Business Valuation Allocation for Small Manufacturing Units

Business Valuation Allocation for Small Manufacturing Units

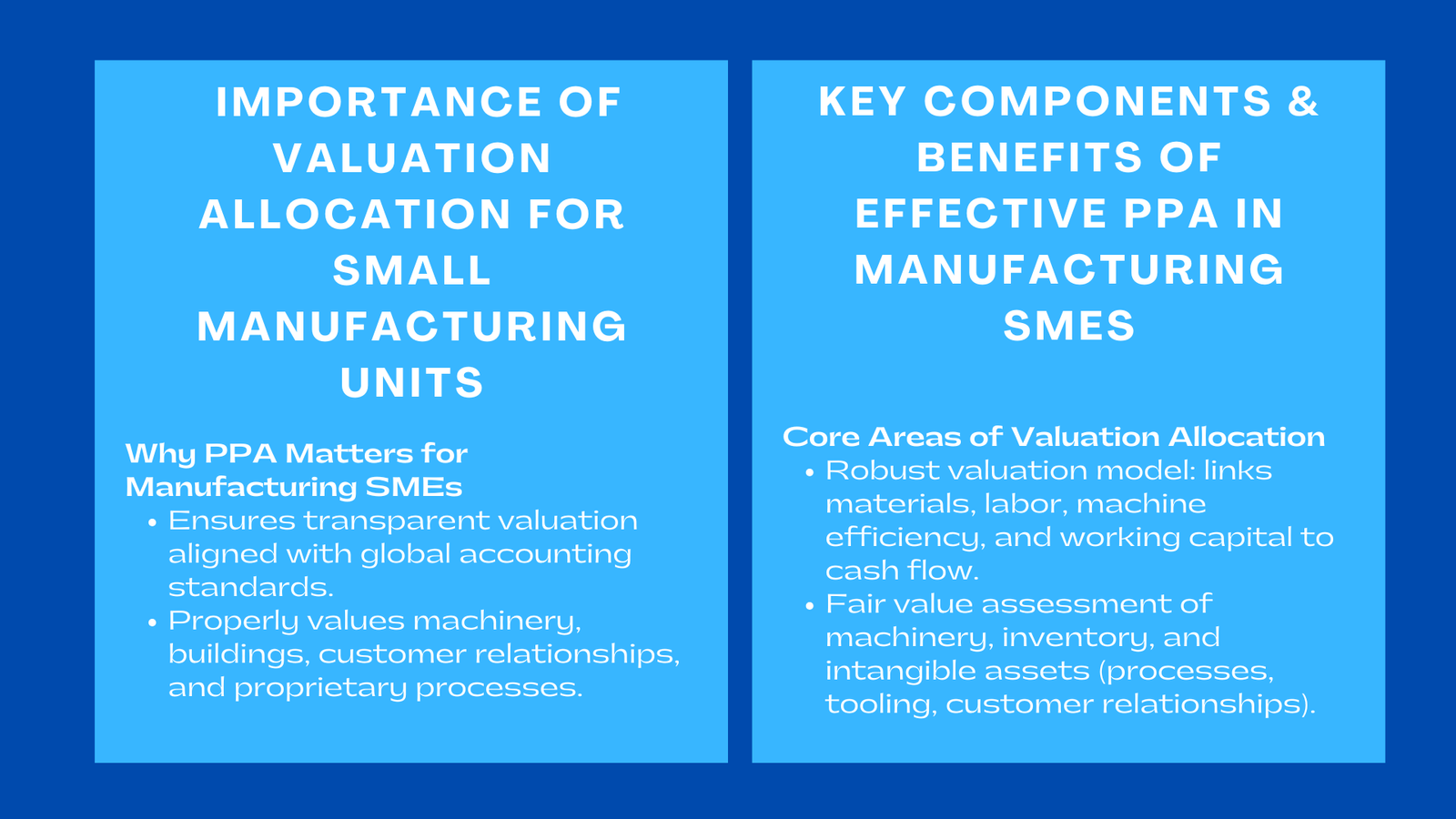

Small and medium manufacturing enterprises operate in ever-more transparency-expectation and investor-scrutable business environments, bound by global accounting standards. As these businesses conduct acquisitions, restructurings, capital raising or strategic restructuring and transformation, having an effective approach to valuation and purchase price allocation becomes crucial. Business Valuation Allocation (normally known as Purchase Price Allocation (PPA)), can ensure that each and every part of the business, right from the machinery and factory building, to customer relationships and proprietary processes have been properly valued and reported. Many SMEs now rely on professional business valuation Singapore specialists to ensure that these valuations meet global standards and withstand investor and audit scrutiny.

For manufacturing SMEs, this process is far from a requirement that must be checked off. It is an exercise to improve the strategic clarity, with operational planning and having financial performance matched with real economic drivers of the business. When done correctly, PPA integrates seamlessly with production unit reporting within the IFRS framework and makes the depreciation schedules, modernize inventory valuation, intangible recognition, and the management of long-term assets consistent. This article takes an analytical and pedagogical approach to unraveling the theme and uses the same framework that is generally available in advanced financial modeling programs but modified and adapted to the realities of small manufacturing units.

The Relevance of Business Valuation Allocation for Small Manufacturing Units

Closing the Gap Between Valuation and Real Business Strategy

In manufacturing, valuing is inseparable from the physical approach of production capability and efficiency of the operational function. Purchase price allocation also encourages owners and analysts of assets to appreciate what the true sources of economic value are in the production cycle. Rather than just looking at book values, or historical costs, PPA reveals which parts of the business are producing sustainable cash flows, and which parts of the business need to be improved.

For example, a manufacturing unit may display good revenue growth but by using PPA may find PPA indicates that a significant portion of its value is not from machinery or buildings but from the current long-standing customer base. Alternatively, some SMEs find their production processes will contain some proprietary efficiencies or special tooling that should be considered intangible assets. These insights facilitate the inclusion of valuation priorities in line with strategic directions like expanded capacity, cost reduction, market positioning, etc.

PPA also addresses the lack of alignment between the financial expectations and operational behavior. Once amortization of intangible assets begins, once fair value depreciation alters profit margins, owners are more aware of equipment maintenance issues, production yield, and pricing discipline. Thus, valuation is made a living part of strategy instead of an abstract financial number.

Increasing Transaction and Reporting Complexity

Even though Manufacturing units are run by the family or even locally operated, the complexity of their transactions has increased tremendously. Whether a SME is involved in selling a stake to private investors, consolidating smaller workshops into one larger entity or a transfer of ownership within a family, the financial reporting requirements are increasingly in line with the global IFRS standards.

Under IFRS production unit reporting, companies must classify assets cautiously and try to ascertain the useful lives based on economic reality rather than tax rules, and play value at the time of acquisition. The purchase price then must be divided up among identifiable assets and liabilities such as plant and machinery, inventory, leases, and intangible assets. Any difference which cannot be assigned is goodwill which will have to be tested later on for impairment.

This level of detail means accuracy but adds to the difficulty in bookkeeping for the SME owners who are used to simpler bookkeeping. As a result, PPA has become an important bridge between how transactions are valued and regulating them and will require more knowledge of how operational factors influence the results of transactions.

Basic Areas of Valuation Allocation for Manufacturing SMEs

Designing and Structuring the Valuation Model

A well constructed valuation model for a manufacturing SME starts with an integrated understanding of the workings of the production system. The supply model needs to consider the circles of raw materials, people/labor, overhead, machine efficiency, and working capital. Every assumption, be it regarding production volume, scrap rates, cost drivers need to make an immediate connection to the cash flow prediction and the ultimate valuation.

For PPA purposes this model is the skeleton of the allocation exercise. It ensures that fair value of machinery, land, equipment, and intangible assets are based on the measurable business performance. An adequately structured model is suitable also for auditability. Regulators and auditors expect to see consistent logic across the projected financials, the depreciations and to meet the post-acquisition reporting requirements. By this it reinforces the importance of creating a model, which is internally consistent, transparent, and in accordance with the principles of the IFRS.

Transaction Modeling and Valuation

Valuation in a manufacturing setting is based largely on the insight of the relation of production capacity, cost structure, and market demand over the long term. Analysts have often been starting with a discounted cash flow model which captures the expected economic benefits expectable from the manufacturing unit over time. The DCF approach is of particular usefulness because it takes into account some operational realities such as maintenance capex, production downtime, and technological obsolescence.

Comparable company analysis is also involved, particularly in industries where benchmarks in the industry exist. For asset-heavy SMEs however, the valuation often requires a specialist asset based valuation. Machinery has to be assessed based on its condition, useful life, contribution to productivity and replacement cost. Inventory may necessitate the fair value adjustment if there are unique converting costs during the manufacturing process.

Intangible Assets, which are not as visible as assets, are also equally as important. Many SMEs use long-term customer relationships, special production processes, proprietary moulding or tooling and trade names. These intangible assets need to be recognized in PPA as they are behind future profitability. The fair value of them have to be estimated with income based methods considering the expected customer retention, technology benefits, and cost efficiencies.

Sensitivity and Scenario Testing

Manufacturing environments are dynamic in nature. Prices of raw materials change, labor markets shift, machinery breaks down and economic cycles affect demand. Due to this, in valuation allocation, there is strong demand for sensitivity and scenario analysis.

By making changes to key variables like production amounts, cost of inputs or discount rates, analysts can observe how asset values will react to changes in operational assumptions. A high level of dependency on one customer may reduce the value of customer-related intangible under a pessimistic situation. On the other hand, good operational resilience may be a good enough justification for increased fair values even in volatile markets. These tests enable stakeholders to understand the robustness of the valuation and make adequate preparation for acquiring realistic post-acquisition plans.

Combining Accounting, Finance, and Manufacturing Strategy

At the core of PPA is the marriage between the financial science and the business of doing things. Depreciation recalculations caused by fair value modifications directly have an effect on the margins of profit. Changes in intangible asset amortization alter the reported earnings. Fair value measurement of the inventory has an impact on the cost of goods sold.

When properly aligned with reporting of IFRS production unit accounting, the allocation ensures that financial statements are not a reflection of legacy accounting habits and a lack of economic substance. SMEs have an important benefit of improved visibility in their asset base and investors have the confidence that what is reported accurately reflects the business performance underpinning it. This integration enhances strategic as well as financial governance.

Implementation in SME Manufacturing Environments

Investment Transactions and M&A Integration

In acquisitions which are more manufacturing focused in nature, correct valuation allocation is key in order to build credibility during negotiations. Buyers use PPA to support the price they are competing for the machine, technology, and customer relationships. Sellers benefit because they know that their production assets contain economic value beyond historical cost.

Once a transaction is closed, the PPA framework is then the foundation for post-acquisition accounting. Depreciation schedules alter, amortization commences and good will activity has to be monitored for impairment. These adjustments typically change the nature of EBITDA, tax planning and future investments. By integrating PPA at the beginning of the transaction, SMEs minimize the trade-off between integration and long-term performance reporting.

Portfolio Monitoring for Investors

In acquisitions which are more manufacturing focused in nature, correct valuation allocation is key in order to build credibility during negotiations. Buyers use PPA to support the price they are competing for the machine, technology, and customer relationships. Sellers benefit because they know that their production assets contain economic value beyond historical cost.

Once a transaction is closed, the PPA framework is then the foundation for post-acquisition accounting. Depreciation schedules alter, amortization commences and good will activity has to be monitored for impairment. These adjustments typically change the nature of EBITDA, tax planning and future investments. By integrating PPA at the beginning of the transaction, SMEs minimize the trade-off between integration and long-term performance reporting.

Valuing Production Intangibles Under Uncertainty

Manufacturing companies tend to overlook the significance of intangibles that have no physical form such as proprietary know-how, tooling designs or specialized production workflows. During PPA, these assets will have to be spruced up and valued even though in-house documentation is minimal. Analysts therefore use a mixture of interviews, process observations and past trends in performance to tease out how these intangible drivers help to generate earnings.

In an uncertain environment, one where demand may vary or where the change of technologies may be rapid, valuation is still more so. Income based methodologies take into consideration the factors of probability-weighted forecasts, considering different levels of technological adoption, or customer retention. making sure that the intangible recognition is grounded in realistic expectations.

Improving Strategic and Analytical Thinking

Forming a Decision-Making Mindset

A strict PPA process helps the owners of SMEs to be more analytical. Rather than making decisions based on intuition or habit, they start determining production capacity, replacement cycles, and customer concentration risks on the basis of economic value. This change improves the quality of decisions and also keeps strategic planning consistent with the long-term health of the business.

Owners with knowledge of how valuation drivers work may be better able to deal and negotiate with investors, or to redesign pricing schemes, for instance, or operate in ways that increase future fair values.

Enhancing Communication and Presentation

One of the advantages of structured PPA is that it makes complex financial ideas easy to tell simple and convincing stories with them. Whether it’s a bank, investor, auditor or internal stakeholder, the results of the PPA will form a framework for explaining how the business generates value and why certain assets are more important than others.

This enhances trust and transparency, two buttons that are essential for funding and financing SMEs that are looking for partnering or financing. IFRS-aligned reporting provides further credibility to the business that it operates with discipline as well as professional rigour.

Integrating Technology and Automation

Leveraging Excel and Digital Tools

Although there are still a considerable number of SMEs that use Excel for valuations of companies and models, there are now digital tools available that can be used to improve the accuracy and efficiency greatly. Integration with production data systems, ERP systems or inventory management ensures that fair value assumptions are based on real-time operational data. Automated depreciation modeling and scenario dashboards are a given that make it easier to update valuations with the ever changing market conditions.

Connecting with Data Analytics

Advanced analytics can enable SMEs to visualize trends in production, the efficiency of operations of key drivers like machines, and bottlenecks that can have an impact on asset values. When linked to the valuation model, such analytics are helpful to refine the forecasts and ensure these fair value measurements are based on empirical evidence. This type of integration supports ongoing evaluation, thus making PPA a live tool, and not a one-time exercise.

Advantages of Strong Valuation Allocation for SMEs

Professional and Strategic Value

A well done PPA creates internal discipline by clarifying the importance of assets, strengthening financial reporting and decision-making between departments. It raises the level of professionalism of the SME, which becomes more competitive in its market where investors and partners will expect to be transparent to global standards.

Agility in Volatile Manufacturing Markets

By knowing how valuation drivers respond to changes in operations, SMEs can adapt swiftly to changes in raw material prices, labor or industry cycles. This agility enables the owner to plan more effectively in terms of capex, negotiate with suppliers with greater confidence and ensures value resilience in difficult situations.

Institutional Benefits

For business groups responsible for several factories, PPA and IFRS financial reporting provide a uniform way to establish a basis for internal comparison and corporate governance. This creates a culture of rigorous analysis and it prepares the organization for the bigger transaction in the future.

Conclusion to Business Valuation Allocation for Small Manufacturing Units

Business Valuation Allocation solves a transformative piece in the economics of communication and understanding of small manufacturing units. It establishes an organised link between the production reality in the company and the financial accounting, all so that all the elements of the business are measured in a fair and transparent manner.

As SMEs follow practices that are in line with SME manufacturing purchase price allocation and IFRS production unit reporting, they have the benefit of obtaining strategic clarity and increasing their relationships with stakeholders, positioning themselves for sustainable growth. Valuation allocation is no longer a requirement, however, but a powerful strategic tool for making it through an increasingly competitive and regulated manufacturing landscape.