Allocating Purchase Price for Wellness Spa Centers

Allocating Purchase Price for Wellness & Spa Centers

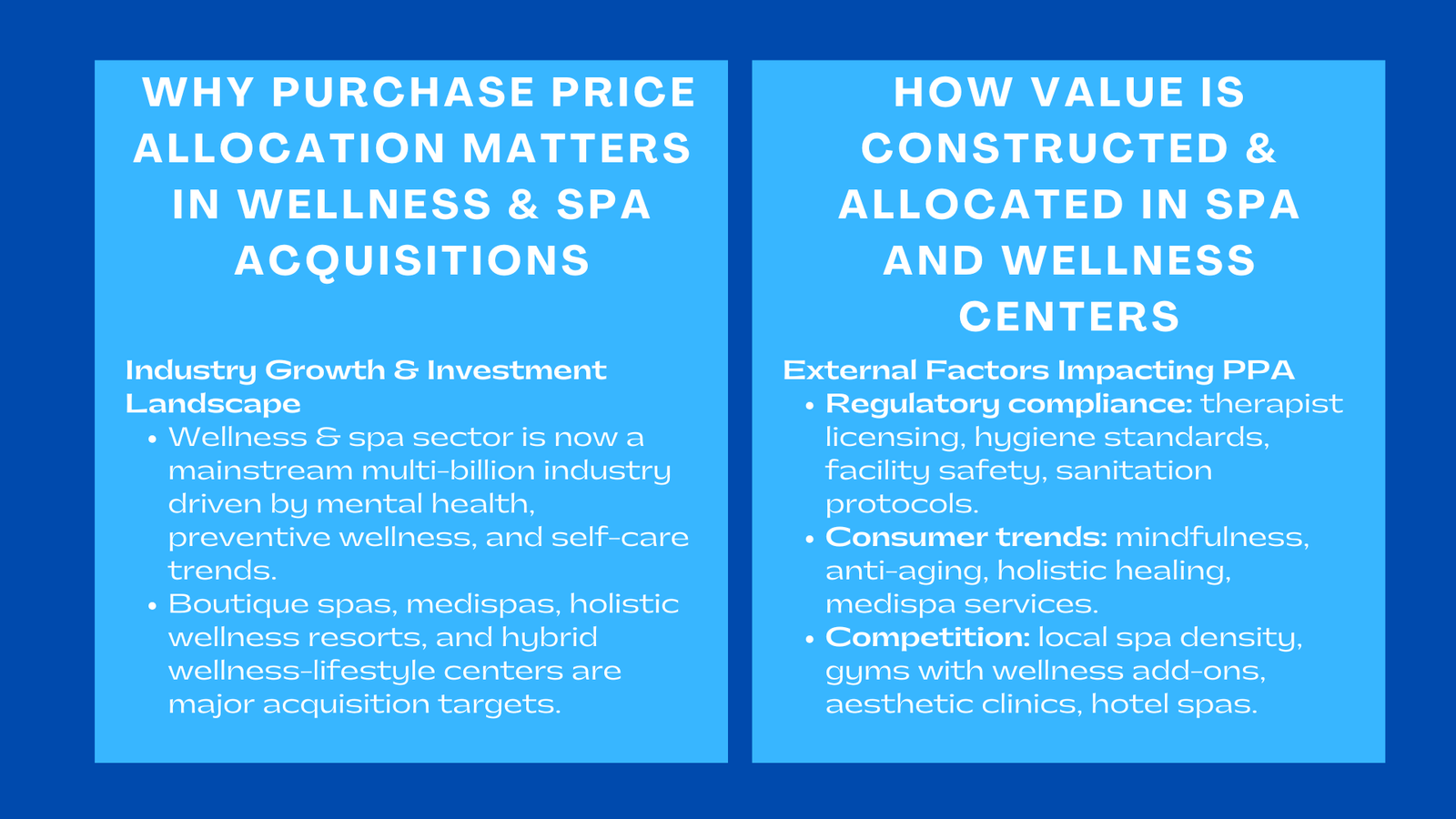

The wellness and spa sector of the world has grown to be a mainstream, multi-billion industry due to the increasing preference of consumers towards mental health, preventive wellness and self-care. Wellness centers and spas as well as wellness-lifestyle hybrid establishments, including a boutique spa chain and medispa establishments as well as holistic wellness resorts, have shifted to be sustainable, high-opportunity targets of investment. Following the growing pace of consolidation, acquisitions involving the sector are getting closer to the acquisitions in more formalized industries where transparency of valuation, accuracy of financial reporting, and compliance with regulations are critical.

In this expanding transacting environment, purchase price allocation is in the limelight. In cases whereby a wellness spa purchase price allocation is purchased according to IFRS 3, the purchase consideration should be recognized in identifiable tangible and intangible assets at a fair value. Such distribution is not an ordinary accounting operation, but a detailed financial analysis which shows the economic organization of the business. PPA is of special interest in an industry where much of the value is in the intangible and experiential elements of the industry.

Wellness and spa resorts are interested in customer loyalty, brand faith, interior atmosphere, profession of therapists, sensory atmosphere, and proprietary ideas of treatment systems none of which is evident in pre-acquisition accounting ledgers. With the growing interest in wellness business by both private equity, hospitality group and franchisors together with other lifestyle conglomerates, a strong, defendable and clear purchase price allocation will be a mandatory requirement to the subsequent financial reporting of the deal as well as future business planning.

Compared to industries in which physical resources prevail in valuation, wellness facilities are driving a large portion of their economic worth in the forms of intangible assets, related to the customer experience and their emotional response. The feeling of calmness, nature of the touch-based therapies, the professionalism of the attendants, the sensory programming, creative architectures and psychological security customers identify with a specific brand become the real secrets to propelling long term revenue.

But the accounting principles of the IFRS demand a discriminating approach to identifying identifiable intangible assets and goodwill. This forms a technical difficulty: most of the elements that are vital in the success of a spa cannot be transferred or detached separately, whether it is the emotional connection between the customer and the therapist, or how the combination of light, music, scent, and design leads to forming a brand experience. These experiential elements ultimately become contained in the goodwill, and those identifiable assets, which could be legally segregated such as trademarks, customer relation, memberships, proprietary products, and treatment frameworks, will have to be held separately.

There is also extensive variation in business models within the sector, with the simplest being walk-in massage studios and providing wellness clubs based on subscription, to the extremely expensive medispa centers where the dermatological treatments are provided under medical supervision. All the models bring distinct risks to operation, capital levels, intangible assets portfolios and cash flows that affect fair value. It is this difference that necessitates the PPA practitioners to have industry specific knowledge and capacity to extrapolate insights in the financial aspects of the operations as well as the consumer psychology.

Understanding Purchase Price Allocation in Spa and Wellness Acquisitions

IFRS 3 Requirements and Their Implications for the Wellness Industry

The IFRS 3 model establishes standards in which business combinations are to be reported. It requires that the acquirers recognize all the identifiable assets, and liabilities at the fair value at the date of acquisition. In the case of wellness and spa centers; a lot of assets which had not been previously identified by the previous owner; that is the assets that were internally created or developed by building a brand, now have to be identified and valued, a process often clarified in professional learning such as an IFRS 3 advanced course for M&A accounting Singapore.

This process involves the determination of licensing rights, customer contracts, membership relation, branding factors, product trademarks, proprietary treatment knowledge and technology platforms applied in management of customers. The appraisal of these assets should be in line with the assumptions in the market that are legally attested as well as supported by reasonable cash-flow forecasts or relief-from-royalty studies. Any value that it cannot assign to certain assets gets verified as goodwill.

New lease accounting in the IFRS 16 which also applies to IFRS M & A reporting in the wellness business development also has to be considered in the accounting of leases where numerous spas are housed in a leased premise with high leasehold improvements. Determination of fair value of right-of-use assets and determination of whether the terms and conditions of the lease facilitate or limit future economic benefit is a valuable part of the allocation process.

How Value Is Constructed in Wellness and Spa Businesses

Wellness centers make income through providing quality, high-end and individualised experiences on a regular basis. The primary value drivers usually are the brand reputation, customer loyalty, strength of recurrent memberships, perceived professionalism of therapists, and the story identity of the wellness philosophy of the spa.

The customers normally decide on the wellness center or gym that they attend in regard to the emotional attachment they have to the brand, the perceived safety and cleanliness of the facility, as well as trust gained during frequent visits. Spas are also dependent on membership, pre-paid packages and regular visits; to stay afloat. This establishes a predictable and repetitive model of revenues which is a significant consideration in the establishment of fair value of intangible assets.

More so, wellness brands tend to be developed through years of storytelling, visual, and word-of-mouth. Brand equity affects the perceived exclusivity, pricing power, customer retention and market differentiation. Although the brand equity cannot be measured, it has a financial effect which needs to be factored in PPA.

Owned treatments: Signature massage, a magical formula of aromatherapy, lines of unique skin care products, and wellness rituals are some of the differentiating factors. In case these treatments determine the use of formalized intellectual property or are subject to any type of legal protection, the treatments can be defined as identifiable intangible assets under IFRS.

Core Components of Purchase Price Allocation in Spa and Wellness Centers

Tangible Assets and Their Contribution to the Customer Experience

Intangible assets are the ones that generate the long-term value whereas tangible assets will provide the immediate physical environment which people will experience. The spas spend much on high quality interiors, sensory design, hydrotherapy installations, sound system, water features, decorative lighting, treatment beds, sauna, and specific ambience equipment. The emotional effect of the service is influenced by the physical environment and is necessary in achieving relaxation and the image of luxury.

Under PPA, the tangible assets should be valued at a fair market value. Spa equipment unlike the industrial equipment is prone to depreciation because it is used extensively, there is the necessity of hygiene, and also it must be replaced frequently to ensure that the aesthetic quality is not compromised. The valuation should also take into consideration the leasehold improvements in most cases, which are highly customized with the aim of offering an immersive customer environment.

Inventory in the spa, particularly the spa that has the retail aspect involves skincare items, oils, aromatherapy products, and wellness related items. The valuation of the inventory should not be inaccurate because goods can either be perishable or there can be a branding contract involved.

Intangible Assets: The Foundation of Wellness Business Valuation

It is normally the intangible assets of wellness centers that make up most of the value of an economic asset. Long term cash flow is a concept widely impacted by customer relationships – especially: memberships or prepaid treatment plans. A good membership base gives predicted steady revenue and minimizes fluctuation of demand. The valuation experts need to gauge the customer retention, frequency of visit, pattern of membership renewals, average spend curves and seasonality.

The value of the brand is vital in the valuation of spas. A spa that has a positive brand, good internet image, or a well-known wellness ideology has pricing strength and an increased share of customer confidence. Royalty-relief models or market equivalents can be used in valuing such brand equity.

Intangible assets like a proprietary treatment process (e.g. signature massage, special healing rite, sensory treatment or special holistic regimen) can also be considered intangible assets in case they are transferable or have intellectual property organization. They are valued on the basis of uniqueness, replicability, and adding value to the premium positioning of the spa.

Technology platforms such as booking systems, customer relationship management systems, customer history analysis systems, user membership systems, and staff scheduling tools are more efficient in operations. They are systems with quantifiable economic value and in case they are tailored or incorporated within more encompassing wellness ecosystems, their worth is even greater.

Customer experience is quite a sensitive aspect of the spa business, and the intangible assets should be all inclusive of the transferrable elements of the experience.

Goodwill: Capturing Emotional Value, Workforce Expertise, and Synergy Potential

The remaining worth turns into goodwill subsequent to the allocation of identifiable assets. Goodwill is quite common with wellness acquisitions and is an expression of the experience aspects that cannot be distinctly identified on IFRS. These incorporate the general mood of the spa, service culture, expertise and personal bond with the client of the therapist and the emotional attachment of the customers to the brand, which is not tangible.

Goodwill is also an indication of the synergies that are expected to be realized of including the spa in the acquirer portfolio. These can encompass increased marketing coverage, cross-selling of wellness services, centralised purchase advantages on the skincare products, and greater digitalization. Goodwill is a figure that serves to determine the strategic benefit that the acquirer is likely to gain other than the operational value of the business that is in place.

External Factors Influencing Purchase Price Allocation in the Spa Sector

Regulatory Compliance, Licensing, and Operational Standards

The wellness industry has severe regulations of the hygiene of the facilities, licensing of therapists, sterilization, sanitation, safety and protection of the consumers. The valuation should take into account whether the spa complies with the rules and regulations, the number of regulatory risks that the premises is exposed to, the appropriateness of the premises, certification of the staff and adherence to the health provisions as well. A spa that has been in compliance since time immemorial and whose employees are all certified will feature reduced risks hence higher asset value.

Consumer Trends, Market Positioning, and Demand Stability

Consumer wellness trends are dominant in the spa industry and they include mindfulness, medical-grade treatment, holistic treatment, anti-aging treatment, as well as recovery-based service. The willingness of the consumers towards paying wellness experiences influences cash-flow estimates and the estimation of the value of intangible assets. Renewal rates, pricing leverage also depend on market positioning i.e. whether a spa is a premium, mid-tier, or community-based.

Competitive Environment and Local Market Dynamics

The issue of competition directly contributes to economic value. Unless the spas are premium in affluent areas, they can effectively compete against each other and enjoy divisive loyalty and occupancy rates, whereas spas in saturated areas might struggle to have competitive pricing. There might be the external competition, including the gym with its wellness add-ons, clinic with its aesthetic treatment, or the hotel with its in-house spa services that can have an impact on the fair value assumptions.

Conclusion to Allocating Purchase Price for Wellness Spa Centers

The wellness and spa centers purchasing process is a complicated procedure that involves incorporation of the financial modeling, technical expertise of IFRS accounting, the sector understanding, and human-focused value creation. Businesses that offer wellness produce revenue with the help of facilities but also with trust, ambiance, sense experience, quality of therapists, and brand identity. These are the factors that determine the future of the business economically and have to be replicated into the purchasing price allocation.

An elaborate PPA harmonizes the acquisition to the accounting requirements of the IFRS M&A reporting guide, and to the investors, it offers transparency of the investment, as well as providing the acquirer with a true picture of the assets that can be used to drive the financial performance. Since the wellness industry is part of the ever-expanding institutional capital-dependent industry, disciplined purchase price allocation will keep on being vital to formulating the real nature of value in the P2E, emotionally-related sector.