How Small Pharmacies Allocate Purchase Price

How Small Pharmacies Allocate Purchase Price

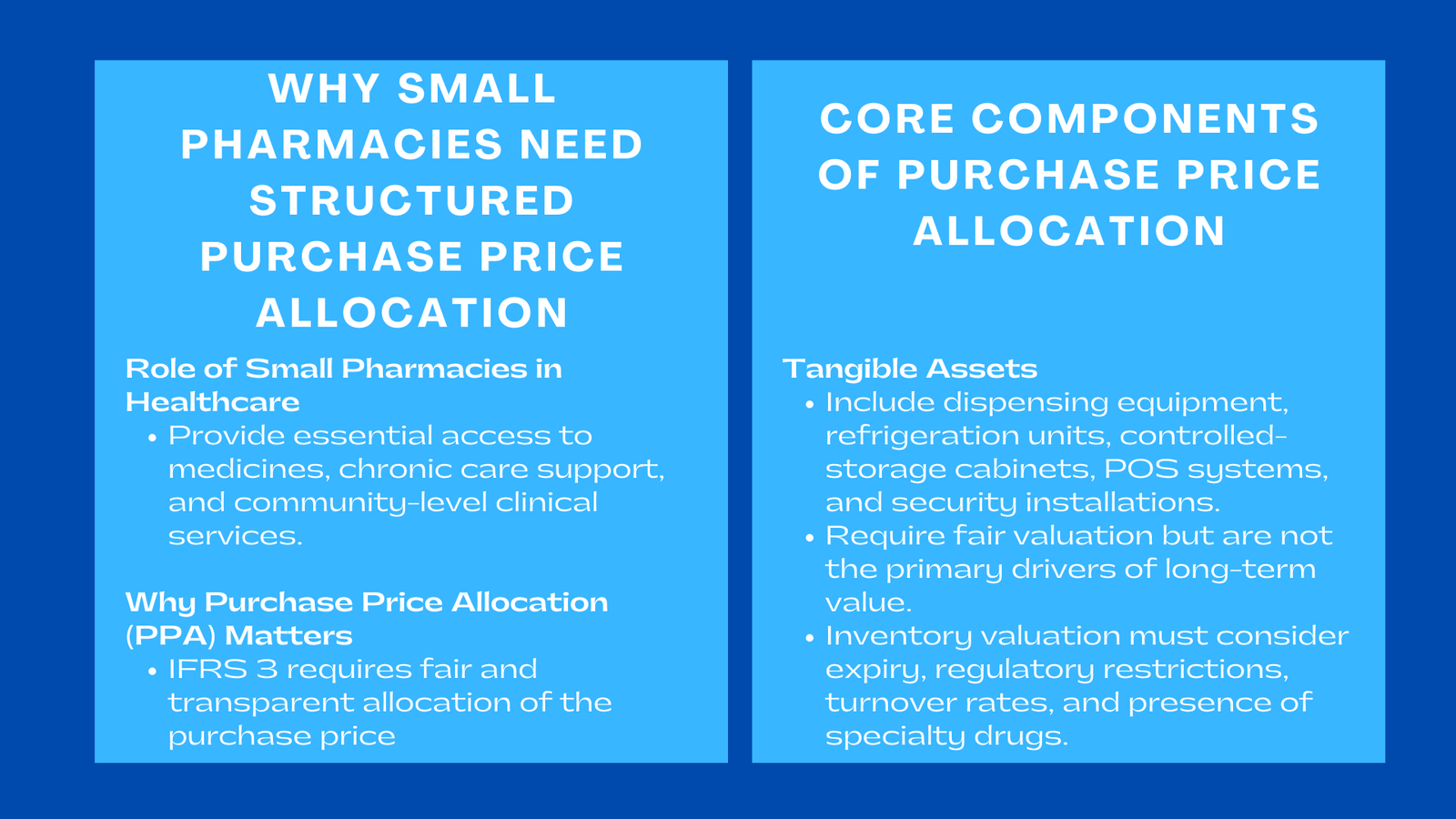

Small pharmacies occupy a special place in the life of community healthcare. They ensure access to much needed medical support, chronic medication management, medicine distribution, and access to pharmaceutical services. As healthcare markets become increasingly consolidated, small pharmacies become more of a target of acquisition by larger pharmacy chains, hospital networks and private equity investors looking to gain greater presence in local healthcare ecosystems. With each acquisition comes the need to carry out a thoroughgoing purchase price allocation process, and this is a process that is required under IFRS 3 to ensure that the consideration paid is assigned fairly and transparently to identifiable assets and liabilities.

The pharmacy industry offers complexities for valuation that go far beyond regular retail businesses. Pharmacies are strictly regulated in their field of business that obligates them to the pharmaceutical standards, rules on controlled substances, data protection laws, and professional licensing requirements. Their commercial value is heavily linked to patient relations, clinical trust, prescription refill behaviour, brand value, as well as the continuity of operations. These intangible components are the essence of the value of pharmacy and the allocation of the purchase price has to identify and measure each of these components in a structured and defensible way. As regulatory expectations grow and financial reporting standards become stronger, PPA has developed into a compliance requirement as well as a strategic tool that uncovered the strengths of a pharmacy’s operations and the potential for future growth.

Unlike general retail businesses that have a significant portion of their revenue derived from walk-in customers and/or turnover of products, the financial performance of a small pharmacy is pharmacy purchase price allocation strongly affected by clinical services and long-term patient involvement. Health information held at pharmacies is confidential; pharmacists manage recurring prescriptions; the care of chronic diseases; and are integrated with insurance reimbursement systems. These characteristics make the economics of valuation of pharmacies significantly different from non-healthcare retailers.

The bulk of value in a pharmacy is associated with intangible assets as opposed to physical inventory or equipment. Patient databases, prescription histories, software platforms, accreditation, brand identity and relationships with healthcare professionals are critically important components of value. These assets need special valuation methodologies based on the contributions that they make to the revenue generation over the long run. Without proper identification and valuation of intangible assets, financial statements are at risk of providing a misinterpretation of the economic profile of the pharmacy, potentially causing impairment, regulatory problems or misalignment of the strategic plan.

Therefore, the purchase price allocation for a small pharmacy has to emphasize both the tangible and intangible aspects of the business in a way that meets healthcare IFRS reporting as well as provide the investors and management with insights that will affect the integration and long-term performance.

Understanding Purchase Price Allocation in Pharmacy Acquisitions

The IFRS Framework and Its Implications

IFRS 3 states that all recognisable assets and liabilities should be recognised at their fair value on the acquisition date. This includes assets which are not always immediately apparent in traditional bookkeeping such as long-term customer relationships, recurring prescription patterns, software capabilities, trademarks and regulatory rights. Pharmacies are subject to further compliance from the health-sector, making the identification and measurement of intangible assets of particular importance, especially for professionals seeking to understand how to apply IFRS 3 for business combinations course Singapore in real acquisition scenarios.

IFRS also has a clear distinction between recognisable intangible assets and between goodwill. Intangible assets need to be recognized separately because these assets are the result of contractual rights or are ones that can be detached from the business and sold on their own. Many assets located in pharmacies such as proprietary dispensing software, supplier agreements, operating licenses, etc., satisfy this requirement. As these items are carrying a significant contribution to the commercial performance of a pharmacy, their valuation is a complex homework demanding analysis and healthcare-specific judgement.

Sector-Specific Expertise Required for Pharmacy Valuation

Pharmacy operations are influenced by standards of professional accreditation, rules on patient confidentiality, insurance reimbursement, distribution of drugs, and digital health platforms. Understanding these regulatory and operating factors is very important when assessing a pharmacy. The process of PPA needs to include knowledge of patient retention patterns, the value of repeat prescriptions, the cycles of chronic disease management, as well as combining clinical services with digital records systems. This makes pharmacy valuation a field that is dependent to a great extent on healthcare-specific methodologies as opposed to generic valuation techniques.

Core Components of Purchase Price Allocation for Small Pharmacies

Tangible Assets and Their Role in Pharmacy Operations

Tangible assets are the ones that provide necessary functionality in the pharmacy operation even if they do not signify the same part of the total value. These include dispensing, refrigeration equipment, and temperature-controlled medications, medication storage cabinets, computers, point-of-sale terminals, shelving, compounding tools, and security installations. Although not key drivers of long-term economic value, they must be given fair value as they support the regulatory compliance and physical operational capacity.

Inventory valuation is one of the major considerations in pharmacy acquisitions. Pharmaceutical inventory consists of prescription medications, over-the-counter medications, medical applications, vaccines and specialized products that require controlled conditions for storage. Inventory needs to be evaluated on a case by case basis due to the vulnerability of pharmaceutical products by obsolescence, expiration, regulatory restrictions and price volatility. Valuation specialists have to assess the stock turnover rates, the percentage of slow-moving items, presence of specialty drugs and adherence to the legal storage requirements. Proper recognition of inventory is therefore, to ensure that finance statements are based on the true value of the stock rather than overestimated value estimates from expired or unusable products.

Intangible Assets: The Primary Drivers of Pharmacy Value

Symbols of intangible assets Most of the inherent economic value in a small pharmacy is from intangible assets. These assets are what support recurring revenue and continuity in patient care.

One of the most important intangibles is the patient database. Pharmacies have large health profiles and prescription histories that are indicative of long-term relationships with patients. A pharmacy with a high number of chronic-disease patients will have steady and predictable income as a result of recurring prescriptions. Valuation analysis sometimes incorporates review of refill frequencies, demographics, retention behaviour, seasonality of prescription base, and chronic care indicator. These are the factors that make the patient data asset one of the most valuable components in the PPA process.

Pharmacy management software Another intangible asset is pharmacy management software. These systems manage dispensing workflow, inventory management, insurance billing, medication safety checks, electronic recordkeeping and regulatory reporting. When these systems are adapted or combined with national health databases their value is enhanced significantly. IFRS is that these software systems have to be identified separately from goodwill provided that they are identifiable and fulfill the requirements of contractual or technological.

Licenses and accreditation are also fundamental in the operations of pharmacy. Pharmacies are required to meet very strict standards for regulatory requirements concerning pharmaceutical storage, drug handling, professional staffing, and patient confidentiality. These licenses happen to be economic enablers for as much as they economically enable the pharmacy (as the business was legally operated and maintained its ability to generate revenues right after acquisition). In markets where there is low availability of the license, these rights can be very valuable.

Goodwill and the Residual Value of Community Trust

After all the assets that have been identified have been valued, the remainder, if any, of the purchase price is allocated to the goodwill. Goodwill represents the benefits to economic performance that come about as a result of positive assets that are not identified separately but are part of the pharmacy as a whole. This is through community trust established over years of service, professional reputation, relationships with local doctors established over the years, geographical positioning, and overall stability of the customer base.

Goodwill in pharmacies can reflect patient loyalty and brand perception and how much it is worth. Pharmacies that are consistently offering individualized advice, having excellent connections with healthcare providers and have an integral presence in a community generate superior long-term performance. As well, the goodwill value incorporates the anticipated synergies from incorporating the pharmacy into a larger healthcare group. These could be access to centralized supply chains, an increase in purchasing power, access to better technology infrastructure, or an expansion of clinical services.

External Factors Influencing Purchase Price Allocation

Regulatory Shifts and Healthcare Policy Dynamics

Healthcare regulatory environments are directly related to pharmacy valuations. Changes in drug price policies, reimbursement policies, digital health mandates, controlled substances legislation can have a profound effect on the economics of operating a pharmacy. When an acquisition is taking place at periods of regulatory change, valuation assumptions must take into account the stability or volatility of the regulatory environment. IFRS specifies that fair value should reflect the situation at the acquisition date, but forward-looking assessment makes a difference in the goodwill and the whole financial interpretation of a business.

Shifting Consumer Behaviours and Healthcare Patterns

The behaviour of the patients and consumers have a significant role on the pharmacy cash flows. Increasing the demand for treatment of chronic diseases, increasing dependence on online pharmacy services, changing insurance coverage, and increasing use of telemedicine affect the prescription volumes. Pharmacies based in communities with an older population or a high rate of chronic disease are likely to have stable recurring revenue streams. Valuation professionals pay careful attention to these demographic and behavioural patterns because they have an impact on valuation of intangible assets and in terms of goodwill measurement.

Conclusion to How Small Pharmacies Allocate Purchase Price

Purchase price allocation for small pharmacies is an intricate process combining financial value, healthcare compliance, patient behaviour analysis and strategy. Pharmacies rely heavily on intangible components such as patient evaluations, digital dispensing systems, brand position and regulatory accreditations. These assets must be identified and valued as per healthcare IFRS reporting in order to have an accurate and reliable financial representation of the business in hand.

A strict PPA gives investors, auditors, and management the opportunity to have a better understanding of the way the pharmacy is really performing. It illuminates the sources of recurring value embedded in such things as prescriptions and clinical services, and patient loyalty. It makes better decisions of integration, planning for growth, and financial reporting in the future. As healthcare markets continue to modernize and consolidate, the need for accurate and well-documented healthcare IFRS reporting for small pharmacies will continue to increase, enabling these enterprises to have transparent financial reporting and make an important contribution to the overall healthcare system.