Professional PPA Certification Small IT Firms

Purchase Price Split for Small IT Consulting Firms

Introduction: Professional PPA Certification Small IT Firms

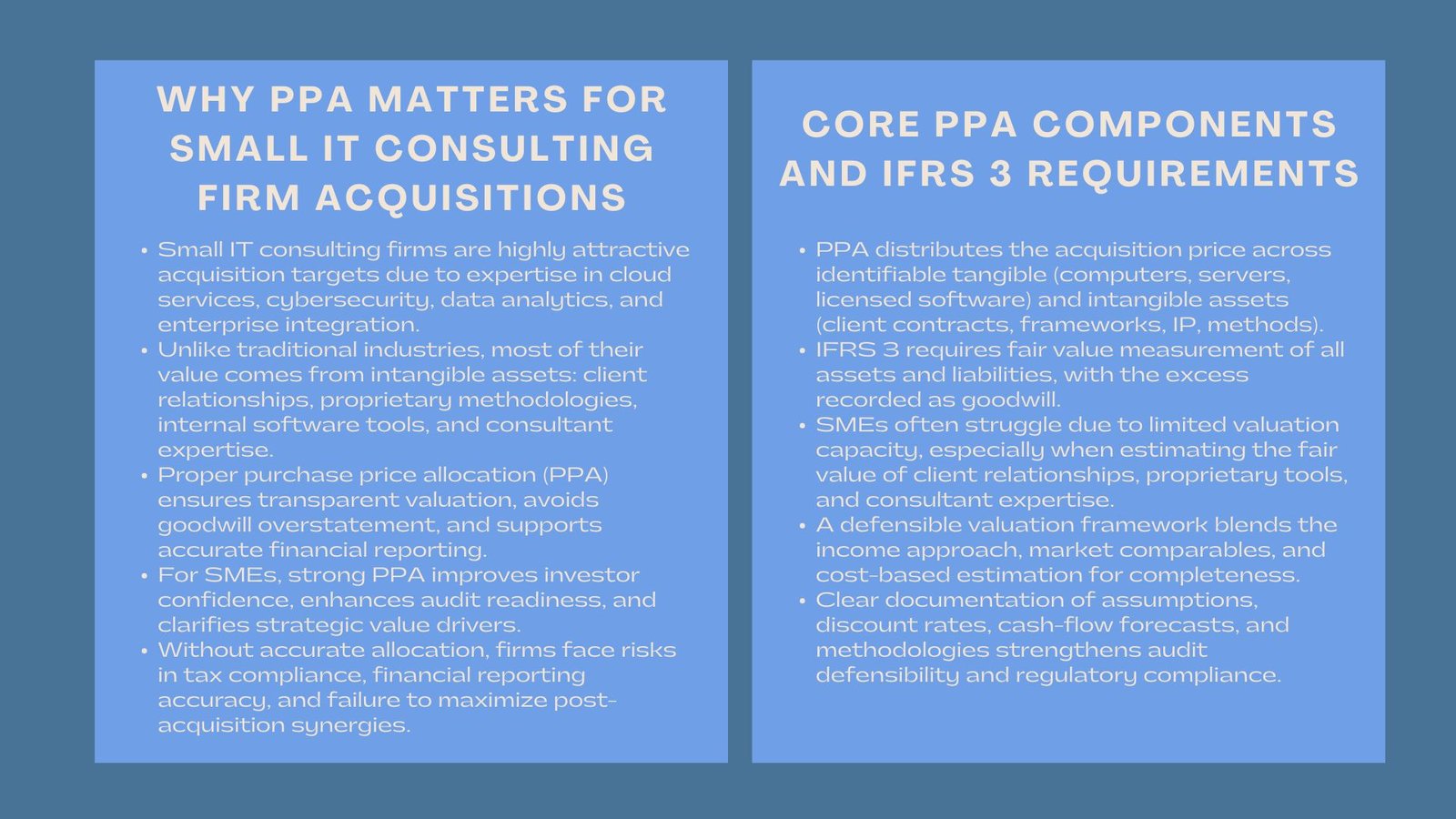

In today’s rapidly evolving digital economy, small IT consulting firms have become highly sought-after acquisition targets. These firms often possess specialized expertise in areas such as cloud computing, cybersecurity, data analytics, and enterprise software integration. Unlike manufacturing companies or traditional service providers, where the bulk of enterprise value is tied to tangible assets like machinery or real estate, IT consulting firms derive most of their worth from intangible resources. These resources include client relationships, proprietary methodologies, software tools, employee expertise, and organizational know-how.

When an acquisition occurs, allocating the purchase price correctly becomes a critical financial exercise. Beyond accounting compliance, it serves as a strategic tool that provides transparency to investors, informs post-acquisition integration, and supports regulatory adherence. For small and medium-sized enterprises (SMEs), following IFRS business combination guidance is essential to ensure that financial statements accurately reflect the fair value of acquired assets, minimize risks associated with goodwill IT consulting purchase price allocation overstatement, and maintain credibility with stakeholders. Without proper allocation, the acquiring firm may face challenges in financial reporting, tax compliance, or even in maximizing the strategic value of the acquisition.

The Concept of Purchase Price Allocation in IT Consulting Firms

Defining Purchase Price Allocation

Purchase price allocation (PPA) is the process of distributing the total acquisition cost of a company among its identifiable assets and liabilities. In the context of small IT consulting firms, this process involves both tangible and intangible assets. Tangible assets may include office equipment, computers, servers, or software licenses. Intangible assets, which often represent the bulk of enterprise value, can include client contracts, proprietary project management frameworks, in-house software tools, methodologies, and the collective expertise of the consulting team.

Properly allocating the purchase price ensures that each asset is recorded at its fair value on the balance sheet. This is particularly important for post-acquisition planning, as misallocation can lead to inflated goodwill, inaccurate amortization schedules, or improper tax treatment. For SMEs, a defensible and transparent PPA process provides a clear understanding of the true economic contribution of each asset, guiding both short-term operational decisions and long-term strategic planning.

Strategic Implications of Accurate Allocation

Accurate allocation extends beyond compliance. By understanding which intangible assets are driving the firm’s revenue and profitability, management can make informed decisions regarding resource allocation, investment priorities, and retention of key personnel. For example, identifying that a significant portion of revenue stems from a proprietary software tool may prompt the acquiring firm to invest in upgrading the platform or protecting it with intellectual property rights. Similarly, recognizing the value of long-standing client relationships helps ensure that client retention strategies are prioritized during integration. Without proper PPA, firms risk overlooking these critical drivers of value, potentially eroding the benefits of the acquisition.

IFRS Reporting Considerations

IFRS 3 and Business Combinations

International Financial Reporting Standard 3 (IFRS 3) sets out the principles for accounting for business combinations, including the identification and measurement of acquired assets and assumed liabilities. IFRS 3 requires that all identifiable assets and liabilities be recognized at fair value, with any excess of the purchase price over the net identifiable assets recorded as goodwill. In the case of small IT consulting firms, this includes the valuation of tangible assets such as office equipment and intangible assets such as client contracts, internal software systems, and proprietary methodologies.

Challenges for SMEs in IFRS Reporting

For SMEs, implementing IFRS 3 can be challenging due to limited accounting resources and specialized expertise. Many small IT consulting firms may not have the internal capacity to perform detailed fair value assessments of intangible assets. However, compliance with IFRS business combination standards is critical for multiple reasons. Accurate financial reporting enhances transparency, facilitates smoother audits, and builds investor confidence. It also ensures that the acquiring firm understands the contribution of each asset to the overall profitability and strategic position of the business. SMEs may benefit from engaging external valuation experts to provide rigorous and defensible assessments of intangible assets, helping to bridge gaps in internal expertise and resources.

Asset Valuation Framework for IT Consulting Firms

Income Generation Assessment

The income-based approach is often the most appropriate for small IT consulting firms because it links the value of assets to the expected future economic benefits they generate. This method involves projecting cash flows associated with client contracts, recurring service agreements, and proprietary methodologies, then discounting them to present value. A robust income-based valuation requires careful consideration of multiple factors, including historical revenue patterns, client retention rates, project profitability, and market conditions. Additionally, assumptions about risk factors and discount rates must be clearly documented to ensure that the valuation withstands regulatory and audit scrutiny.

Market-Driven Valuation

The market-based approach relies on analyzing transactions of comparable companies to determine fair value. While finding exact comparables can be difficult due to the unique nature of each consulting firm’s intangible assets, examining acquisition data from similar IT consulting businesses provides a reference point for assumptions about asset value. This approach can validate the income-based valuation by offering external benchmarks for the value of client relationships, proprietary methodologies, or intellectual property. The market-based method is particularly useful when assessing assets that are actively traded in the market or where there is an observable trend in acquisition multiples.

Cost of Development Method

The cost-based approach estimates the value of assets based on the cost to replace or reproduce them. This is most relevant for tangible assets such as computers, servers, and licensed software, as well as internally developed tools or proprietary platforms. While the cost-based approach can establish a baseline, it often undervalues intangibles like consultant expertise, client relationships, or proprietary methodologies that generate significant revenue. Therefore, combining income-based, market-based, and cost-based methods is recommended to produce a comprehensive and defensible valuation that captures both tangible and intangible contributions.

Typical Problems Encountered in PPA

Valuing Client Relationships

Client relationships are the cornerstone of value in IT consulting firms, yet their valuation presents significant challenges. Each client relationship varies in strength, duration, and revenue potential. Predicting future billing patterns, retention, and contract renewals requires careful analysis and consideration of historical data, industry trends, and competitive dynamics. If these relationships are undervalued, the firm may underestimate its goodwill or misallocate purchase price, which can distort financial statements and complicate post-acquisition planning.

Valuing Consultant Expertise and Methodologies

The expertise of consultants and proprietary methodologies also present challenges in valuation. Determining how specialized skills contribute to revenue and productivity requires qualitative judgment supported by financial modeling. Proprietary methodologies—such as unique project management frameworks, software development protocols, or analytical tools—must be evaluated for their economic impact and revenue-generating potential. Without a structured valuation, these critical assets may be overlooked or underappreciated, reducing the strategic value of the acquisition.

Integration and Accounting Challenges

Post-acquisition integration of intangible assets requires careful planning to ensure compliance with IFRS standards. Accurate recording of goodwill, amortization schedules, and deferred tax implications is essential for transparent financial reporting. Small firms may face challenges in integrating these assets into their accounting systems without external expertise. Mismanagement can result in inaccurate balance sheets, poor investor confidence, and potential regulatory issues.

Importance of Documentation

Documenting assumptions, methodologies, and calculations is vital for audit defensibility and regulatory compliance. Clear and thorough documentation ensures transparency, reduces the risk of disputes with tax authorities or auditors, and provides a foundation for post-acquisition management decisions. It also allows stakeholders to understand how asset values were determined and provides credibility to financial reporting.

Balancing Quantitative and Qualitative Judgment

A robust purchase price allocation balances quantitative financial models with qualitative judgment about the firm’s intangible assets. While financial models can calculate present value and project revenue, understanding client behavior, employee expertise, and the strategic value of proprietary methodologies requires judgment and insight. This holistic approach ensures that the allocation reflects the true economic value of both tangible and intangible assets.

Why Precision in Purchase Price Allocation Is Critical

Enhancing Decision-Making

Accurate allocation of purchase price provides critical insight for strategic decision-making. Management can identify which assets drive revenue and profitability, allowing for informed decisions on resource allocation, employee retention, and technology investment. Recognizing the true value of intangible assets such as client contracts, software tools, and consulting expertise enables firms to optimize operations, improve efficiency, and maximize post-acquisition returns.

Regulatory Compliance and Risk Mitigation

Correct allocation also ensures regulatory compliance and mitigates risk. By reflecting the fair value of assets and liabilities, the acquiring firm minimizes exposure to disputes with auditors, tax authorities, or other stakeholders. Transparent reporting enhances credibility, reassures investors, and supports smooth post-acquisition integration.

Long-Term Strategic Benefits

Beyond compliance, accurate PPA supports long-term strategic growth. It identifies the key value drivers, anticipates post-acquisition integration challenges, and informs planning for employee retention, client relationship management, and technology development. Over time, this strategic clarity strengthens the firm’s competitive position, facilitates sustained growth, and ensures that the acquisition delivers tangible business benefits.

Conclusion

Purchase price allocation for small IT consulting firms is a complex but essential exercise that combines accounting precision, strategic insight, and regulatory compliance. By evaluating both tangible and intangible assets, adhering to IFRS business combination guide, and carefully documenting assumptions and methodologies, acquiring firms can achieve transparency, defensibility, and actionable strategic intelligence. Accurate PPA informs post-acquisition integration, supports informed decision-making, and strengthens long-term value creation. In an environment where intangible assets such as client relationships, proprietary tools, and employee expertise represent the bulk of a firm’s worth, a meticulous purchase price allocation process is indispensable for sustainable growth and competitive advantage in the IT consulting sector.