Certified IFRS 3 and IFRS 9 Valuation Course

Reassessment of Contingent Consideration: IFRS 3 and IFRS 9 Treatment

Learn Certified IFRS 3 and IFRS 9 Valuation Course

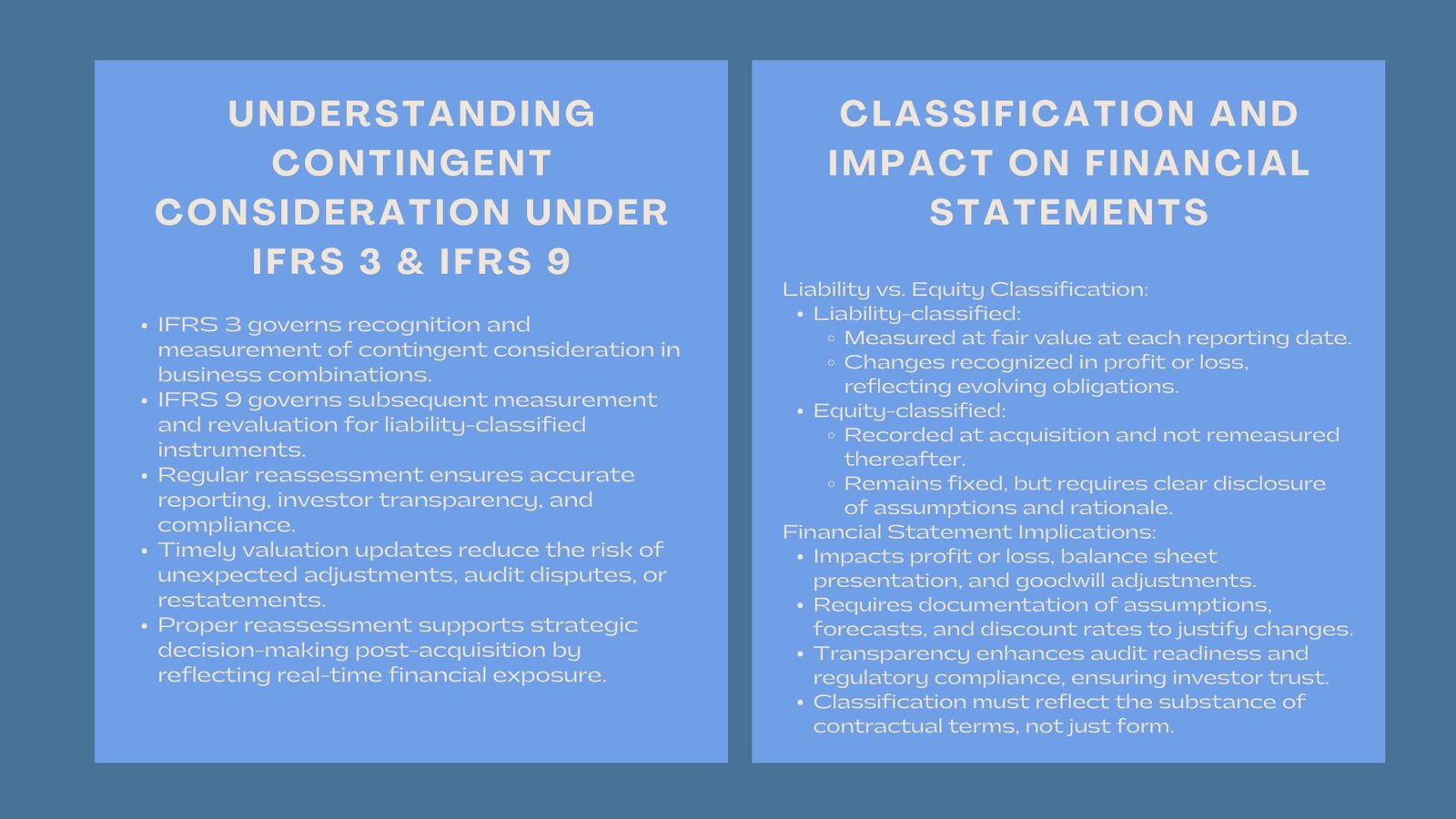

The aspect of contingent consideration frequently develops after an acquisition since the performance criteria are achieved or market conditions vary. The rules to follow in assessing are extensive in IFRS 3 and IFRS 9 depending upon liability-classification or equity-classification of the obligation. These standards are crucial in ensuring that financial reports are properly made and that they comply with the standards.

Besides compliance, renewed evaluation of contingent consideration enables firms to take steps in advance to the dynamism of the different situations like projects in increase and decrease of revenue, EBITDA performance or market conditions that affect the reassessment of contingent consideration under IFRS 3 and IFRS 9 anticipated payments. Decent and timely valuation maintenance and reporting of the value will ensure the financial statements are up to date in terms of any obligation and transparency to the investors as well as aiding in effective post-acquisition decision-making and reducing the risk of unanticipated adjustment of accounting or disagreements between the buyer and the sellers.

The Role of IFRS 3 in Business Combinations

The IFRS 3 an accounting standard that deals with accounting in cases where one entity gains control over the other. The standard provides that the recording of acquisitions is in a manner that reflects the actual economic substance of the transaction and the transparency, as well as comparability among the financial statements.

In IFRS 3, acquisition method should apply to all business combination. This includes recognizing the acquirer, date of acquiring, identifiable assets and liabilities acquired, and any non-controlling interests (NCI) in the acquisition and recognizing and measuring goodwill or gain of a bargain purchase.

Contingent consideration is one of the important points discussed by IFRS 3, or more precisely, some extra payments that are determined by future events, e.g., the achievement of certain performance level or the release of certain revenue milestones. Contingent consideration should be calculated at fair value at the date of acquisition even when the payment is contingent or uncertain or depends upon the outcome in future. This makes sure that any possible obligations are duly put in the financial statements at the beginning.

The IFRS 3 also differentiates a contingent consideration to be treated either as equity or liability. In case the arrangement is to be renewed in absolute number of shares of the acquirer, then it is treated as equity and not remeasured in the future. But in case of cash or variable amount, then it is treated as a liability and then re-measured at fair value and, any changes are recorded in the profit or loss- in line with the eighth IFRS 9.

Essentially, the IFRS 3 offers a systematic and principle-driven method of recognising the financial implications of mergers and acquisitions. It improves faithful depiction of business combinations by stating that all the assets, liabilities as well as contingent arrangements are transparently presented at fair value.

How IFRS 9 Governs Financial Instrument Classification and Measurement

IFRS 9 -Financial Instruments defines detailed principles in the classification, measurement and recognition of financial assets and liabilities. It aims at having financial instruments reported in a form that captures the business model of the entity and the contractual cash flows nature of the instrument.

Financial instruments are categorized under the IFRS 9 in three broad categories of measurements:

- Amortized Cost – of instruments that gather contractual cash flows which are comprised of principal and interest only.

- Fair Value through Other Comprehensive Income (FVOCI) – of instruments where they are owned to gather cash flows as well as to sell assets.

- Fair Value through Profit or Loss (FVTPL) – of instruments that fail to meet the above conditions or traded instruments.

In the case of contingent consideration that is considered as a liability in a business combination, IFRS 9 would require it to be measured subsequently at fair value through profit or loss (FVTPL). It is stated that, any modifications in fair value of the contingent liability, post acquisition date, which may arise out of alteration in assumptions, performance results or discount rates must be reflected instantaneously, in the income statement.

This condition is one manifestation of the principle of IFRS 9 that financial instruments are to reflect a real picture of economic reality in real-time. The standard helps to avoid the distortion of profit or loss by outdated valuation since the standard requires fair value remeasurement.

Increased disclosure and impairment requirements in IFRS 9 also improve the transparency of investors in risk assessment and financial condition. In combination with the IFRS 3, it ensures that contingent considerations and other financial instruments are recorded, measured, and reported in the same fashion – giving a comprehensive and accurate view of the financial standing of an entity.

Liability vs Equity Classification

- Contingent consideration of the type known as liability: Valued at fair value, at every reporting date. There are profit or loss changes identified.

- Contingent consideration which is of equity nature: Remains fixed in equity no remeasurement is allowed after acquisition.

Reassessment needs to be judged carefully and supported by evidence such as new predictions, new assumptions on probabilities and the change in the discount rates. Conversely, contingent consideration classified as equity is recorded at acquisition at a fixed amount. No remeasurement is allowed, so changes in performance or market conditions do not affect its carrying amount. Reassessments of assumptions, such as new probability estimates, forecasts, or discount rates, must be carefully evaluated and supported by thorough documentation to maintain compliance and transparency. From a governance perspective, liability classification provides a clearer picture of the company’s potential cash flow obligations, ensuring that investors and other stakeholders can assess the ongoing financial exposure associated with the acquisition.

Impact on Financial Statements

Reassessment affects:

- Gains or losses on consideration of type of liability.

- The presentation and disclosure in the balance sheet.

Goodwill computation in the event of adjustments during the period at which the measurement is done. Liability-classified consideration impacts profit or loss through changes in fair value, influences the presentation of the balance sheet, and may affect accounting treatment for liability and equity classified contingent consideration goodwill calculations if adjustments occur after the measurement period.

Regulators, auditors, and investors can have clarity because proper documentations of assumptions, methodologies and rationales are given. Equity-classified consideration remains stable on the balance sheet but still requires detailed disclosure of assumptions, methodologies, and rationales to ensure auditors, regulators, and investors can understand the accounting treatment.

Clear and accurate reporting of contingent consideration improves financial transparency, reduces the risk of misstatements, and provides confidence that post-acquisition obligations are properly accounted for under IFRS standards. Therefore, it is crucial for companies to thoroughly analyze contractual terms and consider the substance of the arrangement before determining classification. Clear documentation supporting the decision is essential, especially during audit and regulatory reviews, to ensure compliance with IFRS principles and to avoid future restatements or misinterpretations.

Conclusion

Refrasurement of provisions of contingent consideration as per IFRS 3 and 9 IFRS allows presentation of current information about the pending obligations to purchase. The provision of the correct and clear cut accounting lowers the chances of misstatements, keeps the investors at ease and ensures that post acquisition reporting is done as per the requirements of the contract and also as per the regulations. Firms which cope with reassessment with stringent measures are well prepared to audit and the planning of strategy. Proper classification, diligent monitoring, and transparent documentation reduce compliance risks and enhance investor confidence.

Continuous revaluation allows management to act proactively in response to emerging performance or market trends. This supports future deal structuring, integration planning, and risk management, enabling companies to pursue robust and value-driven M&A strategies. Organizations that implement rigorous reassessment processes strengthen their financial reporting integrity while maximizing strategic outcomes from acquisitions.

Moreover, continuous monitoring and revaluation also enable the management to take preventive action based on the emerging performance or market. This would help protect compliance not to mention educate the future deal structuring, risk assessment, and integration planning, which will contribute to more robust and value-oriented M&A strategies.