Best Practices for PPA Integration

Best Practices for Managing PPA Process and Integration After Acquisition

Introduction to Best Practices for PPA Integration

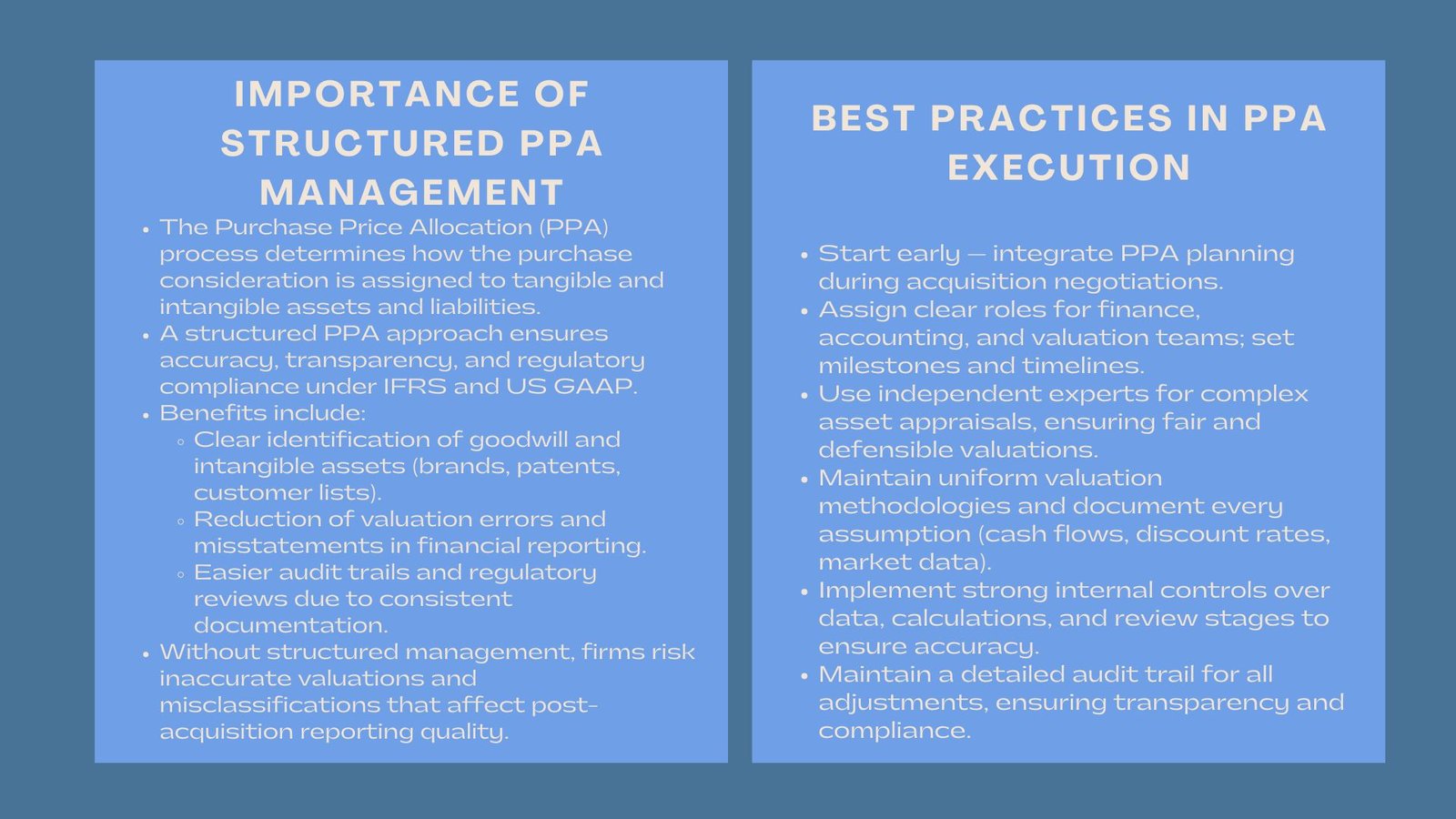

One of the most important processes of mergers and acquisitions is the management of the Purchase Price Allocation (PPA) procedure and the process of integrating an acquired company. The structured approach would also make sure that the determination of the purchase consideration to the tangible and intangible assets and assumed liabilities is correct and in accordance with the accounting standards. In addition, seamless post acquisition integration is a way of achieving anticipated synergies and reducing impacts of acquisition on the current operation. In the case of the financial and accounting professionals, the knowledge of the best practices in both, PPA management and integration, is crucial to the proper financial reporting and good business performance.

Significance of Structured PPA Management.

An efficient PPA process offers transparency in purchase price allocation, enables precise measurement of goodwill, and appropriate provision of intangible assets, including customer relationships, brands and intellectual property. In the absence of a systematic process, mistakes in valuation, misclassifying of assets or incomplete documentations may arise and could be subject to regulatory examination or misstatements of financial positions. Companies, which embrace an effective management of PPA processes, are in a good position to cope with the complex valuations, transparency and easier audit process.

Planning the PPA Process

The proper management of PPA starts in the stage of acquisition planning. Firms must establish objectives, schedules, and tasks of finance, accounting, and valuation departments. Upon identifying the most significant assets and liabilities, with contingent considerations being one of them, it is possible to gather supporting data and independent appraisals in a timely manner. Involving experts of valuation during the planning process is a way of making sure that such assets and difficult liabilities are valued appropriately. Being proactive eliminates the chances of making post closing adjustments that may come up and also assists in keeping the financial statements straight.

Carrying out true Calculations.

The essence of any PPA process is the valuation of acquired assets and liabilities. Physical assets like property, plant, and equipment should be appraised on a regular basis, whereas more complicated approaches, like the income approach, market comparables, and cost approach are necessary in intangible asset cases. Finance teams are expected to cross-check assumptions on assumptions on cash flows, discount rates and useful lives with market data and internal assumptions. Credibility and auditing support is achieved when these assumptions are properly documented. Having uniform methodologies used in all valuations would provide a good ground to use goodwill and report it later.

Combining Finance and Operational Teams.

The integration that occurs after the acquisition is as important as the process of the PPA. The operational and finance departments need to work hand in hand to harmonize systems, procedures, and reporting conventions. The involvement of accounting policies, consolidation of financial statements and coordination of operational processes minimizes the chances of errors and it makes reporting of post-acquisition process more efficient. Adopting post-acquisition integration best practices such as establishing a central project team, setting clear milestones, and maintaining ongoing communication across departments enhances coordination and ensures that both financial and operational objectives are achieved.

Documentation and Internal Controls.

The PPA process should be carefully and fully documented. All evidence, such as market data, past financial statements and independent appraisals should be used to substantiate all valuations, assumptions and allocation decisions. When the strong internal controls over data collection, calculation, and review are applied, the risk of errors is minimized, and the adherence to the IFRS and US GAAP ensures. It will be essential to have an audit trail of all adjustments that are performed during PPA or integration in order to achieve transparency and ease of review by auditors and regulators.

Post-Acquisitions and Post-Acquisition Adjustments.

However, despite due consideration and planning, it might be required to effect post-acquisition adjustments as additional information is obtained or temporary allocations are determined. The finance teams ought to observe fair value of the assets and liabilities, reassess contingencies and update the goodwill calculations where the need arises. It is important to conduct such reviews in a systematic way such that any amendments made would be transparent, well documented and justifiable. Periodical monitoring also helps in the timely identification of impairment or other accounting implications to protect the financial statements.

Co-operation with Expert helpers.

Outside experts will create objectivity and expertise especially where the asset or the liability is intangible. Independent validation is conducted by valuation specialists, tax advisors and legal consultants to assist in ensuring that the PPA process and integration activities are of professional standard. They are most useful in cross-border acquisitions where the accounting standards and regulations may be different and thus make the process more complex. Close collaboration between internal and external teams contributes to efficient PPA process management and reinforces best practices for accurate post-acquisition reporting.

Overcoming the Most frequent Obstacles.

The management of PPA process and integration is fraught with a number of challenges. These are misalignment of financial systems, incomplete or inconsistent data of the acquired company, and different assumptions of asset valuations. Culturally, there may be miscommunication between and among teams, which may put a frog in the way of integration. The three key recommendations that organizations should adopt in order to overcome these challenges are early planning, standardization of procedures, and adopting standard reporting structures. Periodic review of progress and management control would be used to ensure that both financial and operational goals are achieved successfully.

Measuring Continuous Improvement and Success.

Compliance is not the only measure of success in PPA and integration but also the realization of expected synergies and operational efficiencies. Finance departments need to monitor the most important indicators, such as accuracy of asset valuation, promptness of reporting, and integration initiatives. The outcome of every acquisition is to be learnt and feed into subsequent PPA processes and integration strategies to deliver a continuous improvement cycle. The implementation of the standard post acquisition integration techniques would guarantee that the knowledge acquired during the previous transactions is utilized in order to enhance efficiency as well as accuracy.

Conclusion

The PPA process management and integration of an acquired company are important in ensuring that there is proper financial reporting and operational success. Through effective PPA process management and adhering to the best practices of the post-acquisition integration, the organizations may guarantee the adherence to the accounting standards, transparency, and maximization of the acquired organization value. Professional attitude to valuation, reporting and teamwork helps to protect the integrity of the financial statements and promotes sustainable post-acquisition performance.