Advanced Purchase Price Allocation for Hotels

Purchase Price Split in Boutique Hotel Acquisitions

Introduction: Advanced Purchase Price Allocation for Hotels

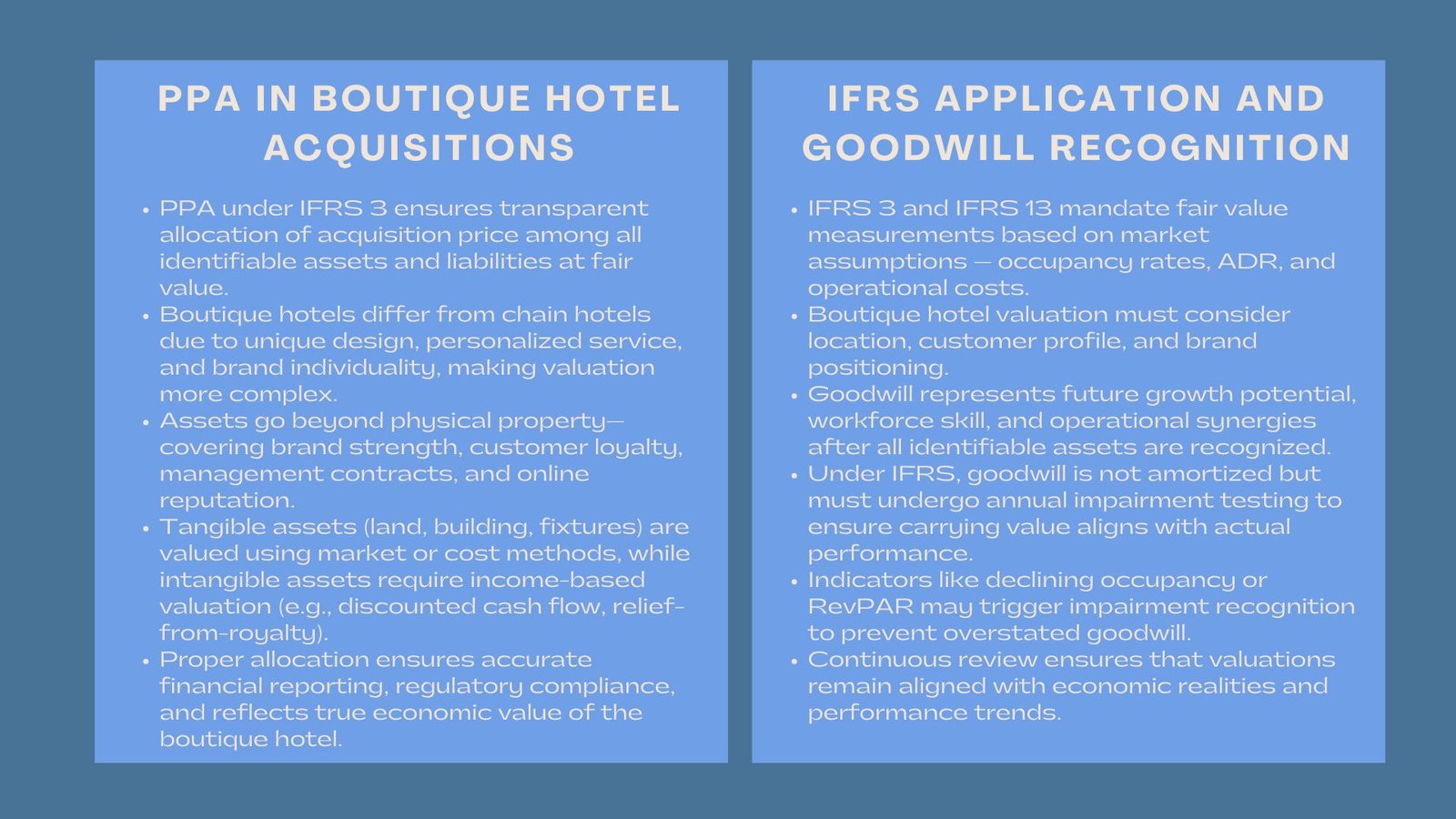

In the case of a purchased boutique hotel, the even allocation of the acquisition price across the various assets and liabilities of the hotel is an important component of the accounting of the purchase. The Purchase Price Allocation (PPA) as per IFRS 3 gives a uniform method of identifying and valuing all the tangible and intangible assets acquired in order to attain transparency and uniformity in financial reporting.

In contrast to large chain hotels that work with the set systems, the boutique hotels have their own peculiar features individual treatment, special design, and strong brand name, which complicates the evaluation process. Every property is usually an individualized concept, implying that fair value of its assets goes far above real-estate to encompass non-real-estate such as brand name, client loyalty, and management skill.

International Financial Reporting Standards 3: Boutique Hotel Valuation.

In accordance with IFRS 3, the acquirers have to record all identifiable assets and liabilities of the acquiring companies at their fair values on the acquisition date. The principle supplies that the financial statements properly reflect the actual value of the business that is acquired.

In boutique hotel acquisitions, a thorough boutique hotel purchase price allocation separates tangible assets such as property, fixtures, and furnishings from intangibles like guest relationships, management contracts, and brand value. This is aimed at making sure that every asset is recorded at fair value that reflects the contribution to future cash flow.

Tangible assets are often quantifiable by using market comparables or replacement cost, but intangible assets should be quantified using more specialized methods, which in most cases are income-based valuation approaches, which estimate the future economic benefits of these assets.

Elements of the Purchase Price Split.

Tangible Assets

The physical assets normally comprise the hotel property, land, building structures, furniture, fixtures and equipments. They are usually assessed with the help of the market or cost method, considering such factors as the condition of houses, their age, and their replacement price.

Intangible Assets

The real worth of a boutique hotel can be the intangible aspects which can show the difference between the competitors and bring regular visitors. Common intangibles include:

- Brand Recognition: The hotel has a unique idea and name, which can be used to justify high prices.

- Customer Relationships: The base of repeat clientele base will help in the predictability of future revenue.

- Management and Franchise Agreements: Contracts (regulating the functioning of hotels or brand belonging) are subject to quantifiable fair value.

- Online Presence and Reputation: Good online rating and strong social media influence can have great effect on occupancy and power of pricing.

The intangible assets should be to be evaluated on whether they satisfy the IFRS 3 requirement on recognition and valued.

The use of IFRS on the Hospitality Sector.

When applying PPA in the hospitality industry, there are unique challenges due to the cycling weather conditions, seasonal traffic and the variability of operations. Proper hospitality IFRS reporting ensures that all relevant assumptions, valuation methods, and discount rates are transparently documented.

Under the IFRS 13, the fair value measurement should represent an amount that should be received in a normal transaction between a market of market players at the measurement date. This implies that realistic assumptions regarding anticipated occupancy rates, average daily room rates (ADR), and costs of operation should be factored in the valuations.

In the case of boutique hotels, other considerations that should be made by an acquirer include the location, customer profile and brand positioning. A downtown life style hotel, say, may have much different value drivers than a seaside resort- even though they might be of similar size.

Goodwill Recognition and Impairment Testing.

The purchase price adjusting all identifiable assets and liabilities have been estimated and the remaining value is considered as goodwill. When it comes to the case of the boutique hotels, goodwill tends to be the potential growth in the future, operational synergies, and accumulated workforce.

Under IFRS, goodwill is not to be amortized, but is to be tested annually to see whether they are impaired. In case of performance that is lower than projected (either decreased occupancy, or lower revenue per available room (RevPAR)), an impairment loss may be required to be noted. This is in order to maintain the carrying value of goodwill to be in tandem with the actual earning capacity of the hotel.

A consistent review of performance measures, together with external business environment, will ensure that there will be no overstated goodwill and that the standards of IFRS are adhered to.

Reporting and integration following acquisitions.

Once the purchase price allocation is made, the acquirer needs to combine the financial data of the boutique hotel in the financial reporting framework of the acquirer. This will involve the matching of the depreciation and amortization schedules, the accounting policies, and the consistency of disclosures of all business units.

The performance of the assets should also be monitored continuously, particularly in such a dynamic industry as the hospitality industry. Frequently reviewing the value of the intangible assets including the brand equity and customer loyalty could be useful in pointing out the initial indications of impairment or loss of value.

Close integration also involves cooperation among the finance departments, hotel administration and third-party appraisers. This cross functional practice also makes sure that the accounting is not only accurate in terms of financial records, but also the operational drivers of the hotel in the real world.

Obstacles to the Boutique Hotel Valuation.

The promotion of the worth of boutique hotels is associated with multiple practical and theoretical challenges:

- Market Volatility: Market seasonal demand, economic cycles and tourism trends may lead to substantial fluctuations in cash flow projections.

- Smaller Comparable Data: In comparison to chain hotels, there are less direct comparables to a property in a boutique hotel, and therefore the process of benchmarking is more complicated.

- Reliance on Reputation: A lot of a boutique hotels worth is found in its image, design and guest experience which are hard to measure.

- Regulatory and Regional Factors: The regulatory factors that can have a significant impact on fair value assessment include local property taxes, licensing, and tourism regulations.

To mitigate such issues, it is necessary to pay special attention to the implementation of valuation standards and turn to the services of other experienced specialists in valuation of the hospitality business.

Conclusion

Precise reporting of the purchase price in acquiring a boutique hotel is very important in ensuring transparent and reliable financial reporting. By procurement of a well-documented purchase price allocation of a hotel through a well established hospitality IFRS reporting framework, acquisition buyers can achieve compliance, assure investor trust, and identify the actual value drivers of each property. In addition to regulatory requirements, what is in it is that this process offers valuable lessons about the role of design, service, and brand identity in ensuring long-term success in the hospitality industry, which is a competitive industry.