Certified IFRS 3 and US GAAP Course

IFRS 3 vs US GAAP: Key Differences in Purchase Price Allocation

Introduction to Certified IFRS 3 and US GAAP Course

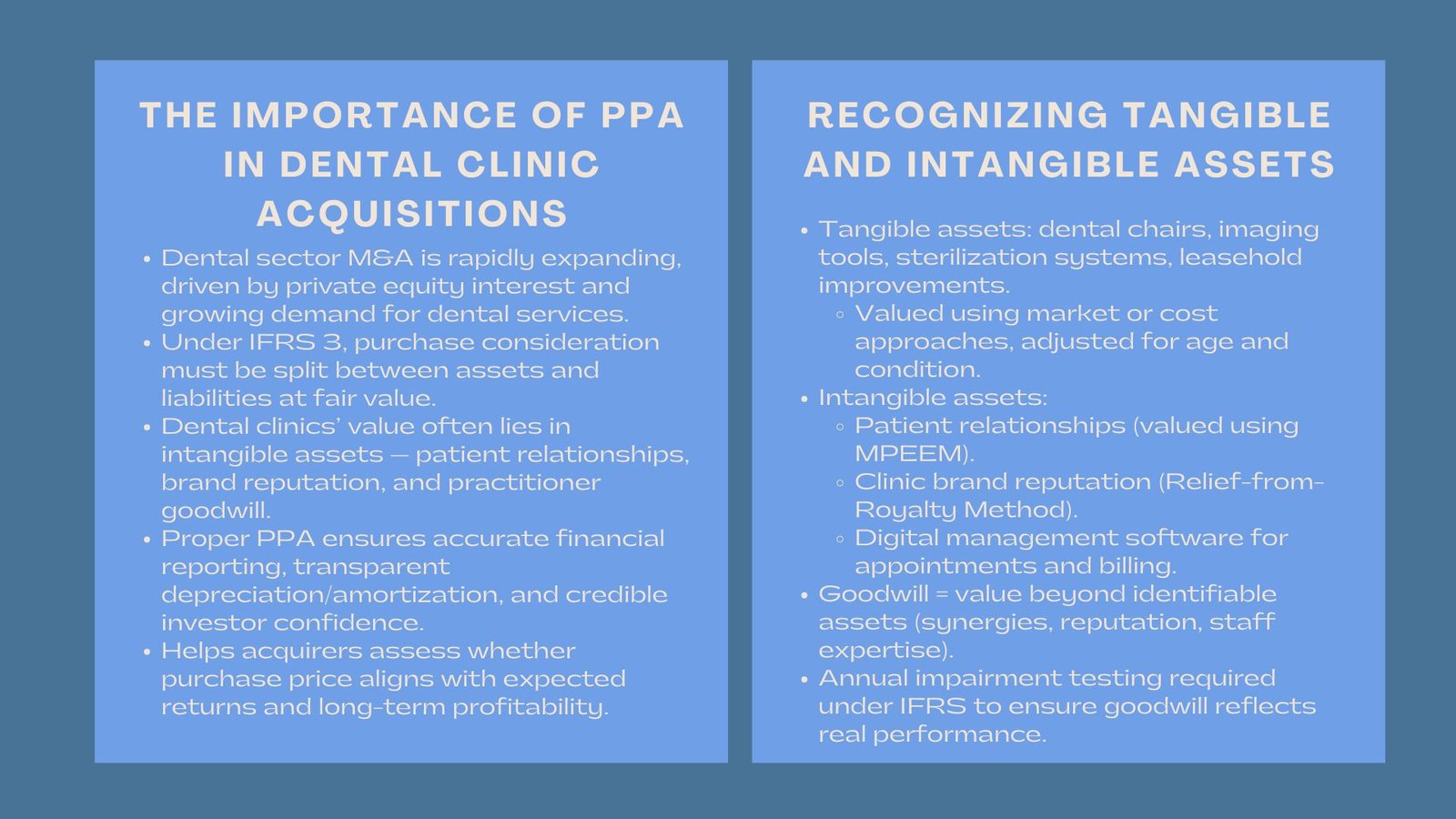

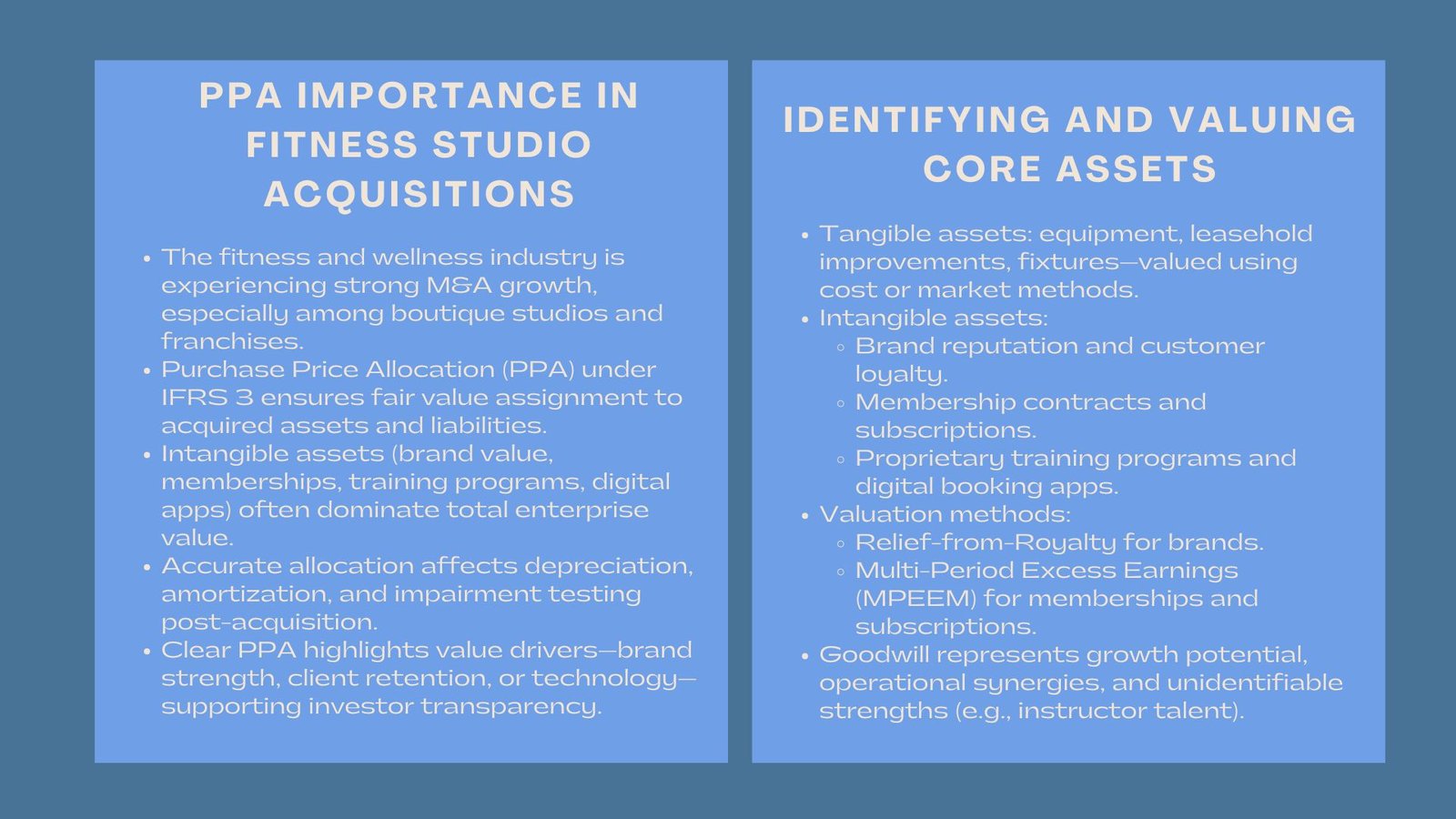

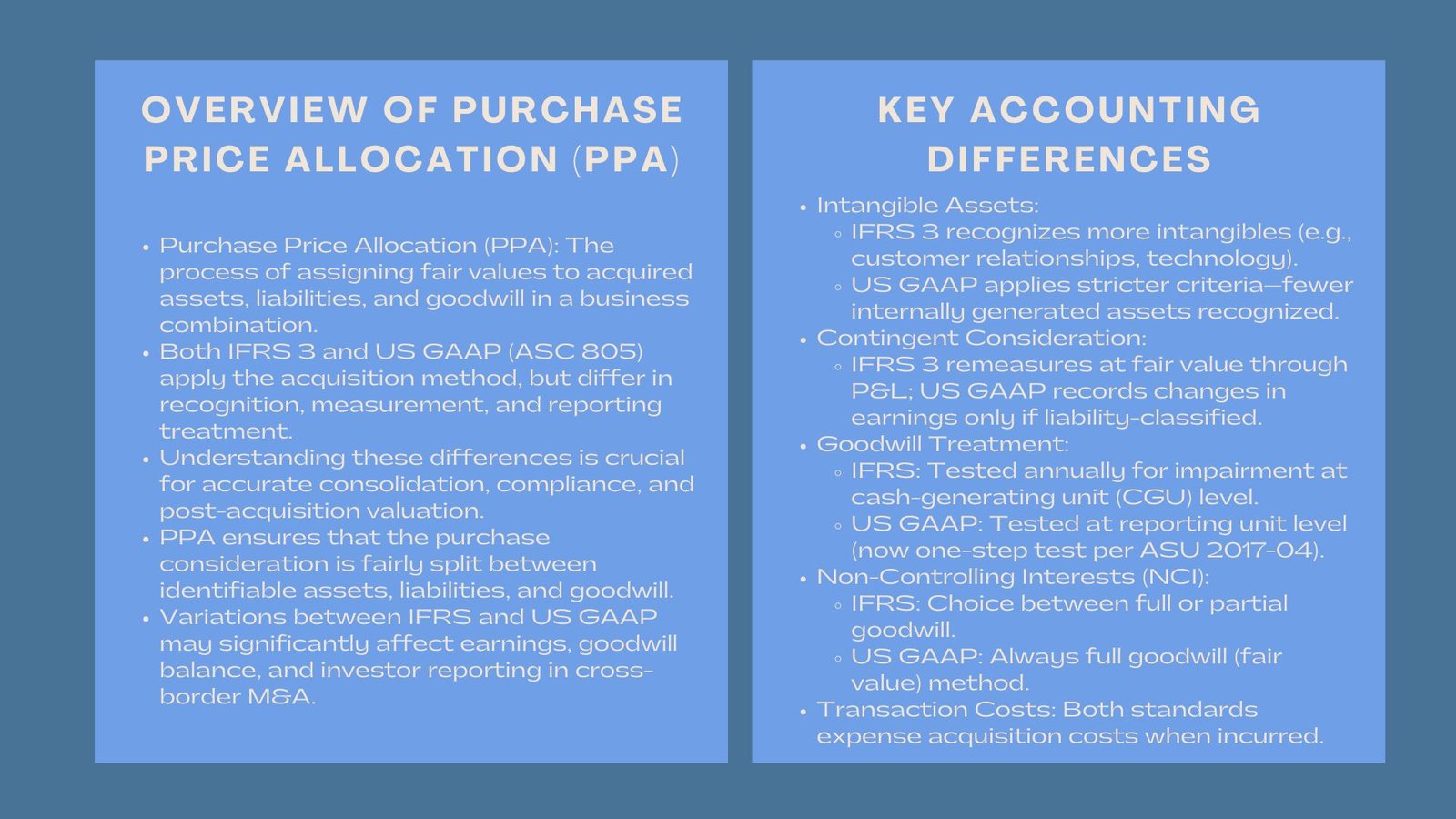

One of the basic points of accounting business combinations is called Purchase Price Allocation (PPA). Both the IFRS 3 and US GAAP frameworks give guidelines on assigning the consideration to purchase of the acquired assets and liabilities including intangible assets and goodwill. Nevertheless, there are some major differences between the two standards that have potential to impact greatly on the financial reporting, valuation and post acquisition analysis.

When it comes to finance and accounting professionals, these differences are important to comprehend in order to guarantee compliance, the provision of correct financial statements, and effective management of cross-border M&A.

The summary of PPA under IFRS 3 and US GAAP.

PPA is mainly aimed at giving fair values to the all the acquired assets and assumed liabilities at the acquisition date. The surplus between the purchase consideration and the fair value of the net assets is considered as goodwill.

- IFRS 3: Uses the acquisition method and focuses on the fair value measurement where identifiable assets and liabilities must be recognized at fair value at the date of acquisition.

- US GAAP (ASC 805): The acquisition method is also applicable, although there are subtle differences in how to recognize, measure and subsequently account some of the assets and liabilities.

These differences though similar may give rise to various financial outcomes and reporting treatment.

Intangible Assets were recognized.

Among the major differences between IFRS 3 and US GAAP, one should mention recognition of intangible assets:

- IFRS 3: Recognises an intangible asset on its own, when it is identifiable, either: by contractual/legal right or separability. The IFRS will have a greater acknowledgment of intangible assets such as customer relationship, technology, and trademarks.

- US GAAP: Intangible assets are required to be identifiable but they are more restrictive on recognition. Some internally generated intangible cannot be identified and distinguished unless they are acquired or contracted.

This difference means that there is a strong tendency of greater accepted intangible assets under IFRS than US GAAP, and a resulting effect on goodwill.

Contingent consideration can be measured.

Contingent consideration earouts or performance-based payments are more or less different under the two frameworks:

- IFRS 3: Contingent consideration which is deemed to be a liability is valued at fair value on the date of acquisition with the future adjustments recorded in profit or loss.

- US GAAP: The contingent consideration liabilities are first recorded at fair value, however, thereafter the changes are normally recorded in earnings when they are considered to be a liability. Equity classified contingent consideration however is not remeasured once initial recognition is done.

These variations have implications to the initial PPA calculation and the volatility of the post acquisition earnings.

Acquisition-Related Costs Treatment.

The other significant change concerns the account of transaction costs:

- IFRS 3: The expenses related to acquisitions like legal, due diligent, and advisory fees are expensed when incurred. The purchase consideration does not consider them.

- US GAAP: Likewise, the transaction costs are expensed when they are incurred. This similarity is the opposite of the case with older standards, which is historical cost treatment, but it still places more emphasis on the omission of these costs in the purchase price.

These rules are necessary in order to know how to present financial statements and do proper accounting.

Goodwill Calculation and Subsequent Measurement.

There is a subtle difference in the goodwill measurement between IFRS 3 and the US GAAP:

- IFRS 3: The goodwill is determined as the premium between the surplus of consideration transferred and the fair value of identifiable net assets. It is not amortized but is also tested annually at the impairment level which is at the cash generating unit (CGU).

- US GAAP: This is also computed as goodwill but impaired at reporting unit level. In contrast to IFRS, the US GAAP permits two-step impairment test (step 1: fair value of reporting unit, step 2: impairment test). ASU 2017-04 now makes this a one-step test, although variation in CGU and reporting unit definitions can still have an impact on the impairment results.

These differences may lead to various impairment costs and timing in the financial statement.

Identification of Non-Controlling Interests (NCI)

NCI also differs in terms of treating it in accordance with the two standards:

- IFRS 3 NCI can either be measured on a fair value (full goodwill method) or at the percentage of net assets (partial goodwill method).

- US GAAP: NCI is to be measured at all times at fair value (full goodwill method).

The decision taken under IFRS may have an impact on the level of goodwill that is identified and the equity that is recorded as belonging to non-controlling shareholders.

Steps Acquisitions and Previously Held Interests.

The case of acquisition on the basis of which the acquirer has an interest is different:

- IFRS 3: Previously, held equity interests have been re-measured at fair value, as of the acquisition date and the resultant gain or loss recorded in profit or loss.

- US GAAP: Remeasurement rules are also similar in ASC 805, and the gains or losses are to be recorded in the earnings. There might however be nuances in timing and presentation.

This affects financial statements in multi-stage acquisitions especially cross-border acquisitions.

Post-acquisition adjustments and fair value Measurement.

- Both IFRS 3 and the US GAAP permit a 12 months measurement period in which they can adjust provisional value of assets, liabilities, and contingent consideration. Differences include:

- IFRS 3: The adjustments of the measurement period include new information on facts and circumstances that were in place during the date of acquisition.

- US GAAP: Allows adjustments also in a measurement period, but the guidance states that it should be applied retrospectively and reported in the first reporting period after the adjustments have been finalized.

Effective knowledge will guarantee adherence and minimize audit risk.

Practical Implications for Finance Professionals

Understanding the purchase price allocation differences between IFRS 3 and US GAAP is crucial for:

- Consolidation and reporting of business acquired accurately.

- M&A involving cross border where parent and target companies use different accounting standards.

- Projection of financial indicators after acquisition, such as the amortization of intangibles, and possible impairment of goodwill.

- Reporting financial performance and reasons of statistics to investors and regulators.

The differences in recognition, measurement and impairment rules may have material impacts on the reported goodwill, earnings and balance sheet measures.

Best practices in navigating the IFRS and the US GAAP differences.

- Conduct Dual Accounting Test: In case of cross-border transactions, model PPA using the IFRS and the US GAAP to expect the difference in financial reporting.

- Document Valuation Assumptions: Prepare well maintained working papers to provide assistance in making fair value allocations, recognition of intangibles, and determination of contingent considerations.

- Align Internal Teams and Advisors: Finance, tax and legal teams must have coordination of assumptions, reporting and disclosure requirements.

- Track Changes in Monitoring and Standards: IFRS and US GAAP are constantly changing; to remain compliant, it is necessary to maintain up-to-date

- Get Ready to Face Audit Raised Eyebrow: Make solid justification to key assumptions, especially in such areas as goodwill, NCI and intangible recognition.

Conclusion

While IFRS 3 and US GAAP share a common acquisition method, the accounting treatment of business combinations under IFRS and US GAAP exhibits meaningful differences in areas such as intangible recognition, contingent consideration, goodwill measurement, and NCI.

Finance practitioners working with PPA have to be aware of these differences so that they can report correctly, in line with the regulations, and communicate effectively to the stakeholders. The art of these nuances can enable the companies to manage the transactions across the borders effectively without compromising the transparency and integrity of the financial statements.