Case Study Purchase Price Allocation in a Financial Services Company

Case Study: Purchase Price Allocation in a Financial Services Company

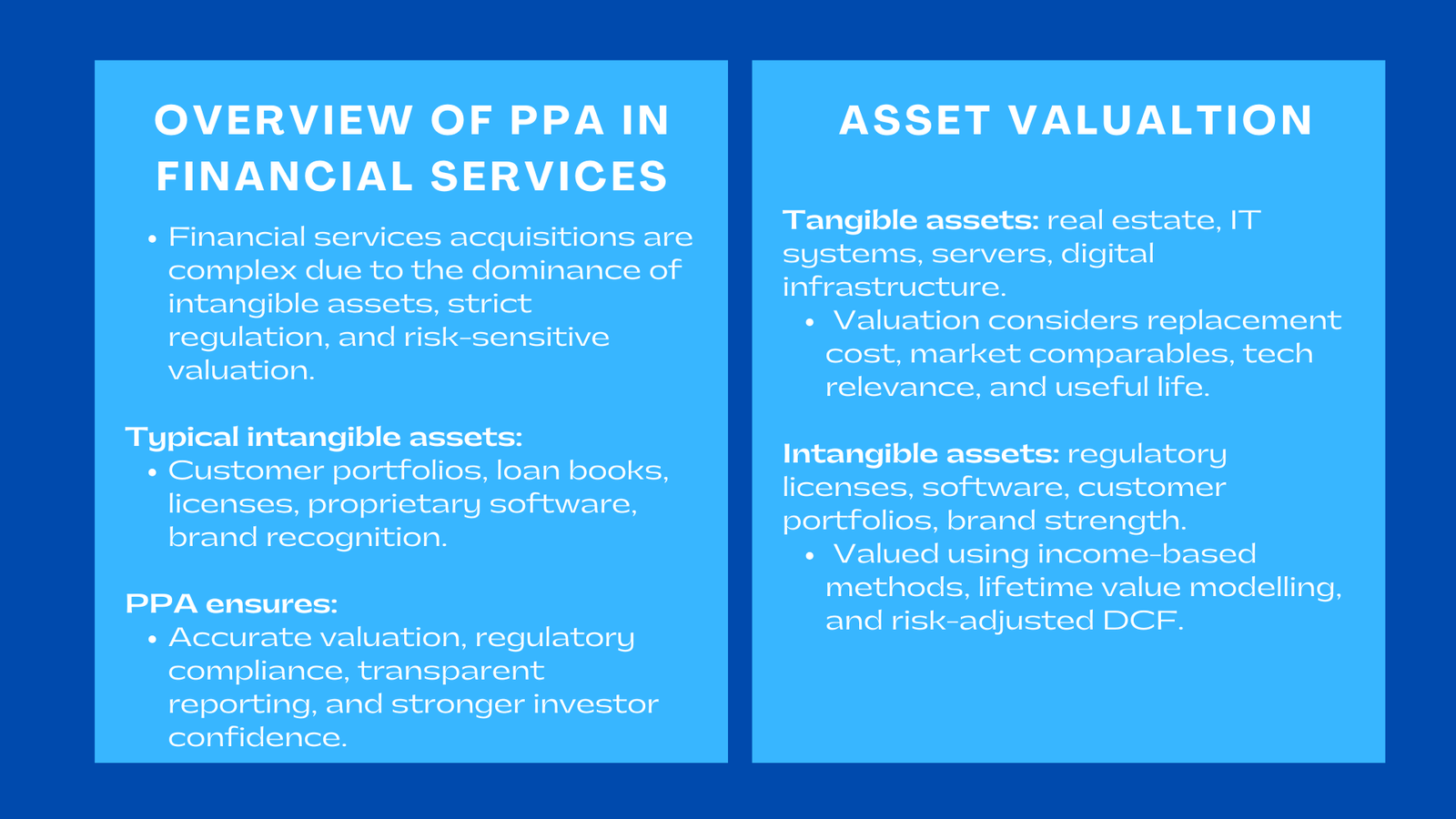

Acquisitions in the financial services sector are inherently complex due to the predominance of intangible assets and the highly regulated nature of the industry. Customers and loans, licenses, software platforms, and brand recognition are among the major intangible assets typically present in financial services acquisitions. Accurate purchase price allocation (PPA) is essential to assign the purchase cost to both tangible and intangible assets with precision. Proper allocation promotes transparency in financial reporting, ensures compliance with regulatory standards, and enables informed strategic decision-making. This case study analyzes the PPA process for a financial services company acquisition in Singapore, highlighting the valuation of assets, accounting challenges, and post-acquisition integration planning. By examining both tangible and intangible components, the study illustrates how PPA serves as a foundation for operational efficiency, investor confidence, and long-term strategic growth.

Understanding the Complexity of Financial Services Valuation

Valuation in banking and financial institutions is uniquely challenging because many of the assets are unrealized, and their value is heavily influenced by regulatory frameworks, market conditions, and risk exposure. Loan portfolios, for instance, must be valued with reference to anticipated credit losses, interest rate spreads, repayment behaviors, and overall borrower performance. Accurately modeling these factors requires sophisticated risk assessment, scenario analysis, stress testing, and sensitivity evaluations. Without detailed consideration, misstatements in valuation can lead to over- or underestimating enterprise value, which may have significant financial and regulatory consequences, especially when institutions engage external expertise such as brand valuation services in Singapore to support broader valuation needs.

Importance of Customer Relationships and Recurring Revenue

Customer relationships are a critical intangible asset in financial services and are typically valued using income-based approaches. By projecting future fee income, deposit retention rates, and cross-selling potential, organizations can estimate the long-term profitability associated with maintaining these relationships. Such valuations consider customer demographics, engagement levels, and historical behavior patterns to determine projected revenue streams. The results of these assessments directly impact post-acquisition profitability and integration decisions, such as prioritizing high-value client retention strategies and aligning product offerings across merged entities. Ultimately, customer relationships are a primary driver of recurring revenue, making their proper valuation essential for sustainable enterprise performance.

Detailed Valuation of Tangible and Intangible Assets

Physical Assets Assessment

Physical assets in a financial services company include real estate, office equipment, and IT infrastructure such as data centers, servers, and digital platforms. Valuation of these assets involves analyzing replacement costs, market comparables, technological relevance, and current utilization. For example, the value of a data center is influenced not only by the cost of servers and network equipment but also by software capabilities, cybersecurity protocols, scalability, and redundancy systems. Real estate assets must be evaluated considering location, occupancy rates, and market trends, as these factors affect both operational efficiency and potential resale value. Equipment, office fit-outs, and IT installations must be assessed in light of age, maintenance history, and expected useful life, ensuring that depreciation is properly accounted for in the overall PPA.

Valuation of Intangible Assets

Intangible assets represent a significant portion of enterprise value in financial services. These include customer portfolios, regulatory licenses, proprietary software platforms, intellectual property, and brand recognition. Customer portfolios are valued based on projected revenue streams, retention rates, and lifetime value calculations, which indicate the potential long-term profitability of ongoing relationships. Regulatory licenses are critical for operational legitimacy, enabling companies to operate legally and maintain compliance in highly regulated markets. Proprietary software platforms enhance operational efficiency, streamline processes, and create competitive advantages that have direct financial implications. Brand recognition, although less tangible, influences customer trust, market positioning, and overall credibility, which contribute to long-term financial performance.

Liabilities Assessment

Liabilities such as loan obligations, lease commitments, and regulatory reserves must also be carefully evaluated. Accurately valuing these liabilities ensures that net assets are fairly represented and that goodwill is not overstated. Inaccurate liability assessment can distort PPA outcomes, reduce transparency, and compromise post-acquisition financial reporting. Assessing liabilities involves examining contractual obligations, anticipated payouts, historical defaults, and potential regulatory fines, thereby providing a complete and balanced view of the financial position of the target entity.

Goodwill and Strategic Implications

Understanding Goodwill

Goodwill represents the premium paid above the fair value of net assets and is an important indicator of anticipated synergies, market position, and strategic advantage. In financial services, goodwill often reflects prospective growth opportunities, customer loyalty, market credibility, and management expertise. Unlike tangible assets, goodwill embodies intangible value, including the institution’s brand reputation, operational know-how, and the trust clients place in the organization. Correct measurement of goodwill not only affects the balance sheet but also influences investor perception, credit ratings, and post-acquisition profitability, making it a critical component of PPA.

Strategic Value of Customer Portfolios

Customer portfolios are central to financial services PPA because they have a direct impact on future revenue streams. The lifetime value of high-quality clients, retention rates, and cross-selling potential contribute to recurring income and operational stability. Accurate valuation requires detailed analysis of client behavior, historical transaction data, and the probability of attrition. By understanding the financial value of customer relationships, management can make informed decisions regarding retention programs, service enhancements, and targeted marketing strategies, thereby ensuring that strategic value is maximized post-acquisition.

Role of Brand Recognition

Brand recognition is another key intangible that drives goodwill in financial services. A strong and trusted brand attracts new clients, reinforces loyalty among existing customers, and strengthens the organization’s market position. Maintaining brand credibility is particularly important in a highly regulated and competitive environment, where reputational risk can have direct financial consequences. Valuation of brand recognition considers brand strength, market perception, customer satisfaction, and historical performance, allowing organizations to quantify its contribution to long-term enterprise value.

Methodologies for Asset Valuation

Multi-Period Excess Earnings Method

The multi-period excess earnings method is commonly applied to value intangible assets such as customer relationships and proprietary software platforms. This approach estimates the expected cash flows attributable to the asset over multiple periods, deducts contributory asset charges, and discounts the remaining excess earnings to present value. By accounting for both risk and future revenue potential, this method provides a robust framework for valuing intangibles in a highly regulated and competitive financial services environment.

Discounted Cash Flow Analysis

Discounted cash flow (DCF) analysis is widely used to value both tangible and intangible assets. Projected revenue streams, operating costs, and associated risks are incorporated into the model to calculate present value. DCF analysis allows financial institutions to quantify the economic benefits of customer portfolios, loan books, and digital platforms while adjusting for potential credit losses, market fluctuations, and regulatory uncertainties. When applied rigorously, DCF analysis strengthens transparency in reporting and ensures that asset valuations are aligned with expected financial performance.

Liability Valuation

Valuing liabilities accurately is equally critical. Regulatory reserves, lease obligations, and loan commitments must be fully incorporated into the PPA framework. Proper assessment of liabilities ensures fair representation of net assets, prevents overstatement of goodwill, and facilitates effective risk management. Misstated liabilities can compromise both compliance and financial credibility, highlighting the importance of meticulous valuation and detailed documentation in the PPA process.

Post-Acquisition Integration and Planning

Operational Integration

Proper PPA informs post-acquisition operational integration strategies. Identification of high-value assets allows management to allocate resources efficiently, optimize IT infrastructure, and harmonize customer service operations across merged entities. Integration planning typically involves aligning digital platforms, consolidating data centers, harmonizing accounting systems, and streamlining operational processes to achieve synergy and efficiency.

Strategic Decision-Making

PPA provides a foundation for strategic decision-making, as it enables management to understand the relative value of tangible and intangible assets. Decisions regarding technology investments, workforce allocation, and customer engagement strategies are informed by the insights gained from a comprehensive PPA. These insights ensure that post-acquisition operations are optimized to maximize long-term value, minimize costs, and enhance profitability.

Risk Management and Compliance

In the financial services sector, where regulatory requirements are stringent, PPA contributes to both risk management and compliance. Accurate asset and liability valuation ensures that regulatory reporting is correct, audit risks are minimized, and operational compliance is maintained across jurisdictions. PPA also supports ongoing monitoring and control of financial and operational risks, allowing the organization to respond proactively to market changes and regulatory updates.

Enhancing Investor Confidence

Transparency in Reporting

A well-executed PPA enhances transparency in financial reporting. By clearly allocating purchase price among tangible and intangible assets, management can provide investors with accurate information regarding enterprise value, projected revenue streams, and asset performance. Transparency in reporting fosters investor trust, strengthens market confidence, and reduces the likelihood of disputes or regulatory scrutiny.

Boosting Market Credibility

Clear and accurate PPA outcomes reinforce market credibility. Investors, rating agencies, and regulators are better able to assess the financial health and strategic prospects of the merged entity, which can positively impact credit ratings, investor perceptions, and long-term capital raising opportunities. Strong market credibility also positions the organization to attract high-value clients and retain key personnel, further supporting sustainable growth.

Conclusion to Case Study Purchase Price Allocation in a Financial Services Company

Financial services acquisitions demand rigorous PPA to ensure accurate reporting, regulatory compliance, and informed strategic decisions. Tangible and intangible assets must be valued with precision to ensure proper recognition of goodwill and support long-term operational success. Careful documentation of assumptions, methodologies, and valuation of loan portfolios and customer relationships in banking M&A outcomes boosts investor confidence, minimizes audit risk, and facilitates post-acquisition integration. In a sector where customer portfolios, loan receivables, and proprietary platforms constitute a significant portion of enterprise value, proper PPA under IFRS 3 ensures that all elements contribute meaningfully to financial transparency, risk management, and sustainable growth. Ultimately, a well-structured PPA not only discloses the distribution of purchase price but also serves as a strategic roadmap for leveraging acquired assets, optimizing operations, and maximizing long-term value in a highly regulated and competitive financial environment. Properly executed, PPA enables financial institutions to merge efficiently, enhance operational performance, and support sustainable development, ensuring that both tangible and intangible assets deliver measurable value to stakeholders.