Certified PPA Course for Fitness Studios

Purchase Price Distribution in Fitness Studio Acquisitions

Introduction to Certified PPA Course for Fitness Studios

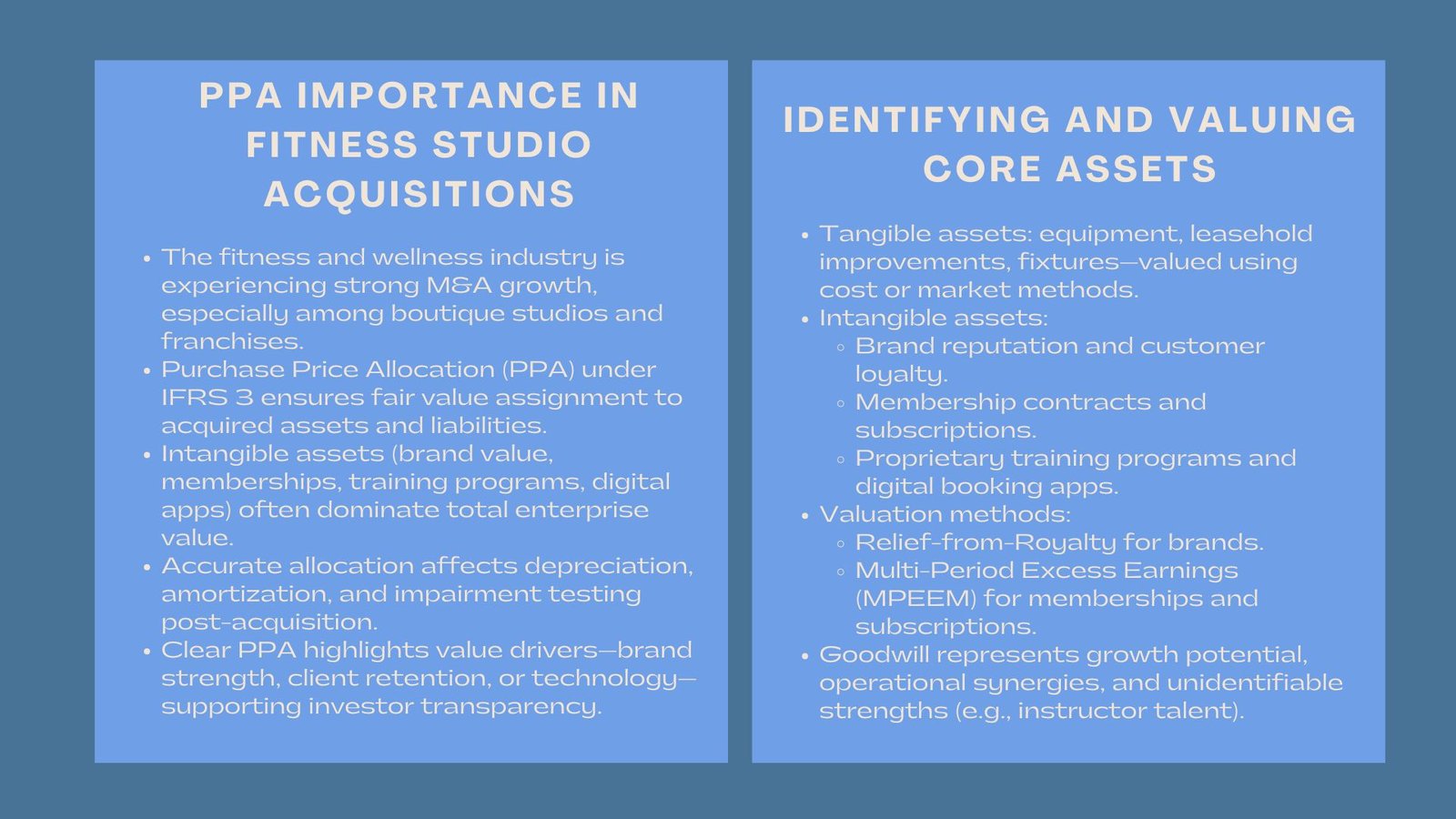

The health and wellness industry has developed rapidly in the last couple of years due to the rise in customer demand of fitness, lifestyle, and personalized wellness programs. That boom has caused the fitness industry to become increasingly active in terms of merger and acquisition (M&A) activity, especially between boutique studios and gym franchises. In the cases of these kinds of transactions, it is important to find the way of fairly assigning the price of acquisition to ensure both transparency in the financial statements and compliance with the regulations.

Purchase Price Allocation (PPA) according to the International Financial Reporting Standards (IFRS 3) is a process of recognizing and determining fair values of the tangible and intangible assets acquired and liabilities incurred in a business combination. In the case of fitness studios, where intangible assets such as brand reputation, membership base and lease arrangements can be much of the enterprise value, being careful about allocation of purchase price will be necessary to reflect economics surrounding the transaction.

1. The PPA implications of Fitness Studio Acquisitions.

1.1 The importance of Accurate Allocation.

In the acquisition of a fitness studio a large percentage of the purchase price is usually associated with the intangible assets that cannot be seen on the balance sheet prior to acquisition. They can be member contracts, brand identity, proprietary training programs, bookings and fitness tracking platforms. The fitness studio purchase price allocation ensures that these elements are properly recognized at fair value, separating them from goodwill.

This allocation has an impact on post-acquisition financial reporting, and especially depreciation, amortization and impairment testing. An example of this is that the amortization of customer relationships with specific terms will be done on the basis of their useful life and goodwill will continue to undergo impairment testing on an annual basis. The correct allocation is another factor that assists acquirers in determining the areas in the business that bring the most profitability and sustainability.

1.2 Sector-Specific Complexity

Contrary to the traditional service industries, competition in the fitness studios is high, and the seasonal patterns of memberships and profitability of the locations are uneven. This complicates the issue of valuation because cash flows in the future rely on retention and local market demand among the members. The correct PPA assists investors to identify the type of assets acquired that generates long-term value creation: brand value, digital engagement tools, or instructor teams.

2. Determination of Tangible and Intangible Assets.

2.1 Physical Equipment in Fitness Centres and Studios.

Assets in the fitness studios are normally tangible in the form of gym equipment, leasehold improvements, and fixtures. They are normally appraised on cost or market methods keeping in view of depreciation, functional obsolescence, and maintenance status. An example event is the case of a chain of yoga studios, where old and neglected premises could be at a disadvantage compared to newer studios with updated facilities.

Nevertheless, the physical assets can be a smaller fragment of the enterprise worth. The intangible elements are quite likely to predominate in valuation mix in the case of a boutique fitness and franchise model.

2.2 Intangible Assets: The Drivers of Core Value.

Fitness studios are well identified by intangible assets that represent their real identity and competitive prowess. These may include:

- Brand recognition and loyalty in the wellness market.

- Membership agreements and clients.

- Intensive in house training or fitness programmes.

- Franchise/operating rights.

- Digital booking or mobile applications.

These assets will not be caught in the same category of goodwill under IFRS 3 and recognition of them is on a different basis since they can be identified that is, they can be sold, licensed or enforced through a court of law. Income-based methods that valuation experts utilize include the Relief-from-Royalty Method of valuing the brand or the Multi-Period Excess Earnings Method (MPEEM) of valuing member contracts and subscriptions.

A franchise gym chain, say, can discover that much of its fair value is in the value of its brand and repeat business, and not its physical capital.

3. Goodwill and Its Post-Acquisition Treatment.

3.1 Calculating Goodwill

Once all the identifiable liabilities and assets have been valued, the purchase consideration that remains goodwill. This figure is an expected synergies, operational efficiencies, or unknown factors like workforce built up. In the case of fitness studios, the goodwill would most frequently reflect the potential of growth in the future in the form of new memberships, new branches or greater digital capabilities.

3.2 Goodwill Impairment and Monitoring.

In ISO, goodwill is not amortized, but should be subjected to annual impairment test. Part of the goodwill might have to be written down in case actual performance or growth of members does not match projections. This needs to be closely assessed on a continued basis in terms of performance measures including retention of members, consumer satisfaction, and profitability in the studio.

Such as, in case an acquirer overestimates the growth of a fitness brand in the already saturated market, various impairments testing that follows will indicate that the amount of goodwill recorded surpasses that which can be recovered and therefore the adjustment is necessary.

4. Lease and Location Factors.

4.1 Lease Assets under IFRS 16

Leases are a core part of the activities of the fitness studio because the majority of the enterprises are based on rented premises. Under the IFRS 16, the acquirers are required to recognize the right-of-use (ROU) assets and lease obligations at fair value. It is possible that the valuation results may be greatly affected by the appeal of the lease like its friendly rental conditions or the location of the leases.

The studios whose location is intangible due to their high demand in urban areas can add to the total value of the business. On the contrary, bad lease agreements have a negative impact on net asset value, which implicates goodwill.

4.2 Location-Specific Intangibles The Fair Value.

This is because a good studio is one with good foot traffic and visibility, which would benefit the brand equity indirectly. Location as such cannot be identified as an asset according to the IFRS, but the advantages it offers tend to be reflected in other of the commonly identified intangibles, like increased brand value or relationships with customers.

5. The Issues and Real-Life Matters.

5.1 Data Quality and Forecasting.

Fitness companies are based on the principle of recurrence of revenues and to make correct forecasts, it is necessary to have reliable data regarding churn rates of the members, the average life of the membership and seasonal sales. Any missing or errors in membership data may result in mispricing of intangible assets. Comprehensive data analysis should be invested in by the acquirers in order to have credible projections.

5.2 Systems and Processes Integration.

After acquisition, there is need to integrate accounting, membership management and operational systems to be able to do successful reporting. This makes sure that the future financial outcomes are in line with assumptions to valuation and allocation. Lack of adequate integration may lead to discrepancies in the course of impairment testing or during auditing of the IFRS.

6. The Role of IFRS Compliance

6.1 Ensuring Transparency and Comparability

Compliance with IFRS accounting for gyms provides a consistent framework for recognizing, valuing, and disclosing acquired assets. This increases comparability in transactions and increases stakeholder trust. Adherence to audit checking because of transparent reporting of the methods and presumptions also decreases the danger of conflict with the regulators.

6.2 The views of investors and lenders.

Transparent PPA reporting is heavily valued by investors and lenders to determine the stable business and its potential in future performance. Once there is a gym chain or a studio group that offers clear records of the value of assets and amortization schedule, it shows good governance and financial discipline- a fact that would facilitate easier access to financing and the confidence of investors.

7. Cases Study: Boutique Fitness Chain Acquisition.

Take an example of a purchased fitness brand of a boutique with a price of $8 million. The PPA stated the following:

- Such Tangible assets (equipment, leasehold improvement, fixtures): $2 million.

- Other unrecognizable intangible (brand, member contracts, mobile app): $3 million.

- Liabilities ( lease obligations and deferred revenue): 1 million.

- Resulting goodwill: $4 million

The image of the brand and brand loyalty were significant sources of value in this case. The categorical segregation enabled the management to project the amortization costs precisely as well as to pre-plan the annual impairment of goodwill per the IFRS 36.

8. Strategic Value of PPA Effective Implementation.

Good purchase price allocation does not simply comply but it gives wisdom. It assists those who acquire to know which assets are used in retaining members, maintaining the revenues, and keeping the brand loyal. This knowledge is used to make an investment in marketing, technology and service improvement in a market characterized by differentiation by experience.

To accurately prepare financial reporting, an accurate PPA framework is needed to match accounting treatment with operating realities. It improves the capability of the management to determine performance and strategize on future growth, mergers, or refinancing.

Conclusion

The success of the post acquisition in the fast emerging fitness and wellness market relies on the ability of the acquisition to find the value and quantify it. Fitness studio purchase price allocation should be based on transparency, compliance and strategic clarity by having a detailed purchase price allocation supported by sound IFRS accounting of gyms. In addition to the technical accounting provisions, proper allocation of purchase prices will enable investors and other acquirers to understand the real motivators of business value- assisting fitness brands to become more robust, stronger and more cost effective in a market environment that is becoming highly competitive.