What You Ned to Know Purchase Price Allocation FAQs

What You Ned to Know Purchase Price Allocation FAQs

Purchase Price Allocation (PPA) is one of the most important elements in the field of mergers and acquisition (M&A) and may leave behind more questions than answers on the part of business owners, CFOs and lawyers. The effect of PPA goes further than tax implications; it extends to financial reporting and valuation methodologies of a company and the process is not only a compliance requirement; but also a strategic process that has an effect on the long-term value creation, goodwill recognition, and amortization schedules.

This article looks into the most common questions (FAQs) which were raised concerning the Purchase Price Allocation and come up with an approach that would help in elucidating technical matters and revealing the strategic importance of Purchase Price Allocation in the current dynamic deal-making world. For organizations seeking expert support, PPA valuation services in Singapore can provide clarity and compliance assurance, while independent M&A valuation services in Singapore help ensure accurate transaction reporting. Choosing the best PPA services for Singapore businesses is crucial to aligning both financial and strategic outcomes of an acquisition.

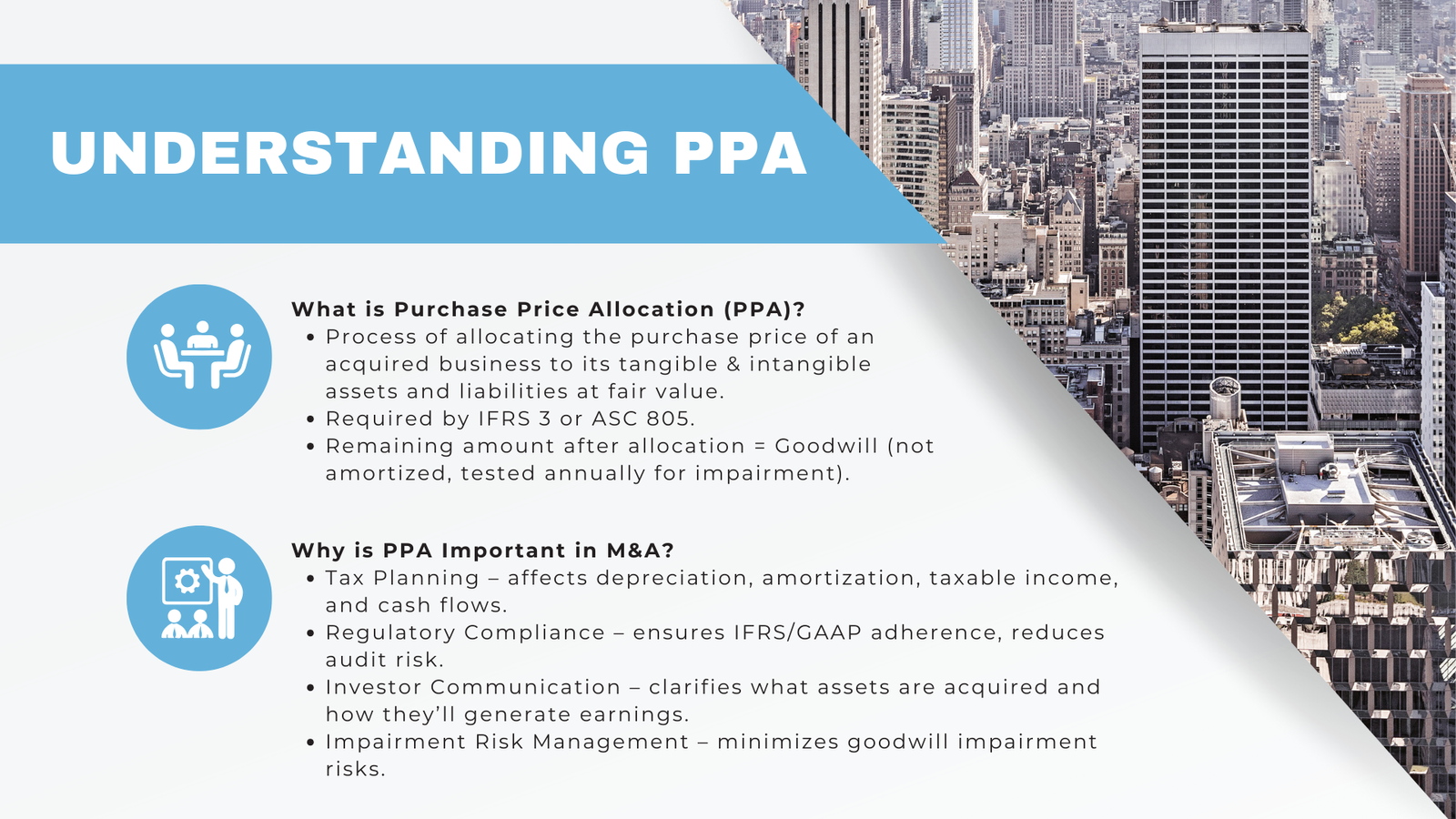

What Is Purchase Price Allocation (PPA)?

The concept of allocation Purchase Price Allocation (PPA) refers to an allocation of purchase price of a business, formerly acquired, to respectively allocated tangible, as well as intangible assets and liabilities. This allocation is carried out as per the requirement of financial reporting in a jurisdiction depending on IFRS 3 or ASC 805.

Whenever a company buys another one, they are usually buying not only tangible assets such as equipment and buildings but also the intangible ones, such as trademarks, relationships with customers, or a proprietary technology. These types of purchases should have a fair distribution of the purchase price. What is left following the process of allocation of fair values to the identifiable assets and liabilities is taken as goodwill and these are not subjected to amortization though impairment testing is carried out annually.

Why Is PPA Important in M&A Transactions?

PPA is vital in the post-acquisition financial figures that facilitate transparency and correctness. The implication of this goes beyond its accounting relevance to strategy:

- Tax Planning: Plan a purchase price allocation; depreciation and amortization of assets or liabilities may be affected thus the direct impact on taxable income and cash flows.

- Regulatory Compliance: IFRS or GAAP compliance is achieved through correct PPA which will reduce risk of audit and regulatory examination.

- Investor Communication: The investors obtain a better understanding of which assets have been purchased and how they are going to give subsequent earnings.

- Impairment Risk Management: Express allocation will minimize the threat of goodwill impairment, which can produce a worst effect of future financial reporting.

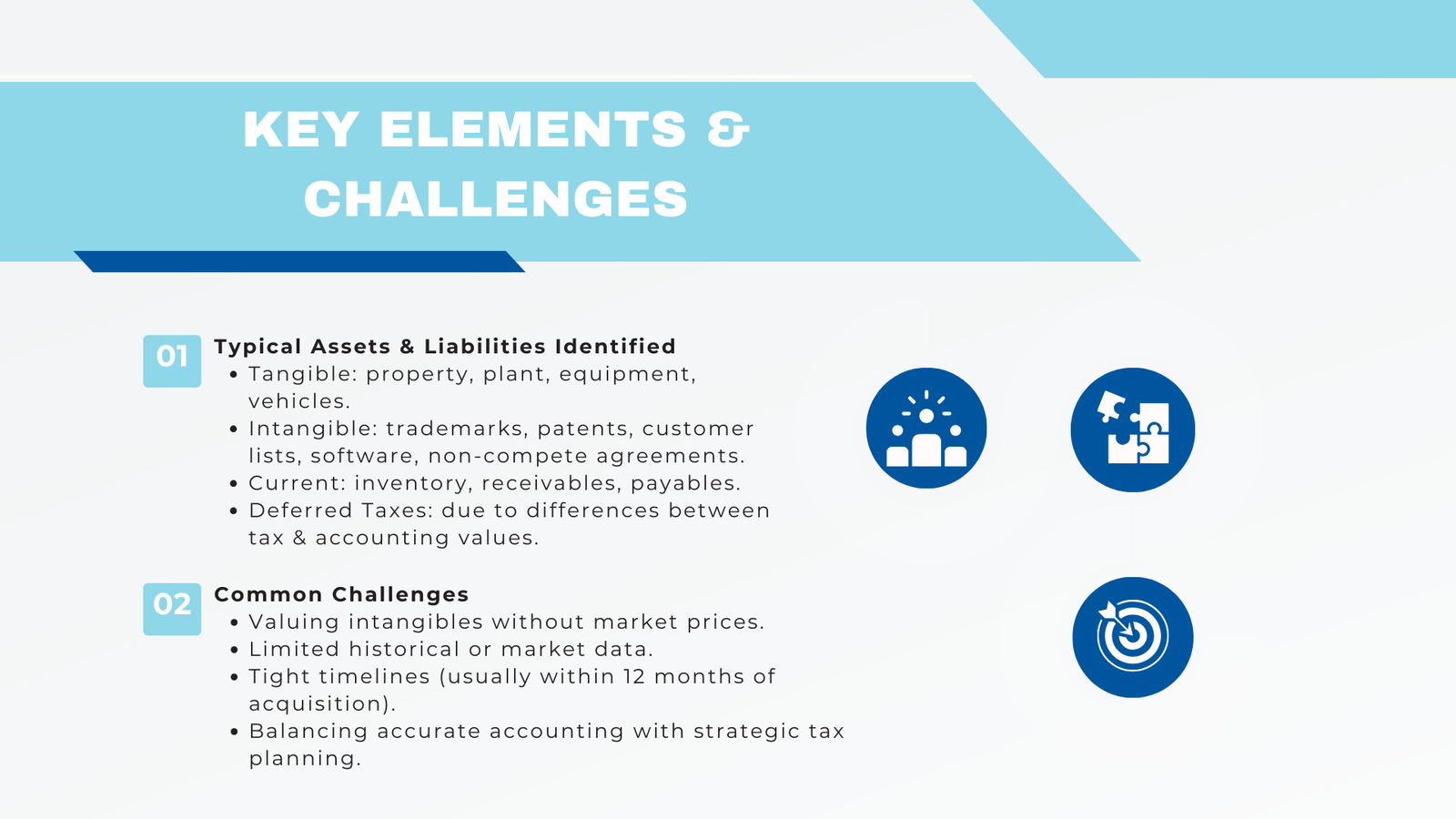

What Assets and Liabilities Are Typically Identified?

Under a typical PPA the assets and liabilities which are identifiable and possible to be separated with the business are established and valued at fair value. Assets widely known are:

- Tangible Assets: physical property, plant and equipment, company motor vehicles.

- Intangible Assets: Trademark, patent, customer list, proprietary software, non-compete agreement.

- Current Assets and Liabilities: Inventory, account receivable, account payable.

- Deferred Tax Assets/Liabilities: Emerging because of short term disparities between the tax and accounting values.

Intangible assets are the ones that are sometimes the hardest to value for they do not have a readily observable market price. One method that valuation specialists may employ in order to ascertain their fair value includes the cost method, relief-from-royalty method, or even through the excess earnings method.

What Are the Common Challenges in Conducting a PPA?

Another of the main difficulties is the valuation of intangibles. They lack a physical existence and may not possess active markets and hence identifying their fair value would have to be done thoroughly and with knowledge.

The other complexity is availability of data. Privately held companies may not be able to access past financials or comparative information in the market. Consolidation of systems and data of both the acquirer and acquirer after the transaction may slow down the process of PPA.

In addition, the time of communication is very important. Financial accounting usually demands completion of PPA settlement within a period of 12 months of the date of acquisitions. In this process, companies might be required to make tentative allocations which shall later be completed when all the required information is available.

Finally, it is sometimes hard to find a balance between the two (accounting accuracy and strategic tax planning). Any over-allocation to amortizable intangible may produce short term tax advantages but may raise eyebrows during audit or manipulate the financial statements.

How Does PPA Impact Tax Reporting?

The treatment of purchase price does not only influence the accounting standard but also tax treatment. Such as, in the asset purchases, the buyer can attribute a larger percentage of the purchase price filling the one that depreciates quicker (such as equipment) or amortizing (such as some intangible actions). The effect is bigger deductions of tax in the previous years, and this improves cash flow.

Tax does vary by jurisdiction. A Form 8594 is used in the U.S. on the reporting of asset sales and buyers and sellers must agree on which asset classes the price will be divided. Disharmony in reporting may result in punishments.

Besides, PPA impacts on postponed tax accounting. When an intangible asset consists of a different book value and tax base the deferred tax liabilities or assets might emerge, and such must be accounted according to IFRS or U.S household.

What Happens If PPA Is Done Incorrectly?

An inaccurate or non-compliant PPA can lead to:

- Audit Red Flags: Differences in value or absence of support to valuations may draw attention of auditors and regulators.

- Restatements: incorrect allocations might demand restatement of financial reports and impairs the confidence of an investor to a company.

- Tax Exposure: Too much deduction may be taken or insufficient tax provision may be reported as improper allocation is done which entails interest along with penalty.

- Impairment Charges: Understating goodwill or under-allocation of goodwill to amortizable intangibles can lead to the future impairment write-offs that hurt earnings.

These are the risks that should be considered, and engaging a qualified valuation advisor is essential to both limit these risks and the successful outcome of the allocation to meet audit and tax authority challenges.

Is Goodwill the Same as Intangible Assets?

No, then intangible assets are not equal to goodwill. Goodwill is the premium paid over the fair value of identifiable net assets (assets based on minus liabilities). It tends to capture synergies, growth expectations in the future, or assembles workforce, factors that cannot be identified separately.

Goodwill is not amortized as is the case with identifiable intangible assets but is instead tested against turnover impairment after every year. Conversely, intangible assets like those relating to contracts with customers or patents are amortized over the useful lives of the assets except when they are considered to have indefinite lives.

Can a Company Choose How to Allocate the Purchase Price?

In some respect, yes. In asset deals particularly during the private M&A, it is possible to negotiate between the buyer and the seller on the way the price should be distributed across the different assets. But the allocations should exist at the fair market value and should be justifiable according to the rules of valuation and documentation.

Such allocation is a little limited in the cases of share acquisitions where people are not buying individual assets, but rather what is possessed is a share. Nonetheless, in order to prepare consolidated reports, the acquirer has to nevertheless apply the purchase price on the books to underlying assets and liabilities.

The final thing is that whatever is allocated shall be in concurrence to the financial reporting standards or tax regulations where applicable. Different treatments of accounting and tax reporting might require reconciliation which can be done using Deferred tax.

Who Typically Performs the Purchase Price Allocation?

PPA is typically performed by experienced M&A, valuation and accounting standard financial professionals. Although in-house corporate finance departments could be at the forefront of the process, it is usual that professionals in the outside world of valuation or advisory firms come in. This helps to have independence, technical accuracy and credibility in front of auditors, regulatory institutions and tax authorities.

Experienced valuers will use known valuation methods, collect market information, compare the comments of performances of previous years and project future advantages because of the purchased assets.

Final Thoughts

Purchase Price Allocation is not just a compliance exercise, but it is considered a strategic financial skill that lays a foundation to correct reporting, minimize tax impact of the transaction, and to realize value of the conglomeration or absorption of the target company. It is therefore mandatory that both sides of the M&A transaction learn how to perform the purchase price allocation correctly, how to recognize intangibles, and how to treat goodwill.

The FAQs associated with PPA indicate how essential that process is to the lifecycle of a deal, which is the negotiation process, post-merger integration and the long-term financial outputs. Careful and transparent companies willing to approach PPA are in a better place to develop the sustainable value and reduce financial and taxation risks.