Case Study Valuation and Allocation in a Renewable Energy Project Acquisition

Case Study: Valuation and Allocation in a Renewable Energy Project Acquisition

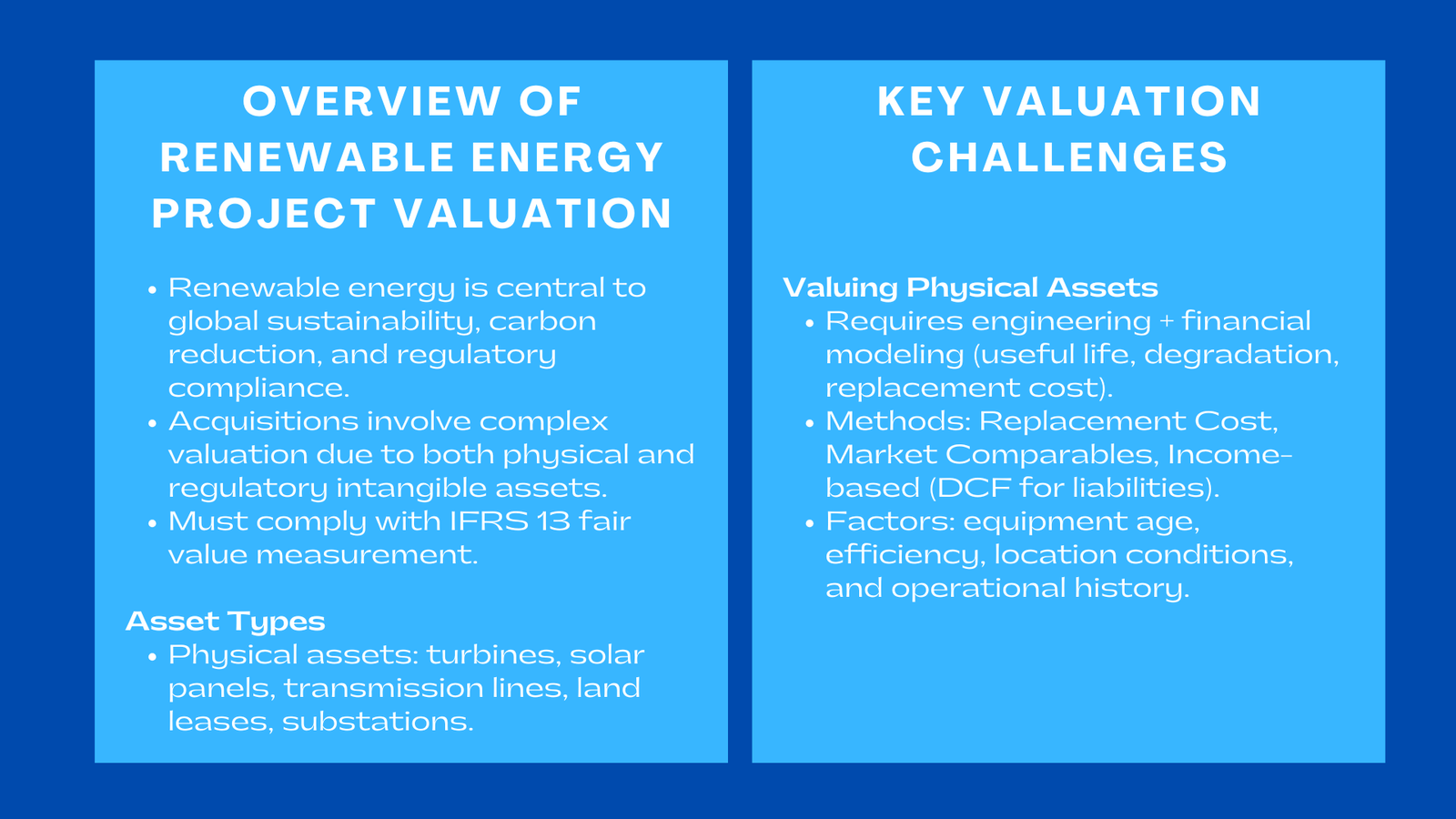

The renewable energy sector has emerged as a critical component of sustainable economic development, driven by global initiatives to reduce carbon emissions, promote clean energy, and comply with evolving environmental regulations. Acquiring renewable energy projects involves complex valuation considerations because these projects comprise both physical and regulatory intangible assets. Physical assets such as turbines, solar panels, land leases, and transmission systems coexist with intangible elements like power purchase agreements (PPAs), environmental permits, and government incentives. Properly accounting for both types of assets is essential to determine the fair economic value of the project and ensure compliance with accounting standards such as IFRS 13 for fair value measurement.

This case study focuses on purchase price allocation for renewable energy project acquisition , highlighting the challenges in valuing physical assets, contracts, and regulatory approvals, as well as the strategic implications for investors, operators, and regulators. Understanding the interplay between tangible and intangible assets is critical for maximizing value, managing risk, and ensuring sustainable performance in the renewable energy sector.

Valuation of Physical Assets

Importance of Physical Asset Valuation

Valuing physical assets in renewable energy projects is a complex task that requires the integration of engineering knowledge and financial modeling expertise. These assets include solar arrays, wind turbines, substations, transmission lines, and supporting infrastructure such as control systems and energy storage units. The valuation process must consider replacement cost, useful life, operational efficiency, and expected performance degradation. Accurate valuation ensures that the purchase price reflects both the current market value and the expected future utility of the asset, which is also essential when understanding how to do tangible and intangible asset valuation Singapore in broader project assessment.

Replacement Cost Method

The replacement cost method calculates the expense required to rebuild or replace an asset with similar specifications, adjusted for inflation and technological advancements. This method ensures that the valuation accounts for current market conditions and anticipated future expenditures. For example, a wind turbine installed ten years ago may have been valued at USD 3 million, but replacing it with modern technology today may cost USD 4.5 million due to efficiency improvements, material costs, and labor. This difference is crucial in reflecting true economic value.

Useful Life and Performance Considerations

The useful life of equipment is a major factor in determining depreciation schedules and long-term financial projections. Wind turbines typically have a lifespan of 20–25 years, while solar panels can last 25–30 years depending on environmental conditions and maintenance. Performance degradation over time, such as decreased energy output due to wear and tear or environmental impacts, must be factored into the valuation. Failing to account for performance decline can result in an overestimation of the project’s financial viability and future cash flows.

Market Comparables and Benchmarking

In addition to replacement cost analysis, valuers often use market comparables to assess fair value. By comparing similar renewable energy assets in similar locations or jurisdictions, evaluators can establish realistic valuation ranges. This approach is particularly useful when assets are unique or emerging technologies are involved, providing a benchmark to support financial assumptions and reporting.

Liabilities and Income-Based Valuation

Liabilities associated with physical assets, including operational obligations or debt financing, are typically assessed using income-based approaches, such as discounted cash flow (DCF) modeling. DCF models consider expected future revenues, operational expenses, and associated risks, helping prevent overstatement of goodwill during acquisitions. By integrating both cost-based and income-based approaches, companies can achieve a more accurate assessment of net asset value and strategic investment potential.

Valuation of Intangible Assets

Key Intangible Assets in Renewable Energy

Intangible assets often constitute a substantial portion of the total project value in renewable energy acquisitions. These include PPAs, regulatory permits, licenses, proprietary technologies, and environmental credits. Unlike physical assets, intangible assets are primarily valued based on their capacity to generate predictable cash flows or provide strategic advantages, such as access to government incentives or favorable regulatory treatment.

Power Purchase Agreements (PPAs)

PPAs are contractual agreements guaranteeing the purchase of electricity generated by a renewable energy facility. They are a vital source of long-term, stable revenue, significantly influencing the project’s valuation. Income-based valuation methods, especially DCF modeling, are commonly used to quantify the present value of future cash flows under PPAs. Factors such as contract duration, counterparty creditworthiness, and pricing structures directly affect the projected revenue stream and, consequently, the overall project value.

Regulatory Permits and Incentives

Environmental permits and government incentives, including feed-in tariffs or tax credits, are intangible assets that mitigate regulatory and operational risks. Proper valuation must consider the likelihood of permit renewal, compliance costs, and potential legislative changes. These intangible elements not only impact financial performance but also influence the strategic positioning of the project within regional energy markets.

Documentation and Auditability

All assumptions underlying the valuation of intangible assets must be well-documented and auditable. Transparency ensures that stakeholders, including investors and regulators, can verify projections and the rationales behind revenue assumptions, risk adjustments, and discount rates. Proper documentation also strengthens compliance with IFRS and other financial reporting standards, which is critical in highly regulated sectors such as renewable energy.

Asset Assessment in Renewable Energy

Evaluating Physical Infrastructure

Physical infrastructure valuation requires careful consideration of technological efficiency, operational history, and environmental conditions. For instance, a wind farm equipped with next-generation turbines may achieve higher energy output and lower operational costs compared to older installations, which must be factored into replacement cost and DCF models. Additionally, location-specific factors, such as wind speeds, solar irradiance, and grid access, significantly influence the expected performance and value of physical assets.

Assessing Intangible Assets

Intangible assets, including PPAs, licenses, and proprietary technologies, are assessed primarily through income-based methods. DCF modeling projects expected cash flows and incorporates risk factors such as regulatory uncertainty, market demand fluctuations, and technological obsolescence. Accurate valuation of intangible assets ensures that the purchase price allocation reflects the true economic contribution of these assets to the overall project.

Operational and Market Considerations

Valuers must also consider operational performance, maintenance records, and market dynamics. For example, a solar farm in a region with increasing electricity demand and government subsidies may have higher projected cash flows, increasing its valuation. Conversely, areas with declining incentives or market oversupply may reduce the value of both tangible and intangible assets. These considerations are vital for realistic and robust financial projections.

Goodwill and Strategic Value

Understanding Goodwill in Renewable Energy

Goodwill represents the premium paid over the fair value of net assets and reflects anticipated synergies, strategic advantages, and future growth potential. In renewable energy, goodwill often accounts for expected operational efficiencies, regulatory benefits, and expansion possibilities.

Role of PPAs in Strategic Value

PPAs enhance strategic value by providing revenue certainty, supporting regulatory compliance, and facilitating operational integration. The acquirer’s confidence in the target company’s project portfolio, technology, and operational capabilities is embedded in the goodwill component of the acquisition.

Government Incentives and Market Position

Goodwill also reflects the value of government incentives, long-term contracts, and established relationships with regulators and stakeholders. In a sector characterized by evolving technology and policy landscapes, the careful management of goodwill is critical for maintaining financial performance and realizing strategic benefits over time.

Managing Goodwill Effectively

Continuous Operational Analysis

Effective management of goodwill requires ongoing evaluation of operational efficiency, regulatory developments, and market demand. By continuously monitoring energy production, compliance metrics, and market conditions, companies can ensure that anticipated synergies—such as shared facilities or optimized energy production—are realized, thereby protecting both financial and strategic value.

Compliance and Transparency

Proper PPA enhances financial reporting transparency, ensuring that asset values, liabilities, and goodwill are accurately represented in financial statements. This not only supports investor confidence but also ensures adherence to accounting standards such as IFRS 13, particularly in regulated energy markets.

Performance Tracking Against Projections

Monitoring actual performance against initial projections is critical. This involves assessing energy output, operational efficiency, compliance adherence, and market conditions. Effective tracking allows companies to identify underperforming assets and take corrective actions, ensuring long-term financial performance aligns with acquisition assumptions.

Strategic Implications of Purchase Price Allocation

Informing Management Decisions

A well-executed PPA provides a framework for strategic decision-making, guiding management on asset maintenance, reinvestment priorities, and portfolio diversification. By identifying high-value assets and contracts, organizations can allocate resources efficiently to maximize returns.

Optimization of Capital and Operations

The PPA framework informs operational improvements, such as upgrading turbines, replacing underperforming solar panels, or renegotiating PPAs. This ensures that assets are utilized optimally, costs are controlled, and revenue potential is maximized.

Benchmarking and Performance Evaluation

PPA also facilitates benchmarking against other renewable energy companies operating across multiple jurisdictions. Investors and regulators can evaluate comparative performance more effectively, assess risk exposure, and gauge operational efficiency relative to market peers.

Supporting Long-Term Sustainability

Beyond financial transparency, proper PPA supports sustainable growth by identifying assets that provide long-term environmental and economic benefits. Strategic allocation ensures that resources are focused on projects that deliver both profitability and positive environmental impact, enhancing the overall reputation and competitiveness of the acquiring company.

Conclusion to Case Study Valuation and Allocation in a Renewable Energy Project Acquisition

Renewable energy project acquisitions require a combination of engineering expertise, financial modeling skills, and regulatory knowledge. Accurate valuation of both physical and intangible assets is essential for determining fair value, ensuring compliance, and providing transparency to stakeholders.

PPAs are central to purchase price allocation, offering insights into revenue streams, operational priorities, and regulatory compliance. Effective valuation of power purchase agreements and intangible assets in renewable energy improves investor confidence, supports strategic decision-making, and ensures long-term financial performance.

Managing goodwill appropriately is critical for realizing anticipated synergies, maintaining stakeholder trust, and optimizing financial returns. Continuous monitoring of operational performance, market conditions, and regulatory developments ensures that acquisitions deliver both strategic and financial benefits.

Ultimately, a robust approach to valuation and allocation in renewable energy projects ensures transparent reporting, efficient capital deployment, and sustainable growth. Properly executed, these strategies strengthen financial performance, support broader adoption of clean energy technologies, and contribute to long-term value creation for all stakeholders.