Benefits Avoiding Depreciation Recapture Pitfalls in Small Business Purchase Price Allocations

Benefits Avoiding Depreciation Recapture Pitfalls in Small Business Purchase Price Allocations

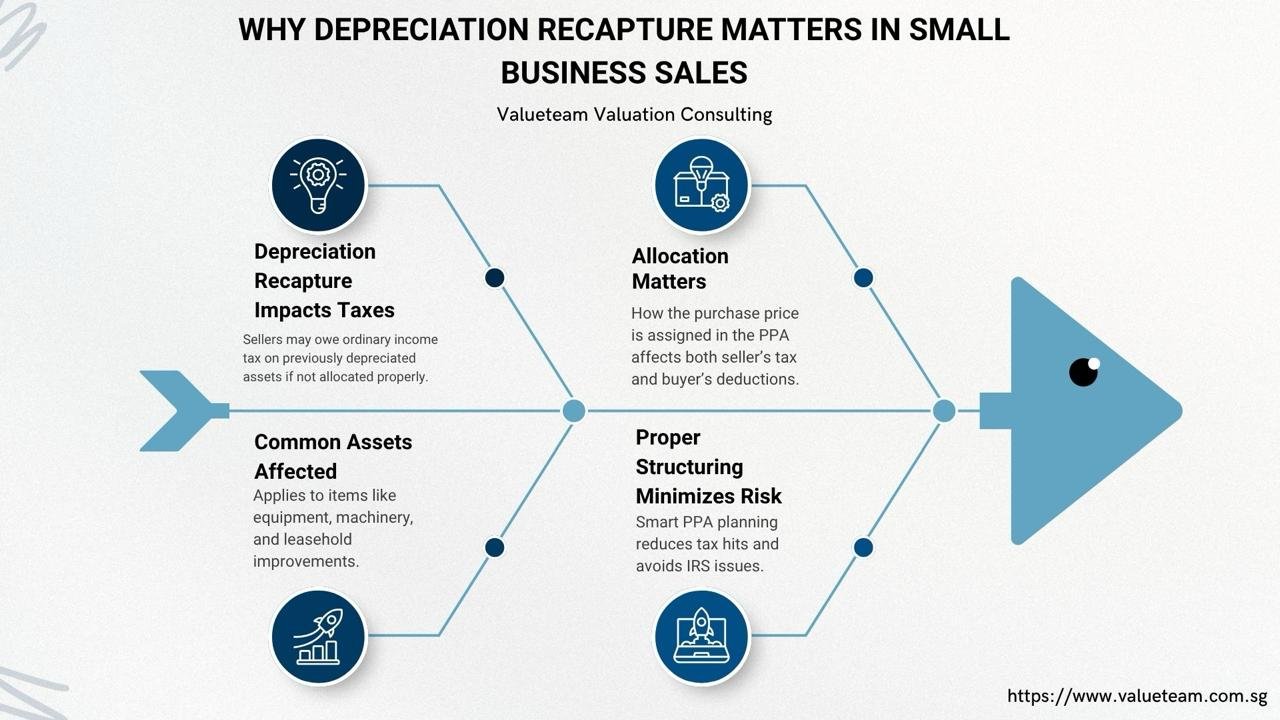

Introduction: Why Depreciation Recapture Matters in Small Business Sales

In the sale of a small business, it’s easy for both buyers and sellers to focus solely on the total transaction price, often overlooking a critical factor: depreciation recapture. Depreciation recapture occurs when the sale price of an asset exceeds its adjusted tax basis, usually applying to equipment, machinery, vehicles, or leasehold improvements that have been depreciated over time. How the purchase price is allocated through the Purchase Price Allocation (PPA) can significantly influence the seller’s tax liability. Proper allocation can reduce the amount of recapture taxed as ordinary income, while poor allocation may unexpectedly increase the seller’s tax burden, potentially affecting the net proceeds from the sale.

Careful PPA planning is therefore more than just an accounting exercise—it is a strategic approach to protecting cash flow, minimizing potential IRS scrutiny, and ensuring compliance with tax regulations. By thoughtfully distributing values between depreciable assets and intangible assets, such as goodwill, trademarks, or customer relationships, sellers can optimize their tax outcomes while buyers can benefit from future amortization deductions. Additionally, documenting the rationale for asset valuations, involving qualified valuation professionals, and coordinating IRS reporting (Form 8594) helps avoid audits, penalties, or disputes. Ultimately, understanding and proactively managing depreciation recapture within the PPA process allows both parties to achieve a fair, tax-efficient, and financially secure transaction, ensuring smoother post-sale operations and long-term confidence in the deal.

Understanding Depreciation Recapture Pitfalls in small business PPA

Depreciation recapture occurs when the adjusted tax basis of a sold asset is less than its sale price, and the difference is taxed as ordinary income, not at capital gains rates. In a business sale, the IRS requires buyers and sellers to allocate the purchase price across asset classes—cash, inventory, equipment, and intangibles. Depreciated assets like computers, vehicles, and furniture are particularly sensitive, as higher allocation to these increases the seller’s recapture tax liability. Misallocation can lead to unexpected tax bills and compliance issues.

Common Mistakes Small Business Owners Make

A large number of those in business, who are small business proprietors, and especially first-time sellers, are ill-aware of the tax impact of recapture of impact of depreciation methods on financial reporting in Singapore before this is unfortunate to happen to them. Here are some common errors:

Leaving allocation to the buyer: Failing to negotiate PPA upfront risks unwanted tax consequences.

Over-allocating to tangible assets: Increases buyer depreciation but triggers higher recapture taxes for the seller.

Underestimating goodwill/intangibles: These typically enjoy capital gains treatment, which is tax-favorable for both parties.

Inconsistent IRS Form 8594 filings: Both buyer and seller must report the same allocation; discrepancies can trigger audits or penalties.

Smart Strategies to Minimize Recapture Risk

Negotiate PPA early: Include the agreed allocation in the sale contract.

Balance asset classes: Allocate between depreciable assets and goodwill allocation of purchase price Singapore/intangibles for optimal tax treatment.

Hire valuation professionals: Ensure accurate, defensible valuations, especially for intangible assets purchase price allocation Singapore.

Document rationale: Record fair market values, asset conditions, and third-party inputs.

Coordinate Form 8594 filing: Ensure both parties report consistent allocations to avoid IRS issues.

Real-World Example: How Allocation Impacts Tax Liabilities

A $1M logistics business sells trucks (fully depreciated), office equipment, a customer list, and goodwill. Allocating $300K to trucks triggers high recapture taxes, while allocating more to goodwill/intangibles reduces taxes and maximizes net proceeds. Collaboration with a tax advisor ensures a fair, compliant allocation.

Conclusion: Turning Recapture Risk Into Strategic Advantage

Depreciation recapture doesn’t have to hurt a business sale. Strategic PPA planning, professional guidance, and careful documentation can minimize tax exposure, ensure IRS compliance, and create a tax-efficient, win-win outcome for buyers and sellers.