Advanced PPA for Manufacturing SMEs

Purchase Price Allocation for Manufacturing SMEs

Introduction to Advanced PPA for Manufacturing SMEs

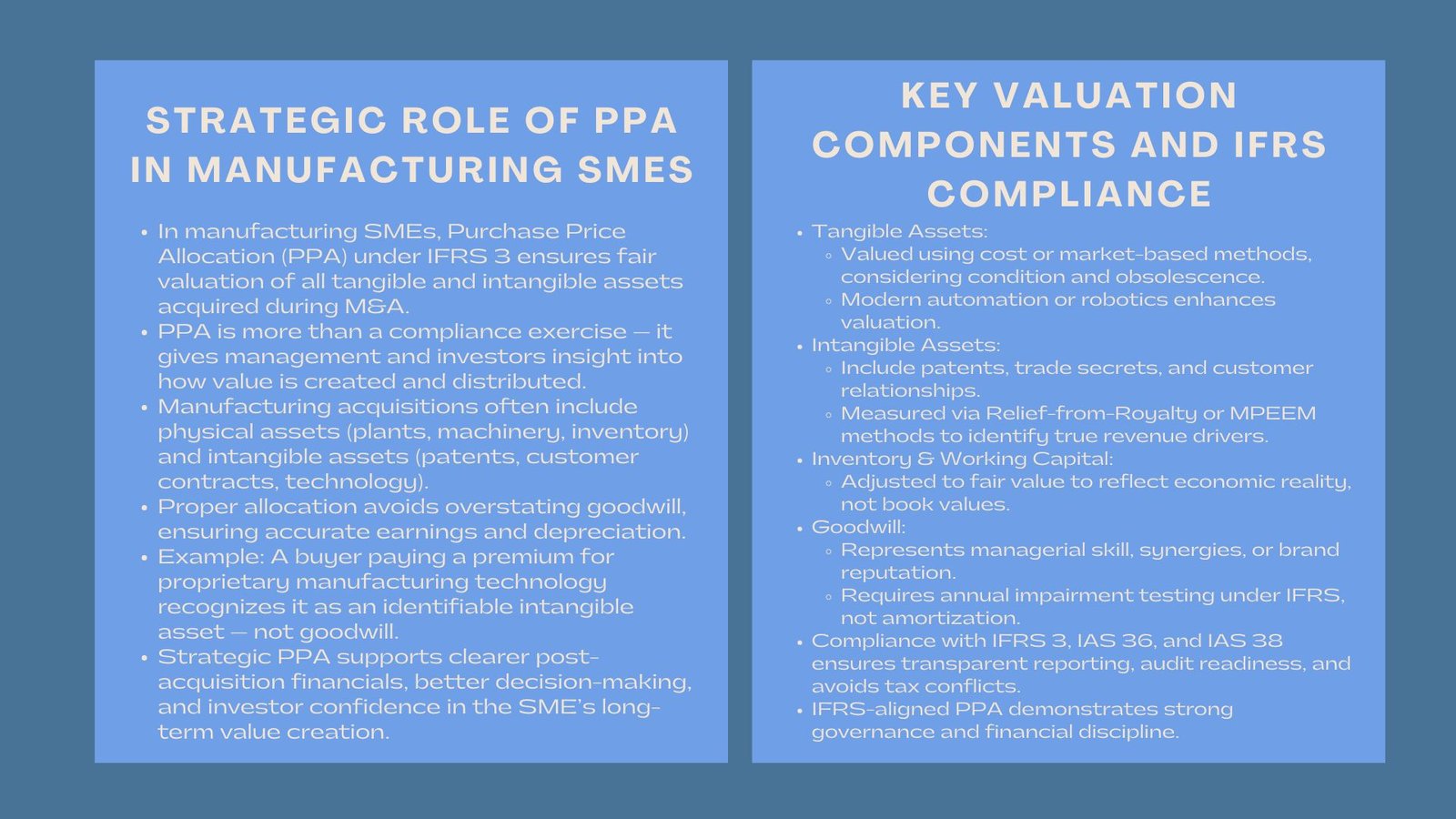

With the current vibrant business environment, small and medium-sized businesses (SMEs) in the manufacturing industry are taking up mergers, acquisitions, and strategic consolidations in very high numbers. Such deals can usually be historic milestones towards growth, expansion or diversification. Nevertheless, the Purchase Price Allocation (PPA) process is one of the most important and technically challenging things to ensure following an acquisition.

Under the International Financial Reporting Standards (IFRS) which is IFRS 3 on Business Combinations, PPA requires the acquirers to recognize, measure and attribute fair values to all physical and intangible assets and liabilities acquired during a transaction. In the case of manufacturing SMEs, this process is more than simply accounting compliance, it also gives management and investors a clear picture as to how value is created and shared throughout the business.

1. Knowledge of PPA in the Manufacturing Environment.

1.1 PPA and the role in making manufacturing acquisitions.

In the case of an acquisition of a manufacturing SME, the amount of the purchase price will reflect the fair value of both the physical assets (such as machinery, inventory and property) and soft assets (patents, customer contracts and proprietary technology) of the acquired business. The manufacturing SME purchase price allocation ensures that each component of the business is properly valued, offering clarity on what portion of the price corresponds to identifiable assets versus goodwill.

This difference matters since it has a direct impact on the future financial statements. Earnings are affected by assets that have finite useful lives, which are amortized or depreciated, i.e. equipment or patents. In the meantime, goodwill is still open to testing of impairment on an annual basis. This allocation would be correctly done and avoid excessive overstatement of goodwill and would provide a reliable performance tracking.

1.2 Investors and Stakeholder Relevance.

In the eyes of an investor, PPA shows the real value in a manufacturing SME. As an illustration, a buyer may find out that much of the buying price was based on a technology of production that is proprietary or a base of loyal customers. This understanding directs post-acquisition strategy, including putting research and development or supply chain resilience first.

2. Essential Elements of Purchase Price Allocation of SME Manufacturing.

2.1 Tangible Assets

SMEs in manufacturing are usually endowed with large physical resources, such as production plants, specialized equipment, and raw materials. They are normally assessed through cost-based or market-based methods. The appraiser takes into consideration physical condition, cost of replacement, and economic obsolescence in order to come up with fair values.

Indicatively, a factory that has state of the robotics can fetch a better valuation than a factory that is using outdated equipment, because the automation capacity is a direct addition to the efficiency and profitability of its operations.

2.2 Intangible Assets

The differentiating value in manufacturing businesses is the intangible assets of the business. These can be proprietary designs, patents, trade secrets and customer relationships. These have to be identified under the IFRS in different accounts as opposed to goodwill as long as they satisfy the criteria of identifiability- they should be sellable, transferable or of contractual rights.

Income-based approaches used by valuation specialists in a PPA, include the Relief-from-Royalty (with patents or trademarks) or Multi-Period Excess Earnings Method (with customer relationships). The result will make the management know the drivers of revenue that most contribute to the enterprise value.

2.3 Current Assets and Inventory.

Inventory and specifically working capital is critical in the manufacturing businesses. Raw materials, work in progress, and finished goods need to be adjusted to fair value at the date of acquisition. This makes sure that the post-acquisition cost of goods sold and gross margins is based on economic reality and not the book values passed on by the seller.

3. Goodwill and Its Implications.

3.1 Definition and Calculation

Goodwill denotes the remaining balance of fair value of identifiable assets and liabilities and the total purchase price after the deduction of the fair value of identifiable assets and liabilities. Within the environment of manufacturing SMEs, the aspects of goodwill may reflect value in the form of managerial expertise, personnel know-how or some anticipated future economies of scale synergies.

Nonetheless, goodwill is not amortized under IFRS. Rather, it should be subjected to testing of impairment on an annual basis usually on the basis of discounted cash flow (DCF). In case the future cash flow stops covering the recorded goodwill, impairment should be employed, and profit and loss statements should be affected.

3.2 Generally encountered difficulties in Goodwill Valuation.

The manufacturing SMEs are associated with unpredictable prices of raw materials, labor market, and demand patterns. Goodwill testing and impairment testing are complex because of these variables. A properly done PPA reduces this risk as it offers a well-justified basis to computation of goodwill grounded not on rough estimates but on precise values of assets at the asset level.

4. The IFRS Compliance in PPA Role.

4.1 The standards of the IFRS require alignment with those maintained by Financial Reporting Standards.

Reporting of PPA has to be in line with the IFRS 3 and other applicable standards, including, IAS 36 on impairment and IAS 38 on intangible assets. Following an IFRS reporting guide ensures consistency, comparability, and credibility in financial statements.It is also helpful in conducting external audit and due diligence by investors who wish to see the methodologies and assumptions applied when valuing assets.

Adequate compliance will avoid conflicts with auditors and tax authorities particularly in the case of intangible assets being re-valued or where there is a difference in patterns of amortization between taxations and audits.

4.2 Improving Transparency and Governance.

The production of SMEs that comply with the IFRS rules in their process of the PPA is an indication of good corporate governance and financial discipline. Clear reporting develops investor confidence and increase the availability of money, which is essential to those businesses intending to expand production or venture into foreign markets.

5. The Practical Application: Case Study.

Take a case example of a mid-sized precision component manufacturer that has been purchased at a price of 10 million dollars. By examination of a detailed PPA:

- The real property and machinery were valued at 4 million dollars.

- Customer contract and patented tooling design Intangible assets valued at a fair amount of $3 million were assigned.

- The recognizables of liabilities included long-term liability with the suppliers and deferred liabilities and maintenance that equaled to 1 million dollars.

The other $4 million was brand goodwill, which was associated to brand reputation and operational expertise. Through meticulously recognizing and putting a premium on every individual part, the acquirer had a concise insight into the future amortization costs and risks of impairment, as well as profits. The current case illustrates how a well-developed PPA process will grant compliance and strategy. It enables management to work on value creation and not on accounting corrections to post acquisitions.

6. Best Practices and Common Pitfalls.

6.1 A missing Asset Identification

The firm had not fully identified its assets, including the fixed and current intangible asset and liability items (a liability).

Another mistake made during the production of PPA is the failure to pay attention to some intangible resources like the specific production techniques or even the relations with suppliers. Ignoring them decreases the reported asset value and inflates goodwill creating the possibility of impairment in the future. Thorough due diligence causes all the pertinent assets to be enclosed.

6.2 Overreliance on Book Values

The economic reality of acquisition can be manipulated by just using pre-acquisition book values. Valuation methods that are based on market and income are vital in showing the actual worth of assets. These inaccuracies can be avoided by hiring qualified valuation professionals and adherence to the IFRS.

7. Strategic Advantages of PPA Precision.

A correct and justifiable PPA does not only offer regulatory compliance, but also, it empowers management choices. Knowing the fair value of equipment, technology, and client contracts, business leaders can focus on the aspects of investment and have optimistic plans on future expansion.

To investors, a credible PPA increases transparency, comparability to peers and reduces risks associated with the impairment of goodwill. In the case of auditors, it makes it easier to verify and increases the credibility of financial statements.

Conclusion

Purchase price allocation is much more than a technical accounting requirement in the manufacturing industry, it is a strategic instrument of evaluating value and making decisions following an acquisition. A properly carried out manufacturing SME purchase price allocation supported by an elaborate IFRS reporting guide enables SMEs and their investors to streamline the financial accuracy with business performance. The end result is that this process will put manufacturing businesses in a place to grow in a sustainable manner, increase control, and increase stakeholder confidence.