Accredited IFRS 3 PPA Certification Program

Case Study: Purchase Price Allocation for a Manufacturing Company Acquisition

Introduction: Accredited IFRS 3 PPA Certification Program

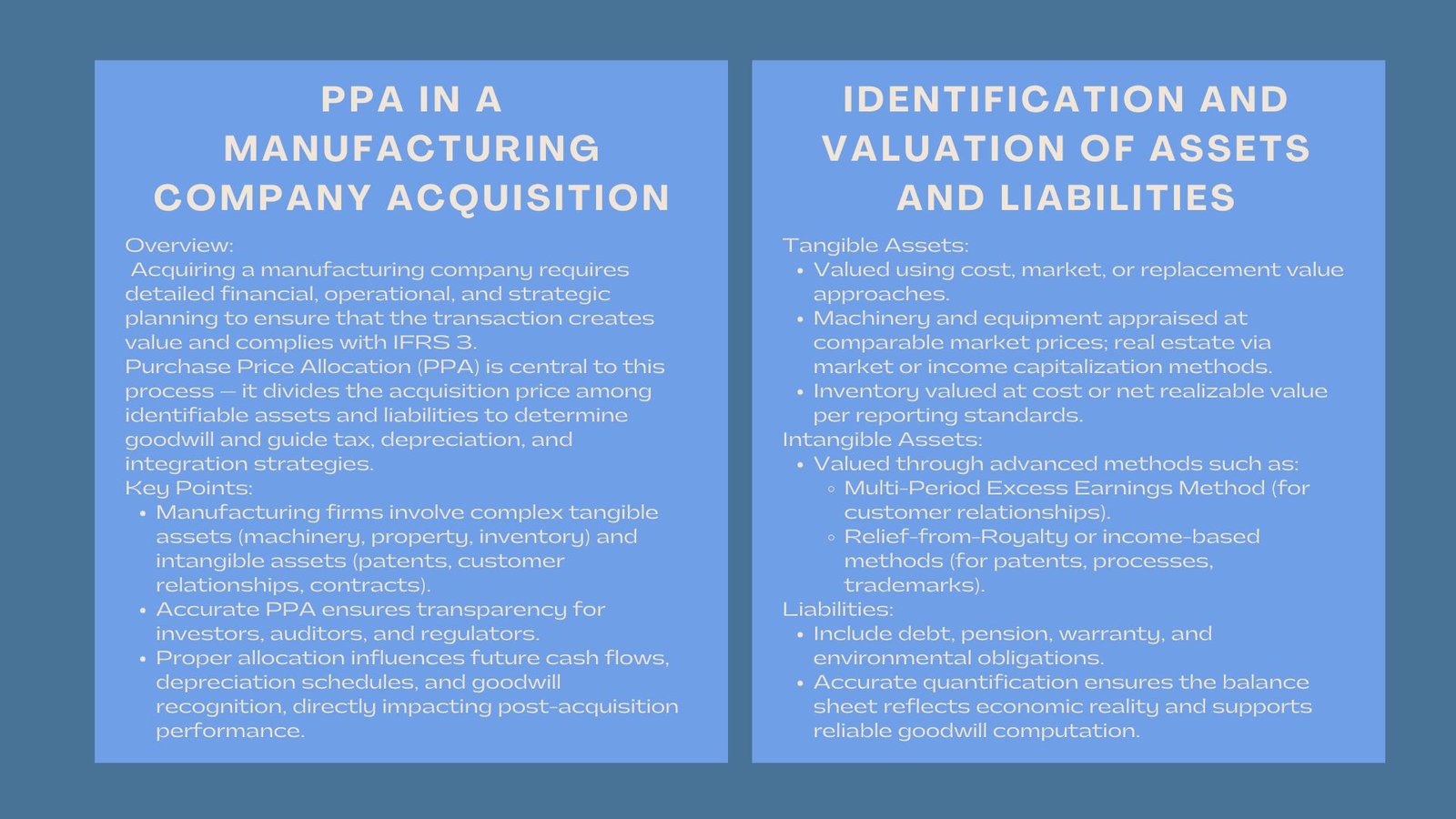

The process of acquiring a manufacturing firm necessitates careful thought with regard to the arrangement of financial, operational, and strategic planning to make sure that the purchase process brings about value and adheres to the accounting and regulatory rules. Purchase Price Allocation (PPA) can be considered one of the most important aspects of this process as the overall price of the acquisition is divided between the assets and liabilities of the company.

It is imperative to this process when reporting financial standing and planning taxes, and integrating the acquired organization. Manufacturing firms are very complicated due to the fact that they usually have physical resources like machines, manufacturing lines, inventory, and property and also, there are intangible resources like the relation with the customers, the proprietary processes, patents, and supplier contracts.

Proper preparation of a PPA assists in identifying the difference between goodwill and fair value of identified assets, which is used to indicate depreciation, amortization, and outlook of future cash flow. It is also a guarantee in maintaining the IFRS 3 goodwill and intangible asset valuation in M&A standards that can enable investors and auditors to be aware of the financial well-being and anticipated gains of the takeover. This case study studies the PPA process of a manufacturing company, the valuation method, accounting issues and the strategies that their management assumed.

Understanding the Purpose and Scope of IFRS 3

IFRS 3 Business Combinations is one of the foundation accounting standards set by the International Accounting Standards Board (IASB) that gives accounting directions on how companies ought to record mergers, acquisitions, and other kinds of business combinations. The main aim of IFRS 3 is to have all business combinations being transparent and comparably reported and the transactions are recorded in terms of their relevant economic substance and not its form.

In the IFRS 3, all business combinations must be acquired using the method. This includes the identification of the acquirer, the date of acquisition, the identification of the identifiable assets acquired and the liabilities of the acquisition at their fair values and the realization of goodwill or a gain through the purchase a bargain. The methodology makes sure that the financial statements furnish the user, i.e. the investors, regulators and analysts with the relevant and reliable information concerning the effects of acquisition on the financial position and performance of a company.

IFRS 3 is not merely limited to simple acquisitions. It is applicable to mergers, takeovers, restructurings and step acquisitions- provided that one of the entities acquires control over another business. It however does not cover joint ventures and combinations between common controlled entities.

The second granting border consistency in reporting is achieved by establishing clear recognition and measurement principles in IFRS 3. This international standardization enables the multinational companies and investors to make better decisions because they are able to compare the outcome of acquisition in different jurisdictions and industries.

Practically, IFRS 3 is one of the key elements in integration of financial reporting, valuation, and tax implications, and, therefore, the element cannot be ignored in the accounting, valuation, and mergers and acquisitions. These are the preconditions of mastering Purchase Price Allocation (PPA) and acquiring the right to guarantee the post-acquisition reporting.

Why PPA Is Essential in Business Combinations

Purchase Price Allocation (PPA) is a very important procedure that is required under the IFRS 3 to give the true financial effect of an acquisition. It requires the purchase consideration that has been paid to obtain a target company to be allocated appropriately to identifiable assets that are obtained and liabilities assumed based on their fair values at the date of acquisition. Any balance after this allocation is considered as goodwill, which is supposed to be the future economic benefits that are not identified easily or can not be separately recognized.

The value of PPA is that it facilitates transparency and accuracy in the financial reporting on the post acquisition. Without the appropriate allocation, the balance sheet and income statement of the company may be inaccurate in terms of the value of assets, future amortization and depreciation, and finally profitability of a merged company. PPA provides a picture of what was actually purchased to the management and the stakeholders, and this is through tangible assets, intangible assets like trademarks or customer relationships, and contingent liabilities.

PPA should also be used to understand the tax implications. Depreciating and non-depreciating assets are directly related to the tax deductions and deferred tax balances under the IAS 12. Furthermore, the valuation and recognition of intangibles affect the impairment testing, according to IAS 36, the goodwill and the intangible assets are to be monitored to be written-down.

In mergers and acquisitions, precise PPA contributes to improved integration decisions and further investor confidence because it provides that the fair value principles in IFRS 3 will be met. It also has lessons to be learnt when doing future valuation, strategic planning and measurement of performance.

Finally, PPA is not only a compliance test but a strategic financial procedure, which assists corporations to articulate the elemental economic nature of an acquisition, which maintains clear, constant and conformity with the worldwide reporting and taxation frameworks.

Identification and Valuation of Assets

The process of PPA starts with an overall inventory of all assets and liabilities. The tangible assets in manufacturing enterprises are also frequently easy to value, and the practices applied are the things like the cost, market, and the value of replacement. As an example, machinery and equipment could be appraised at a market price of other similar machinery or they could be depreciated. The valuation of real estate assets can be based on the market purchase price allocation case study for manufacturing company Singapore comparables or the capitals of income. The inventory valuation is taking into consideration the cost of the inventory or the net realizable value based on the requirements of the reporting.

However, intangible assets need more advanced methods of valuation. The multi-period excess earnings method can be used to value customer relationships; this is a technique that estimates future cash flows as a result of retaining existing customers. Unless otherwise, proprietary manufacturing processes, patents, and even trademarks are generally evaluated using either income-based or relief-from-royalty methods. The valuation of these intangibles should be done accurately since very often they constitute a large part of the total value of the acquisition.

The liabilities should also be well identified and quantified. They can be those outstanding debts, pension liabilities, warranty liabilities, or environmental clean up liabilities. Economic reality of the acquired company is properly termed; the balance sheet bears the accurate reflection of the economic reality of the company.

Goodwill Recognition and Strategic Implications

Once the purchase price has been apportioned by means of identifying its assets and liabilities, any remainder is considered as goodwill. When acquiring companies, goodwill is usually projected synergies, operating efficiencies, positioning in the market and strategic benefits associated with acquisition of the acquired firm and its combination with the current operations. The impairment test of goodwill is done every year under IFRS 3 and thus goodwill cannot be overstated in the financial statements.

In addition to the compliance, the appreciation of the strategic implications of PPA would assist the management to make wise operational decisions. An example of this is determining the fair value of equipment which could inform its maintenance and replacement program and its client contract worth which could inform its retention strategy after it has been acquired. Moreover, proper allocation of assets may impact tax planning since the values allocated will determine the depreciation and schedules of amortization. Adequate documentation of the assumptions and methodologies will ensure the audit is audit ready and commercial to the stakeholders.

Conclusion

Purchase Price Allocation Manufacturing acquisition is a very important exercise that unites both technical accounting and strategic planning. Properly recognizing and measuring both the tangible and intangible assets is to make sure that it goes in line with the IFRS regulations as well as promotes transparency to investors and regulators. With a comprehensive PPA, companies can make a sound operational and financial decision, can plan taxes in the most effective way and realise integration synergies.

Taking PPA in a systematic way the management will have better insight on the actual value of the acquisition. It facilitates a proactive strategy of utilizing its assets, cash flow, as well as long-term development. Finally, a properly done PPA will have the effect of increasing the confidence of the stakeholders; the ability to sustain business after acquisition and the acquisition as desired by the companies in terms of its strategic and financial goals.