Certified PPA Training for Dental Clinics

Allocating Purchase Price for Dental Clinics

Introduction to Certified PPA Training for Dental Clinics

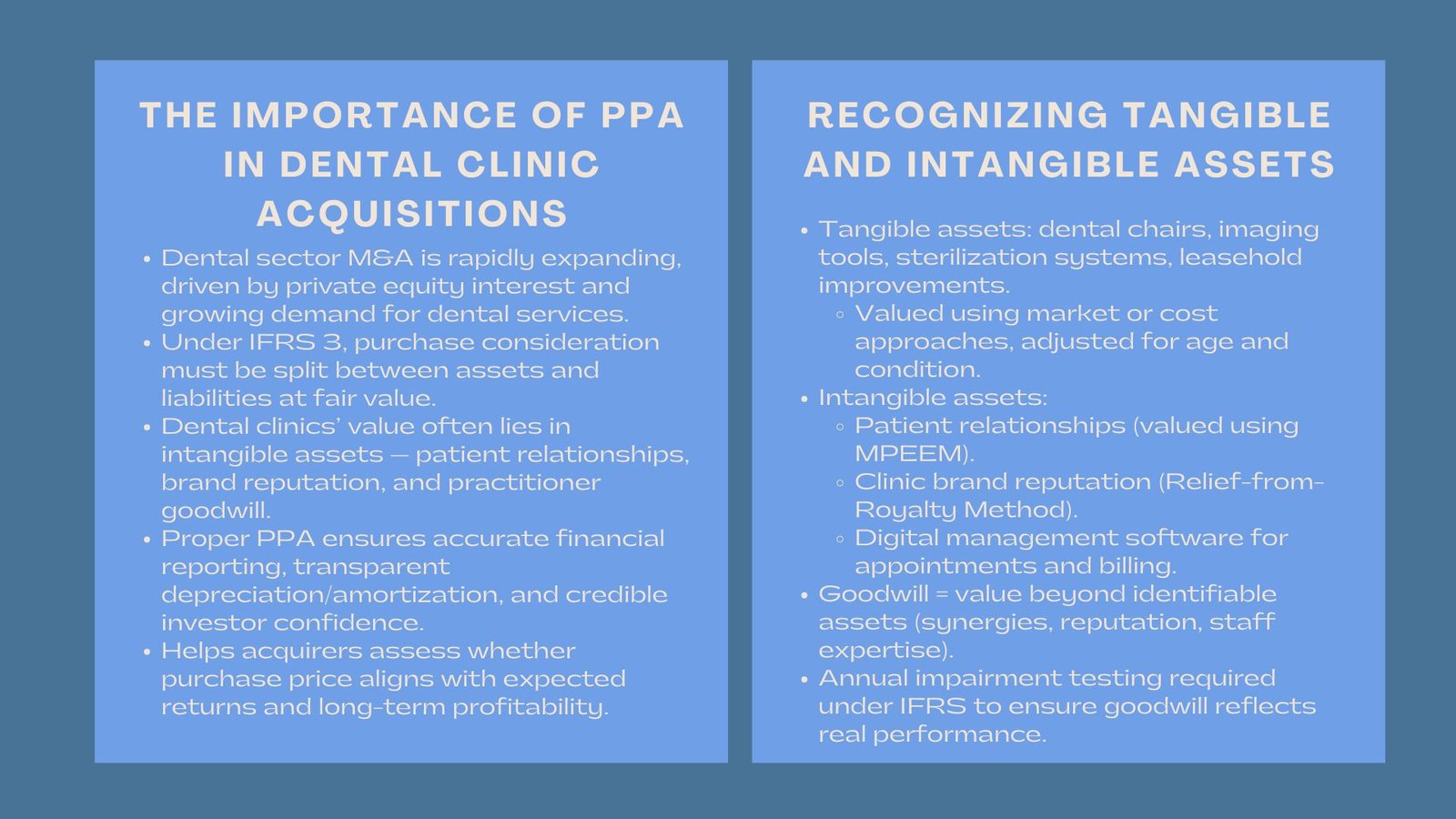

One of the most active industries in the recent years is the dental one in terms of mergers and acquisitions (M&A). Healthcare groups, professional networks, and the ever-growing population of dental clinics are being sold to increasing numbers of private equity firms in an attempt to find unobtrusive cash flows and a rising demand in preventive and cosmetic dental services. Never before the success of such acquisitions however is not solely based on operational integration but also proper financial reporting; more so; in terms of purchase price allocation (PPA).

Under International Financial Reporting Standards (IFRS 3), purchase consideration is to be split between the acquired assets and liabilities to be at the fair values when a dental clinic is being acquired. This allocation has extensive implications against financial reporting, taxation and subsequent profitability analysis.

1. Learning about the Significance of Purchase Price Allocation.

1.1 The importance of PPA in Healthcare Acquisitions.

The physical assets of the dental practice, including dental equipment, office furniture and leasehold improvements are frequently overshadowed by the intangible ones, including patient relationship, practice reputation, and goodwill of the practitioner, in the education of a dental practice acquisition. The dental clinic purchase price allocation ensures that these elements are recognized correctly, providing a clear picture of what the acquirer is truly paying for.

Proper allocation will also influence depreciation and amortization schedules that will have an impact on future profits. An example is that fair value of dental equipment will be used to calculate the cost of depreciation and identifiable intangible like patient lists or trademarks will be amortized over their useful lives.

1.2 Effects on post acquisition financial reporting.

PPA assists acquirers to determine whether the purchase price is consistent with anticipated returns by establishing the true sources of value. It also lays the foundation to further impairment testing which is essential to healthcare institutions that rely heavily on recurring patient revenues. Transparency in the allocation under IFRS creates investor confidence and confidence among the regulators because it portrays the actual substance of the transaction.

2. Determining and Recognizing Tangible Assets.

2.1 There are common tangible assets related to the dental practices.

Dental clinics normally contain high value material resources such as specialized dental chairs, X-ray machines, sterilization systems as well as digital imaging equipment. The valuation of these assets is done according to their replacement cost or their market value with adjustment to age and condition. Tangible asset valuation also includes leasehold improvements which include clinic fit-outs, and design alterations.

An example of this is that a modern dental chain with state of the art diagnostic equipment will probably assign a higher value to the purchase price because of the tangible assets than a small clinic in the neighborhood with a primitive set of tools.

2.2 Revaluation and Depreciation The consideration of revaluation and depreciation.

After recording principles of fair value of tangible assets, they are further depreciated using standardized accounting procedures. When equipment is overvalued, depreciation charges will be increased, and this will have an impact on the profit margins in the future. The acquirers have thus to strike equilibrium between realistic valuation and sustainability in terms of financial performance after the acquisition.

3. Intangible Assets should be recognized.

3.1 The relationship to patients and patient records are considered items

In a majority of dental acquisitions, patient association is among the most prized intangible assets. Such associations can be virtually converted into frequent visits and fixed sources of revenue. Valuation experts can estimate the value of the expected future cash flows offered by such relationships using the Multi-Period Excess Earnings Method (MPEEM), which is also an income-based method.

Indicatively, the intangible value of a clinic will be higher than that of a new practice because it has a higher retention rate and more loyal, long-term, clients.

3.2 Goodwill Practitioners and Brand Reputation.

The patient acquisition and trust are largely attached to the brand reputation of a dental clinic, as well as the status of professionalism held by the dentists. Under the IFRS 3, these identifiable assets are observed individually in the case they can be sold, transferred, or even licensed. In the case of multi-location dental groups, the brand name can be valued under Relief-from-Royalty Method which is done based on the estimated savings that are not required to pay royalties to use the brand.

3.3 Digital Infrastructure and Software.

Dental practices are moving to proprietary software to schedule appointments as well as bill and manage patients. These online systems can also be identifiable intangible assets in case they are directly related to the efficiency of operations and client retention. They are normally valued by cost-based or income-based valuation techniques.

4. Goodwill and Post-Acquisition Implications.

4.1 Determining Goodwill Value

Once all the intangible assets that can be identified and categorized as tangible assets are identified, the remaining value of the purchase consideration is goodwill. This is the surplus value that the buyer anticipates the synergies, workforce skills and prospect of growth that cannot be isolated.

The goodwill in the case of dental clinic deals can be based on the anticipation of the acquirer to gain more referrals, brand growth or integration advantage associated with shared marketing and administration.

4.2 Goodwill Impairment Testing.

Under the IFRS, goodwill is not amortized but should undergo a test on impairment annually. In case the performance of the clinic is less than expected such as patient visits or revenues have decreased, some of the goodwill may have to be written down. Constant check into performance measures like retention of patients, cost structure and market share is thus imperative in sustainable financial management.

5. Lease and Location Issues.

5.1 Lease Accounting under IFRS 16

The lease accounting is an important component of the PPA because dental clinics are usually run out of rented facilities. The right-of-use (ROU) assets and associated lease liabilities have to be reported at fair value. The location, which is a medical hub or a commercial centre with heavy pedestrian traffic tend to be prime sites that enhance the total value of the business.

5.2 Comparing Advantages of Location.

Though the location is not seen as an asset, it also adds indirect value to other assets – especially the brand recognition and customer relations. A clinic located in a high-income area, e.g. well placed, might have better revenue prospects along with better intangible valuations as compared to a clinic in an inaccessible area.

6. IFRS Compliance and Disclosure

6.1 Transparency in Reporting

Compliance with healthcare IFRS reporting ensures that the allocation process is transparent, comparable, and auditable.IFRS 3 includes comprehensive disclosures of the procedures applied in establishing fair values, significant assumptions, valuation practices and sensitivity of findings to inputs variations.

Transparency disclosure does not only appeal to the auditors and regulators but also gives the investors a clear picture of the percentage of purchase price which is attached to the tangible and intangible assets.

6.2 Coherence between M&A Transactions.

Multi-clinic groups which are growing by serial acquisitions need consistency in valuation procedures. Use of comparable standards in the transaction assists the management in evaluating performance on a similar platform and increases the feasibility of consolidated financial reports.

7. Hospital Practical Dental Clinic PPA Dilemmas.

7.1 Limited Historical Data

One of the difficulties may be the inability to make reliable cash flow predictions because smaller clinics might not have well-developed accounting systems or all patient databases. Where this is the case, valuation professionals should use market standards, industry standards, or proxy data to determine fair values.

7.2 Differences in Personal Goodwill.

Individual reputation of the practitioner, and not necessarily the clinic, might be the source of part of the value in privately owned dental practices. Personal goodwill cannot be recognized as a separate asset under IFRS 3 and thus, personal and business goodwill should be analyzed carefully to identify the difference between the two.

8. Case Study: Purchase of a Dental Group Region.

Take an example of a local dental group that has been purchased at 5 million dollars. The PPA led to the allocation as follows:

- Tangible assets (equipment and leasehold improvements): one point two million dollars.

- Traceable intangible assets (patient relationships, brand and software): $2 million.

- Liabilities ( lease and payables): $ 0.5 million.

- Goodwill: $2.3 million

In this case, the largest portion of the value included intangible assets, which does show the significance of recurring patients and recognized brand. After the acquisition, the acquirer needs to take up annual tests of the goodwill impairment and report under the IFRS 3 and IFRS 16 framework to make the information transparent.

Conclusion

The integration of the acquisition of dental clinics is not just a matter of operations but also has to be economically accurate and adhere to international standards. Comprehensive dental clinic acquisition cost allocation with sound healthcare IFRS reporting is a clear, credible value generation. Through the identification of the real sources of value, such as the relationship with patients or the strength of a brand, the acquirer is able to handle the post-acquisition expectations in the most appropriate way, to remain transparent, creating the basis of long-term growth and financial stability in the competitive healthcare industry.