Certified PPA Training for Law Firms

Purchase Price Distribution for Law Firm Acquisitions

Introduction to Certified PPA Training for Law Firms

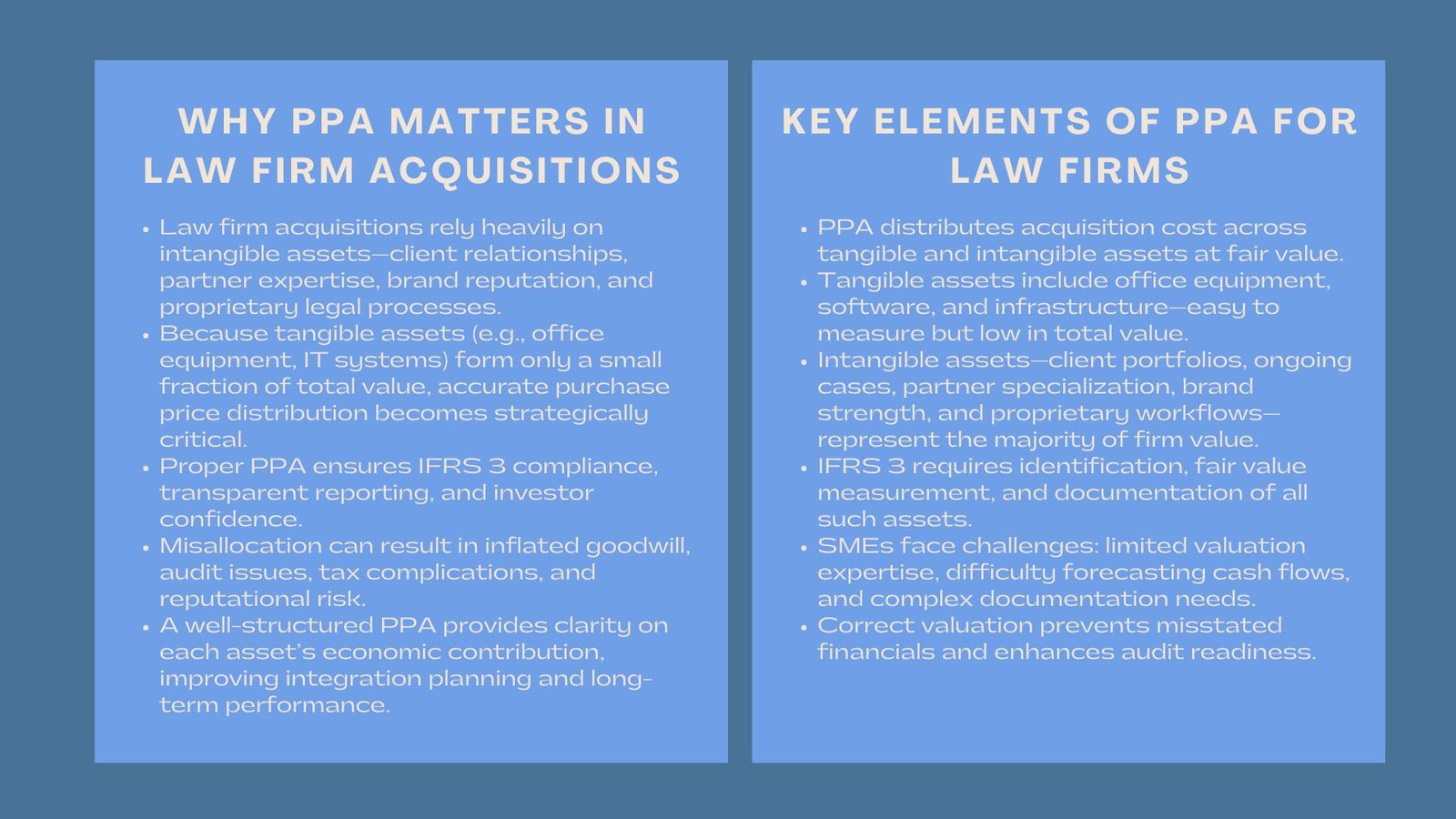

Acquiring a law firm in today’s professional services market presents unique challenges that extend far beyond standard accounting procedures. Unlike traditional businesses that rely heavily on tangible assets such as inventory, machinery, or real estate, law firms derive the majority of their value from intangible elements that are difficult to quantify. These include client relationships, partner expertise, ongoing legal engagements, brand reputation, and proprietary case management processes. As such, the purchase price allocation process is not merely a technical accounting task but a strategic necessity that can significantly impact post-acquisition performance.

Accurate law firm purchase price allocation ensures adherence to IFRS 3 professional services guide standards, supports transparent financial reporting, enhances investor confidence, and provides a clear understanding of the economic contribution of each asset to the overall firm value. For small and medium-sized professional services enterprises, these considerations are critical, as misallocation of purchase price can lead to inaccurate balance sheets, inflated goodwill, tax law firm purchase price allocation complications, and even reputational risk. Therefore, understanding how to distribute purchase price across tangible and intangible assets is essential to achieving both compliance and strategic objectives.

ExploringPurchase Price Allocation in Law Firm Acquisitions

Defining Purchase Price Allocation

Purchase price allocation (PPA) refers to the accounting process of distributing the total acquisition cost of a business among the identifiable assets and liabilities acquired. In law firms, this process involves assessing both tangible and intangible components. Tangible assets, such as office furniture, computers, and IT infrastructure, are relatively straightforward to value using market or replacement cost methods.

Intangible assets, however, comprise a significant portion of the firm’s value and include elements such as client portfolios, ongoing legal matters, partner expertise, firm reputation, and proprietary methodologies or processes. Proper PPA ensures that all assets are recorded at fair value in accordance with IFRS standards, which is crucial for financial reporting, taxation, and post-acquisition planning. Failure to allocate the purchase price correctly can distort financial statements, inflate goodwill, and create regulatory or audit issues that may affect investor confidence.

Identifying Tangible and Intangible Assets

In law firm acquisitions, tangible assets generally include office equipment, computers, software licenses, and leased office space. While these assets are relatively easy to quantify, their value often represents only a small fraction of the total purchase price. The majority of the firm’s worth lies in intangible assets. Client relationships are particularly critical, as recurring engagements and long-term contracts contribute directly to future revenue streams.

Partner expertise, reputation within specialized practice areas, and the intellectual capital embedded in proprietary legal processes are also central to value creation. Firm brand recognition and market positioning further enhance economic benefits by attracting new clients and retaining existing ones. Distinguishing between tangible and intangible assets allows the acquiring firm to prioritize key resources, inform post-acquisition integration strategies, and ensure proper amortization or impairment testing under IFRS guidelines.

IFRS 3 Compliance in Law Firm Acquisitions

Key Requirements of IFRS 3 for Professional Services

IFRS 3 sets out the accounting standards for business combinations, emphasizing the fair value measurement of identifiable assets and liabilities and the accurate calculation of goodwill. Compliance with IFRS 3 is particularly critical for professional services firms, where intangible assets form the majority of value. Under this standard, assets such as client portfolios, recurring legal engagements, and proprietary workflows must be identified and recorded at fair value. Goodwill is then calculated as the residual amount after allocating the purchase price to all identifiable assets and liabilities. This ensures that financial statements provide a true reflection of the resources acquired and their contribution to the combined entity’s future economic benefits.

Challenges Faced by SMEs

For small and medium-sized professional services enterprises, IFRS 3 compliance can be challenging due to limited internal expertise and resource constraints. Valuing intangible assets, such as client relationships or partner knowledge, often requires specialized valuation methods and external expert support. These assets are not only difficult to quantify but also central to the firm’s revenue generation, making accurate valuation critical. SMEs may also face challenges in documenting assumptions, applying appropriate discount rates, and projecting future cash flows, all of which are required for compliance with IFRS 3 professional services guide standards. Inadequate valuation or documentation can lead to audit adjustments, disputes with tax authorities, or challenges in investor negotiations.

Strategic Benefits of IFRS Compliance

Adhering to IFRS 3 is not solely about meeting regulatory requirements; it offers strategic benefits as well. By accurately allocating purchase price among tangible and intangible assets, management gains insights into which elements of the law firm generate the most value. This knowledge allows for better post-acquisition integration, resource allocation, and operational planning. For example, identifying high-value client portfolios can inform retention strategies, while recognizing partner expertise as a critical asset can guide talent management and incentive structures. Compliance also enhances transparency and credibility with auditors, investors, and regulators, reducing the risk of disputes and supporting long-term financial stability.

Approaches to Determining Law Firm Asset Value

Future Cash Flow Estimation Method

The income-based approach is particularly well-suited for law firms, as it links the value of assets to the expected future cash flows they generate. This involves estimating revenues attributable to client engagements, ongoing cases, and partner expertise, then discounting these projected cash flows to present value. Key considerations include client retention rates, recurring billing patterns, and the risk profile of legal services offered. This method provides a defensible and transparent approach for determining the value of intangible assets and supports IFRS-compliant financial reporting.

Comparative Market Benchmarking Method

The market-based approach relies on comparable transactions in the legal services industry to determine asset value. While finding direct comparables may be challenging due to the unique nature of each law firm, analyzing acquisitions of firms with similar client bases, practice areas, and regional presence offers a useful benchmark. Market-based valuations can validate assumptions used in income-based approaches and provide an objective perspective on fair value.

Asset Replacement Cost Analysis

The cost-based approach calculates the replacement or reproduction cost of tangible and intangible assets. In law firms, this method may be applicable to office equipment, IT systems, and certain proprietary tools. However, it often underestimates the value of intangible assets such as client relationships and partner expertise, which are critical to generating revenue. Despite its limitations, the cost-based approach provides a foundational reference and ensures that tangible asset values remain consistent with observable market costs.

Holistic Multi-Method Valuation Framework

Combining income-based, market-based, and cost-based approaches creates a more comprehensive and defensible valuation. Income-based methods capture expected future benefits, market-based methods provide benchmarking, and cost-based methods ensure tangible assets are valued appropriately. For SMEs, integrating these approaches allows for more accurate, transparent, and regulatory-compliant purchase price allocation, ensuring that intangible assets driving revenue are properly recognized and accounted for.

Critical Issues in Law Firm Purchase Price Allocation

Valuing Client Relationships

Client relationships are a law firm’s most valuable asset, but they are also difficult to quantify. Their value depends on the stability of client engagement, contract terms, recurring billing patterns, and the likelihood of client retention after the acquisition. Misestimating client value can distort the allocation of goodwill, impact amortization schedules, and create misalignment with actual revenue generation.

Assessing Partner Expertise and Reputation

Partner expertise, specialization, and reputation are central to a law firm’s ability to attract and retain clients. This human capital element directly affects future revenue potential and overall firm valuation. Additionally, proprietary legal processes, knowledge management systems, and precedent libraries contribute to intangible value but are often difficult to quantify due to their uniqueness. Accurate assessment of these elements requires rigorous analysis and often the use of external valuation experts.

Documentation and Audit Readiness

Meticulous documentation of valuation assumptions, methods, and calculations is essential for audit defensibility and regulatory compliance. A transparent and detailed record enhances credibility with stakeholders, reduces the risk of disputes, and ensures that valuations are both repeatable and defensible. Firms that fail to maintain proper documentation may encounter challenges during audits, tax reviews, or litigation, which could result in financial, operational, and reputational consequences.

Operational Impacts of Accurate Purchase Price Allocation

Informing Operational and Strategic Decisions

A well-executed PPA provides management with detailed insights into the economic contribution of each asset. This knowledge allows firms to allocate resources efficiently, retain key client relationships, and prioritize investments in high-value areas. For example, understanding which practice areas generate the highest profitability can inform staffing decisions, marketing investments, and client development initiatives. Accurate valuation also enables firms to anticipate future cash flows, manage operational risk, and improve overall business performance.

Mitigating Regulatory and Audit Risk

Accurate allocation ensures compliance with IFRS 3 and related professional services guidelines, reducing audit risk and regulatory exposure. Properly valued assets reflect true economic contributions, support defensible goodwill calculations, and minimize potential disputes with regulators, auditors, or investors. Compliance also enhances stakeholder confidence, facilitates investment decisions, and provides a foundation for robust post-acquisition financial management.

Supporting M&A Negotiations and Investor Confidence

Defensible and transparent purchase price allocation strengthens negotiating positions during acquisitions. Identifying and valuing intangible assets such as client portfolios, partner expertise, and proprietary legal processes allows for premium valuations while providing a clear rationale to investors. This transparency improves trust, facilitates smoother post-acquisition integration, and enhances the long-term success of the combined entity.

Conclusion

Purchase price distribution for law firm acquisitions is a complex but essential exercise that combines accounting rigor, strategic insight, and regulatory compliance. SMEs acquiring law firms must ensure that tangible and intangible assets are correctly identified, valued, and allocated according to IFRS 3 professional services guide standards. A properly executed PPA not only ensures financial transparency and audit defensibility but also provides actionable insights into the firm’s core value drivers, such as client relationships, partner expertise, and firm reputation. As law firms increasingly rely on intangible assets to generate revenue and maintain competitive advantage, accurate purchase price allocation becomes a strategic tool, empowering management to leverage acquisitions effectively, ensure regulatory compliance, and achieve sustainable growth in a professional services-driven economy.