How to Allocate Purchase Price Across Asset Classes IRS Form 8594

Learn How to Allocate Purchase Price Across Asset Classes IRS Form 8594

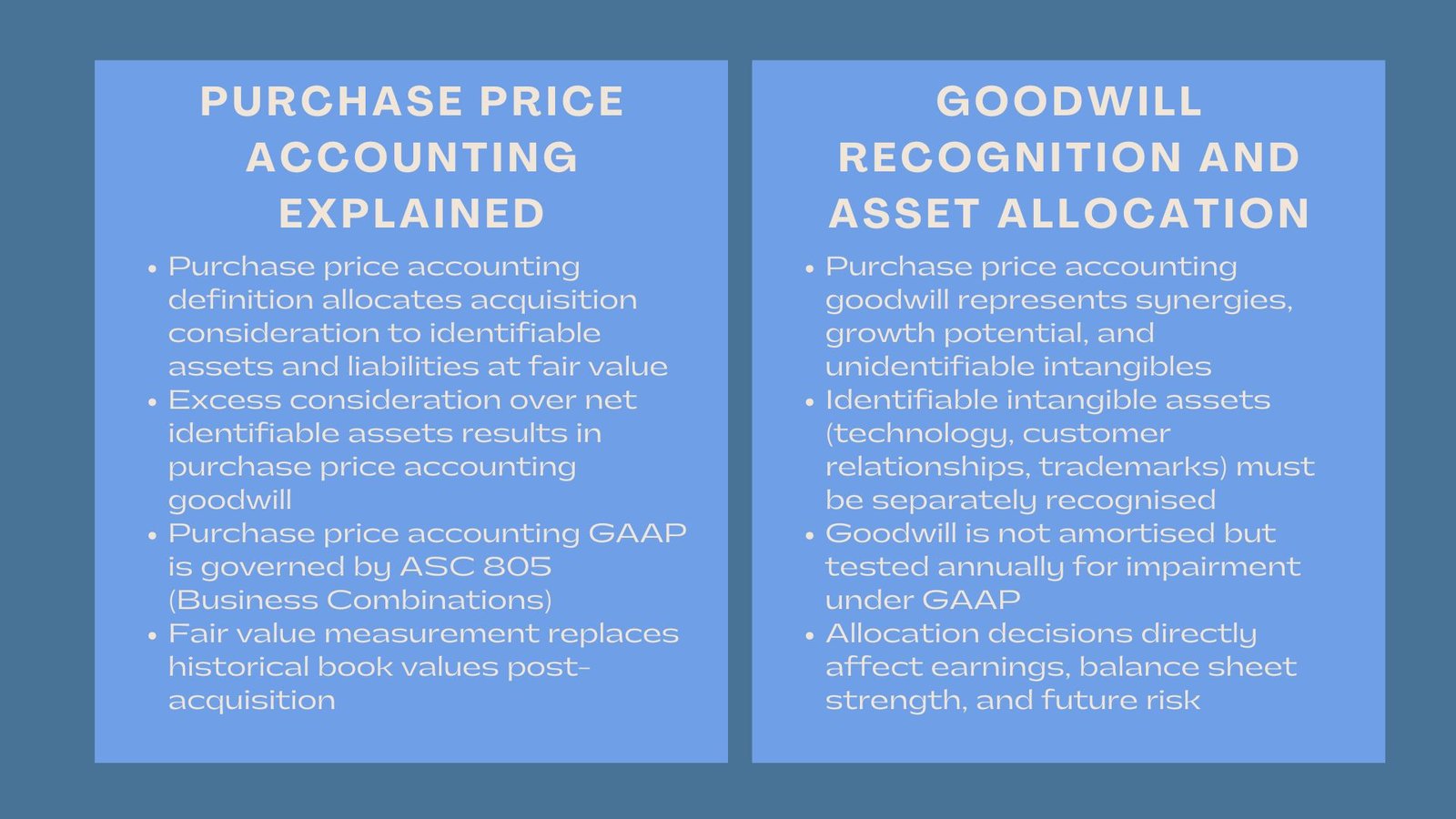

In the United States, selling a business is not just a commercial deal—it’s a taxable event requiring specific IRS reporting. One critical form is IRS Form 8594, “Asset Acquisition Statement Under Section 1060,” which ensures the buyer and seller report the purchase price allocation across various asset classes consistently. This allocation impacts how the buyer depreciates or amortizes assets and how the seller reports gains—whether as ordinary income or capital gains. Misreporting or inconsistencies between parties can trigger IRS audits, disputes, or penalties. Comprehensive purchase price allocation services Singapore help ensure that these allocations are accurate and compliant.

Form 8594 is required under IRC Section 1060 for asset-based transactions involving a trade or business and mandates allocation across seven asset classes—from cash to goodwill—in a specific order. Each class carries different tax consequences. For example, inventory results in ordinary income, while goodwill may be taxed at favorable capital gains rates. Proper planning can optimize these outcomes—buyers may prefer more value assigned to depreciable assets, while sellers aim to reduce taxable ordinary income. Businesses can rely on purchase price allocation services in Singapore to meet these requirements and maximize efficiency. Understanding the benefits of purchase price allocation in Singapore is essential for both buyers and sellers to mitigate risks and enhance strategic outcomes.

What Is IRS Form 8594 and When Is It Required?

The IRS Form 8594 is the document submitted by the buyer and the seller in case the group of assets forms a trade or business, and this is an acquisition. The form must be used whenever there is a basis to believe that goodwill, or a going-concern basis is attached to the transaction, which is common in the majority of business sales, which are done as an asset purchase rather than as stock purchase.

The aim of the form is to have the buyer and seller report the allocations of the purchase price across categories of assets in a consistent manner. Each party will have to submit Form 8594 along with his or her tax returns at the end of the year in which the exchange by sale was made. When the buyer and seller file different allocations extra care should be taken as it will attract red lights to the IRS who could result in audits and/or revision. This is why harmonization on the allocation in the purchase agreement is not only a best practice but also one that is essential to compliance.

Why Allocation Matters for Taxes

The way the purchase is allocated will identify how various aspects of the consideration are to be taxed. There are certain purchases that directly translate to ordinary income to its seller and costs to the buyer like inventory. Machinery or buildings, among other assets, undergo depreciation in a number of years, thereby granting the buyer tax deductions over a period of time as opposed to in one period. Customer relationships or patents should be amortized using the fifteen-year section 197 rules. Goodwill which usually takes a big share of residual allocation has its fifteen-year amortization.

The allocation also defines how a seller should be taxed in full either as ordinary income or capital gains. Sellers usually prefer allocations to goodwill or capital assets since they are taxed at low capital gains rates. On the other hand, buyers will like to have allocations that maximize depreciation or amortization deductions and minimizing taxable income in subsequent years after the acquisition. The latter opposing incentives make the process of purchase price allocation a central one in providing negotiations, as well as clarify the great importance of Form 8594 in the transactions.

The Residual Method of Allocation

According to the IRS, purchase price allocation must consider the residual method, where the total consideration given is divided into categories of assets in a particular order up to the point where all the consideration is apportioned. This will require that any assets that remain even after the fair market value of all assets should be debited to goodwill.

Under the residual method, the allocation starts with the cash and equivalents followed by the receivables then inventory, tangible property and the various classes of intangibles. The final step is goodwill or going-concern value which is anything left over after the purchase price can be allocated to something specific and identifiable. This structure helps to capture economic reality and ensures uniformity and does not allow the allocation to be manipulated just to get a tax benefit.

This method, in terms of mechanics, is easy to understand but difficult to do. Appraisal of the fair market value of assets, particularly intangible assets like trademarks, customer lists, and so forth will take valuation skills and documentation. Since goodwill is the leftover, the amount of goodwill will wholly depend on the aggressiveness of valuation of other asset classes. Purchasers who attempt to maximize amortizable intangibles should do so on a cautionary note, as whose values have been overstated by the decision of the IRS can be reexamined.

Depreciation and Amortization Opportunities

Probably, the aspect of purchase price allocation with the potential to provide the most significant impact is the establishment of depreciation and amortization benefits to the buyer. Purchasing a higher percentage of the cost of the assets that can be depreciated e.g. equipment or amortizable intangibles e.g. patents will enable the acquirer to take the tax deduction over time. Such deductions minimize the taxable income and give actual cash flow advantages.

As in the case of the depreciation of machinery which may commonly be charged in accelerated manner and then such is giving rise to bigger write off in initial years. Intangibles, which are the contracts with customers,marks or even goodwill, are amortized in 15 years. Such duration is long, but it continues to give a consistent flow of deductions which further increases after-tax returns. The allocation of deductions is a lever that can materially alter the economics of a deal as the present value of the deductions is very large as far as tax planning point of view is concerned.

Ordinary income increases, however, they will be resisted by sellers in case of allocations. As an example, a seller has a possibility of paying more benefits on ordinary income in case too much of the purchase price gets assigned to inventory or receivables. These conflicting interests need a balance where they need to be negotiated, and a preferably written contract provision of the purchase contract to indicate the distribution. In absence of such agreement, each party can provide Form 8594 (with different values as the other party may file an incorrect value) and this opens up the possibility of non-compliance and even IRS interference.

The Role of Goodwill and Intangibles

The single most common big asset identified in purchase price allocation is goodwill. It is the excess of fair market value of tangible and identifiable intangible assets that a purchaser is ready to pay over a fair value of the business. This premium can be associated with synergies, reputation, and customer loyalty among other attributions that are hard to measure separately.

Goodwill is considered as a Section 197 intangible, notwithstanding on a tax basis, and is amortized in the equal manner of a fifteen year duration. Although this will not grant an immediate advantage of faster depreciation, it introduces a long term flow of deductions. Because goodwill continues to amortize, sellers may prefer its capital gains treatment and buyers can easily accept substantial allocations of it as well.

Section 197 amortization applies to other intangibles as well, as in the case of patents, trademarks, or customer relationships. Goodwill vs. identifiable intangibles: the criticality is how one tries to separate out the goodwill and identifiable intangibles. Assets that can be separately identified and valued, the less goodwill will be left under the residual goodwill. The relevance of this distinction is that some intangibles can be more readily defensible in valuation, and can generate more clearly depreciated schedules, whereas goodwill is never a catch-all residual.

Managing Post-Closing Adjustments and Compliance

The use of Form 8594 is not a single time activity. In case the purchase price varies as a result of eat-outs, working capital, and contingent payments after the close, supplemental Form 8594 must be filed by both parties. This makes sure that the IRS will have a coherent history of the final allocation, and will be able to follow an unfixed tax basis of assets.

Once the deal is close, careful record keeping and communication between the buyer and the seller is needed to maintain the compliance. Lack of timely or updated forms may lead to fines, controversies or disallowances of the deductions. It is therefore good practice to include the allocation contracts within the contract of sale proper which does not provide sufficient room to interpret. Additional protection is obtained by utilizing valuation professionals and tax advisors to assist in the allocation that will not only be beneficial during negotiations with the other party but also during the defense of the allocation with the IRS.

Conclusion: A Strategic and Compliance-Driven Tool

At first sight, IRS Form 8594 seemingly is a mere part of a reporting requirement yet, in actual sense, it is a strategic instrument the implications of which have serious tax implications. How the purchase price is allocated to asset classes will decide the tax liability of the seller and depreciation and amortization benefits that the buyer can get. Negotiators can negotiate friendly through the knowledge of the rule, proper documentation through careful drafting of allocations with strong valuation back-up and the best way to go is structuring deals such that business can optimize the tax treatment in each party.

Finally, it is not only compliance with the purchase price allocation but it is also a tax planning opportunity. To the buyers, cash flow and the rate of returns of assets post-deal are among the most important aspects of such ability to step up the basis of the assets and claim depreciation and amortization. The allocation on part of the sellers may determine whether to earn ordinary income or capital gain. Form 8594 allows the effective reporting by both parties, and thus the IRS, has a good idea of how the deals are being made.

Mastering the dynamics of Form 8594 and purchase price allocation will also account for some of the nuances of a not so new form of succeeding in the competitive market of mergers and acquisitions where every percentage point of return counts.