Certified Goodwill Impairment Testing Course

Goodwill Calculation and Impairment Testing after PPA

Learn the Certified Goodwill Impairment Testing Course

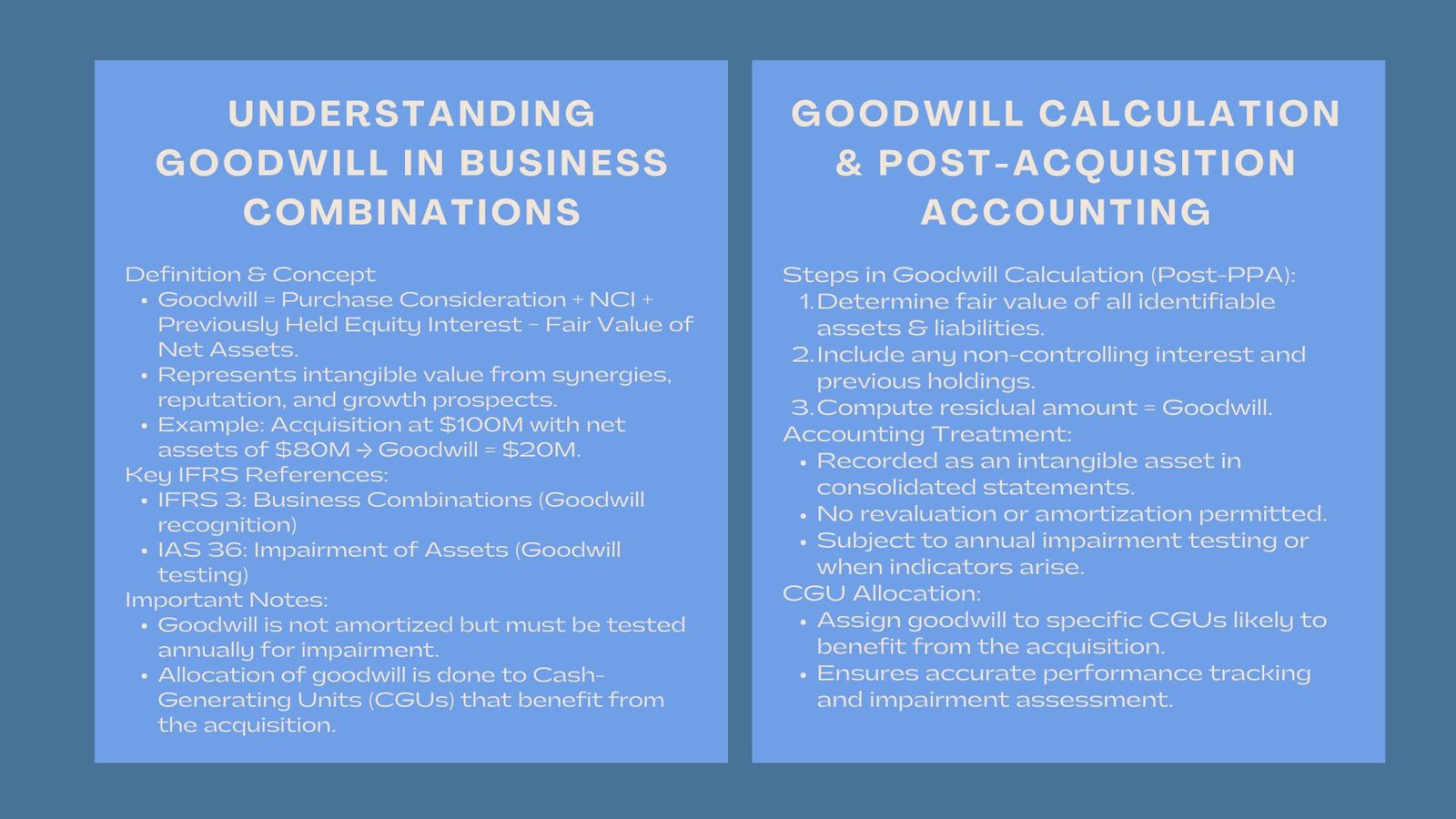

Purchase Price Allocation (PPA) is one of the central components in the process of allocating the total purchase consideration in any business combination to identifiable businesses assets, liabilities, and goodwill. Although both tangible and intangible assets are measurable, goodwill is the value left behind or the premium that a buyer pays to acquire synergies, reputation and future growth prospects that cannot be directly determined.

To a finance professional, the calculation and testing of goodwill on how to ensure that IFRS 3 and IAS 36 are adhered to is paramount. Such measures affect the quality of financial reporting and perception by investors many years after the acquisition is concluded.

What Is Goodwill in a Business Combination?

The surplus of the purchase consideration less the fair value of identifiable net assets acquired is called Goodwill. Simply put, it is based on the worth of anticipated synergies and non-identifiable benefits which will be worth the price of the acquisition.

An example of this is when Company A acquires Company B at a cost of 100m, and the fair value of the identifiable net assets of Company B consist of 80m, the resulting goodwill will be 20m. This 20 million reflects the intangible aspects like loyalty of customers, brand recognition, expertise of the management and synergies.

Goodwill is not a separately identifiable asset but the aggregate of unrecognized value that is to be paid by the buyers other than the measurable assets.

How Goodwill Is Calculated After PPA

The practice of calculating goodwill in purchases price allocation is structured under the IFRS 3. It entails the process of establishing the fair value of all identifiable assets obtained and liabilities incurred then evaluating the value against the purchase consideration.

Here’s the general formula:

Goodwill = Purchase Consideration + Non-Controlling Interest + Fair Value of Previously Held Equity Interest – Fair Value of Identifiable Net Assets.

Breaking this down:

- Purchase Consideration – The sum of money paid by the acquirer which may be in the form of cash, shares or contingent payments.

- Non-Controlling Interest (NCI) – Refers to the equity that is not owned by the acquirer in the acquiree and which is determined either at fair value or at a proportionate amount of net assets of the acquiree.

- Previously Held Equity Interest – When the acquirer had a prior ownership interest, then it should be remeasured at fair value on the date of acquisition.

- Identifiable Net Assets – This is the total known assets (both tangible and intangible) less liabilities with an asset being measured at fair value.

The goodwill that results are taxed as intangible asset in the consolidated financial statements of the acquirer. Nonetheless, as opposed to other intangibles, goodwill is not amortized, but it should be impaired on an annual basis or other indicative events to show that it is likely to lose value.

Goodwill Accounting Post-Acquisition.

Once recognized, goodwill is recorded in the balance sheet as such indefinitely unless impaired. It is not revalued or amortized as it is an indefinite-life asset. Nevertheless, the carrying value of the asset should always indicate its recoverable amount which is fair value less expenses of disposal and value in use.

This continuous review will ensure that the value of goodwill remains an expression of real, economic gains and not an exaggerated acquisition idealism.

Goodwill to Cash-Generating Unit (CGUs).

The allocation of goodwill under IAS 36 should be to cash generating units (CGUs) or groups of CGUs by the acquirer likely to enjoy the synergies that will arise as a result of the acquisition. A CGU represents the minimal identifiable unit of assets which yields relatively independent cash flows.

This allocation is important as goodwill impairment testing is done at CGU level but not at an entity level. The distribution must be sensible, justifiable, and in line with how the management internal reporting and monitoring is done.

Good will Impairment Testing: The Purpose and Process.

Impairment testing aims at ensuring that goodwill is not not recorded at a higher amount than the recoverable amount. An impairment loss has to be included once the carrying value of a CGU (which includes goodwill) is more than the recoverable amount.

The good impairment testing as per IFRS 36 is divided into the following steps:

Step 1: After identifying the CGUs that hold Goodwill.

Allocate goodwill to CGUs or clusters of CGUs which are likely to accrue proceeds of the acquisition.

Step 2: Ascertain the Carrying Amount.

This is categorized as the book value of assets of CGU, as well as the goodwill that is allocated.

Step 3: Determine the Amount that can be Recovered.

The amount to recoup is the greater of:

- Fair Value Less Costs of Disposition (FVLCD): The amount that can be received in a sale of the CGU in an orderly sale, less the cost of disposal.

- Value in Use (VIU): This is a present value of the estimated future cash flows of the CGU.

Step 4: Compare and Recognize Impairment.

The difference between the carrying amount and the recoverable amount is considered as impairment loss in the profit or loss statement in case the carrying amount is more than the recoverable amount. The impairment is first used to reduce the carrying value of the goodwill, and in the case of a loss that is higher than the goodwill, it is then used against other assets of the CGU proportionately.

The most important Assumptions in Impairment Testing.

The testing of impairment of goodwill largely depends on the assumptions regarding the future cash flows, discount rates, as well as growth rates. These assumptions should be explained by the finance teams using the objective evidence and consistency.

Critical inputs include:

- Cash Flow Projections: These are normally based on management budgets and five year forecasts.

- Terminal Growth Rate: The maximum anticipated future growth of the cash flows after the forecast period, and is usually in line with the long-term economic trends.

- Discount Rate (WACC): This is the risk-adjusted rate which is applied to discount future cash flows on the basis of weighted average cost of capital.

These assumptions need to be documented to resist the auditor scrutiny and transparency in financial reporting.

The usual causes of Goodwill impairment.

Some of the events or circumstances which might suggest the possibility of impairment of goodwill include:

- Major deterioration in the market capitalization or profitability.

- Negative business environment shifts.

- Loss of important clients or contracts.

- Competitiveness-disruption by technology.

- Failure to perform the acquired business better than expected.

When these indicators occur, the firms should conduct an impairment test at the interim rather than at the end of the year.

Facts and Practical Problems and Good Practices.

Judgment and Estimation Risk.

The testing of impairment of goodwill is very much of judgment especially when it comes to the future performances and discount rates. Sensitivity analyses are usually needed because even minor alterations in assumptions can be very material to the outcomes.

Market Volatility

The problem with economic uncertainty is that it may be difficult to project recoverable amounts confidentially. The assumptions should be updated on a regular basis by the finance teams and should be in line with the external market data.

Disclosure Requirements

The IFRS requires comprehensive disclosure regarding material testing of impairment of assets, underlying assumption, sensitivity analysis as well as the justification of any impairment that is recorded. Open reporting establishes confidence in the investor and reduces the threat of regulatory review.

Conclusion

Goodwill represents a vital yet inherently uncertain component of acquisition accounting. Its value captures the future benefits expected from combining businesses, but without proper monitoring, it can quickly become overstated. Understanding the calculation, allocation, and goodwill impairment testing under IFRS 36 is essential for maintaining accuracy and credibility in post-acquisition reporting.

By applying robust valuation techniques, maintaining disciplined forecasting, and adhering to IFRS requirements, finance professionals can ensure that goodwill remains a meaningful reflection of the enterprise’s long-term value.