Purchase Price Allocation in Professional Services Firms

Purchase Price Allocation in Professional Services Firms

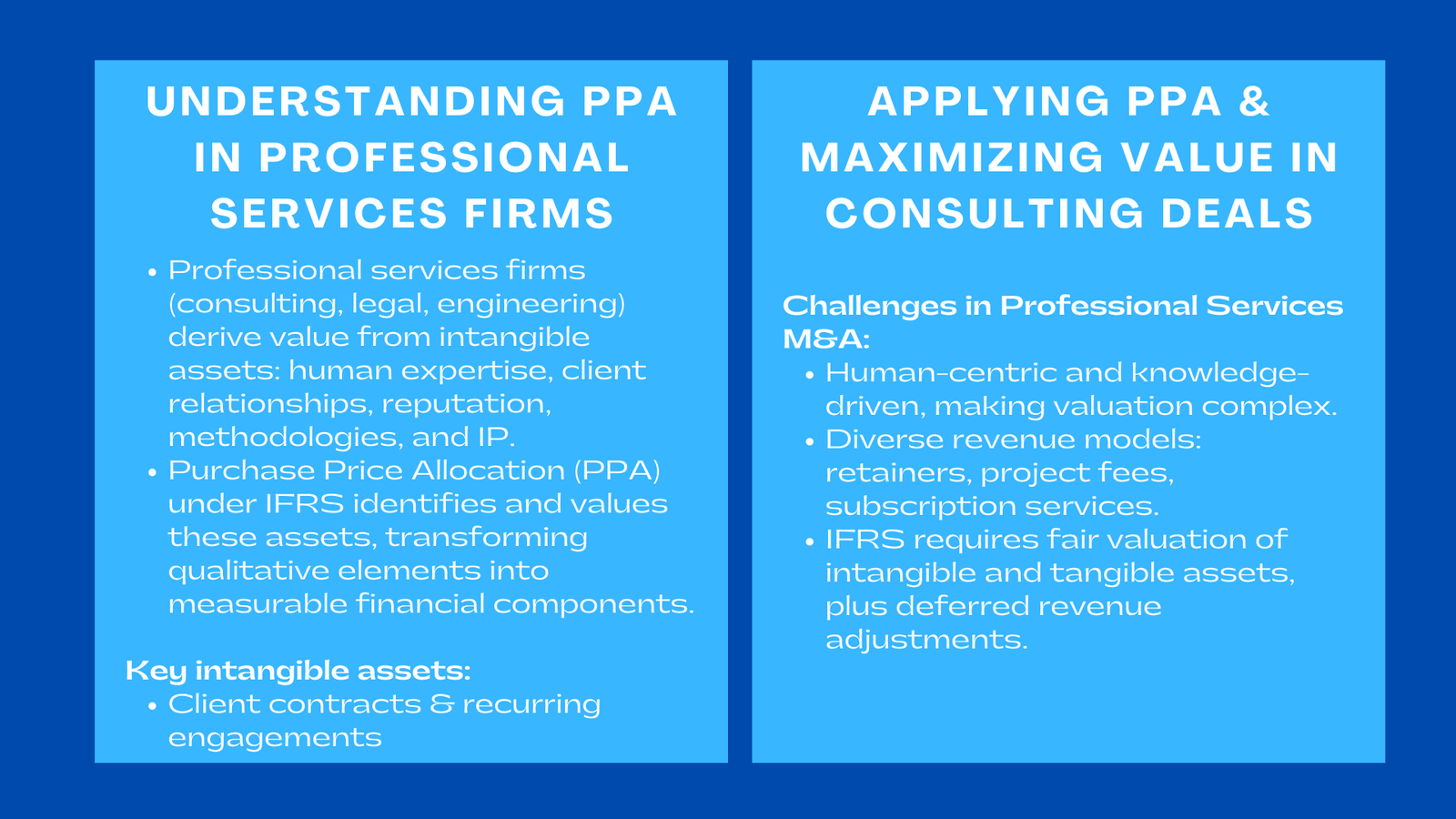

Professional services firms—such as consulting practices, advisory groups, legal firms, engineering consultancies, and specialized service partnerships—represent a unique sector where business value is largely intangible. Unlike asset-heavy industries, these firms derive economic strength from human expertise, client relationships, reputation, methodologies, and proprietary intellectual property. When such firms undergo mergers, acquisitions, or strategic integration, allocating the purchase price becomes essential for ensuring transparency and compliance with IFRS business reporting. Purchase price allocation (PPA) identifies and values the components of the acquired firm, particularly intangible assets that significantly influence long-term revenue. This process transforms the qualitative attributes of professional services into quantifiable financial components that can be reported with accuracy.

The consulting industry has become a focal point for strategic acquisitions as firms seek deeper expertise, expanded client portfolios, and access to niche capabilities. IFRS reporting ensures that these transactions reflect economic substance rather than contractual price alone. Consulting firm purchase price allocation makes it possible to distinguish between identifiable intangible assets—such as methodologies, client contracts, and proprietary frameworks—and consulting firm purchase price allocation goodwill. As the consulting landscape grows more competitive, transparent reporting under IFRS strengthens investor confidence, supports regulatory compliance, and ensures that acquisitions align with long-term business strategy.

Increasing Importance of IFRS-Compliant Reporting in Consulting and Advisory Deals

Linking Expertise, Reputation, and Relationships to Financial Reporting

Professional services firms rely heavily on human capital, intellectual frameworks, and established client trust. These intangible elements, though central to firm performance, are difficult to reflect in traditional financial statements. Purchase price allocation bridges this gap by identifying intangible value drivers and assigning them measurable worth. From proprietary methodologies and unique advisory frameworks to recurring client engagements and brand prestige, PPA allows financial statements to capture the full economic landscape of a consulting firm acquisition. This clarity enhances the integrity of IFRS business reporting and helps acquirers evaluate whether the premium paid aligns with the firm’s long-term potential. Participation in IFRS 13 fair value measurement training Singapore further equips professionals with the skills to accurately assess and report these intangible assets in compliance with international standards.

Supporting Strategic Decision-Making in Consulting Acquisitions

Mergers and acquisitions in the consulting industry often aim to secure specialized expertise, enter new markets, or access high-value client accounts. PPA delivers the analytical basis needed to assess the strategic logic behind acquisition prices. By evaluating the strength of client cohorts, renewal patterns, service lines, and operational synergies, the allocation process provides insight into expected future performance. This supports negotiation, integration planning, and long-term financial forecasting.

IFRS Complexity in Professional Services Transactions

Valuation Challenges in Human-Centric, Knowledge-Based Firms

Consulting firms present unique valuation challenges due to their reliance on talent, intellectual capital, and non-contractual client loyalty. Under IFRS, human capital cannot be recognized as an intangible asset, even though it is crucial to the firm’s value. Analysts must identify separable intangible assets such as client contracts, proprietary tools, software, and specialized methodologies that meet recognition criteria. The absence of physical inventory or industrial assets further shifts emphasis toward intangible valuation, making PPA particularly essential in this sector.

Dynamic Revenue Structures and Engagement Models

Professional services firms employ diverse revenue structures—including retainers, project fees, hourly billing, success fees, and long-term advisory agreements. Each model carries unique timing, predictability, and cash-flow characteristics. IFRS requires these revenue streams to be evaluated individually for fair value allocation. Analysts must consider contract duration, service delivery complexity, ongoing engagements, and probability of renewal to understand how they influence the value of intangible assets and liabilities.

Identification and Valuation of Key Intangible Assets in Consulting Firms

Client Relationships and Contract Portfolios

Client relationships represent one of the most valuable intangible assets in consulting firms. Long-term engagements, multi-year contracts, recurring advisory roles, and established trust contribute to predictable future cash flows. Under IFRS, these relationships can be valued if they produce identifiable future benefits. Analysts must evaluate contract stability, client concentration, renewal likelihood, and historical engagement patterns to assign fair value accurately.

Proprietary Methodologies, Frameworks, and Intellectual Capital

Consulting firms rely on structured methodologies, strategic frameworks, diagnostic tools, research libraries, and digital solutions that enhance service delivery. These proprietary elements can significantly differentiate the firm within the market. Under IFRS, such tools may be recognized as intangible assets if their economic utility is identifiable, separable, and measurable. Analysts must examine development history, usage relevance, replication cost, and competitive advantage to determine fair value.

Brand Equity and Market Reputation

The reputation of a consulting firm influences its ability to attract clients, recruit talent, and command premium pricing. Brand equity—rooted in service quality, market recognition, industry awards, and leadership thought capital—may contribute significantly to business value. While brand reputation cannot always be recognized separately under IFRS due to identifiability limitations, its influence is often reflected in goodwill.

Evaluating Tangible Assets and Infrastructure

Technology Platforms and Knowledge Management Systems

Professional services firms increasingly rely on internal platforms, collaboration tools, data systems, project management software, and knowledge repositories. These systems support operational efficiency and quality control. Tangible and software-based assets must be valued at fair market value, taking into account technological maturity, scalability, and integration requirements. While these assets represent a smaller proportion of overall value compared to intangibles, their inclusion remains crucial for completeness in PPA.

Office Spaces and Operational Fixtures

Consulting firms may maintain physical offices, training facilities, collaborative spaces, and technology setups that contribute to service delivery. IFRS requires these tangible assets to be valued fairly based on condition, remaining useful life, and market comparability. Even though physical assets typically represent a minor part of the total allocation, they support the operational backbone of the consulting environment.

IFRS Treatment of Deferred Revenue and Contract Liabilities

Reassessing Retainers, Prepaid Engagements, and Ongoing Projects

Professional services firms often receive advance payments for engagements, ongoing consulting work, or subscription-based advisory services. Under IFRS, these contract liabilities must be measured at the cost of fulfilling remaining service obligations. This requires evaluating project scope, delivery timelines, staffing requirements, and margin expectations. Accurate valuation ensures that deferred revenue aligns with IFRS principles and reflects the economic burden of future work.

Impact on Post-Acquisition Earnings and Financial Reporting

The recalibration of deferred revenue under IFRS can significantly influence reported earnings in the months following acquisition. Adjustments may alter the timing of profit recognition, especially for long-term projects or complex advisory engagements. Consistent IFRS business reporting ensures that financial outcomes reflect the true substance of contractual obligations rather than invoicing patterns.

Understanding Goodwill in Consulting Firm Acquisitions

Non-Separable Advantages and Strategic Synergies

Goodwill in consulting firm acquisitions captures advantages that cannot be individually recognized as intangible assets. These may include leader expertise, firm culture, cross-office collaboration, talent reputation, and complementary service offerings that enhance strategic positioning. Goodwill represents the acquirer’s expectation of future profitability driven by integration synergies, new market opportunities, and enhanced capabilities.

Monitoring Goodwill Through Performance and Market Dynamics

IFRS requires annual impairment testing for goodwill, making its ongoing monitoring critical. Performance trends, client retention, project win rates, and competitive shifts influence goodwill recoverability. A disciplined approach to monitoring ensures that strategic expectations embedded in the acquisition align with operational realities and market conditions.

Applying Purchase Price Allocation Across Consulting M&A Scenarios

Boutique Firm Acquisitions and Niche Consulting Expertise

Large consulting networks frequently acquire boutique advisory firms that specialize in digital transformation, sustainability, human capital, financial modeling, or regulatory compliance. PPA helps acquirers identify value contributed by specialized frameworks, client networks, and expert teams, ensuring consistent reporting across diverse service lines.

Cross-Border Acquisitions and International Consulting Expansion

Global consulting firms often acquire regional practices to expand their geographic presence. These transactions must incorporate currency considerations, local market dynamics, cultural integration, and regulatory requirements. IFRS business reporting ensures consistent valuation across jurisdictions and supports international comparability.

Strategic Integration Within Multi-Service Advisory Platforms

Professional services acquisitions often result in integration into multi-service platforms combining consulting, audit, tax, advisory, and digital capabilities. PPA clarifies how intangible assets and goodwill contribute across service segments, enhancing clarity in consolidated reporting and strategic planning.

Strengthening Analytical Thinking in Professional Services Valuation

Building Forward-Looking Perspectives on Engagement Demand and Market Trends

Purchase price allocation encourages analysts and investors to adopt forward-looking perspectives on consulting demand drivers. These include regulatory changes, digital innovation trends, economic cycles, and industry-specific shifts that influence client needs. Incorporating these elements enhances the accuracy of future cash flow projections and valuation assumptions.

Applying Financial Discipline to Project-Based and Retainer Revenue

Professional services valuation requires understanding how billable hours, project margins, staff utilization, and client profitability affect long-term performance. Integrating these metrics into PPA enhances analytical rigor and aligns valuation outcomes with the business realities of consulting operations.

Communicating PPA Results to Consulting and Advisory Stakeholders

Translating IFRS Valuation Outputs Into Practical Strategic Insights

Consulting partners, senior advisors, and client-facing teams often focus on strategic execution rather than the technical specifics of IFRS reporting. Clear communication of purchase price allocation outcomes ensures alignment between financial reporting and operational strategy. This transparency builds trust across the firm and supports successful integration.

Supporting Governance, Transparency, and Audit Readiness

Comprehensive documentation of valuation assumptions, recognized assets, and goodwill judgments enhances audit readiness and strengthens corporate governance. High-quality reporting improves the credibility of the consulting firm within both internal governance structures and external regulatory environments.

Integrating Technology and Data Analytics Into Consulting Firm PPA

Leveraging Project Management Systems and Client Databases

Consulting firms collect extensive data on engagements, project durations, client feedback, resource utilization, and financial performance. Incorporating this data into PPA enables more accurate valuation of client relationships and intellectual capital. Analytics-driven insights enhance the reliability of IFRS reporting and support informed decision-making.

Enhancing Valuation Models Through Automation and Digital Tools

Advanced financial modeling tools allow analysts to simulate revenue cycles, forecast client retention, and assess operational efficiency. Automation reduces human error and ensures consistency in PPA methodologies. The integration of technology reinforces the relevance and reliability of valuation outcomes.

Institutional Advantages of Rigorous PPA in Professional Services Deals

Enhancing Reporting Integrity and Strategic Alignment

Rigorous purchase price allocation strengthens reporting quality by accurately reflecting the economic value of the consulting business. The clarity gained supports strategic alignment, improves forecasting accuracy, and enhances stakeholder confidence in financial statements.

Building a Culture of Analytical Precision in Professional Services Firms

Adhering to IFRS business reporting and consistent PPA practices encourages analytical discipline within firms traditionally driven by expertise and qualitative judgment. This culture of precision supports balanced decision-making and sustains long-term competitiveness.

Conclusion to Purchase Price Allocation in Professional Services Firms

As professional services firms evolve in response to digital transformation, global integration, and increasing competition, purchase price allocation plays a vital role in ensuring accurate financial representation of consulting capabilities. Through systematic IFRS business reporting and deep analysis of intangible value drivers, PPA enhances transparency, strategic clarity, and investor confidence. For acquirers, consulting partners, and financial professionals, understanding consulting firm purchase price allocation is essential in navigating complex transactions and sustaining long-term growth in a highly specialized sector.