How Effective PPA Enhances Financial Reporting and Strategic Synergies

Learn How Effective PPA Enhances Financial Reporting and Strategic Synergies

In the dynamic landscape of mergers and acquisitions (M&A), Purchase Price Allocation (PPA) is not merely a post-deal formality—it is a powerful financial and strategic tool that bridges the gap between transaction execution and long-term value realization. Often misunderstood as just an accounting requirement, effective PPA reporting under IFRS 3 Singapore plays a critical role in translating the economics of a deal into financial statements that accurately reflect the acquired business. When conducted properly, purchase price allocation valuation services Singapore enhance transparency in financial reporting, unlock significant tax efficiencies, and strengthen the realization of strategic synergies between merging entities.

Beyond basic compliance, PPA offers management a structured opportunity to align valuation assumptions with strategic intentions. It allows acquirers to reflect the fair value of both tangible and intangible assets—such as technology, customer relationships, or brand equity—on the balance sheet, helping investors understand where value lies. Moreover, effective PPA supports smoother post-merger integration, aids in aligning internal performance metrics with acquisition objectives, and creates a more defensible position during audits. In this way, PPA valuation consulting Singapore serves as both a financial lens and a strategic lever in maximizing deal outcomes.

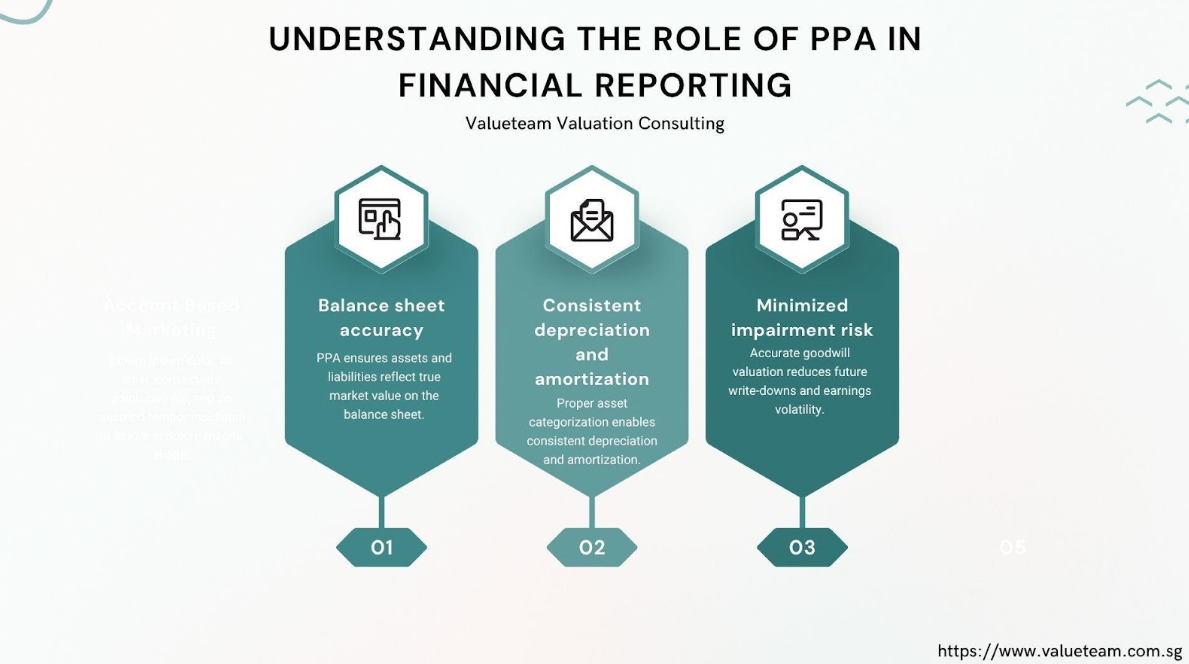

Understanding the Role of PPA in Business Combinations

Purchase Price Allocation refers to determining the identification of the fair value of the assets which have been purchased and the assumption of the liabilities of a business purchase by allocating the purchase consideration which has been paid to the acquired assets and assumed liabilities. Remaining that cannot be apportioned is treated as goodwill. In IFRS 3 (Business Combinations) or ASC 805 that applies in US GAAP, this allocation is compulsory and not discretionary, a requirement that prevents misleading representation of economic reality regarding what has been acquired.

PPA is an instrument that mediates the disparity between the price of purchase accepted at the negotiating table and the real value of assets being bought. In absence of this process, financial statements would not be transparent and comparability would be missing as investors would use this information to determine the value accretive nature of the acquisition. The inclusion of brand, technology, or relationships between itself and its customers as an intangible also adds value to the financial narrative by highlighting the unseen aspects of creating value in its business.

Enhancing Financial Reporting Transparency

Among the most direct results of a sound PPA is financial reporting promotion. Investors, analysts and regulators require some clarity on what a company has purchased. In the event that all the consideration is treated as goodwill, then the stakeholders would not be aware of the value of the different assets which will be instrumental in future performance. Differentiating and valuation of tangible and intangible assets help in bringing about a greater level of information and credibility in financial statements formulated by PPA.

Take the example of when a significant share of the allocation is characterized as a relationship with the customers, investors will be convinced that the customer base of the acquired company is robust and will produce long term dispensation of income. In the same vein, the acknowledgment of the importance of technology assets will suggest that company growth will be done through innovation. On the liability side, express filing of taken obligations provides no more surprises as to future earnings. Such a level of granularity enables stakeholders to further gauge the sustainability of earnings, the quality of assets and risks inextricable in the transaction.

Open reporting assists compliance as well Transparent reporting helps in compliance as well Regulators are insisting more and more that financial statements be at fair value and auditors are questioning assumptions of PPA valuations. A proper allocation backed up by independent valuation helps cut down chances of disputes, restatements or impairment charges that would serve to diminish confidence in the market.

Aligning Accounting with Strategic Objectives

Compliance is only one side of a good PPA, as it will add another rational behind the deal. Each and every acquisition is fuelled by specific expectations i.e. such as entry in new markets, availability of technology, expansion of product range or operations and synergies. To the extent that it meticulously weights and identifies assets in line with the goals of the deal, PPA is a story that bridges the gap between reasoning behind the said deal and results in the financial perspective.

An example is when a company buys another firm in order to tap into its brand equity and the loyal client base. The fact that the PPA points out notable investments in the brand value and customer relationships affirms the acquisition strategy. In the same regard, when a technology firm acquires a startup due to its intellectual property, then the identification of patents and research and development resources defends the strategic story being sold to stockholders. By doing this, PPA becomes a communication rather than accounting exercise as it bridges the gap between numbers and strategy.

Goodwill, Impairment, and the Signal to Stakeholders

The most common outcome of purchase price allocation is goodwill. Although it reflects the future earnings attainable due to the synergies and unidentifiable assets, its too high levels create doubts. The shareholders and the analysts can dispute the validity of the price paid by the acquirer as being too high or management can be too exuberant in projecting synergies.

Effective PPA goes a long way in alleviating these associations by reducing the residual goodwill through appropriate recognition of identifiable assets. The clearer the allocation is the better the goodwill number will be regarded. This is important since goodwill is required to be tested on an annual basis under IAS 36 / ASC 350. Assumed conditions which do not realize a substantial abnormality in the earnings of the companies and which do impair goodwill make a substantial knock to earnings and this is construed by the market as failure of the acquisition strategy.

This is because by practicing diligent measurement and support to ensure the existence of goodwill, it promotes stakeholder confidence in PPA. It indicates that the management has been thorough in the valuation of the business and they are determined to make the accounting reflect the benchmark of operating conditions.

Unlocking Strategic Synergies Through PPA

Effective PPA also contributes to measures and capturing synergies i.e. the value additions that make most acquisitions worthwhile. Synergies may be in the form of costs savings, increases in revenue, or diversification of risks. Although not all synergies are done directly in the balance sheet, the impact of synergies will help bring them off by outlining the assets that will provoke them.

As an example, when there are synergies that are expected out of the integration of technology platforms, a value allocation such as software or patents can be allocated to bring an anchor of these capabilities. Where a set of synergies is realized through cross-selling to a new customer base, then customer relationships will be recognized and the pathway identified. By outlining allocation and mapping it to anticipated synergies, companies will be able to keep watch over whether integration is indeed producing aspired results.

Besides, proper PPA aids in internal management, by giving asset values that will have to be cared for and tended to. Intangible resources that are recognized become visible in the balance score card and thus due attention and investment is considered in an attempt to maintain them. By doing this, not only will PPA improve reporting, but it will also inform post-acquisition strategy.

Managing Risk Through Documentation and Valuation

Auditors, regulators, as well as investors, pay a lot of attention to PPA since it affects reporting and strategy. Excess surges into assets that are depreciable or amortizable even though no such extreme actions might be perceived in the economic world. On the other hand, too much goodwill can create suspicions of lack of discipline in the deals.

These risks have to be handled through sound documentation and valuation. Discounted-cash-flow or relief-from-royalty can also be defensibly allotted to independent appraisal (known methodology). The documentation of the assumptions, discount rates and cash flows forecast in detailed form provides that the allocation will be able to stand regulatory and audit tests. Such a rigorous level not only guards against controversy, but it also builds credibility between financial statements and people who also use the statements to make decisions.

The issue of risk management is even more complicated in cross border transactions. Various jurisdictions might have different tax and reporting requirements and therefore some harmonization between tax codes, local standards, and IFRS is needed. A good PPA will unify these considerations, so that not only are the allocations made compliant but also optimised to meet global and local needs.

Conclusion: From Compliance to Strategic Advantage

The matter of Purchase Price Allocation is frequently considered a technical accounting task that is done after the euphoria of a deal is finalized. But when done well it is much more than that. It increases financial reporting, it makes it transparent, it reduces risks with strong valuation, and provides strategic rationale of the acquisitions. By making asset recognition a vehicle of strategic synergies, the PPA becomes very valuable in conveying the value creation to the investors and in the post acquisition integration.

Effective PPA will ensure that the acquisitions are justified at the negotiation table and this is backed up in the financial statements in an age where the stakeholders require not only accountability but also strategic clarity. This allows it to rank the role of PPA as compliance to competitive advantage and hence a staple of contemporary dealmaking by linking it to accounting and strategy.