Certified Earn-Out Valuation Training Singapore

Earn-Out Clauses in M&A: Impact on Purchase Price and Financial Reporting

Introduction: Certified Earn-Out Valuation Training Singapore

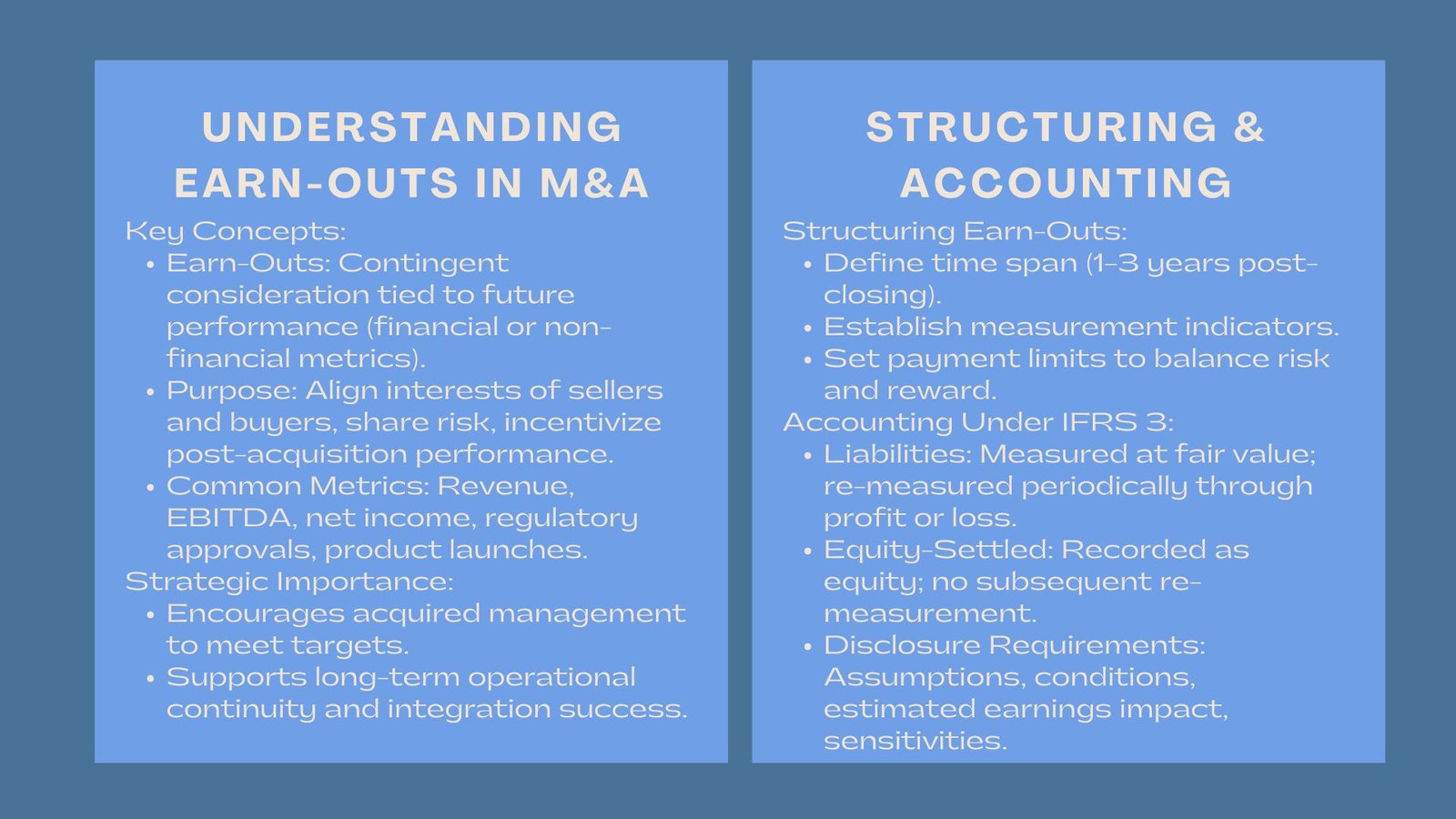

The ear-outs are some of the most popular contingent consideration mechanisms used during the M&A transactions. Part of the purchase price is tied to future performance as the goals of the managers are shared by earn-outs, as do the risks, incentive, and the management goals. However they also introduce some complexities in the financial reporting that requires the close valuation, overseeing as well as disclosure.

Fair interpretation of earn-out is also essential to CFOs, both accountants and deal advisors who must find a balance between fair value reporting on the one hand and integration strategies on the other hand. In addition to accounting and reporting, earn-outs are also significant in post-acquisition management since it influences the actions of operations and makes sure that the performance targets are accomplished besides the sustainability of the acquisition behavior among the acquired management teams and their strategic interests to the company acquiring them. An appropriate organization, realistic measurement, and careful preparation of earn-outs is, therefore, not only essential whilst ensuring compliance with the regulations, but also, achievement of desired financial and strategic outcomes of the acquisition.

Structuring Earn-Outs

Earn-outs can be pegged on financial metrics such as revenue, EBITDA or net income or non-financial aspects of performance such as regulatory approval or product launches. There is a need to make sure that clear, measurable and enforceable conditions are developed so as not to create wrangles upon closing.

The following methodology would allow calculating them:

- Setting a time performance span (1 3 years after closing)

- Setting up measurement indicators.

- Establishing payment limits that can be given or charged.

This way, the buyers will be guaranteed that the earn-out clauses accounting and reporting under IFRS 3 process will align with the business objectives, and the sellers will have a motive to grow the operations that will take place after the acquisitions.

The effectiveness of an earn-out depends on having clear, measurable, and enforceable conditions to avoid disputes after closing. Ambiguity in targets, timeframes, or calculation methods often leads to conflict between buyers and sellers. This methodology ensures that the earn-out mechanism is both strategically aligned and fairly compensatory, balancing risk and reward for both parties.

Accounting and Reporting Considerations

Under IFRS 3:

- When the acquisitions are done, structuring contingent earn-outs in mergers and acquisitions obligations are in the form of being fair value during the acquisition date.

- Re-measurement of the liabilities is on a per-period basis in regard to fluctuations in the profit or loss.

- Equity-settled earn-out will be entered into the equity, and will not be altered upon takeover.

- The disclosures of the assumptions, conditions of performance and estimated earning impact should be done in the financial statements. Analysts and investors have very high follow-ups on these metrics as they define the perceived value and the success of the acquisition integration.

- Companies must disclose assumptions, performance conditions, and potential financial impact in the financial statements.

- Transparency is crucial for analysts, investors, and regulators who closely monitor the earn-out metrics, as they often indicate the perceived value and success of the acquisition.

Disclosures should include:

- The basis of measurement for contingent payments

- The expected range of payouts

- Key sensitivities or uncertainties affecting the estimates

Conclusion

The ear-out clauses constitute effective ways of matching the interests together with the control of risks of acquisition and it has to be reported and accounted for. The properly structured and well reported earn-outs will ensure that the acquirer and the seller both enjoy the post-merger outcomes with the IFRS being used. They enhance investor confidence and provide some transparency to the financial performance and strategic performance of the transaction besides complying.

Moreover, earn-outs allow the long term association involving acquisition and acquiring parties. The earn-outs will enable it to maintain the momentum operations and reaffirm behavioral habits of the management with respect to goal orientation and thus enhance the success of the acquisition by providing quantifiable incentives and harmonizing the performance targets. Companies that integrate earn-out structures into their M&A planning are able to balance risk, incentivize performance, and improve long-term integration success, making the earn-out a strategic as well as financial tool.