Certified PPA Modeling Error Analysis

Common Errors in PPA Models and How to Avoid Them

Introduction to Certified PPA Modeling Error Analysis

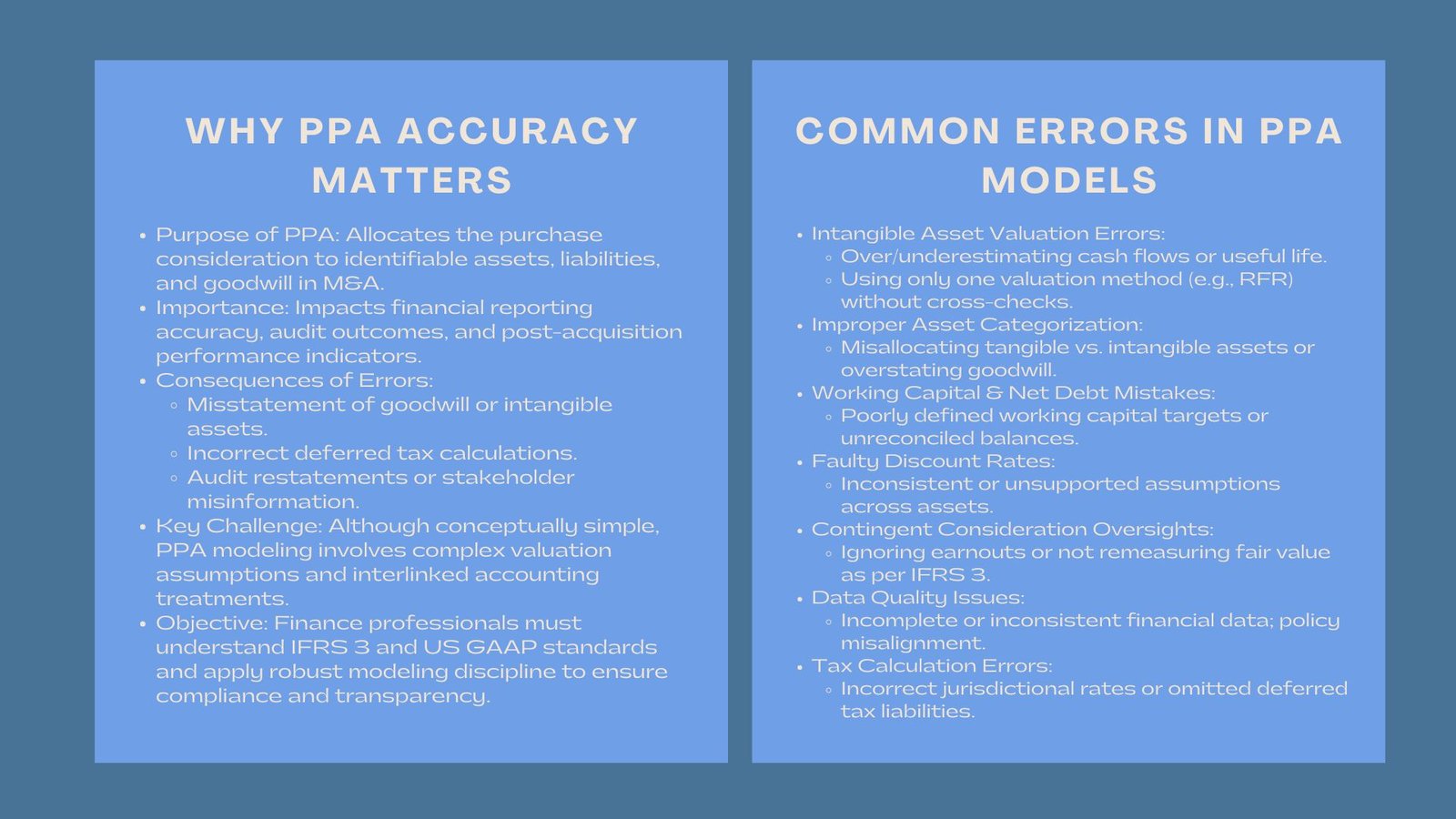

Purchase Price Allocation (PPA) is a very important procedure during mergers and acquisitions, under which the purchase consideration will be allocated to identifiable assets and liabilities, including intangible assets, and goodwill. Although the concept of the PPA modeling is simple, it can be extremely complicated, and the number of possible errors that can result in inaccurate financial statements or other audit issues can be large.

In case of the finance experts, awareness of pitfalls and establishment of strong practices is the way to go in order to be in adherence to the IFRS 3 and the US GAAP, besides making financial reporting transparent and credible.

Why PPA Accuracy Matters

A properly developed PPA model is not simply an accounting process; it offers a great knowledge of the fair value of the acquired assets, provides information on amortization and depreciation schedules, and influences post acquisition financial indicators. The possible model errors may lead to:

- Excessive or inferior overstatement or understatement of goodwill.

- The wrong identification of intangible assets.

- The deferral tax is misestimated.

- Audit adjustments/restatements.

- The use of false performance indicators to stakeholders.

Therefore, identifying and addressing common mistakes in purchase price allocation modeling is essential for both compliance and strategic decision-making.

Typical Errors in PPA Models

Wrongful Valuation of Intangible Assets.

Among the most common mistakes, wrong valuation of intangible assets, including customer lists, brands, and proprietary technology, can be listed.

- Assessments of the useful life or cash flow may be inflated or understated due to underrating of useful life or cash flow estimates.

- Using a single method to value (e.g. relief-from-royalty on brands) without balancing and counterbalancing it with other methods may end up with skewed results.

To ensure that they do not happen, valuation assumptions are supposed to be supported, and more than one methodology should be taken into consideration when possible.

Inappropriate allocation of Tangible and Intangible Assets.

- PPA needs accurate categorization of assets. Common missteps include:

- Improperly assigning residual value of goodwill rather than assigning the same value to an intangible asset.

- Moving some physical assets into the intangible category because they are functionally similar.

These inaccuracies cause distortion of balance sheets and amortizations of future, which may impact on earnings and tax calculations.

Mistakes in the Working Capital and Net Debt Adjustments.

- Most PPA models do not well accommodate working capital and net debt at closing.

- Defining the working capital of a target in an incorrect way or including/excluding some liabilities will distort the calculation of net assets.

- The cash and debt among other balance sheet details and the purchase agreement may not be reconciled, resulting in discrepancies.

These pitfalls are avoided by clearly defining and reconciling procedures.

Pecuniary Discount Rates or Assumptions.

The intangible valuations that are based on income are based on future cash-flow discounting. Common errors include:

- Application of varying discount rates from various assets.

- Lack of support of assumptions by market data or risk profile.

- Failing to consider fluctuations in economic factors that influence the anticipated cash flows.

It is a move to standardize the discount rate methodology and document assumptions which enhances model credibility.

Failure to consider Contingent Consideration and Earnouts.

- The contingent consideration, e.g. earnouts is usually undervalued or not factored into PPA models.

- Under IFRS 3, fair value must be measured at the date of acquisition and any other change thereafter recorded either in profit or loss.

- Not including contingent liabilities or not classifying them as liabilities may influence goodwill and general valuation greatly.

Contingent consideration should be identified, classified and modeled in fair values in order to ensure that PPA is done properly.

Data Quality Issues

The financial data of the target company may contain mistakes, which are not complete or inconsistent. Common issues include:

- Absence or falsification of past financial statements.

- Differing accounting policies.

- Balance sheets and off-balance sheets which are not reconciled together with intercompany balances.

These have to be addressed by means of rigorous due diligence, data validating and harmonizing of accounting policies.

Incorrect Tax Calculations

Reason being that accounting and tax basis of an asset and liability are often different, deferred tax adjustments are often poorly managed. Common mistakes include:

- The inability to use the appropriate tax rate on particular jurisdictions.

- Excluding intangible asset deferred tax liabilities.

- Ignoring transitory variations as a result of valuation changes.

The incorporation of tax knowledge during the initial stage of the PPA process would guarantee proper modeling.

Best Practices to Avoid PPA Errors

Adopting best practices for accurate PPA calculations mitigates errors and enhances model reliability. Key strategies include:

Quick and Proper Preliminary Due Diligence.

Start PPA modeling at the due diligence stage to obtain full information about the financial, operational and legal aspects. The valuation and allocation of a potential issue can be done easily by identifying the issues early.

Apply More than one Method of Valuation.

Triangulate the intangible asset value through various techniques like income approach, the market approach and the cost approach. There are several views that give more defensible and strong evaluation.

Standardize Assumptions

Be consistent in the discount rates, growth assumptions and useful lives of all assets. Reasoning and documentation of why assumptions were made to make it more transparent and auditable.

Match Working Capital and Net Debt.

Provide specific procedures of working capital and net debt adjustments. Compare these items with the purchase agreement and audited financial statements in order to avoid variations.

Engage Specialists

Objectivity of valuation can be achieved through independent valuation experts especially in the cases of complex intangibles, contingent consideration or in cross border transactions. Specialist contribution enhances credibility and abatement of audit risk.

- Adopt Superior Review and validation.

- Perform the peer reviews and sensitivity analysis.

- Compare the PPA outputs with previous M&A benchmarks or the industry standards.

- Prepare all changes and assumptions in a way that they can be audited.

- Be flexible to have adjustments on the measurement periods.

Both the IFRS 3 and the US GAAP permit a period of 12 months (the usual period of measurement) in order to refine provisional values. Make sure that models are not hard and fast to accommodate new information without making them complex.

Red Flags of Auditors.

Probably, finance professionals are expected to take the initiative to eliminate those areas which are likely to generate audit interest:

- Huge goodwill left-over without evident explanation.

- Major post acquisition changes to provisional PPA allocations.

- Unaccounted variance of purchase consideration and fair value of net assets.

- Inequality in the use of accounting policies among assets.

Early response to these red flags would minimize the chances of audit disputes and compliance.

Conclusion

PPA modelling is a very complicated but a necessary part of M&A accounting. With a clear understanding of typical errors of purchase price allocation modeling coupled with the adoption of best practices in the calculation of PPA, finance professionals will create accurate and compliant financial statements that can withstand the audit process.

A thorough strategy of PPA does not only meet the regulatory needs, but also offers any valuable insight into the economic value of acquired businesses, which eventually results in more improved strategic decision-making and stakeholder trustworthiness.