Allocation of Acquisition Price in SaaS Companies

Allocation of Acquisition Price in SaaS Companies

Introduction to Allocation of Acquisition Price in SaaS Companies

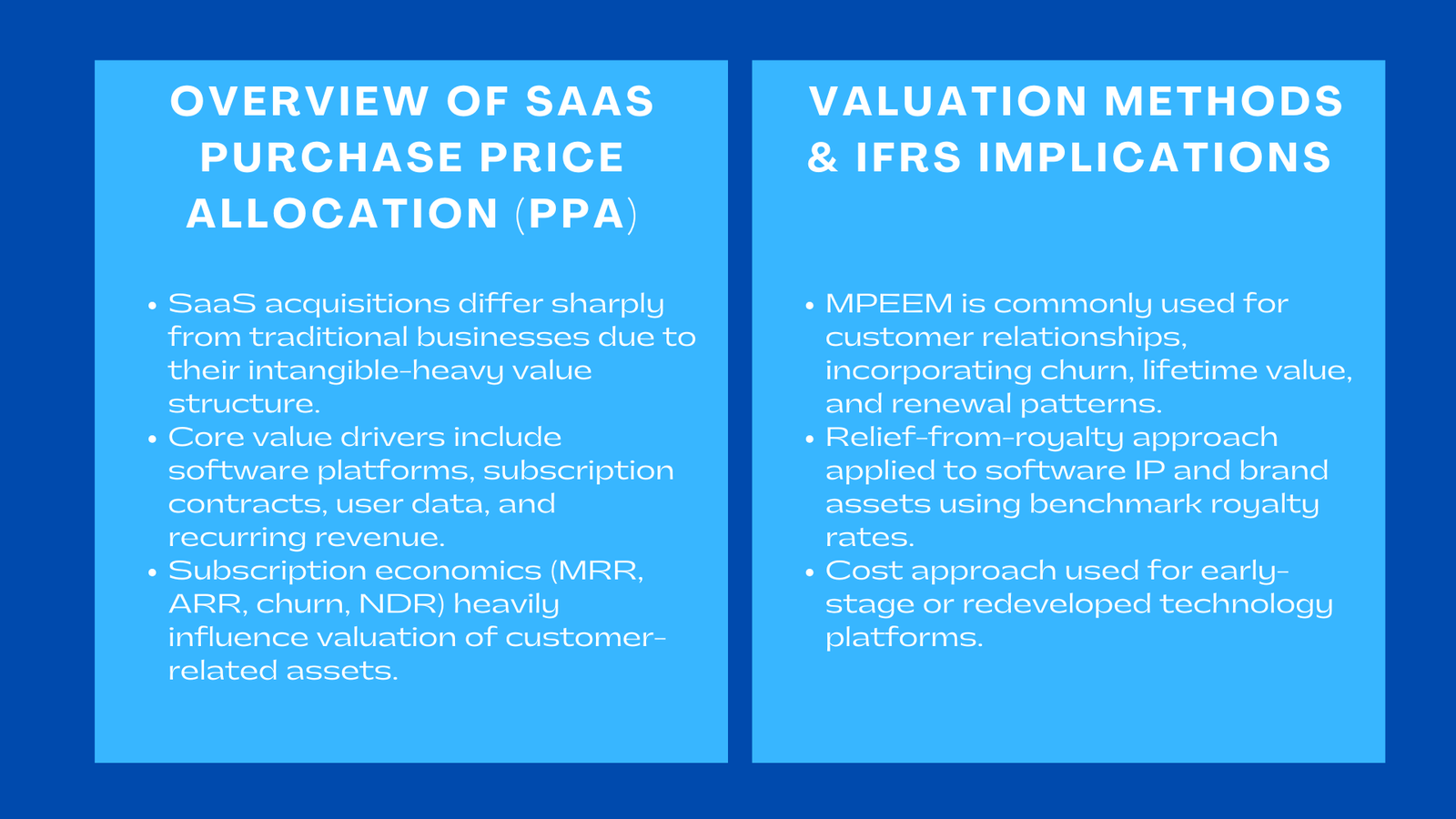

The SaaS businesses have turned into an acquisition powerhouse of the modern digital economy. Their cyclical revenue streams, high scalability and sticky customer base make them desirable to both strategic buyers and private equity investors. Nevertheless, SaaS business structure is quite different to the traditional product or service companies and this disparity is even more noticeable at Purchase Price Allocation (PPA) under IFRS 3, where many acquirers rely on comprehensive purchase price allocation services in Singapore to ensure accurate valuation and compliance.

The article is dedicated to a single area, which is the allocation of the acquisition price to identifiable intangible assets of SaaS companies and, in particular, to their operations that are highly technology-oriented and their value creation that is generated through subscriptions. Investigating the valuation approaches, types of assets that are specific to the industry, and the implications of the IFRS reporting, this article offers finance specialists a clear guideline on how to analyse PPA in the SaaS context.

1. Getting to the Bottom of Why SaaS PPA Is radically different.

1.1 SaaS Acquisitions are Dominant with intangible Value.

SaaS companies do not necessarily have many physical assets as opposed to manufacturing or retail business. Intellectual property, software codebases, hosted services, customer contracts, user data, as well as recurring subscription revenue, represent their principal sources of value. During SaaS company purchase price allocation, analysts quickly find that intangible assets represent the core economic engine of the acquisition.

An asset-light structure leads to PPA process wherein much of the purchase consideration is spread out among technology assets, customer relationships, and even, depending on the business, trade names or proprietary algorithms. The scope and extent of intangible valuation need a special treatment in comparison with other sectors.

1.2 Subscription Economics Mould Valuation of Asset.

SaaS businesses are based on a subscription basis, that is, revenue recognition and retention of customers are disproportionately important in value definition. Monthly recurring Revenue (MRR), annual recurring revenue (ARR) and net dollar retention (NDR) have a direct impact on the projected cash flows involved in the asset valuation.

The measures of intangible assets to fair value purpose are affected by customer churn, upgrade tendencies, pricing tier mix, and length of contract.

2. Determining Intangible Assets That Have Value in SaaS Acquisitions.

2.1 Software Platforms and Proprietary Technology.

Ranging between the back-end structure to the user interface, the software platform is generally the central element of a SaaS enterprise. This platform is appreciated to be an intangible technology and can be equipped with such features as automation engines, analytics modules, API frameworks, and machine learning capabilities.

The valuers have to decide whether the platform is single integrated or it consists of several identifiable modules. Its fair value can be significantly affected by the magnitude of the technical debt, the inability to scale, and the maintenance needs.

2.2 Customer Relationships and Subscription Contracts.

The most important identifiable intangible is normally customer related assets. The recurring subscription model implies that the customers will present continuous economic value in the form of renewals, upgrades, and cross-sells.

In determining fair value, the analysts look at the customer segmentation, churn behaviour, industry sector served, and duration of relationship. SaaS providers of an enterprise nature that have multi-year contracts have varying intangible valuation profiles compared to SaaS providers that follow monthly subscription-only models.

2.3 Trade Name and Brand Equity

Brand reputation is a significant factor in some of the SaaS businesses, and in particular in those companies that exist in a competitive sector, such as CRM, cybersecurity, or project management. Trade names are one of the most powerful intangible resources, although they are not the biggest ones, as they determine the efficiency of customer acquisition and the perception of the entire market.

The relief-from-royalty technique is currently typically used, and the value that a prospective buyer would pay to license the brand is approximated.

3. SaaS Intangible Assets Valuation Methodologies.

3.1 Customer contract customer contracts based on income.

Customer relationships are usually subjected to the multi-period excess earnings method (MPEEM). This technique predicts anticipated cash flow of already existing customers, excluding contributory asset charges towards technology, brand and working capital.

The valuation is made up of MRR and ARR growth projections, churn assumptions, customer lifetime value (CLV), and cohort-level behaviour.

3.2 Relief-from-Royalty of Brand and Software.

The relief-from-royalty approach places value on software technology and trade names by determining the hypothetical royalty payments that the acquirer will make by the ownership of the IP. To choose the right royalty rates, it is necessary to compare with the similar licensing deals in the SaaS and software sectors.

Such factors include software distinctiveness, patent defensibility, cost to replicate analysis, and so forth may have an impact on the valuation results.

3.3 Technology Adjustments to Cost Approach.

The cost approach can be used as a complimentary or supplementary strategy when the software platform is in its early phases or requires considerable re-development. This would involve the assessment of the development time, engineering labour rates, testing cycles, and the backlog features, which would be needed to develop a similar product.

4. Regulatory and Reporting Issues.

4.1 IFRS SaaS Valuation Requirements.

According to the IFRS 3, acquirers should recognize and measure all the intangible assets on a separate basis with goodwill. SaaS companies, whose technology stack is layered, and their customer relationships are subscription based, need to be more strictly separated than traditional companies.

The reporting environment is further shaped by software IFRS reporting, which governs how development costs, cloud-based assets, and licensing arrangements are capitalised or expensed. The rules will have an impact on PPA since the difference between the internally generated intangible and identifiable assets acquired will have an impact on what is recognised on the balance sheet.

4.2 Determination and Amortisation of Useful Life.

SaaS acquisition has a finite useful life on most of the intangible assets. The technology platforms can have a range of 3 up to ten years with regard to expected updates, scalability and competitive risk. Customer relationship assets are amortised by using survival curves that are calculated using the churn patterns.

The shortness of life of trade names may be caused by the change of branding strategy after the acquisition.

4.3 Goodwill and Post PPA Monitoring.

The remaining value on allocation of purchase price is goodwill. SaaS good will usually indicate synergies like integration across the platforms, an extended market reach, or product bundling measures.

An annual impairment testing is vital especially in acquisitions of tech sector where customer behaviour and competition change very rapidly.

5. SaaS PPA challenges in the real-world.

5.1 Multi-Year Contract Enterprise SaaS.

A SaaS vendor that has purchased its multi-year enterprise deals will tend to have a high concentration on relationships with customers and software IP. The longer the term of the contract, the less volatile the cash flows will be, and the greater will be the intangible values.

5.2 SaaS based SMB with high churn.

A design-tool SaaS platform that is popular with freelancers can have a higher churn, but lower customer-relationship asset worth, and a higher goodwill because there are cross-selling synergies envisaged in the aftermath of the acquisition.

5.3 SaaS in its Early Stages and a Rampant Technological Change.

The growing AI platform can also need a combined approach to valuation since the software is constantly being recreated, and the technology asset is not as inert as the software.

Conclusion

Making an allocation of the acquisition price in the case of SaaS companies requires a strong grasp of subscription economics, technology architecture, and IFRS requirements. Compared to conventional industries, SaaS PPA is more complicated by the fact that intangible resources prevail and the operations are built upon recurring revenue models. The finance professionals may obtain the transparent and defensible allocation results under the IFRS through disciplined identification and valuation of technology IP, customer relationships, and brand elements.