Allocation of Acquisition Price Play Schools

Allocation of Acquisition Price for Play Schools

Introduction to Allocation of Acquisition Price Play Schools

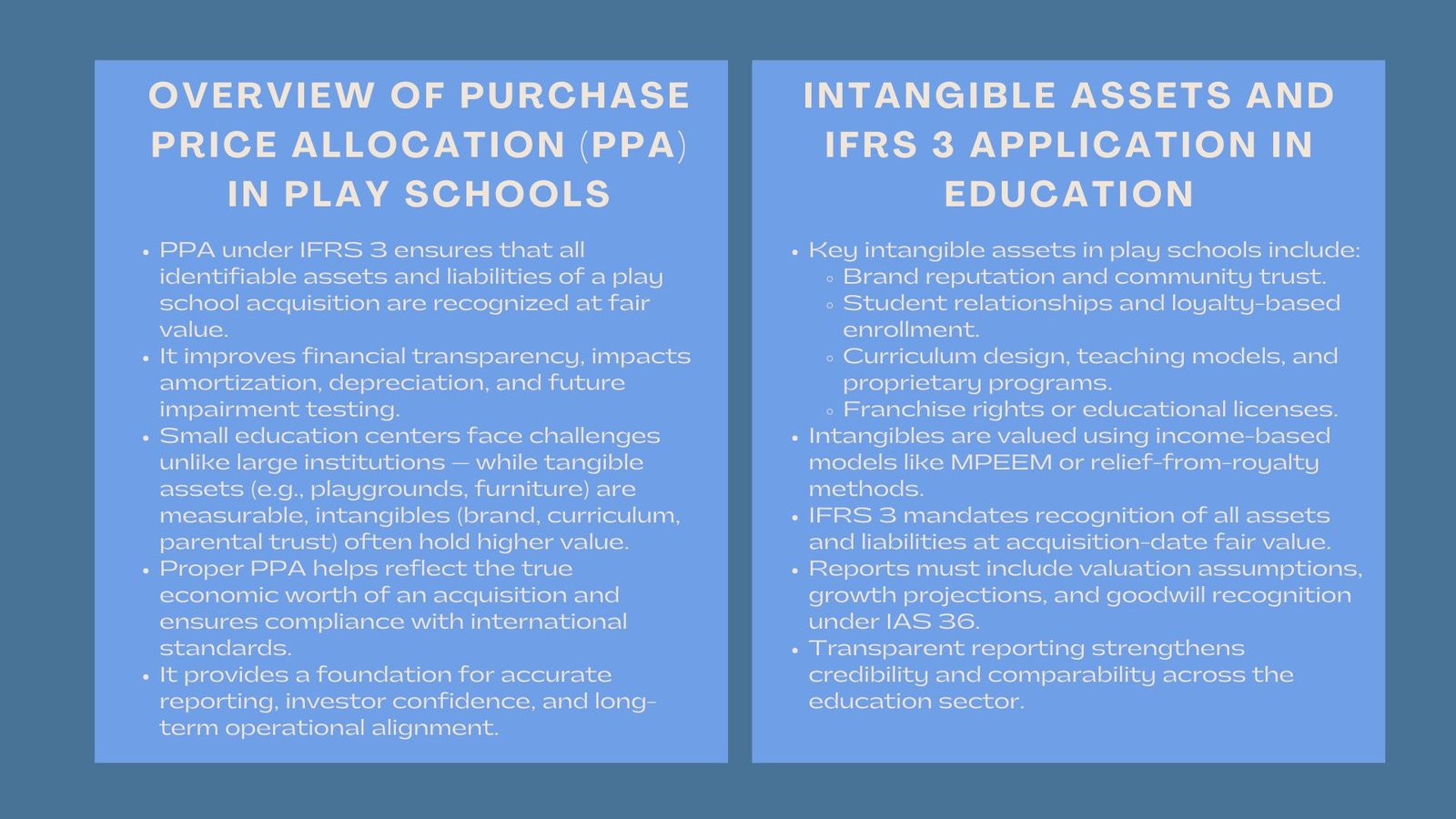

The allocation of purchase price is one of the most technical but imperative steps of financial reporting when a play school or an early childhood education center is being acquired. Purchase Price Allocation (PPA) process through the IFRS 3 provisions makes sure that all the identifiable liabilities and assets are recorded at fair value on the date of acquisition. This does not only enhance transparency, but also influences future depreciation, amortization as well as impairment evaluations.

Although big organizations could have a system of valuation in place, smaller organizations like play schools might have special issues. Their physical resources such as property, playground equipment and teaching materials are easy to quantify, yet their intangibles, such as brand reputation, curriculum design and relationships with parents often have higher value.

Knowledge on Purchase Price Allocation in Education.

Purchase Price Allocation is used to split the total acquisition consideration into particular categories of assets and liabilities. In the case of play schools, this is done through the identification of both non-physical and physical value drivers. A well-executed preschool purchase price allocation allows acquirers to fairly represent the true worth of an institution and comply with financial reporting standards.

PPA process is usually incorporated with the following major steps:

- Determining Assets and Liabilities: Tangible assets such as buildings, furniture, and educational equipment are appreciated and intangible ones such as list of students, trademarks, and proprietary teaching techniques.

- Appraisal of Intangible Assets: Intangibles may be required to be determined with methods based on income, like Multi-Period Excess Earnings Method (MPEEM) or relief-from-royalty models.

- Identification of Liabilities: Deferred revenue, tuition and any other unearned income should be determined.

- Computations of Goodwill: The amount obtained by subtracting fair values of identifiable assets and liabilities to the purchase price is used as goodwill.

This is done to make sure that the balance sheet of the acquiring company shows the true economic value of the play school that has been acquired.

Important Intangible Assets under Play School Valuations.

The intangible assets play a vital role in the early education businesses, because they tend to contribute to the growth and profitability in the future. The most widespread intangibles in this industry are:

- Brand and Reputation: The perceived education and parental trust is very significant in market value of a school.

- Student Relationships: The discounted cash flow projections can be used as a measure of enrollment contracts and parent loyalty.

- Curriculum and Educational Programs: Proprietary lesson plans and new teaching models can be of significant value.

- Franchise or Licensing Agreements: The schools being run based on formal franchise arrangements have identifiable rights that are capable of being individually appreciated.

These intangibles should be cautiously identified and valued in order to be compliant and relevant in making decisions.

The implementation of the IFRS 3 in Education Sector.

In the IFRS 3, all assets obtained and liabilities assumed should be realized at the fair value of their acquisition-dates. The new ownership of the play school will be based on a clear and standard financial base, thanks to this framework.

A comprehensive early childhood IFRS reporting process includes:

- Comprehensive records of fair value procedures.

- Valuation assumptions, discount rates and growth projections are clear.

- Determination of tentative estimates, which are completed in 12 months of acquisition.

- Identification of goodwill and annual impairment test under IAS 36.

Reporting business: This reporting discipline is more applicable to the education business because it improves the credibility of the business as well as the comparability of financial statements in the industry.

Typical Problems of the Valuing Play Schools.

The value of a play school cannot be appropriately compared with other commercial businesses because it has a number of peculiarities:

- Limited Market Comparables: There are few market comparable standards available to early education institutions and this necessitates a customized approach in valuation.

- Subjective Intangible Values: It may be difficult to measure the value of reputation of the school, its teaching philosophy, or community trust.

- Regulatory Differences: There may be a huge impact on the asset values by local licensing, accreditation, and compliance costs.

- Variable Enrollment: Intake and retention of the students change with demographics, competition and it is not certain which way to predict the future.

These difficulties cannot be overcome without special knowledge, strong information gathering and close collaboration of the financial analysts, auditors and education consultants.

Goodwill and Continuous Evaluation.

There are instances whereby goodwill is generated when there is an excess of purchase consideration over the fair value of identifiable net assets. During acquisitions of play schools, goodwill is normally attributed to the anticipated influx of students to the school, long term enlargement or workforce of teachers.

Goodwill under the IFRS is to be tested annually on impairment. The issues such as the decreased enrollment, lower tuition fee, or image damage may be outward signs that goodwill is being inflated. Periodic reviews are made to keep financial statements up to date and goodwill is matched to actual performance.

Integrating and monitoring after the acquisition.

After the acquisition has been made complete, the new owners need to incorporate accounting policies and have similar standards in reporting. Continuous evaluation of student population, school performance, and facility enhancement may also influence asset valuation and need consistent revision.

The frequent financial status reporting will be a way of not only keeping the school in check with the IFRS but also give an understanding of whether the school is yielding its projections. The alignment of the performance in operations with the results in accounting enables the preservation of the confidence of investors and increases the sustainability in the long term.

Conclusion

The allocation of the acquisition price of the play schools is not just an exercise in technical accounting but a strategic process which would determine the perception of value and reporting of the same. Properly prepared preschool purchase price allocation gives a reasonable reflection of physical and intangible assets whereas an organised early childhood IFRS reporting makes transparency and compliance. Collectively, the practices provide a strong basis of sustainable education development.