Advanced PPA for E-Commerce Professionals

How E-Commerce Businesses Allocate Purchase Price

Introduction to Advanced PPA for E-Commerce Professionals

The wave of mergers and acquisitions (M&A) of e-commerce organizations has been on the rise in the rapidly changing digital economy as the investors are in search of scalable and data-intensive business models. However, for each successful deal there is a very important financial process the allocation of the purchase price. According to the International Financial Reporting Standards (IFRS 3), Purchase Price Allocation (PPA) is mandatory following a business combination and the aim of which is to fairly allocate all the total consideration given to identifiable assets and liabilities.

In the case of e-commerce businesses, this division is especially thorny, since a large portion of their worth is not in physical property but in intangible property – in terms of technology systems, customer database and brand recognition. Knowledge of the PPA implementation process will guarantee that the financial statements at the end of the post-acquisition period are economically accurate, and they are in compliance with the IFRS standards.

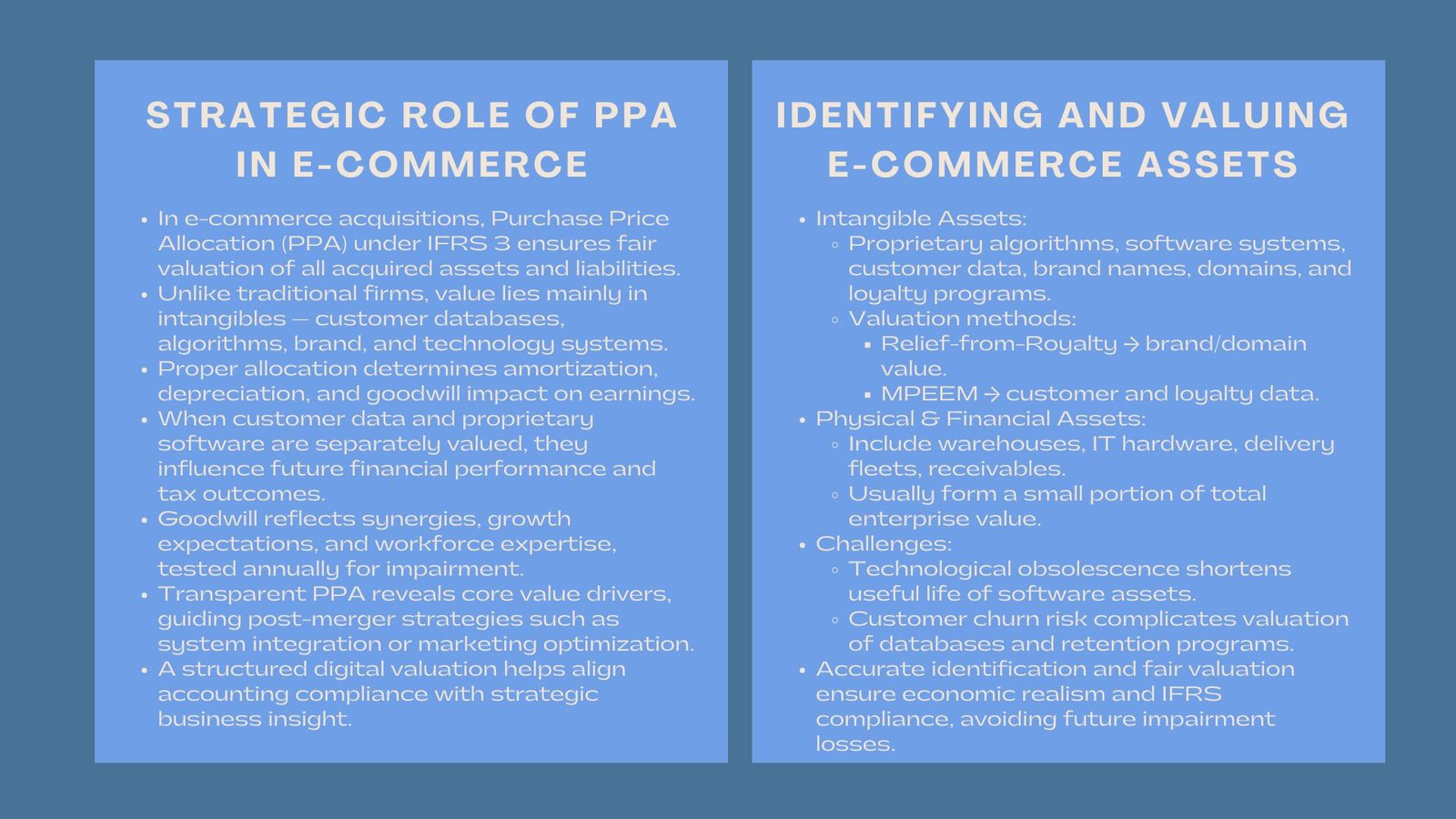

1. The Strategic Significance of PPA in the E-Commerce.

1.1 These are the reasons why PPA is important to the digital businesses.

The intangible assets are the core source of value in e-commerce firms unlike traditional brick-and-mortar companies. Their digital marketing capabilities, customer data and platforms create a recurring revenue and potential scalability. The e-commerce purchase price allocation process identifies and measures these assets to determine how much of the total acquisition cost should be assigned to each component.

This has no only an effect on the balances sheet of the buyer but also it determines future amortization, depreciation and tax results. As an illustration, when customer relationships and software assets are amortised separately, then they will be amortised throughout their useful life which will impact on reported earnings. Goodwill on the other hand, being the premium on the expected synergies or future growth is not amortised, but is subjected to impairment testing every year.

1.2 The association of PPA with Strategic Decision-Making.

An open and clearly defined PPA will allow the management and the investors to know what enterprise value is driven by. As an example, when the biggest allocation is towards proprietary algorithms or logistics software it is an indicator that technology is the primary driver of performance. On the other hand, when customer retention happens to be the primary asset of the business, it is likely that customer data and customer loyalty programs take the center stage.

Such knowledge can guide acquirers to develop after merger plans, including digital system integration or marketing campaign optimization to capitalize on acquired resources.

2. Determining and recognizing E-Commerce Assets.

2.1 Intangible Assets: The Heart of Digital Value.

The most common e-commerce valuations are based on intangible assets. These may include:

- Algorithms and software that are proprietary and that are utilized in inventory management or personalization of customers.

- Libraries of precious customer understanding.

- High online visibility brand names and domain names.

- Loyalty programs or Subscription-based customer relationship.

Individual intangible assets should satisfy the IFRS 3 requirements of identifiability namely that the asset could be isolated to the business or be the result of legal or contractual rights.

Income-based approaches to valuation commonly include Relief-from-Royalty Method of brand valuation or Multi-Period Excess Earnings Method (MPEEM) of customer data and loyalty Programs. These techniques approximate the present value of economic benefits that any asset can have in the future.

2.2 Physical and Financial Assets.

Less noticeable but tangible assets such as warehouse facilities, computer hardware and delivery vehicles are also all to be valued. Financial assets (receivables and prepayments) are remeasured to fair value at the acquisition date. The issue with e-commerce companies is that in most cases these physical aspects only comprise a minor part of overall value, which supports the necessity of strong intangible valuation.

3. Allocation Challenges Unique to E-Commerce.

3.1 Rapid Technological Change

The rapid rate of technological innovation is a problem to the valuation of e-commerce businesses. An algorithm or a system that is currently at the cutting edge of current technology could be outdated in two years. The useful life estimation of software assets is thus subjective and must be done carefully with references to the industry standards and estimated technology cycles.

As an illustration, an online trading company that heavily invests in proprietary logistics software will need to take into account the length of time that system will be competitive before it needs upgrade or replacement.

3.2 Customer Concentration and Retention risks.

Another asset, which, though volatile, is a crucial asset of e-commerce, is customer relationships. As much as loyal customers add a lot of value, digital platforms have low switching costs and a lot of competition. It implies that one should be very careful in estimating the level of attrition when estimating the value of the customer databases or loyalty programs on a fair basis.

The inflated retention of customers assumption may cause the inflating intangible assets value and thus impairment in the future.

4. Goodwill and Impairment Testing.

4.1 In Digital Acquisitions, Goodwill Determinability.

When the identifiable assets and liabilities have received fair values, any purchase excess would be goodwill. Goodwill in e-commerce is commonly a symbol of anticipated synergies, technological advancement in future, or new market access. It is unable to capture things that are indefinable like brand reputation, workforce capabilities and platform scalability.

At the same time, because goodwill is not amortized in IFRS, it has to be the subject of annual impairment testing. In case future cash flow is not able to cover the goodwill recorded, impairment loss should be identified. Monitoring on a regular basis will make sure that the carrying amount of goodwill is in line with the actual performance of the business and the market.

4.2 Common Impairment Triggers

The indicators that can show the impairment of goodwill can be the diminishing web traffic, reduced conversion, or a rise in competition. The management should be vigilant of the changes in the digital market that can influence the customer interaction or revenue growth expectations. Through sensitivity analysis and scenario modeling, companies would be able to evaluate the sensitivity of the major assumptions to goodwill recoverability.

5. IFRS Considerations for E-Commerce PPA

5.1 Compliance and Reporting Standards

Accurate PPA is governed by IFRS 3 (Business Combinations), IAS 36 (Impairment of Assets), and IAS 38 (Intangible Assets). Following an online retail IFRS reporting framework ensures that all acquired assets are properly identified, valued, and disclosed. Open reporting causes confidence among investors and enables verification by the auditors.

The e-commerce firms also enjoy the advantage of having a comprehensive documentation of valuation practices and assumptions as well. This is necessary in defending fair value estimates in the external reviews or regulatory scrutiny.

5.2 Data Integrity and System Integration.

Data integrity is very important throughout PPA since e-commerce functions are based on digital systems. Combining monetary as well as customer information of acquired company is employed to guarantee appropriate valuation. As an illustration, transaction histories or customer lifetime value indicators can be analyzed to draw on a more reliable projection of intangible asset cash flows.

6. Case Study: The Purchase of a Digital Marketplace.

Suppose that a multinational retailer buys a local online shopping platform at a price of $50 million. The following was found during the PPA process:

- Loyalty program and customer database worth 12 million in the MPEEM approach.

- Brand and domain name worth 10 million through Relief-from-Royalty method.

- Owned order management software worth 8m.

- Physical assets (warehouse, equipment, and IT infrastructure) worth 5 million dollars.

- Debts of 7 million dollars.

The rest of the 22 million was classified as goodwill, which was a reflection of the reputation of the marketplace, talent in the technology and prospects of growth.

This was an elaborate allocation that gave the investors a picture on where the value was being concentrated, specifically, digital and customer-centric assets, and allowed the acquirer to control amortization and impairment proactively.

7. Strategic Value of Appropriate implementation of PPA.

Proper allocation of purchase price leads to a solid financial base of an acquisition and enhances integration after the merger. It makes sure that the values of reported assets are justifiable and consistent with future performances expectations. When it comes to e-commerce companies, PPA is not just an accounting exercise, but a strategic investigation into the origins and the development of digital value.

The separation of goodwill and identifiable intangibles enables the management to improve the monitoring of the performance indicators that are associated with customer interaction, use of technology, and brand building. This keeps investors with utmost confidence besides facilitating future expansion plans, such as IPO preparation or internationalization.

Conclusion

The digital-first economy needs proper allocation of acquisition price in e-commerce companies to be understood, so as to be financially accurate and strategically foresighted. Effective procurement of purchases through the Internet guarantees that after the acquisition, the statements prepared according to the IFRS are adequate to measure the value drivers of the business. With the ever-changing environment of e-commerce, those companies that are able to master this process will be in the best position to maintain the transparency, investor trust, and profitability in the long term.