Advanced PPA Training for Analysts

Adjustments for Working Capital and Net Debt in Purchase Price Determination

Learn Advanced PPA Training for Analysts

In a negotiation of a merger or acquisition, the purchase price agreed upon is hardly ever the final amount agreed upon at the time of closing. Different post deal modifications take place so that the buyer is provided with business in desired financial state. The most frequent and the most important of these are working capital and net debt adjustments. To professionals in the finance field, it is imperative to know these adjustments in order to evaluate the value of the deal, negotiating it, and having a fair deal result.

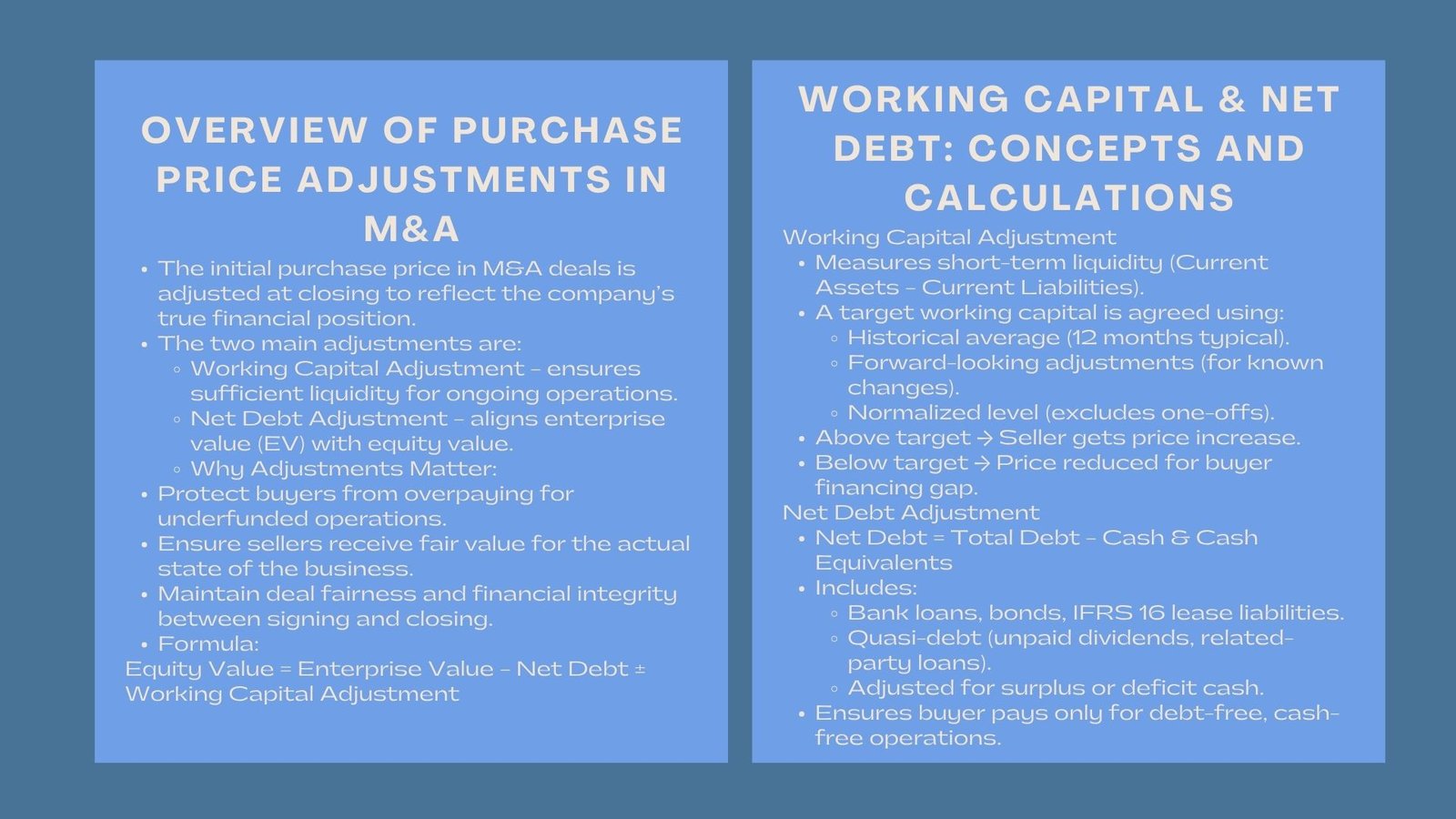

Understanding Purchase Price Adjustments in M&A

Theoretically, a buyer accepts to purchase a business through cash-free and debt-free terms with a normal amount of working capital. This makes sure that the buyer will not pay extra funds to finance or idle cash when he or she is buying only the operating assets to run the business. But as the financial position of the company will vary on a daily basis, the price at which the purchase is purchased during signing will usually be corrected upon closing to reflect the true levels of cash, debt and working capital.

These adjustments obtained after closing are a shield- they ensure the parties (buyers and sellers) will not be overcharged or underserved as a result of operational shifts between the time of signing and closing.

Working Capital: What to Know in Deal Situations.

The working capital is the liquidity of a business in the short term, and it is estimated by calculating the difference between current assets and current liabilities. It captures the cash which is invested in daily running of the business in the form of inventories, receivables and payables.

When it comes to M&A, it is necessary to identify a target working capital. This standard is the normalised amount of the working capital that the business must run at. Any variation of this at the time of closing results in a change of the purchase price.

As an illustration, when the actual amount of working capital at closing is above the target, the seller can be given an upward adjustment, since the buyer is purchasing more net current assets. On the other hand, when the working capital is less than the actual, the purchase price is decreased to cover shortcomings in financing the buyer.

The calculation of the Target Working Capital.

The process of setting up the target level entails an in-depth study of past and projection data. Common approaches include:

- Historical average method: This method involves calculation of an average of monthly working capital levels over a period of representation (i.e. 12 months) to remove seasonal effects.

- Forward-Looking Method: Correction of the past average in the light of the known future adjustments, new contracts, production shifts or inventory build-ups.

- Normalized Level Approach: This removes the unusual or non-recurring items that distort the underlying working trend in the capital.

The negotiating level is usually much more oriented onto a target level since this serves a direct influence on the final price paid. The parties should be in agreement on the elements to be incorporated and should be consistent between the definition of the working capital in the purchase contract and the financial model.

Elements of Working capital Adjustments.

Typical components include:

- Trade Receivables: Contact with doubtful debts or overdues.

- Inventory: at lower of cost, net realizable, without obsolete or slow moving inventory.

- Trade Payables: checked over and accruals or provisions added.

Other Current Assets and Liabilities: Prepaid expenses, accrued income or short-term provisions are all items that are dependent on the definition of contract.

A properly designed working capital adjustment system will make it fair and reduce post-deal dispute.

Learning about Net Debt Adjustments.

The working capital is based on the operational liquidity whereas net debt alterations address the structure of the company. The total debt less cash and cash equivalents at the end of the year is usually considered as net debt.

The goal of the net debt adjustment in purchase price determination is to align the enterprise value (EV) of the business with its equity value. Buyers agree to pay for the equity of a debt-free company; therefore, any excess debt at closing reduces the price, while excess cash increases it.

Calculating Net Debt

Net debt includes:

- Interest Bearing Borrowings: Bank loans, bonds and other finance instruments.

- Lease Liabilities: Under IFRS 16, it should be considered a component of a financial debt.

- Cash and Cash Equivalents: Cash, bank balances as well as short term investments which have the ability to counter debt.

- Quasi-Debt Items Adjustments: There are also possibilities that items such as unpaid dividends, related-party balances, or deferred purchases considerations are also included based on definitions of contracts.

How to establish what counts as debt-like or cash-like items is complicated – the areas where negotiations can frequently take place between the buyer and the seller.

Correlation of Working Capital and Net Debt.

There are close adjustments between working capital and net debt. When the definitions are not consistent, then one should overstate the other. As an example, when a supplier loan is categorized as a trade payable (impacting working capital) and as debt (impacting net debt) the resulting adjustment would be different.

The purchase agreement should clearly define the boundary between the purchase and the omission in order to avoid cases of double-counting the purchase or omission. Both aggregations must be matched at the due diligence stage by the finance departments to ensure uniformity.

Valuation Implications

Determination of purchase price begins with a valuation of an enterprise in terms of discounted cash flow or market multiple. The enterprise value is the value of the business regardless of the way it was financed.

In order to come up with equity value- the price paid to the shareholders, corrective entries are made in account of net debt and working capital variances. The relationship can be expressed as;

Value of Equity = Enterprise Value -Net Debt +-Working Capital Adjustment.

The greater the net debt balance, the lower the equity value and the greater excess working capital, the greater the equity value. This formula forms the basis of the valuation results into real purchase consideration.

The Significance of Definiteness in Contracts.

Unclear definitions of working capital or debt-like are one of the key causes of the post-closing disputes. Purchase agreements are therefore to:

- State Components Unambiguously: Include and exclude items of both working capital and net debt.

- Define Calculation Methodology: Indicate whether balances are calculated with accounting policies in inclusive of past financial statements or with applying the IFRS standards.

- Give Sample Calculations: In the agreement, give examples to eliminate loopholes in the interpretation.

- Set Dispute Resolution Mechanisms: Lasting arbitration or party independent expert processes to fix differences efficiently.

At the contract stage, transparency and accuracy will help the two parties save on time and cost when closing.

Real Work Problems in Adjustment Computations.

Timing Differences

There is a frequent cut off problem in transaction that transpires mid-month or quarter. As an example, invoices that were received after getting a closing but involved a pre-closing operations should be carefully assigned to prevent counting the same invoice twice.

Seasonality

In the case of seasonal businesses, the economic position can be skewed by closing either at a high point or low point in the working capital cycle. It is important to note that it is imperative to adjust the target level according to seasonality.

Quality of Financial Data

Lack of full or constant financial data may result in error in adjustment computation. Providing strong data in the due diligence reduces the chances of recalculation of data after closing.

Finance Financing Best Practices.

- Get Definitions in Place: Decide on accounting policy issues between buyer and seller prior to writing the purchase contract.

- Simulations Simulate Closing Scenario Run the pro forma calculations to learn the possible adjustment results.

- Track Pre-Closing Changes: Importantly, monitor financial shifts in a balance sheet after its signing and before closing, to predict any important variances.

- Outsource Advisors: Independent evaluators or valuation or transaction advisors can assist in ensuring that calculations are correct and avoiding disagreements.

- Keep Audit Ready Notes: Keep records with the notes of all assumptions and calculations to be used by the audit or arbitrators.

Adjustment Analysis Insights on being strategic.

In addition to compliance with the contractual terms, working capital and net debt adjustment analysis will provide a good understanding of the efficiency of the operations and cash management. Continued working capital deficits can be taken as a sign of structural inefficiencies, and a high level of debt may be an indication of financing risks.

To the buyers, these amendments give an enhanced perspective of the actual economic situation of the company and allow in developing the future cash flow planning after the acquisition. To sellers, knowledge of the mechanics would help them ensure that they get the best possible deal proceeds as a result of dealing with positions on balance sheets before closing.

Conclusion

The working capital and net debt adjustments are part and parcel of purchase price determination in the M&A transactions. They also make sure that the buyer of the business gets the business in the shape that it was intended and that the seller is fairly compensated. To the professionals in the field of finance, the ability to master these concepts will improve the effectiveness of the negotiation process, the level of accuracy in financial modeling, as well as transparency in transactions. Instead of taking these adjustments lightly, both sides would be able to realize a just and efficient deal result that would indicate the optimal value of the business.