Understanding Purchase Price Consideration in MA

Understanding Purchase Price Consideration in Mergers and Acquisitions

Learn Understanding Purchase Price Consideration in MA

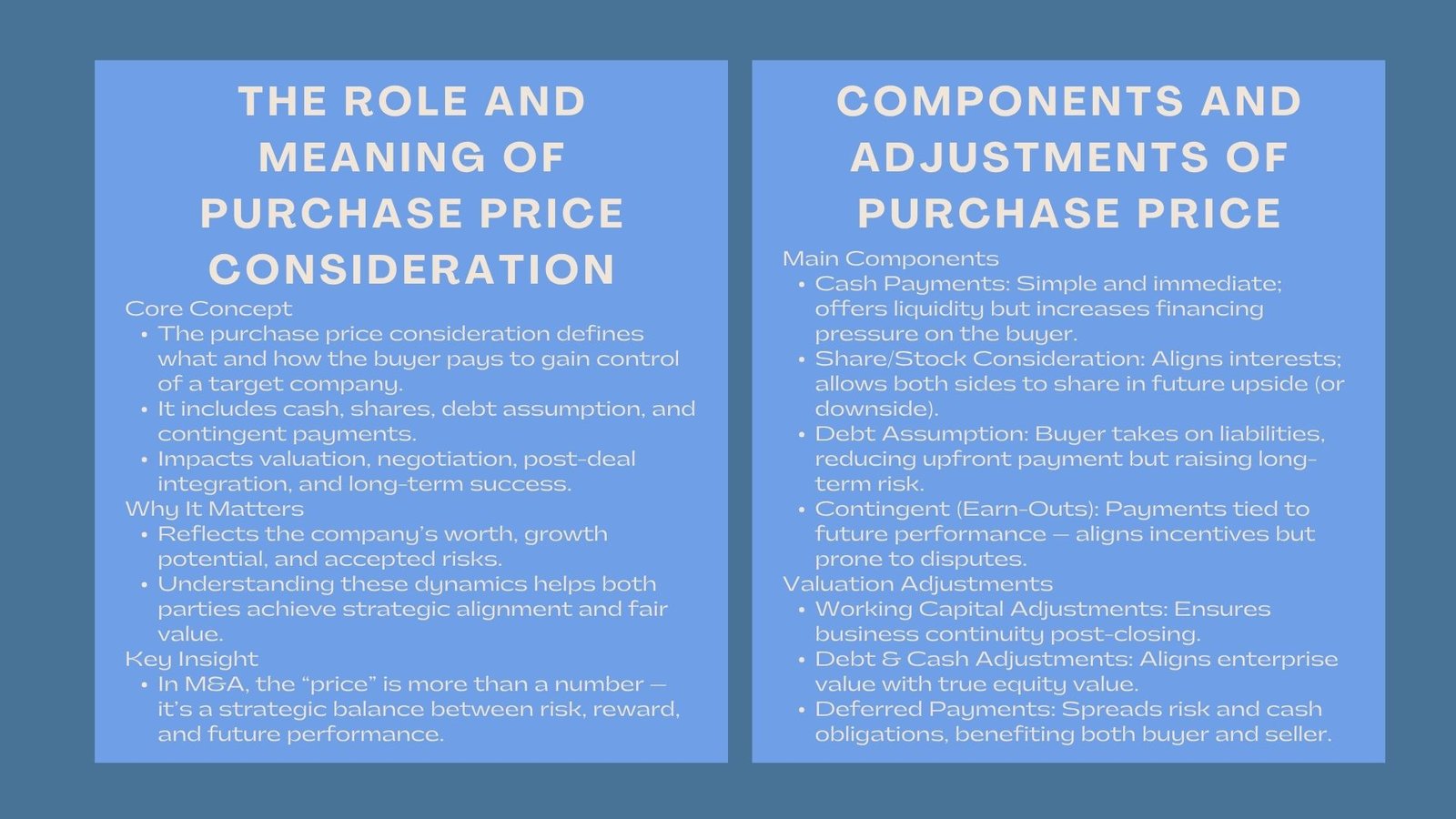

Purchase price consideration is the most important and sometimes the most bargained part of any merger or acquisition. It does not only dictate the amount, which a buyer would pay the target company, but also how the payment would be made, distributed and settled. This concept is very relevant to the professionals working in the field of corporate finance, investment banking, strategic management because it has a direct impact on the success of a deal, post-deal integration, and value realization.

In the process of two parties settling on the desire to join or one out of them settling on the need to purchase another, purchase price is not merely an agreed price. It summarizes highly complicated financial, legal, and operational suppositions of the worth of the company, the potential of the company, and the risks to which both sides are prepared to accept. Consequently, understanding the peculiarities of purchase price consideration is the secret of effective negotiation and the attainment of strategic goals on both parties.

What Do You Mean by Purchase Price Consideration?

Purchase price consideration in its essence amounts to the overall price of what the acquirer pays in order to gain control of the target company. It covers all the types of payment in terms of cash, shares, debt assumption, or any other financial instruments that were provided instead of ownership.

But M&A deals are not a simple transaction and may comprise a number of different elements that may have a considerable influence on the actual value that is exchanged. It can modify the price following closure depending on the working capital, debt or based on the contingent performance target. This complexity is the reason why valuation and negotiation have become such the focus of the M&A process.

In most transactions, the consideration can be in the form of upfront payments and contingent payments (often referred to as earn-outs) which are payments made based on how the acquired company will perform in the future. This framework aids in the reduction of risk between the buyer and seller, aligning incentives and giving responsibility to the future outcomes.

Purchase Price Consideration Components.

Cash Payments

The simplest form of consideration is in cash form. It gives instant liquidity to the seller and makes the valuation process easier to the two parties. It is however, also a major burden to the financier of the acquirer particularly in huge acquisitions. Buyers may use debt financing, or private equity or use internal reserves to finance the acquisition.

Cash deals are used where the acquirer assumes complete control and does not wish to have dilution of control or in cases where the acquirer wishes to evade post-deal valuation changes.

Share or Stock consideration.

In stock based transactions, the seller is not paid with cash, but is issued with shares of its own company by the buyer. Such a type of payment is the one that gives both sides a share in the potential upside (or downside) of the merged entity.

Share-based consideration is especially applicable in cases where stock of the acquirer is highly valued or where the cash is a priority. It however demands close consideration of the volatility of the share prices, exchange ratios as well as the subsequent dilution of ownership to the current shareholders.

Debt Assumption and Liabilities.

During a few of the acquisitions, the purchaser accepts some of the debts or liabilities of the target company as part of the entire price paid. This will have the effect of lowering the amount of cash paid, but raising the total financial liabilities of the buyer.

The importance of having knowledge on how debt and contingent liabilities are included in the final price in order to achieve fair value is important. These elements are usually quantified and negotiated by financial advisors and valuation professionals who carry out a thorough due diligence.

Contingent (Earn-Outs) Consideration.

Earn-out is a conditional fee guiding the performance of the target company after the acquisition. It is usually employed when one is not certain about the future outcomes of the target or the seller is still running the business after purchasing it.

Earn-outs are beneficial to both parties since the seller is motivated to meet future performance objectives, whereas the buyer is lessened the risk in case the target is not met due to a portion of the payment being contingent on performance. Nevertheless, earn-out terms are prone to controversy in case of a poorly defined statement, thus they need to be designed and have performance metrics.

Valuation and Adjustments in purchase price.

Similar to the Trading Adjustments, these are working capital adjustments and are usually categorized as either a sale or purchase.

Working capital is one of the most popular types of post-closing adjustments. Usually, transactions provide the amount of working capital that is normalized needed to operate the business. The purchase price is adjusted in case the actual working capital at the time of closing is lower or higher than this target.

This type of mechanism makes sure that the buyer is able to get a business that can perform in a normal way once the transaction is done and there are no liquidity shortages or surpluses.

Debt and Cash Adjustments

The net debt position of the target, i.e. total debt less cash on hand is also modified in purchase price. Buyers will usually make a deal where they will pay an enterprise value and then make changes to these financial items to come to a final amount where they pay the equity value that will actually be provided to the shareholders.

These changes put the ultimate price more in line with the actual financial situation of the company at the acquisition.

To Contingent and Deferred Payments.

The other typical arrangement in M&A dealings is deferred payments. The buyer can also be able to agree to pay some of the price over a period depending on attainment of some milestones instead of paying the full price at closing.

This is a win-win strategy: it will help the buyer to disperse cash liabilities, whereas the seller might get better returns in case the performance targets are achieved.

Strategic and Financial Implications.

Hedging Buyer and Seller Incentives.

The purchase price consideration design may have a considerable impact on the conduct of both parties prior to and following the closing. Earn-outs, performance compensation and share based compensation are all useful means of aligning incentives to motivate the seller to continue performing and to allow the purchaser to protect his/her investment.

Proper negotiation of these terms will make sure that both parties will be determined to see the business continue to prosper once the business deal is made.

Impact on Deal Financing and Structure

From the buyer’s perspective, the form of payment influences financing strategy, capital structure, and risk exposure. Large cash deals may increase leverage and interest obligations, while stock deals can dilute ownership. Hybrid structures combining both can balance risk, liquidity, and tax considerations.

Riverstone’s mergers and acquisitions valuation training course Singapore explores how these financial structures shape deal outcomes and long-term integration success, providing professionals with hands-on experience in analyzing real-world case studies.

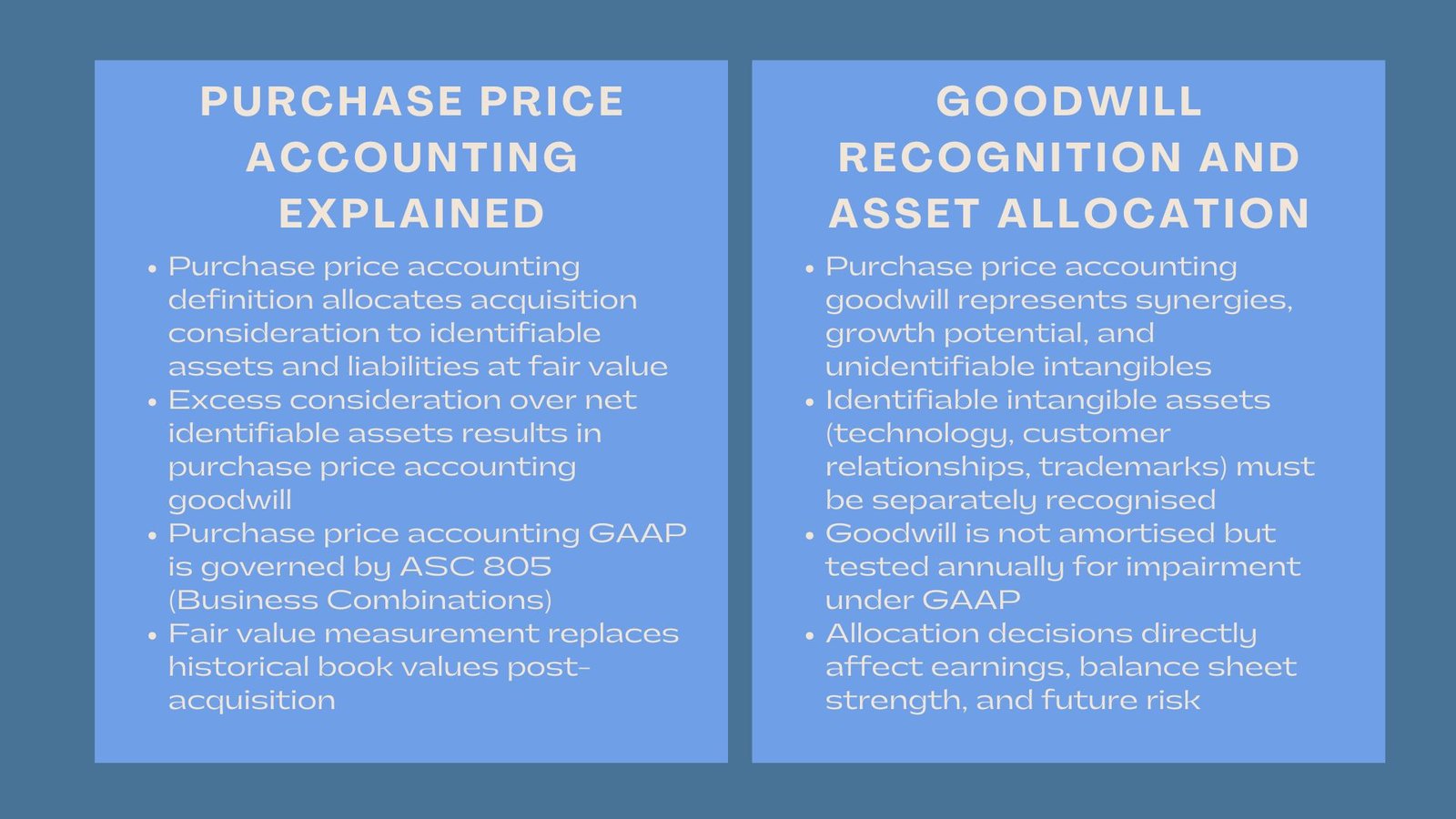

Post-Deal Integration and Accounting Impacts

The consideration of purchase price has a direct impact on the accounting of the purchase after the acquisition. Goodwill, intangible assets, and deferred tax implications are determined by allotting the purchase price.

The teams of finance and auditors should make sure that the allocation of purchase price is fair value as per the international financial reporting standards. A deep understanding of these principles — such as through corporate finance training for M&A professionals, enables professionals to interpret and manage these accounting implications effectively.

Prevailing Purchase Price Negotiation pitfalls.

It usually is complicated to negotiate the appropriate purchase price consideration. Buyers wish to have the lowest risk and highest value, and sellers are willing to be paid well and safeguarded against uncertainties that may arise after the deal is done. The following are some of the challenges:

- The difference of opinion on valuation assumptions and future projections.

- Lack of clarity in the definition of performance measures in earn-outs.

- Likely liabilities discovered in due diligence.

- Currency risk and cross trade and transaction risks.

Effective negotiations need a clear communication strategy, due diligence and financial modelling skills so that both parties are able to come up with a balanced and transparent agreement.

Conclusion

Purchase price consideration is one of the fundamental knowledge that is necessary to make mergers and acquisitions successful. It is not just a figure, it is a strategic creation that pings the valuation, allocation of risk, financing and expectation of performance in the future.

This concept can enhance the effectiveness of negotiations and value of the deal tremendously, and can be of great value to those professionals who deal with corporate finance, investment analysis, or M&A strategy. Whether it is in the context of structuring complex cross-border acquisitions or in the context of controlling local buyouts, the skill to analyze, justify and optimize purchase price considerations is essential for understanding purchase price allocation in M&A.