How Small Cafés Handle Purchase Price Allocation

How Small Cafés Handle Purchase Price Allocation

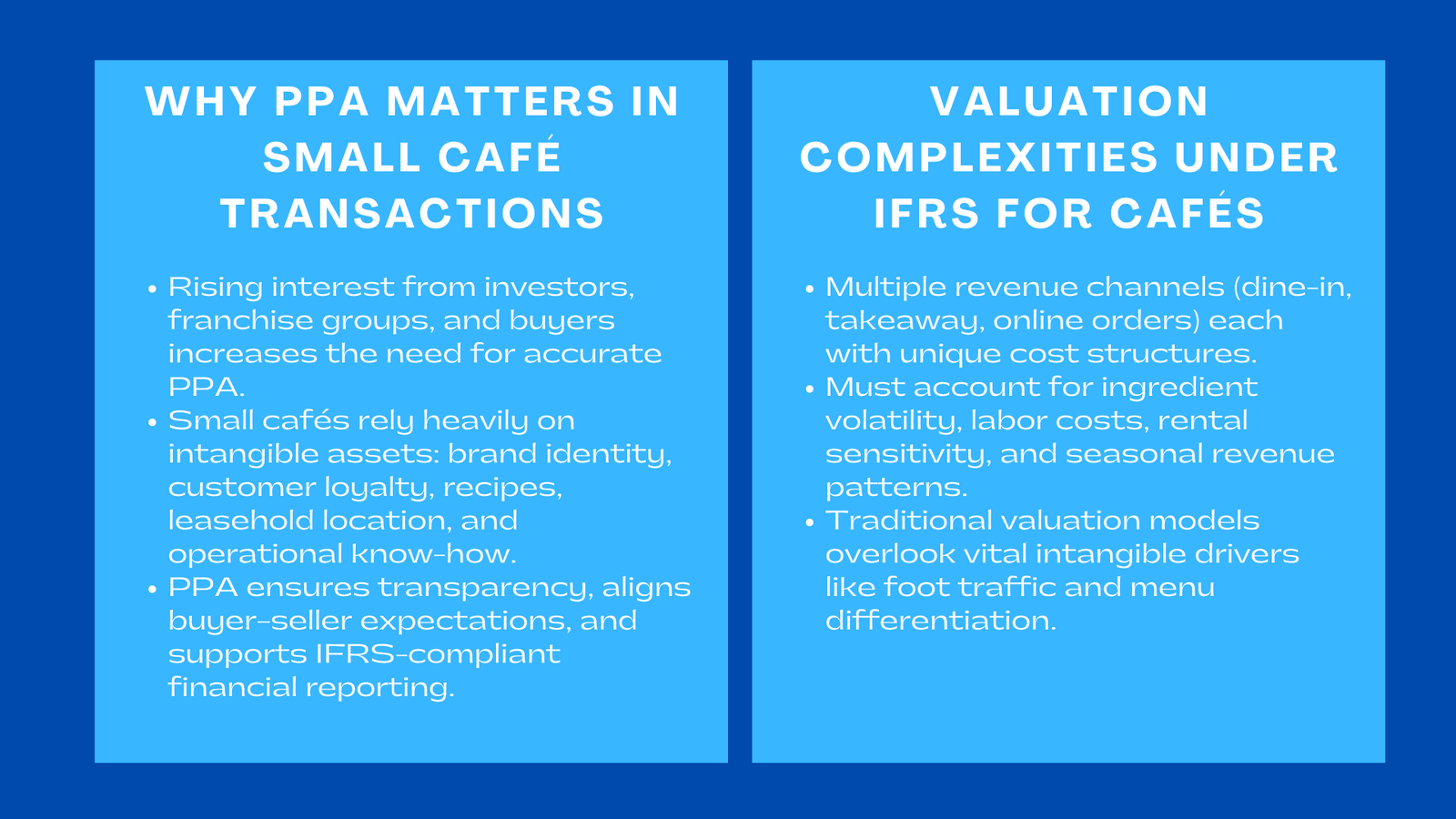

Purchase price allocation (PPA) has emerged as an important process among small cafes particularly with the F & B industry becoming more attractive to investors, franchise chain groups and individual buyers who need stability in their operations and future business development. Small cafes unlike larger hospitality chains tend to be dependent on intangible aspects like the brand identity, client loyalty, recipes, leasehold location, as well as operation practices that create their market identity. In the change of ownership, the distribution of the price of the acquisition is crucial in the establishment of the fair value of these assets when they are reported under the IFRS. This process ensures café purchase price allocation transparency, enhances buyer-seller alignment, and assists it to record financial reporting in the post-acquisitions. PPA framework offers a methodical means of identifying and quantifying the elements that denote the economic value of the cafe other than the buildings it has.

The need to generate precise purchase prices allocation has increased as the café market is experiencing independent acquisitions and small forms of consolidations. Minimal cafes are businesses with a strong competitive environment in which the preferences of customers change quickly and the effectiveness of operations is frequently the determinant of survival. Investors need to be promised of the understanding about which factors of the café make the revenue as well as whether these factors are based on brand recognition, menu differentiation, strategic placement, or functional mechanisms. PPA provides a rigorous system of expressing this value with a financial statement. It makes sure that the contributions in the form of the developed client base and local brand recognition of the cafe are rightfully valued and reflected in the price of acquisition.

Understanding the Strategic Role of Purchase Price Allocation in Small Cafés

How PPA Connects Café Operations with Financial Reporting

PPA essentially acts as the basis of transforming the realistic situations within the functioning of the cafes into monetary handles that portray real economic value. The small cafes tend to create stable sources of revenue not only because of its physical base but also because of the intangible sources like familiarity of the customer, daytime traffic pattern, menu consistency and reputation of the cafe in the local community. These factors can be recognized and appreciated in the process of the PPA, by doing so the acquirers can understand which of the components of a business will make the business overall profitable and which areas will need improvement. In many F&B transactions, investors also rely on established purchase price allocation valuation methodology Singapore practices to support this assessment. This bridging operation and reporting relationship will enable the financial statements to capture the strength of the cafe in true colors.

Establishing Economic Logic Behind Acquisition Pricing

The rationale of the transaction value also becomes clear in the process of the purchase price allocation exercised in the cafes. The investors should know how the price of the acquisition would reflect the value of the physical assets of the cafeteria, the premium that would be paid based on the customer base that it has built, or the value attached to the location benefits. PPA provides a systematic approach to calculating these elements and gives information on the potential of revenue in the future, as well as the risk level. The framework is particularly critical in the F&B industry where the cost structures, operation margins, and demand to the customers differ greatly based on location, reputation, and market positioning.

Navigating the Complexity of F&B Transactions Under IFRS

Challenges Introduced by Café Revenue Models and Cost Structures

Cafes are often run in a combination of the dine-in sales, take-outs, and orders through digital platforms. Both channels have varying cost bases, client activities as well as pricing sensities. Unless all this is taken into consideration, the valuation process under IFRS will require the concept of stability of sales of the company on a daily basis, seasonal changes and the impact of local competition. There are other distinctive attributes of cost faced by small cafes including fluctuating prices of ingredients, labor and sensitivity to changes in rental prices. The following complexities lead to the need to evaluate the revenue sustainability and the opportunity to optimize the margins by the PPA analysts.

Why F&B Acquisitions Require More Than Traditional Valuation Methods

Conventionally treasured valuation models have not taken into account such intangible drivers like customer foot traffic, menu differentiation and a repeat purchase behavior that are important in evaluating the performance of cafes. According to the IFRS, intangible assets should be estimated; such assets should be the ones satisfying their identifiable and measurable economic benefits. Analysts need to review the stability of the revenue of the cafe, trends in the highest demand and the stability of the market location. Such detail is necessary so that PPA should not only show the current performance of the café but also the potential of the long-term functioning.

Identifying and Valuing Key Assets in Small Café PPA

Evaluation of Tangible Café Assets and Operational Infrastructure

The physical aspects of the small cafes might not be as great as in other sectors, although the physical features like brewing machines, kitchen equipment, furniture pieces, and interior upgrades are important aspects of PPA. These assets should be valued taking into consideration the remaining useful life of the assets, the cost of replacement, and their contribution towards the support of the daily operations. The IFRS standards also focus on prices of fair value assessment, which means that equipment is rated according to market circumstances and not only to the prices.

Valuing Intangible Assets: Brand, Recipes, Customer Loyalty, and Location

The greatest part of the cafe value is usually intangible in nature. The brand identity created or developed by the use of decor, consistency of menu, customer experience and presence by the community has to be analyzed as contributing economically. Exclusive formulations and recipes, special menu items, and special formulations of beverages could be important value as well since they could influence customer loyalty. In addition, the place occupied by the café like the foot traffic, ease of access and visibility are considered to be an indirect intangible factor that affects the stability of revenues. Customer relations in terms of visiting the company repeatedly, loyalty visits, and online presence should be measured in the form of a quantifiable financial impact.

Reassessing Revenue Liabilities and Deferred Items Under IFRS

How IFRS Impacts the Valuation of Customer Prepayments and Gift Cards

Minor coffee shops are also known to provide pre-paid vouchers, digital wallet balances or gift cards. These liabilities cannot just be carried forward as it happens in the IFRS since they have to be valued using the probable cost of performing the service obligation. This implies that analysts have to estimate the probabilities of redemption, likely patterns of utilization and possible breakage rates. The fair value adjustment influences recognition of revenue of the acquisition.

Effects on Post-Acquisition Profitability and Reporting

Manipulations in deferred revenue may have a major impact on the reported financial performance of the cafe. The fulfillment costs presented in post-acquisition reports have to be accurate and therefore, it may result in adjustment of profits recognition, particularly in cafes with large customer balances or long-term catering contract agreements. These adjustments are important to the investors who should use IFRS compliant reporting to determine the sustainability of operations.

Interpreting Goodwill and Long-Term Strategic Value

Goodwill Reflecting Non-Separable Café Advantages

Goodwill represents the value which cannot be determined due to reference to certain measurable assets, i.e the reputation of the cafe on the market, staff experience, atmosphere in the cafe and the total effect of the branding and work culture in the cafe. These factors have a significant impact on customer retention and the stability of the daily revenues, hence goodwill is one of the key factors in acquiring cafes.

Monitoring Goodwill Through Performance and Market Dynamics

Since goodwill is liable to yearly impairment examinations, the investors should observe the performance of the café over the long run in order to verify that the anticipations are matched with the real performance. Alterations in consumer tastes, competitor entries, and changes in neighborhood development are aspects that need to be looked at on a regular basis in an effort to tell whether the goodwill can still be regained. This assessment, which is repeated, is a reinforcement of the relationship between strategic expectations and financial reporting.

Applying PPA Across Café Investments and Transaction Scenarios

Role of PPA in Boutique Café M&A and Franchise Expansion

PPA, in the context of the merging of cafes and rolling out franchises, assists investors to differentiate the value created by the extension of the brand and the one created due to the individual cafe operations. The framework promotes standardization in the valuation of various branches of cafes and increases the level of transparency in the relationships of franchisees. This forms a ground to grow more at a pace based on financial clarity.

Supporting Private Investors in Evaluating Operational Potential

Purchase price allocation will be used to ensure that the private investors, who are buying the cafe, assess the underlying economics of the investment to value the price of the acquisition. PPA enables the investors to assess the potential of long-term returns and areas in which the portfolio can be improved based on the key value drivers including menu profitability, patterns of customer traffic, and operational efficiency.

Handling Valuation Uncertainty in Newly Established Small Cafés

New cafes do not have any historical performance or customer relationships forcing them to be less certain when valuing itself. In this case, PPA should be based on scenario analysis, projections under the weight of probability, and close evaluation of early brand development. Such frameworks assist the investor to be familiar with the profile of risk and provide realistic future performance expectations.

Strengthening Strategic and Analytical Thinking in Café Acquisitions

Encouraging Forward-Looking Assessment of Café Performance

The allocation of the purchase price promotes future vision of the operations of the cafes among the investors and analysts. This involves considering market patterns, seasonal patterns, the rising role of the digital orders and the scale of the operations. The forward-looking strategy makes sure the valuation strategies are in compliance with the ability of the café to grow sustainably.

Applying Financial Discipline to Operational Metrics

Operational data, which includes daily sales volatility, menu contribution margins, staff productivity, and customer retention require a financial approach on the part of the analysts. When incorporated in PPA, intangible value will be measured in a consistent and internally consistent manner in respect to the requirements of IFRS reporting.

Communicating Café PPA Outcomes to Stakeholders

Translating Operational Insights into Financial Clarity

The IFRS valuation methodologies might not be known to many pools of café owners as well as investors. Easy reporting of the results of PPA assists in bridging the operations intuition and financial representation gap. Sound reporting will make the stakeholders to comprehend the manner in which the performance of the cafe is converted into the valuation of assets.

Enhancing Transparency and Building Investor Confidence

Effective presentation of the outcomes of PPA is a way of enhancing investor confidence and audit preparedness. The clear presentation of valuation assumptions and methodologies will also show that the coffee shop will have financial credibility that will draw attention to it in terms of future strategic interest or financing.

Integrating Technology and Analytical Tools into Café Valuation

Using Digital Analytics to Support PPA Accuracy

Contemporary cafes use point of purchase marketing systems, online order platforms, and loyalty apps that are useful in creating lucrative information to PPA. The inclusion of these sources of data into the process of valuation will allow being even more accurate in predicting customer behavior and selling periods, as well as the long-term trends in the revenue.

Enhancing Valuation Models with Automation and Real-Time Insights

Dynamism of the modeling is possible with the help of the automation tools and analytical software which is able to consider the real performance of the cafes. In the real time update depending on the sales patterns and operational prices assists in remaining up to date and enhances the trustworthiness of the valuation results.

Institutional Advantages of Applying Rigorous PPA Practices

Improving Reporting Quality and Decision-Making

A built-in PPA approach helps improve financial reporting and increases the level of strategic decision-making. Knowledge of value drivers in the café will aid the owners and investors in making better decisions regarding the improvement of the menu, optimization of the operations, as well as the expansion strategies.

Developing a Culture of Analytical Precision in Café Management

Texan implementation of PPA helps in developing a culture of decision-making data among the management team in the cafe. This field aids in enhancing its operations, cost control, and sustainable financial development.

Conclusion to How Small Cafés Handle Purchase Price Allocation

Due to the ongoing change in the cafe industry, purchase price allocation is actually taking the centre stage in regard to financial transparency, strategic analysis, and long-term sustainability. PPA will increase the precision of IFRS reporting systems and create informed investment decisions by modifying the operational, brand and customer dynamics of a café into systems of structured financial values. To the owners, investors and financial professionals, understanding the business of the process of allocating purchase price of the café offers the clarity and analytical assurance of going through the competitive market F&B IFRS reporting place and establishing strong business platforms.