Certified PPA Training for Marketing Agencies

How Marketing Agencies Split Purchase Price in M&A

Introduction to Certified PPA Training for Marketing Agencies

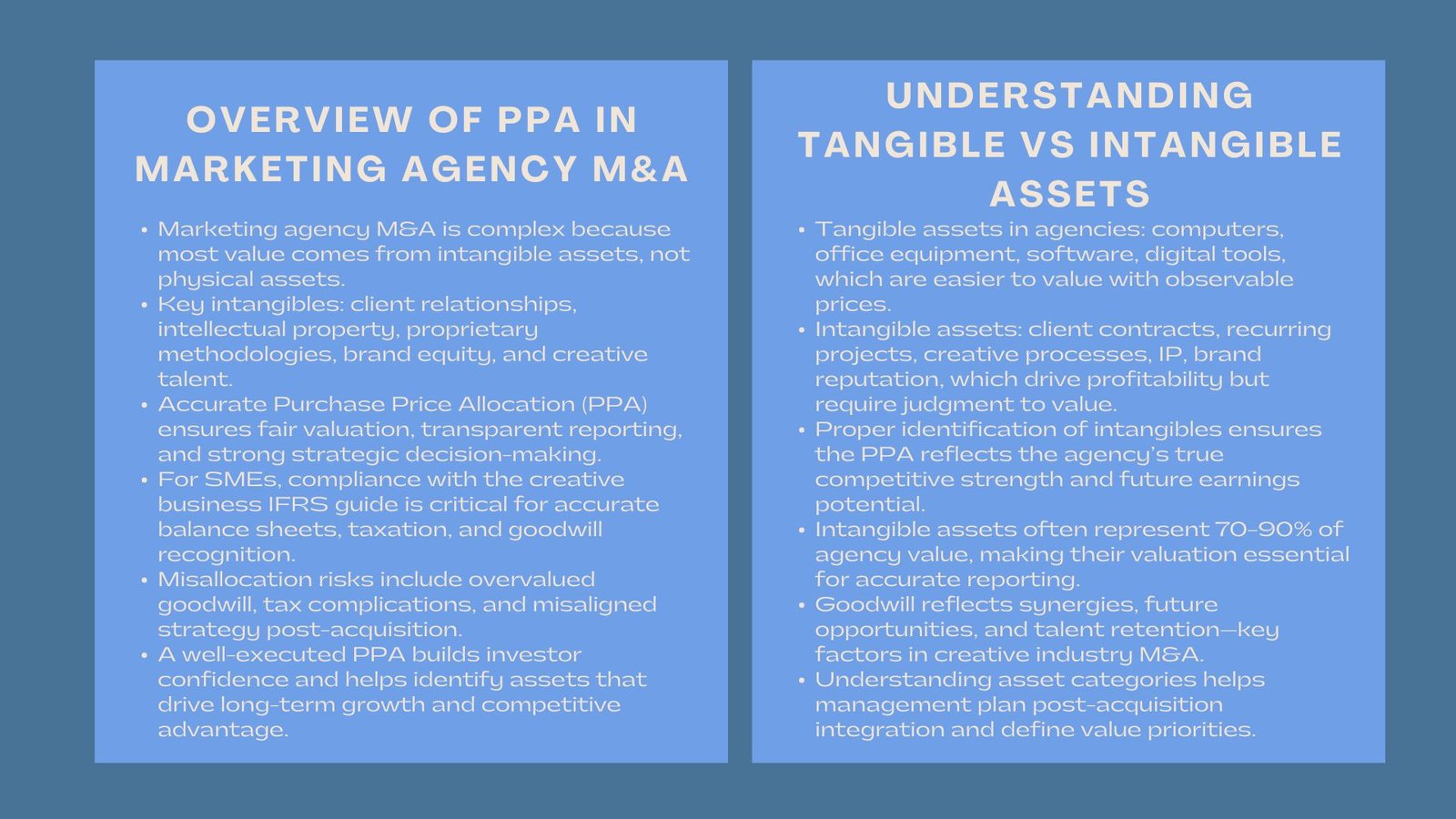

Mergers and acquisitions (M&A) in the creative sector, particularly for marketing agencies, have become increasingly complex and strategic in recent years. Unlike traditional companies that rely primarily on tangible assets, marketing agencies often derive the majority of their enterprise value from intangible resources such as client relationships, intellectual property, proprietary methodologies, brand recognition, and creative talent. Proper marketing agency purchase price allocation ensures that all these tangible and intangible assets are accounted for fairly, allowing accurate financial reporting, strategic decision-making, and regulatory compliance.

For small and medium-sized creative enterprises, adherence to the creative business IFRS guide is especially critical. The allocation of purchase price in an acquisition directly affects balance sheets, taxation, goodwill recognition, and post-acquisition performance measures. Furthermore, a thorough and defensible allocation process helps prevent misvaluation, marketing agency purchase price allocation supports investor confidence, and provides actionable insights into which assets truly drive long-term growth. Without careful allocation, an acquiring company risks overestimating or underestimating the value of key intangible assets, potentially resulting in impaired goodwill, unexpected tax liabilities, or misaligned strategic priorities.

Understanding Purchase Price Allocation in Marketing Agencies

Definition and Purpose of PPA

Purchase Price Allocation is the systematic accounting process of distributing the total cost of acquiring a company across its identifiable assets and liabilities. In the context of marketing agencies, PPA must consider both tangible assets, like office equipment, computers, software licenses, and digital tools, as well as intangible assets, such as client contracts, proprietary campaign strategies, brand equity, and the value of creative talent.

The primary purpose of PPA is to ensure that the acquiring company’s financial statements reflect the fair and accurate value of the acquired business. This enables management, investors, auditors, and regulators to understand the true economic worth of the transaction. PPA is also instrumental in determining the amount of goodwill recognized in the acquisition. Goodwill represents the excess purchase price over the fair value of net assets and typically reflects the synergies expected from combining the two companies, the value of future business opportunities, and the premium for retaining top talent and clients.

Tangible Versus Intangible Assets

Tangible assets in marketing agencies, such as computers, office furniture, software, and technical infrastructure, are relatively straightforward to value. These assets usually have observable market prices or can be appraised based on replacement costs. Intangible assets, however, require more nuanced assessment. Client lists, brand recognition, intellectual property, and proprietary marketing methodologies are often the true drivers of profitability in creative businesses. Their value depends on future economic benefits, including anticipated revenue from client contracts, recurring project engagements, or the agency’s unique market positioning. Accurately identifying and valuing these intangible assets ensures that the PPA reflects the agency’s competitive advantage and strategic potential.

Strategic Importance of PPA

Accurate purchase price allocation is not merely an accounting exercise; it has strategic implications for both the acquiring and acquired firms. By understanding how value is distributed among assets, management can make informed decisions about integration, investment, and resource allocation. For example, if a significant portion of the purchase price is allocated to client contracts and talent retention, the acquiring company may prioritize client relationship management and employee engagement post-acquisition. Furthermore, accurate allocation helps prevent overstatement of goodwill, ensures proper amortization schedules, and reduces the risk of impairment under IFRS standards.

IFRS Considerations for Creative Businesses

IFRS 3 and Business Combinations

IFRS 3 provides the accounting framework for business combinations and mandates that the purchase price be allocated to identifiable assets and liabilities at fair value. For marketing agencies, this includes valuing client contracts, intellectual property, brand recognition, and proprietary processes. Accurate allocation is critical because it influences future financial reporting, including revenue recognition, amortization of intangible assets, and impairment testing of goodwill.

Challenges for SMEs

Small and medium-sized marketing agencies often face challenges when applying IFRS 3 due to limited internal accounting resources, lack of specialized expertise, or insufficient historical data. Despite these hurdles, compliance with IFRS 3 is essential for transparency, credibility, and audit readiness. Misallocation of purchase price can lead to regulatory scrutiny, impaired financial statements, or even litigation. Therefore, SMEs are encouraged to engage specialized valuation professionals with expertise in creative industry M&A to ensure accuracy and defensibility.

Strategic Insights from IFRS Compliance

Applying the creative business IFRS guide offers more than regulatory compliance; it provides strategic insights into which assets drive business value. By analyzing revenue streams, client contracts, intellectual property, and human capital, management can determine which resources require ongoing investment, protection, and development. This insight is critical for post-acquisition integration planning, helping the acquiring firm maximize the economic potential of the acquired agency while avoiding costly misallocation of resources.

Valuation Methodologies for Marketing Agency Assets

Future Earnings Projection Method

The income-based approach links the value of assets to the future economic benefits they are expected to generate. In marketing agencies, this involves projecting revenues from client contracts, considering the probability of renewals, estimating project continuity, and discounting future cash flows to their present value using risk-adjusted rates. This approach is particularly useful for valuing client relationships, recurring contracts, and proprietary methodologies, as it directly reflects the expected contribution of these assets to future profitability.

Comparable Transaction Benchmarking

The market-based approach assesses the value of assets by comparing them with observable transactions involving similar businesses. Although exact comparables are rare in the creative sector, benchmarking against industry multiples, recent agency acquisitions, and client portfolio valuations can provide meaningful reference points. This method helps corroborate income-based valuations, ensuring that the purchase price allocation reflects prevailing market conditions and competitive realities.

Replacement Cost Evaluation

The cost-based approach estimates asset value based on the replacement or reproduction cost of tangible and intangible assets. While this method is often conservative and may undervalue revenue-generating intangible assets, it serves as a useful cross-check to validate income-based or market-based results. In marketing agencies, cost-based valuation can be applied to creative tools, software licenses, or early-stage proprietary processes where future revenue projections are uncertain.

Multi-Method Valuation Framework

A robust PPA process often combines income-based, market-based, and cost-based approaches. Using multiple methodologies provides cross-validation, enhances reliability, and supports defensibility during audits or regulatory reviews. By triangulating asset values across different methods, management can achieve a more comprehensive understanding of the agency’s total enterprise value, ensuring that key intangible assets receive appropriate recognition in financial statements.

Key Challenges in Allocating Purchase Price for Marketing Agencies

Valuing Client Relationships

Client contracts are a significant driver of revenue in marketing agencies, but they vary widely in length, strategic importance, and future profitability. Accurately valuing these relationships requires analyzing historical revenue data, client retention rates, and dependencies on specific clients. Additionally, the strategic significance of certain clients or industries must be factored in, as losing a major client could materially impact the value of these intangible assets.

Assessing Creative Talent and Brand Equity

Creative talent is central to a marketing agency’s success, yet quantifying the contribution of employees to enterprise value is challenging. Similarly, brand equity is inherently subjective, influenced by reputation, market presence, and past campaign successes. While these factors are difficult to monetize, their contribution to future cash flows and competitive advantage cannot be ignored. Valuation methodologies must integrate both qualitative assessments and quantitative projections to capture the true economic impact of human capital and brand recognition.

SME Limitations and Documentation

Small and medium-sized agencies often face resource constraints that complicate comprehensive valuation. Limited historical data, reliance on a few key clients, or insufficient accounting records can increase the difficulty of justifying asset valuations. Maintaining thorough documentation of assumptions, data sources, methodologies, and calculations is essential for transparency and defensibility. Without careful record-keeping, the agency risks post-acquisition disputes, regulatory challenges, or audit deficiencies.

Why Accurate PPA Matters for Marketing Agency Acquisitions

Driving Post-Acquisition Integration

Accurate PPA informs integration strategies by highlighting high-value assets such as client relationships, intellectual property, and key personnel. Understanding where value resides allows management to prioritize retention programs, align project teams, and optimize workflows, ensuring continuity of service for important clients and seamless integration of creative processes.

Resource Allocation and Investment Decisions

By identifying the assets that contribute most significantly to profitability, accurate PPA supports strategic investment decisions. Management can direct resources to strengthen client relationships, retain top creative talent, enhance proprietary methodologies, and invest in marketing technologies that drive growth. This targeted approach maximizes return on investment and ensures that critical intangible assets are effectively leveraged.

Transparency and Stakeholder Confidence

Well-documented and defensible purchase price allocations enhance transparency, build investor confidence, and demonstrate accountability to auditors and regulators. Clear rationale for valuation assumptions ensures stakeholders understand how values were determined, reducing uncertainty and supporting sound governance practices. In competitive creative industries, transparency in asset valuation also reinforces credibility and strengthens relationships with clients and partners.

Best Practices in Purchase Price Allocation for Creative Businesses

Engaging Specialized Experts

Engaging valuation professionals with industry-specific experience is crucial. Experts familiar with marketing agencies understand the unique drivers of value, including client portfolios, creative processes, and brand reputation. Their expertise ensures that purchase price allocations are accurate, compliant with IFRS standards, and defensible during audits or regulatory reviews.

Robust Documentation and Multiple Methodologies

Thorough documentation of assumptions, methodologies, and supporting data enhances credibility and transparency. Using multiple valuation approaches—income-based, market-based, and cost-based—provides cross-validation and ensures that asset values reflect economic reality.

Leveraging Technology and Analytics

Advanced data analytics, modeling software, and predictive tools enable more accurate valuations by facilitating scenario analysis, sensitivity testing, and real-time updates. Integration with digital IP management and client relationship tracking systems allows valuations to reflect actual operational performance, further increasing reliability.

Monitoring and Adjustment

Post-acquisition, continuous monitoring of asset performance ensures alignment between initial PPA and ongoing business reality. Adjustments may be necessary for client retention fluctuations, revenue volatility, or market changes. Regular reassessment ensures financial statements remain accurate, informs management decisions, and supports long-term strategic growth.

Conclusion

Purchase Price Allocation for marketing agencies is a critical process that combines financial rigor, strategic insight, and regulatory compliance. Accurately allocating purchase price under the creative business IFRS guide ensures that tangible and intangible assets, including client relationships, intellectual property, brand equity, and creative talent, are properly valued and reported. This supports investor confidence, audit readiness, and informed creative business IFRS guide decision-making while providing actionable insights for post-acquisition integration, resource allocation, and strategic planning. In a sector where intangible assets define competitive advantage, a comprehensive, defensible, and methodologically sound PPA process is a cornerstone of long-term success and sustainable business growth.