Advanced PPA Tax Compliance Program

Purchase Price Allocation Tax Basis Explained: Deferred Taxes, Compliance, and Strategic Tax Implications in M&A

Introduction to Advanced PPA Tax Compliance Program

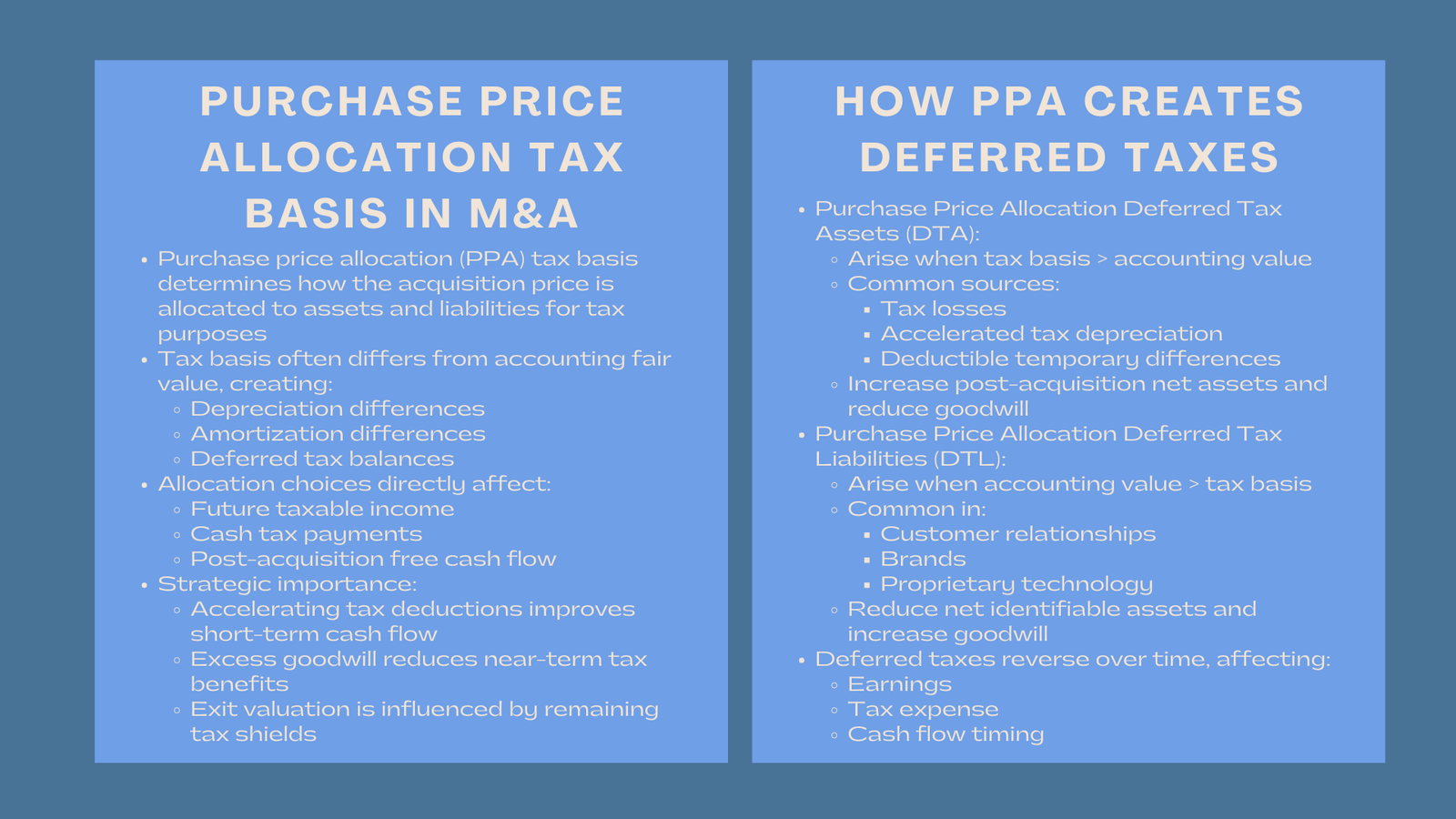

When it comes to any merger or acquisition, the price of the transaction is just a starting point in a much more complicated financial and taxing ride. After a deal has been closed, the finance teams are required to use the purchase consideration to make a defensible allocation between tangible and intangible assets. The purchase price allocation tax basis is at the core of this process and the concept that has a direct effect on the future depreciation, amortization, taxable income and the position of deferred taxes.

Mistakes in this phase will time-bomb earnings over years, precipitate a regulatory review, and cause expensive reevaluation on an audit or tax audit. In close relation to this are the identification of purchase price allocation deferred tax asset, treatment of purchase price allocation deferred tax liabilities, the larger purchase price allocation tax implications, and the financeable reporting framework as determined by the purchase price allocation tax form. This article contains a specialist, narrowed-down, and detailed treatment of the tax basis and deferred tax functioning inside purchase price allocation, and the reason why these mechanics should be grasped as a long-term post-acquisition result.

1. Understanding the Purchase Price Allocation Tax Basis

1.1 Conceptual Meaning of Purchase Price Allocation Tax Basis

The purchase price allocation tax basis refers to how the total acquisition price is allocated to the acquired assets and liabilities for tax purposes. Although accounting standards establish a frame of allocation in the framework of financial reporting, taxing authorities tend to set another frame of the same assets. It is this accounting difference and tax difference which creates deferred tax assets and liabilities after acquisition.

Practically, the tax basis is used to define the speed at which the buyer recovers the cost of acquisition by means of depreciation or amortization deductions. Diversely, the purchase price should allocate more on depreciating equipment or amortizing intangibles to accelerate the tax deductions and enhance cash flows following the deal. On the contrary, higher valuation of non-amortizable goodwill will postpone tax benefits and augment taxable income in the long run.

1.2 Why Tax Basis Matters Beyond Compliance

The purchase price allocation tax basis is not just a form of reporting requirement. It actively determines the post-acquisition tax profile of the merged organization. Tax basis planning is a tool that is used by CFOs and tax directors to effect cash tax savings, manage the balance sheet and optimize effective rates of tax. In leveraged acquisitions, in which debt servicing is highly reliant on free cash flow the tax basis structure may be life or death.

Strategically, exit valuation is influenced also by tax basis planning. This is a critical consideration that buyers check the residual tax shields on asset bases when they are pricing secondary deals, and not just at the time of initial purchase.

2. Purchase Price Allocation and Deferred Tax Mechanics

2.1 How Purchase Price Allocation Creates Deferred Tax Assets

The purchase price allocation deferred tax asset occurrence takes place as a result of an acquired asset with a tax basis being greater than its carrying value. This is usually happening where there are some tax losses, deductible temporary differences or accelerated depreciation opportunities which are not acknowledged by financial reporting standards at the time of acquisition.

In the example, when a target company has capitalized development costs that cannot be immediately deducted to account but can be deducted to tax over a shorter period, the buyer will record a purchase price allocation deferred tax asset with respect to future tax savings. This deferred tax asset augments post acquisition net assets and affects direct goodwill.

2.2 Purchase Price Allocation Deferred Tax Liabilities and Their Origins

The opposite condition gives rise to purchase price allocation deferred tax liabilities, which occur when the accounting value of an asset exceeds its tax basis. This is commonly observed with intangible assets like customer relationships, brands and proprietary technology which is recognized at fair value in accounting but not deductible in taxes or amortized over much longer periods in tax purposes.

Under these instances, the accounting income will be less than the future taxable income which will create a purchase price allocation deferred tax liabilities balance at acquisition. These liabilities lower the amount of goodwill that can be identified in the net and exaggerate the amount of reported goodwill. Through amortization and depreciation over time, the income statement reverses these deferred tax balances since these amortization and depreciation unwind differently.

3. The Broader Purchase Price Allocation Tax Implications

3.1 Impact on Effective Tax Rates and Earnings Volatility

One of the most material purchase price allocation tax implications is its effect on effective tax rates. The temporary tax timing difference caused by the differences between accounting amortization and tax deductions affects quarterly and annual tax expense.

When a company acquires large deferred tax liabilities as a result of intangible assets which are not deductible, the effective tax rate of such a company could be higher in later years. Conversely, substantial purchase price allocation deferred tax asset balances can temporarily suppress effective tax rates by reducing future tax expense. In the case of publicly-traded stock, such volatility may impact the expectations and credit ratings of investors and share valuation.

3.2 Influence on Cash Flow and Debt Servicing

Cash taxes are directly shaped by the purchase price allocation tax basis. Increased amortization deductions will mean reduced taxable income and good operating cash flows. This is especially essential in acquisitions that are supported by private equity, in which capital structures rely on reliable cash flow. The improper planning of the basis of taxes lowers financial flexibility and could limit the ability to reinvest.

The misalignment of tax basis planning in long-lasting projects, in infrastructure and capital-intensive sectors with an asset life of many decades, may give a bias to the long-run economics of projects and internal rates of return.

4. Regulatory Reporting and the Purchase Price Allocation Tax Form

4.1 Role of the Purchase Price Allocation Tax Form in Compliance

Purchase price allocation tax form is the formal statement of allocation of the acquisition price in regard to taxation purposes. This form is normally submitted to tax authorities soon after the transaction has closed and it forms the binding reference with regards to depreciation, amortization and recognition of gains in future periods of taxation.

When filed, the inclusion in the purchase price allocation tax form places a company in a significant disadvantage to recharacterize its assets values to maximize its tax in subsequent years. This renders the very first allocation procedure as one of the most relevant decisions in the tax process throughout the whole sphere of transaction.

4.2 Coordination Between Accounting and Tax Teams

Though two sets of reporting can be used, which is financial reporting and tax reporting, valuation conventions can differ, but on the contrary, there is an increased examination of discrepancies between the two by regulators. Under the financial reporting standards, accounting teams are concerned with fair value whereas tax teams concern the purchase price allocation tax basis. Lack of good coordination among these functions may lead to misaligned reporting, difficulties in auditing and exposure to regulations.

Formal filings are made after successful organizations form joint valuation committees to reconcile accounting fair values with tax basis strategies.

5. Real-World Case Application of Purchase Price Allocation and Deferred Taxes

5.1 Manufacturing Acquisition with High Asset Revaluation

A global manufacturing corporation bought a local company having outdated equipment and having customer agreements. The financial reporting necessitated the revaluation of the production assets and recognition of the customer relations at fair value. The tax authorities however only permitted accelerated depreciation on newly acquired tangible assets only.

The accounting values were higher than the tax basis due to this, which resulted in large purchase price allocation deferred tax liabilities on acquisition. These liabilities were reversed within a time span of five years as accounting depreciation stalled with tax depreciation. The case explains how the purchase price allocation tax implication stretches far beyond integration into the post-merger and financial performance evaluation.

5.2 Technology Acquisition and Deferred Tax Asset Recognition

During an acquisition in a technology industry, the target company had huge net operating losses which could be offset in the future against taxable profits. These losses produced high purchase price allocation deferred tax assets at acquisition. Regulatory constraints, however, downplayed the rate of such losses being consumable. This forced the management to value deferred tax benefits on the basis of complex judgment as they were forced to evaluate valuation allowances on an annual basis.

6. Strategic Planning Using the Purchase Price Allocation Tax Basis

6.1 Tax Basis as a Value Creation Lever

Efficient acquirers use purchase price allocation tax basis as an instrument of value creation as opposed to a non-active measure of compliance. Through a meticulous tax basis-post-deal investment alignment, businesses are able to hasten tax shields, increase cash flows, and increase the profitability of invested capital.

Considering the example, near-term tax efficiency in the purchases of digital transformation can greatly increase the allocation of higher values to software and process automation assets with shorter tax amortization periods.

6.2 Risk Management and Audit Defense

The most common issues that are questioned during post-acquisition audit are deferred tax positions. Proper documentation of assumptions in favor of purchase price allocation deferred tax asset and purchase price allocation deferred tax liabilities minimizes litigation liability and regulatory fines. The tax authorities are more and more requiring third-party valuation support on asset allocations that significantly change the taxable income.

Companies that incorporate the help of tax and valuation experts during the initial stages of the transaction process are in a better position to defend their grounds during the audit and dispute resolution.

7. Image Alt Text for Digital Reporting and Training

Accessibility labeling is becoming more of a necessity in professional digital documentation as well as training documents. An ordinary example of image alt text would say: purchase price allocation tax basis example of deferred tax assets and deferred tax liability by the categories of acquired assets. This guarantees compliance with the standards of regulatory accessibility and strengthens technical communication standards.

8. Long-Term Governance and Financial Reporting Stability

8.1 Deferred Taxes as a Signal to Investors

Advanced investors use deferred tax balances as an indicator of quality purchase accounting. The statement of large purchase price allocation deferred tax liabilities can be an indicator of aggressive recognition of non-deductible intangibles at fair value. On the other hand, large deferred tax assets bring about suspicion when it comes to scrutiny of the realizability and valuation allowances.

These indicators affect the valuation multiples, credit conditions and investor confidence relating to the strategy long after the acquisition is done.

8.2 Institutional Controls and Ongoing Monitoring

The modern governance systems are progressively demanding that the deferred tax balances that resulted due to purchase price allocation undergo periodic re-evaluation. Remeasurement may be occasioned by changes in the tax law or impairment of assets, or business restructuring. This validates the enduring significance of the purchase price allocation tax implication in enterprise risk management.

Conclusion

The technical field of purchase price allocation tax basis is one of the strongest but underestimated forces of post acquisition financial performance. It has a direct effect on the cash flow, earnings stability, and long term enterprise value through its impact on depreciation, amortization, deferred taxes, and effective taxes rates. These acknowledgments of purchase price allocation deferred tax asset and purchase price allocation deferred tax liability, the awareness of other assimilation of purchase price allocation tax implications, and the disclosures institutionalized in the purchase price allocation tax form constitute a closely knitted system of financial repercussion.

Companies that demonstrate their abilities to master such mechanisms in the initial stages of the deal process ensure compliance as well as long-term tax efficiency and credibility of governance. Within a regulatory landscape characterized by increased scrutiny coupled with declining tolerance levels towards reporting ambiguity, disciplined tax-basis-driven purchase price allocation ceases to be an option but a strategic necessity.