PPA Tax Impact on Depreciation Strategies Singapore

Learn PPA Tax Impact on Depreciation Strategies Singapore

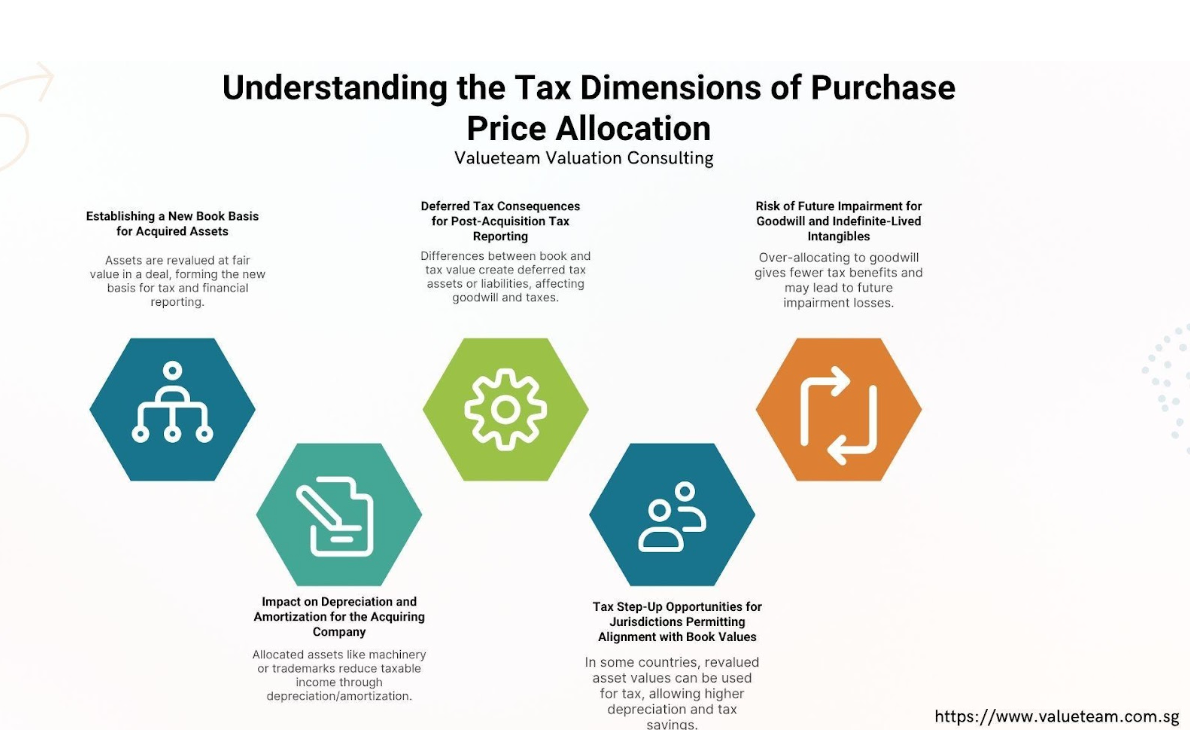

Though often seen as a post-deal compliance task, Purchase Price Allocation (PPA) has become a strategic element in M&A, shaping tax outcomes, depreciation, and long-term financial performance. While firms focus on negotiations and integration, they often overlook how allocation impacts earnings, tax rates, and investor perception. Under IFRS 3, the purchase price must be assigned to identifiable assets and liabilities at fair value, with any excess recorded as goodwill. While goodwill is non-depreciable and subject to impairment (IAS 36), tangible and finite-lived intangible assets can be amortized, providing valuable tax benefits—especially for capital-intensive or high-growth businesses where different depreciation methods explained for businesses can further optimize reporting strategies.

Poorly structured PPA, however, can reduce tax efficiency, increase audit risk, and diminish deal value. Excessive goodwill or weak valuation methods may violate IFRS 13, and cross-border deals risk triggering deferred tax liabilities due to mismatches between fair value and tax basis. Strategic, well-supported allocations—guided by finance, tax, and valuation experts—are critical. Recognizing off-balance-sheet intangibles like customer relationships or proprietary tech and applying defensible valuation approaches strengthens compliance and creates long-term value. Among the key advantages of purchase price allocation in M&A is aligning tax, financial reporting, and investor communication for sustainable growth. Leveraging expert-driven purchase price allocation valuation services Singapore ensures compliance with IFRS while unlocking opportunities for tax efficiency and value creation.

Understanding Purchase Price Allocation in Tax Context

Purchase Price Allocation is the sale procedure of allocating the overall consideration paid during a business acquisition to different assets purchased and liabilities acquired. Tax regulators like the Internal Revenue Service (IRS) in the United States insist that such an allocation is reported on special forms, e.g. form 8594 in case of asset acquisitions. Whereas the process of financial reporting under IFRS or US GAAP is oriented towards fair value measurement to satisfy the interests of investors, the tax reporting takes a different path and has another mission: to select how much of the purchase price is being depreciated or amortized and over what time frame.

Taxation reality is that not all assets are equal. Inventory, receivables, and cash types are normally turned over within a short time and they therefore do not influence the long term tax planning. Conversely, physical property (equipment and real estate), intellectual property (patents, program code, or customer relationships) may be depreciated over a number of years. Goodwill, which quite frequently comprises the largest balancing amount related to many acquisitions, does not hold any or limited immediate tax advantages in some jurisdictions.

Such unfair treatment renders the distribution exercise very crucial Buyers, as would be expected, would prefer to allocate more of the purchase price to assets that are depreciable or amortizable, whereas sellers may want allocations that would minimise their current tax liability, such as allocating more to goodwill that can be treated as a capital gain.

Depreciation and Amortization: Why They Matter

Depreciation and amortization are expenses that are not of cash nature, and they decrease taxable income effectively to create a tax saving, which enhances the post-tax cash flow. To the buyer, the opportunity to increase the tax basis of parts to fair market value when they are bought is something that can help to speed up deductions. As an example, it is possible to allocate a substantial amount of the cost of a business to machinery or equipment, and as a result, enjoy immediate tax savings through increased depreciation write offs in the initial years, which is yet another way through which tax driven deals take place.

Equally, recognition of intangible items like patents or customer contracts can be given value and can be written off or amortized over a realistic life, thus minimising taxable income on a timetable basis. Of more significance is the taking into consideration of the present value of these deductions. A dollar saved now in tax is more essential when compared to a dollar that will be got in ten years. The buyers are therefore likely to insist on allocations that enhance a faster depreciation and amortization. This raises the internal rate returns (IRR) as well as offers it the flexibility of finance in its earlier stages of unity where costs, and threats are high.

To the sellers, however, the net effect of the tax is exactly the opposite. Increased investment in assets of tangible and intangible nature can result in ordinary income being treated as capital gains due to the higher tax rate associated with this source of income. This discrepancy in incentives tends to be a bargaining chip between the buyer and the seller and the outcome of which can significantly alter the economics of the transaction to each party.

Strategic Allocation Between Tangibles and Intangibles

To structure the allocation in a way to help maximize the value of the depreciation requires both an understanding of the tangible assets and intangible assets. There is little to no complications with tangible assets, e.g. property, plant and equipment, since these are depreciated on a regular basis. However, there is more complexity with intangibles. In most tax regulations and guidelines, most of the intangible assets can be amortized, usually provided that they are being amortized over a 15 year period in the U.S. These are customer relationships, brand names, proprietary software and some licenses.

The deduction of purchase price on intangibles may increase tax write-off substantially, but it needs to be well-valued so as to pass tests of tax agencies. Accurate allocations are often questioned by IRS and other regulators and where they notice that a goodwill is obviously understated in favor of amortizable intangibles they can be refuted. Buyers should also support their allocations with self-valuing and well-documented allocation. For example, applying accepted valuation techniques like the multi-period excess earning techniques to value customer relationships or relief-from-royalty techniques to value trademarks establishes a credible position upon which to report for taxation.

A well organized allocation plan balances the interest of a buyer to have an increased deduction against the need of the buyer to be able to meet the revenue and income demands of tax and audit teams. It contains the possible disputes with sellers who could object even to allocations that create additional ordinary income. It is often better to negotiate such differences up front during the deal process and reach agreed allocations which should be contained in the purchase agreement to prevent future arguments that prove expensive.

The Role of Goodwill and Residual Value

Goodwill is excess of the purchase price over net assets acquired. Goodwill has not been of much tax advantage. Most jurisdictions, such as IFRS accounting, do not allow goodwill to be amortized, and it is instead tested against impairment. To report taxes, however, some jurisdictions like the United States permit the amortization of goodwill and other so-called section 197 intangibles, in 15 years.

This therapy brings about a fine line of balance-acting as it were Overstating goodwill decreases the buyer’s immediate depreciation and amortization, however long-term there is still the benefit of the amortization. Sellers, in turn, usually prefer to allocate to goodwill since under preferential capital gains tax, the gains must be attributed to goodwill. The above variation reflects the significance of negotiation and strategic planning in PPA.

Goodwill may be by far the biggest single entry in purchase price allocation. This may be inevitable but at the same time buyers must make sure that all possible tangible and intangible values have been identified and measured individually before goodwill is summed. That also maximizes current and near-term depreciation deductions and increases the tax efficiency of the deal.

Negotiation Dynamics Between Buyers and Sellers

Due to the tremendous tax effects of PPA, the latter can easily develop into a negotiation war arena. Customers want allocations that will maximize depreciation and amortization, whereas the sales persons will want to minimize the ordinary income and maximize on the capital gain. These competing interests will influence the purchase price itself in breadth in addition to the ultimate distribution. A seller can accept a reduced headline price when the allocation favours its taxes and a buyer may be willing to pay a premium when it is able to have allocations that help it accelerate its tax deductions.

This negotiation is usually performed in the purchase agreement whereby there are allocation clauses that indicate the manner in which the purchase price is to be subdivided in respect to the asset classes. In other situations, the arrangement might necessitate both sides to formulate matching allocations to tax agencies, which might lessen the danger of non-matching reporting which may provoke audits.

Otherwise, where no agreement can be made, tax rules can grant one side the freedom to unilateral allocation, usually the buyer, which would be supervised with regulation. Whichever the mechanism, negotiation should be obvious and early in order to prevent conflict and make sure both parties are on the same page as regards to the type of impact the allocation will have in terms of tax.

Managing Risk Through Valuation and Documentation

The tax agencies are only too keen on knowing that purchase price allocation can be manipulated strategically to drive outcomes in the arena of policies of taxes. Because of this, they inspect allocations critically especially when great summations are placed on properties whose depreciation schemes are fast, or on assets that are construed as intangible and are hard to quantify. In order to survive this criticism, purchasers are advised to purchase professional valuations and make certain their procedures are in line with established standards.

When it comes to documentation, it is significant. Detailed reports of the assumptions, calculation and data on which the valuation of assets was made give an audit trail that supports the allocation should it be questioned by regulators. This is not only because it consolidates the position of the buyer under tax but also that it shows openness and fair dealing during negotiations with the sellers. In multinational transactions, the need to match valuations to local tax regulations as well as international regulations on reporting proves to compound the problem further necessitating the provision of coordinated plans.

Conclusion: Turning Compliance into Tax Efficiency

PPA is much more than an accounting exercise that comes after the deal. To the buyers, it is a chance of structuring the allocation in a manner that will maximize the amount of depreciation and amortization thus increasing after-tax cash flows and this will increase the overall return on investment. To the sellers, it is a bargaining chip that can determine their tax exposure and the desirability of the tax.

On both the buyer and the selling side, the outcomes of an allocation will be improved by being familiar with the tax consequences of an allocation, negotiating effectively and supporting allocations with strong valuations and documentation. Finally, PPA is a strategic instrument that, used prudently, can drive the discovery of the latent value in a deal and keep the advantages of a transaction far beyond the closing table.