Business Valuation Allocation for Creative Studios

Business Valuation Allocation for Creative Studios

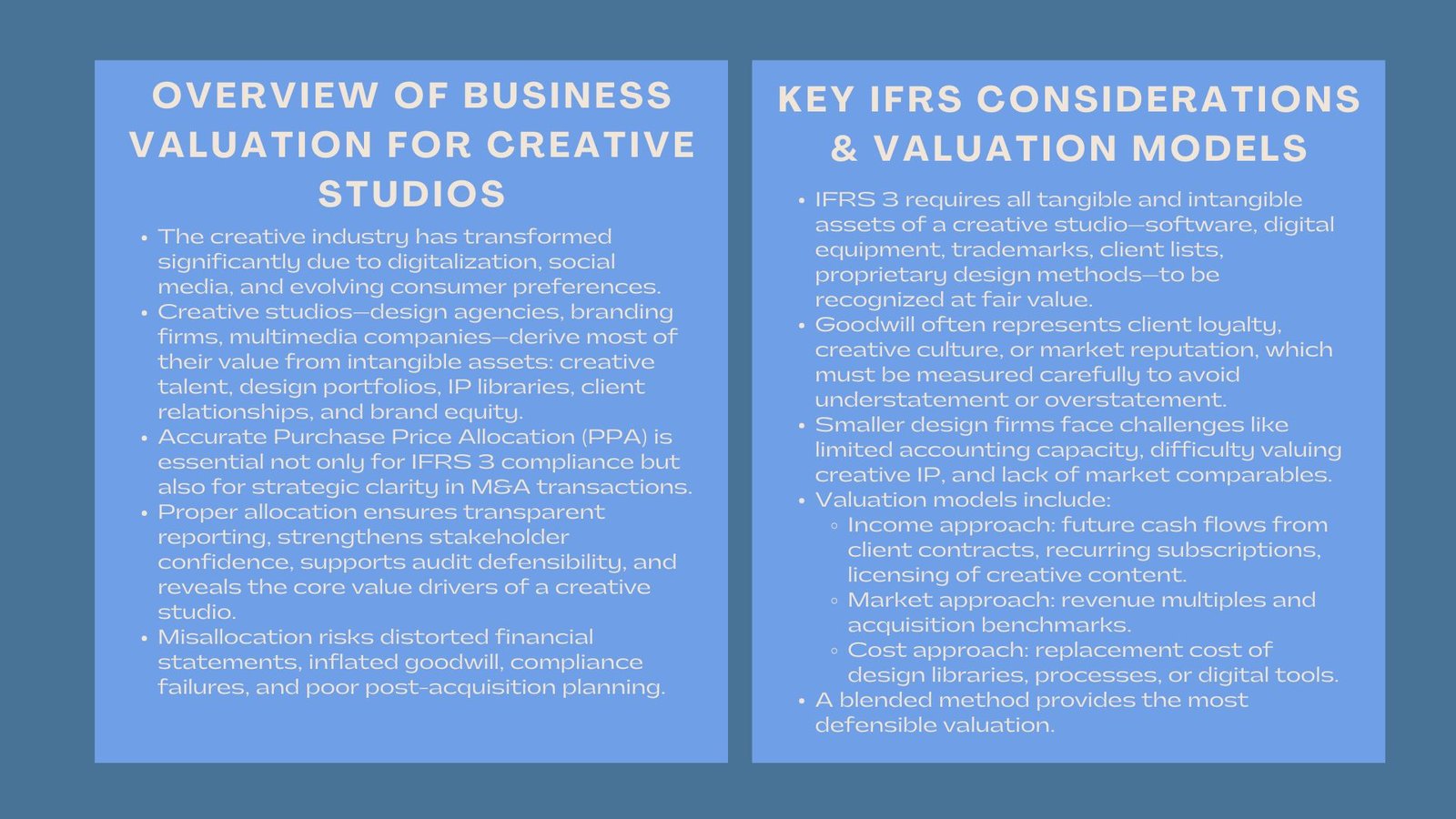

Over the past few years, the creative industry has experienced a great change with the influence of digital technology, social media, and the changing taste of the consumer. Design firms, branding firms, digital content creation firms, multimedia production companies, and other creative studios can be considered as valuable strategic assets to the investment groups focusing on intellectual property-based value. Creative studios, unlike the conventional business model where the major asset is the tangible element, the intangible assets, such as designs and creative talent, client base, brand equity, and libraries of digital content, contribute a significant percentage of value to the business.

It is not only under the IFRS standards where the purchase price of creative studios must be allocated accurately, but also a strategic necessity in a merger and acquisitions (M&A). Appropriate creative studio purchase price allocation would allow registration of both tangible and intangible assets at fair value of the same, creative studio purchase price allocation gives investors and auditors certain transparency, and assists in informed strategic decision-making. In the case of design companies and other creative organizations, the issue is that the company needs to know how to handle IFRS reporting standards to ensure its credibility, increase stakeholder confidence, and achieve the highest possible post-acquisition value.

Interpretation of Purchase Price Allocation in Creative Studios

The Concept of Purchase Price Allocation

Purchase price allocation (PPA) refers to a process of accounting of the total cost of acquisition of a business to its identifiable assets and liabilities. The physical properties in the case of creative studios can be the office space, computers, digital equipment, software licenses and physical design resources. Intangible assets, however, in most cases are the largest part of value and involve the intellectual property like: design portfolios, trademarks, proprietary software, client lists and brand identity.

It helps in terms of proper allocation so that the acquiring firm is able to ascertain goodwill correctly and this is the purchase price in excess of the fair value of the net assets. At a creative studio, goodwill is not only relevant in terms of the creativity of the agency, close client relationship, but also in or through future incomes of business arising through repetition of business and creative work. Appreciation and identification of these assets is a key focus since failure to do this accurately may lead to the distortion of financial statements, impact the tax reporting and undermine compliance with regulations.

Strategic Implications of Accurate Allocation

Correct PPA allows creative studios to make evidence-based decisions based on resource management, approaches to client interaction, and retention. As an illustration, the performance-based creative team that produces high-performing teams can be valued to determine post-acquisition human resource planning and in retention rewards. In the same vein, the internal acknowledgment that proprietary design methods, or design libraries will be valuable is helpful in assisting the investment in technology upgrades, development of creativity and innovation with services.

Proper allocation will also enhance proper financial reporting, enhance audit defensibility and underpin investor confidence. The stakeholders can comprehensively know the drivers of value in a creative studio, and this makes a difference between physical infrastructure and intangible intellectual property that drives revenues.

IFRS Reporting Considerations for Design Firms

Applying IFRS 3 in Creative Studio Acquisitions

Under business combination, the IFRS 3 requires that all identifiable assets and identifiable liabilities be placed at fair value and the goodwill in business interests be measured appropriately. To design companies, it would imply careful inspection of tangible, i.e. equipment and software infrastructure, and intangible assets i.e. creative intellectual property, client contracts and brand value.

The reputational merit, loyalty of the clients, and creative culture, which cannot be easily measured but has a substantial effect on the revenue, is usually embodied in the goodwill within the creative studios. It is important that these intangibles be recognized and their values are not understated so that they meet the reporting requirements of the IFRS 3 and present the real economic value of the studio to the stakeholders.

Challenges in IFRS Compliance for Creative Studios

Small to mid-sized design firms can have difficulties in applying the IFRS reporting because of the scarcity of accounting resources, the inability to determine the value of the creative intangible assets and the unavailability of direct competitors in the market. The proprietary design processes, value of client relationships, and libraries of digital content do not always have standard measures and need a professional assessment.

The use of external experienced professionals in the creative industries and the adherence to IFRS guidelines will make the classifications of the purchase prices credible, defendable, and transparent. Such professional assistance reduces the odds of audit modification, regulatory audit and misrepresentation of financial performance.

Valuation Models for Creative Studio Assets

Expected Income Valuation

An income-based method associates the value of an asset with the projected future cash flow on the asset both tangible and intangible assets. This is usually done in creative studios through estimating the revenue that can be attributed to client contracts, regular contracts, proprietary content, and service agreements that go on. These are projected cash flows which are discounted to present value that incorporates risk, market conditions as well as the time value of money.

Using the case of a design firm as an example, some examples of this that would result in harvesting recurring revenue include retained clients, subscription-based services, and licensing creative content that may be proprietary. The income-based method measures the contribution of such sources of revenues to total acquisition value and gives a justifiable and economically sound distribution of the purchase price.

Valuation Using Market Comparisons

Market based valuation applies the comparisons of the creative studio to other related transactions done in the marketplace including rich buy out of design agencies or multimedia studios. It is possible that there are no precise direct comparisons to be drawn since each studio has a distinct product offering when it comes to creativity, however, comparisons of transaction multiples in terms of revenue, client base, and creativity output can be a good gauge. This would aid the verification of earnings-based appraisal and would make sure that intangible resources are not underestimated as far as market expectations are concerned.

Cost-Derived Valuation

The cost-based method decides the replacement cost of tangible, as well as intangible assets. Physical assets like digital appliances, programs, or office systems can be easily appreciated, whereas intangibles like proprietary methods, creative templates, and library of content can be determined as per creation and implementation expenses. This approach might not well reflect the potential of future revenues, but, nevertheless, it gives a secure floor value of assets and allows good financial reporting in a conservative manner.

Unified Valuation Framework

The ideal approach to a comprehensive PPA process of creative studios is a combination of income-based, market-based and cost-based approaches to arrive at a reasonable and justifiable valuation. This consolidation will guarantee that tangible and intangible assets are not constructed and that goodwill represents the residual value and that such an acquisition will be in compliance with IFRS 3 reports.

Structural Issues in Allocating Purchase Price for Creative Studios

Valuing Creative Talent

The key of any design firm is creative talent. To appreciate the skills, experience, and reputation of the designers, writers, and multimedia specialists, it is important to put into serious consideration their contribution to the relationships with the clients, the delivery of the project or revenues. There are also contracts, employment agreements, and retention incentives that have to be taken into account during purchase price allocation to human capital.

Quantifying Intellectual Property

It is not always easy to measure intellectual property, such as trademarks, design portfolios, proprietary processes and computer stores of digital content. It is crucial to determine professional valuation because of the lack of standardized metrics, as well as, the individuality of the creative output of a specific studio. Credibility and defensibility in audit This will be achieved by proper documentation of the assumptions and methodologies used.

Assessing Client Relationships

Creating relationships with clients in creative studios is a foreseeable source of revenue and strategic importance. The long-term engagements, frequency of contract, and client loyalty have to be measured according to past income, context of the contract and future retention. The wrong assessment of the value of such relations may misdirect the projected income and affect strategic planning after acquiring it.

Brand Reputation and Market Position

The image and positioning of the brand in the studio have significant impacts on the prospects of the business in the future. The determination of brand value will involve examination of the market perception, social media states as well as award, industry recognition and project success in the past. Assigning relevant purchase price to brand reputation will make sure that goodwill is properly measured and indicated and represents the intangible worth of the studio.

Integration and Compliance Considerations

After the acquisitions, recording the intangible assets in the financial statements, the amortization plans, as well as the tax considerations are to be planned thoroughly. Internal compliance can be a problem, especially with small and mid-sized creative studios, which is where they need the professional advice of advisors to be. Precise recording of assumptions, valuation techniques, and data are all very important and ensures transparency, audit preparedness, and confidence to the stakeholders.

Executive Advantages of Accurate Purchase Price Allocation

Informing Operational Decisions

Proper PPA brings insights into the contribution related to various types of assets and this helps in making decisions related to talent management, content development, acquisition of clients, and investment of technologies. Knowing what assets will produce the greatest value enables the management to devise effective resources and produce maximum after the acquisitions.

Enhancing Regulatory Compliance and Investor Confidence

Adherence to the standards of IFRS and obvious distribution of purchase price will reduce the audit risk and reflect the transparency to the investors, lenders, and regulators. The credibility of financial statements and further fundraising, strategic partnering and positioning in the market are supported by a defensible PPA.

Supporting Long-Term Growth

The correct allocation will give the management the opportunity to exploit the intangible resources, including creative talent and intellectual property, in order to grow services, venture into new markets, and enhance the profitability. In the long term, such a strategic stance leads to a more efficient situation in the operation, brand value and profit maximization to the stakeholders.

Example Analysis

Take the example of a design studio that has been purchased at 6M. Existing assets are the office equipment worth 500, 000, software licenses worth 300, 000 and computers worth 200,000. One of the intangible assets is the creative talent that is worth 1.2 million, client portfolios are worth 1.5 million and the proprietary design processes are worth 800,000 as well as the brand reputation worth 700,000. The liabilities consist of accounts payable outstanding to the value of 200,000 and lease obligation to the value of 100,000. Goodwill or the remaining loss in buying the laboratories is made up of the residual purchase price of $1.8 million.

The given example demonstrates that comprehensive PPA makes sure to report the correct data, demonstrate strategic awareness, and adhere to the IFRS guidelines as well as emphasize the need to value the tangible and intangible property of creative studios.

Conclusion: Guide on Business Valuation Allocation for Creative Studios

Creative studio business valuation investment is a demanding procedure that integrates its accounting accurateness with both strategy and IFRS standards. The accurate valuation of physical properties, creative genius, intellectual property, relations with clients and brand identity would make financial reports clear, audit-compliant and informative.

To creative studios, proper PPA is not just an accounting endeavour; it is an effective strategy that helps determine where funds are to be allocated, integration following an acquisition, confidence among stakeholders, among others and design firm IFRS guide encourages a sustainable development. Through professional skills and strong valuation techniques, design firms have also the opportunity to get the best value of acquisitions, meet the requirements of IFRS and a future of success in the highly competitive and innovative market.