Allocating Purchase Price for Childcare Centers

Allocating Purchase Price for Childcare Centers

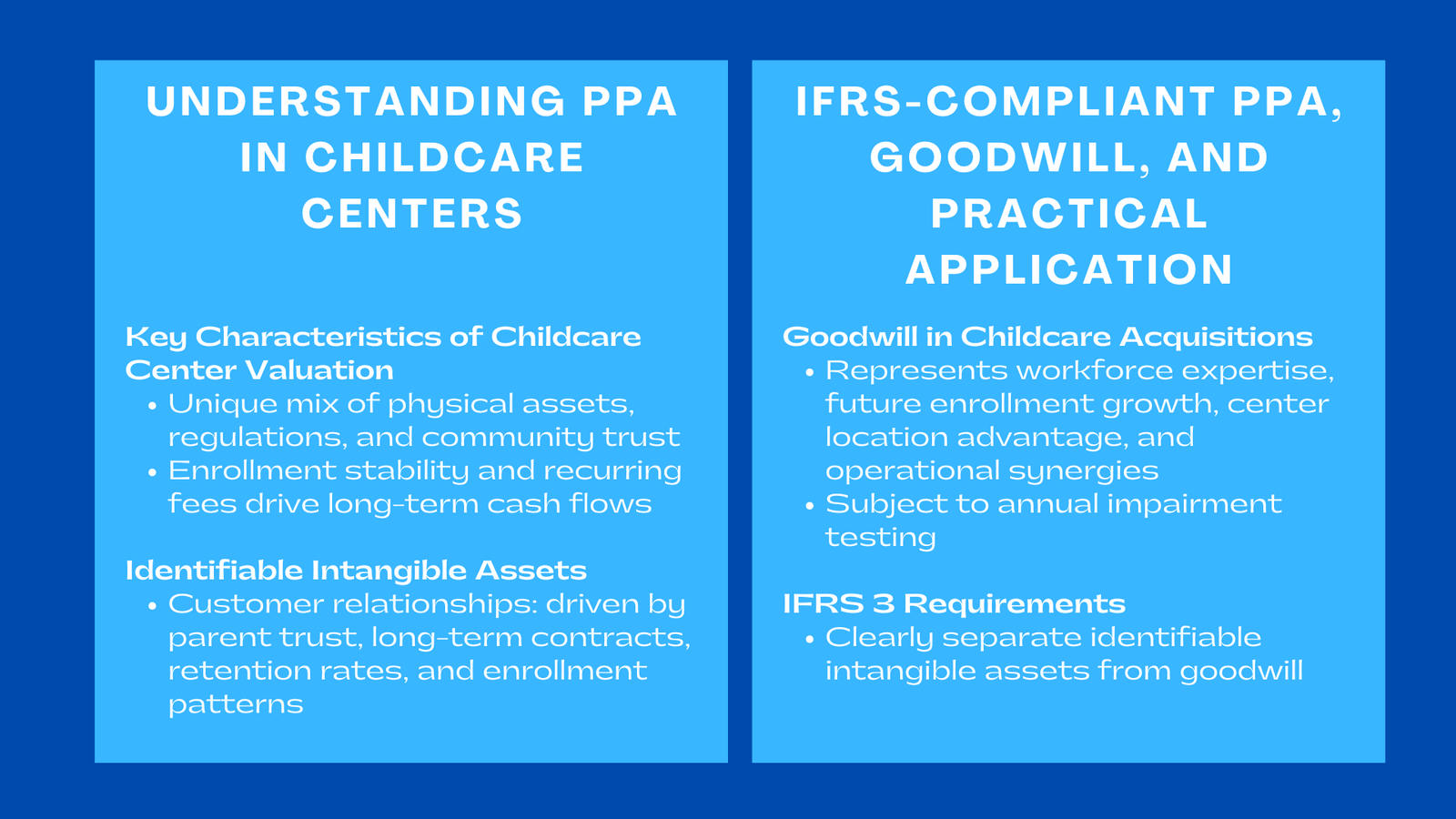

One of the most sensitive and detail-intensive parts of financial reporting allocation of purchase price is done in the acquisition of a childcare center. The early education industries involve a distinct combination of physical resources, legal laws, social confidence, and the duration of the enrollment trends that have a bearing on value identification. To investors, operators and financial analysts, it is important to know how acquisition price is attributed to identifiable assets and liabilities to have a clear picture of reporting, post-deal stability, and long-term strategic planning. The article is dedicated to a particular issue how to design and justify the allocation in the context of childcare center purchase under the IFRS-compliant frameworks with respect to the practical examples associated with the preschool and early learning operators, while also drawing parallels with how healthcare startups allocate purchase price Singapore to highlight cross-sector valuation principles.

1. The Economics of Childcare Center Valentuation.

1.1 The Character of Cash Flows and Stability of Enrollment.

Childcare centres make money mainly on regular charges that are associated with the long term admissions. This implies that the price at which the purchase can be done is usually based not just on the present financial performance but also the cash inflows that can be projected in the future. In the process of price allocation, the finance teams need to distinguish between the available revenue through the current enrolments and the revenue that will be given through the future marketing campaigns or capacity increase. This difference influences the value of the intangible assets including customer relations and reputation of the center.

1.2 Regulatory and Licensing Requirements.

Childcare centers have stringent licensing systems, unlike most small businesses. The valuation model of licenses, safety compliance certifications, and capacity approvals is being commonly affected. In spite of the fact that licenses are not usually separable and saleable, the higher the quality of regulation, the less operating risk, and it indirectly affects the premium that buyers want to pay. These drivers need to be captured in the allocation methodology in order to have compliance and ensure calculability of fair values.

2. Identifiable Assets that are frequently used in the acquisition of a childcare center.

2.1 Customer Relationships Based on Parent Trust.

The childcare industry is hinged on trust. Parents also enter into multi-year contracts particularly when the centers provide preschool and early learning programs. In this respect, customer relationships constitute a considerable part of the distributed value. Measuring their economic benefit entails anticipated rates of retention, terms and cross-selling of other services like after-school programmes or enrichment programs. Within this section, the keyword childcare center purchase price allocation naturally aligns with how finance teams quantify these ongoing economic benefits.

2.2 Brand Reputation and Community Presence

A good number of childcare facilities- particularly the ones run by well known chains have a high brand equity. Although early childhood brands are not as globalized as the retail or hospitality brands, the local recognition can still play a significant role in the transformation of premium pricing. This is frequently reflected by valuation professionals in one of the types of trade name or center reputation assets, to be valued by one of the various methods of relief-from-royalty or other IFRS-approved techniques. In the case of smaller independent centers, the brand portion might be weaker although allocation must be clear in order to show the market positioning.

3. Physical and Operational Assets in Purchase Price Allocation.

3.1 Classroom equipments, learning materials, and facilities.

Identifiable tangible asset base contains equipment i.e. classroom furnishings, educational toys, playground equipment, kitchen equipment and security systems. These should be identified at fair value taking into account the existing condition and the useful life. Tangible asset valuation is a relative insignificance in most childcare transactions when compared with intangibles but is necessary in the proper depreciation planning.

3.2 Leasehold Improvement and Center Modifications.

The majority of childcare facilities are rented out meaning that child-safe environments must be highly renovated. Improvements made to leasehold properties are usually worth a lot particularly to the centers in urban locations or within malls. The fair value measurement incorporates an evaluation of the remaining terms of lease, restoration clauses and market rental comparison.

4. Goodwill and Sector-Specifics.

4.1 What Goodwill and Childcare Deals are.

Goodwill normally reflects the worth of workforce amassed, synergies, future growth of enrollment capacity not yet reached and location advantages of the center. That leftover value, once the identifiable assets have been accounted for, is very subject to question as childcare markets tend to change depending on the demographics, the movement of people in cities, and competition.

4.2 Goodwill Monitoring After the Acquisition.

In the case of childcare centers, impairment tests are supposed to be conducted annually. Impairment reviews can be prompted by such sector-specific indicators as a drop in enrollment, regulatory non-compliance or shifts in the demographics of a neighborhood. Lack of keeping track of these indicators may result in overstated values of assets and loss of investor confidence.

5. IFRS Reporting Requirement on Acquisition of childcare center.

5.1 IFRS 3 in the Early Childhood Education.

The childcare center acquisition reporting must adhere to the constant application of the IFRS 3 to understand the measurement principles and identification of intangible assets. Within this section, the second keyword preschool IFRS reporting is directly relevant, as preschools must follow detailed IFRS requirements to justify the valuation of customer relationships, brands, and goodwill.

5.2 Documentation and Audit-Ready Support

All the assumptions that are utilized in the allocation should be evidenced in the market, in similar transactions, regulatory reports or records of the enrollments. The auditors usually examine the foundation of the fair value, the methods of calculation, and uniformity of the discount rates on the assets. Proper documentation is needed to survive the after-acquisition audit and financial examination.

6. Practical Application: Small Preschool Acquisition Allocation.

Take the case of an operator having a preschool of 120 students, long-term community, and high retention rates yearly. Valuation experts can divide the purchase price into the following after having established the purchase price:

- Relationships with customers that are appreciated by projection of the enrollments over a period of years.

- Local trade name was appreciated through royalty method.

- Improvements that are leasehold are treated at replacement cost less depreciation.

- The learning equipment treasured market comparables.

- The rest was to be allocated as goodwill that was associated with the future scale and enrolment growth.

- This is one of such examples of complicated, but systematic childcare centre valuations.

Conclusion to Allocating Purchase Price for Childcare Centers

Purchasing price allocation of childcare centers requires taking into consideration the operational, regulation, and community-based peculiarities of early education companies. Strict valuation process will be used to maintain compliance, promote transparent financial reporting, and establish trust with investors. When the allocation is done correctly, it is not only fulfilling the IFRS criteria but also has a solid base on long-term growth and strategic decisions in the childcare industry.