor.

PPA can be associated with the valuation methods and taxation principles, which may become quite tricky within a short time. By having a certified public accountant (CPA) also known as a valuation expert you’re getting the numbers right- and staying in compliance, too.

2. Obtain the distribution in paper.

When you are selling your business be sure that the purchase agreement has agreed allocation schedule. The values to be registered by both the seller and the buyer must be identical to stave off red flags.

3. Realize and recognize intangible assets valuation in Purchase Price Allocation

Most of the small businesses ignore the intangible assets such as databases of customers, business systems or trade names. Unless these are well valued, then you may not receive benefits of amortization or may not report on the value of the business.

4. Stay aligned with tax laws

In different jurisdictions, taxation on PPA differs. An example is that there are some assets that are treated to destroy or claim capital gains. This means that when you know that something that works in your country, then you are likely to position yourself optimally.

Example: How PPA Plays Out in a Small Business Deal

Suppose that you sell a business of yours to someone at $500, 000. That could be assigned in the following way:

Inventory: $50,000

Equipment and fixtures: $100,000

Customer relationships: $75,000

Software and database: $25,000

Goodwill: $250,000

On the side of the buyer that 200,000 earmarked to depreciating or amortizing asset (equipment + intangibles) can be added “[over] time] reducing the amount of income that is liable to tax among the buyers. To the seller, the way these categories will be treated will be a difference between the amounts that will be taxed as capital gains and ordinary income.

These allocations may be easily distorted without proper planning, be it increasing the tax levels or creating accidents of disagreement with the tax administrators.

Mistakes to Avoid in small business PPAs

Examples of pitfalls in small business PPAs are:

Valuing goodwill: Also not tax-deductible, but easier to record, goodwill may add to the impending risk of impairment losses linked to the future.

Omission of professional valuation: DIY reports may not survive scrutiny by the auditors.

Revenue ignoring deferred tax effects: Balance sheet differences in book and tax account may generate future liabilities.

Failure to update following a close period of adjustment: When the final purchase price is modified, then the allocation should be changed accordingly.

Conclusion: Treat PPA as a Strategic Step

To the business owner of a small-scale company, Purchase Price Allocation is not merely a check to mark when disposing of the business but rather a key strategic management instrument that influences the relationship between taxes, financial statements, and the outcome of the actual deal. Whether selling or buying, having the knowledge of PPA enables you to hedge against value, avoid regulations, and make future plans.

Allow yourself time to engage in consultation with regulated professionals, make documentation very specific and mutually agreed and treat PPA as a long term investment in your fiscal sanity. Successful implementation of PPA may imply the possibility of smooth audits, more efficient cash flow, and a good relation between buyers/Normal sales and sellers in the future.