Business Valuation Allocation for Retail Stores

Business Valuation Allocation for Retail Stores

Introduction: Business Valuation Allocation for Retail Stores

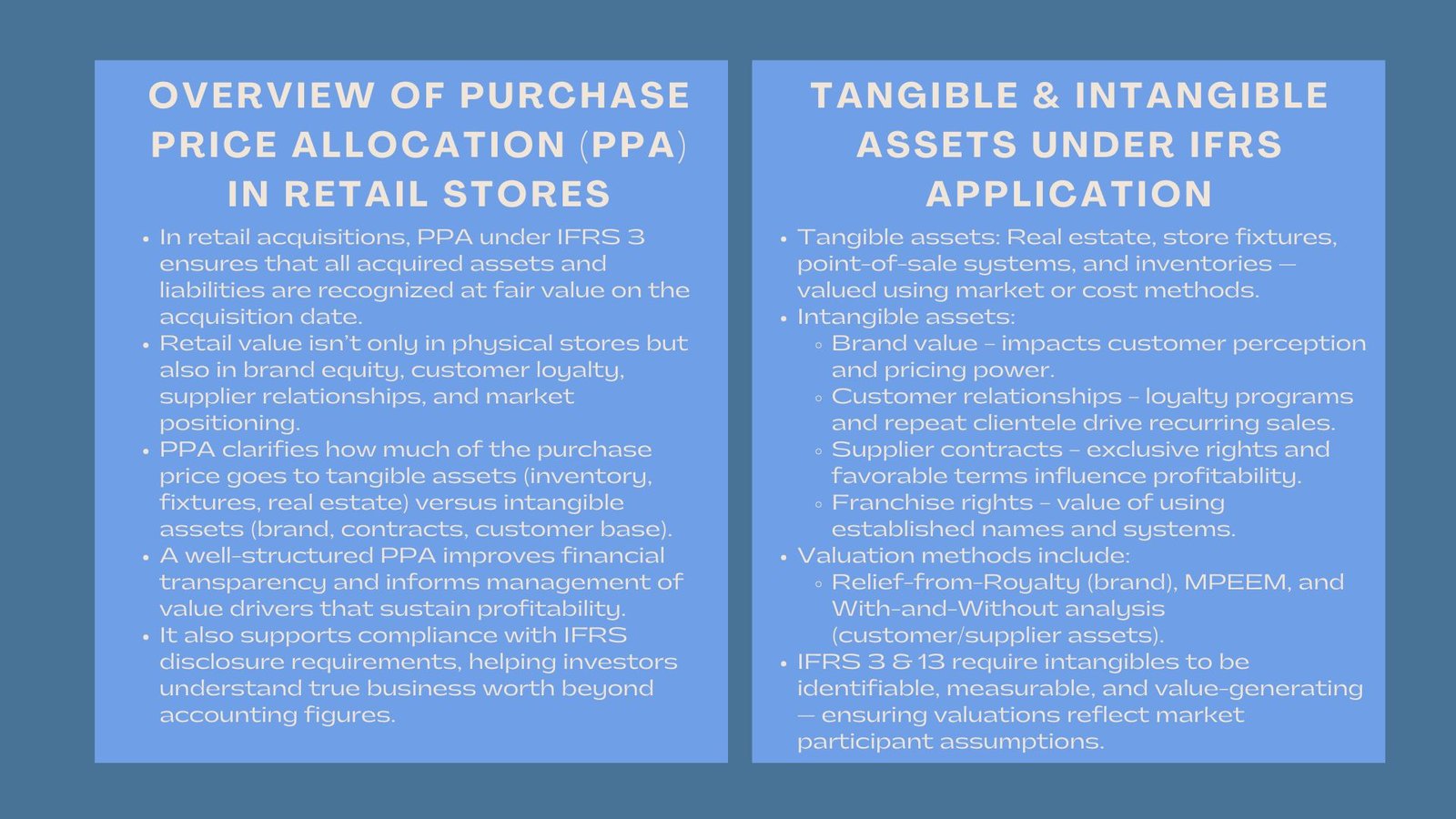

In the retail sector, not only is the physical space of the stores used to make acquisitions but also the brand equity, relationship with customers and even positioning in the market. When a retail chain acquires another one, or when an independent store is purchased by a private investor, it is necessary to decide the allocation of the purchase price to allow transparent financial reporting and correct value reflecting. According to IFRS 3, this is called Purchase Price Allocation (PPA) and all assets and liabilities obtained at fair value on the date of the transaction must be recognized and valued.

Properly designed PPA is able to fulfill accounting necessities and also assists the management to gain knowledge about the origins of business value. These sources can be brand strength, leasehold improvements, customer loyalty, and exclusive supply arrangements as far as retail operations are concerned. All these parts determine the performance of the organization as a whole and should be appropriately classified in the financial statements.

The Retail Acquisition of Purchase Price Allocation.

The acquisitions of retail include various types of assets, both tangible and intangible value drivers. The process of retail business purchase price allocation divides the total purchase consideration among identifiable categories that accurately reflect their contribution to the business’s profitability.

Usually, the process of allocation is divided into the following steps:

- Determine the Acquired Assets and Liabilities: This comprises inventory, fixtures, buildings, equipments, leases, customer lists and trademarks.

- Establish Fair Values: Tangible assets are typically valued by market or cost method, whereas intangibles are typically valued by methods basing on incomes.

- Identify Goodwill: The purchase price less fair value of identifiable assets and liabilities is identified as goodwill

- Prepare Disclosures and Documentation: IFRS demands that all valuation methodologies, assumptions and reasons behind every fair value estimate should be explained in detail.

Proper allocation allows investors, auditors and regulators to view the extent of the acquisition value that is attributed to tangible assets and the brand name and market position.

Physical and Intangible Asset Elements.

Tangible Assets

Retail stores usually have high physical elements, including real estate, store fixtures, point-of-sale equipment and inventory. These are largely valued under a cost method (replacement cost less depreciation) or market method (similar transaction values).

Intangible Assets

The most difficult and important aspect of retail PPA is intangible assets. These can include:

- Brand Value: Good brands impact the customer buying behavior, and power of price.

- Customer Relationships: Customer loyalty programs and repeat customer help in attracting recurring revenue.

- Supplier Contracts: Exclusive rights or favorable supply contracts are the type of supplier contracts whose fair values can be measured.

- Franchise or Licensing Rights: Retail business that operates under franchise of a brand name should consider on rights to use name and systems.

Multi-Period Excess Earnings Method (MPEEM), Relief-from-Royalty Method, or With and Without Analysis are some of the methods that are used to value every intangible asset depending on the type of the asset.

Applying IFRS in Retail PPA

The IFRS 3 concerns each identifiable asset and liability to be recognized at fair value at the point of acquisition. This in practice, implies the alignment of the accounting treatments with real world value drivers. A proper IFRS brand valuation guide helps financial professionals determine whether brand names, trademarks, and related intellectual property meet the recognition criteria under IFRS.

Key considerations include:

- Whether the asset is identifiable (can be separated or a product of contractual rights).

- Whether it contains any measurable fair value which can be reasonably determined.

- Whether it creates economic gains to the acquirer that are not related to other assets.

Retail brand valuation has tended to be based on the Relief-from-Royalty approach, estimating the price of not making royalty payments in future, had the acquirer licensed the brand by a third party. This is in line with the principles of IFRS 13 of measuring fair value that puts an emphasis on the market assumption of participants.

Goodwill Recognition and Management.

Goodwill of retail acquisitions almost always signifies the harmony of business, labor skills, and future income increases of new markets or store extensions. Under the IFRS, goodwill is not amortized, but it should be tested annually on impairment under IAS 36.

Such signs of impairment could be reduction in the growth of same-store sales, loss of essential suppliers, or deterioration of competitiveness in the market. Goodwill testing is done on a regular basis to ensure that the carrying amount is up to date on the economic performance of the store.

Difficulties in Retail Valuation Allocation.

Assessing a retail business is fraught with a number of problems:

- Fluctuating Market Conditions: There can also be significant changes in fair value appraisals because of consumer demand, inflation, and e-commerce trends.

- Seasonality: Retail earnings are seasonal and therefore makes it difficult to forecast cash flows based on intangible valuation.

- Lease Liabilities: Under the IFRS 16, long-term leases may have a significant impact on the purchase consideration allocation.

- Intangible Overlap: The distinction between brand value, customer relationships, and goodwill is a complex process that is subject to expert judgment and strong data.

These issues indicate the need to involve valuation specialists that are experienced in the dynamics of the retail sector and the IFRS compliance.

The Strategy Value of a Good Allocation.

A precise allocation of purchase prices does not only deliver compliance, but it also gives us an idea of how the business is structured and how it is going to be sustained. As an example, the large percentage of value in intangibles can indicate a brand-oriented model, whereas real estate or inventory oriented operations can be indicated by tangible-heavy allocations.

The outcome of transparent PPA also leads to enhanced trust among the stakeholders, ease of communication with the investors and aid in the excellent decisions to be made after the acquisition. They are building blocks of the continued monitoring of the performance of assets, impairment testing, and strategic planning.

Conclusion

Such a combination of technical accounting skills, valuation skills, and market behavior is necessary in setting the acquisition price of retail stores. A comprehensive retail business purchase price allocation backed by a sound IFRS brand valuation guide will make sure that all assets will be valued at reasonable level, goodwill will be properly identified, and the end result will be the true economic nature of the acquisition that will be present in the resultant financial statements. To the investors, the process helps not only to protect the compliance, but to also give them a better understanding of how each of the components, brand, customer loyalty, and operational strength, is the force behind the long-term success of the retail industry.