Certified SPA Wellness PPA Training

Allocating Purchase Price in Spa and Wellness Acquisitions

Introduction to Certified SPA Wellness PPA Training

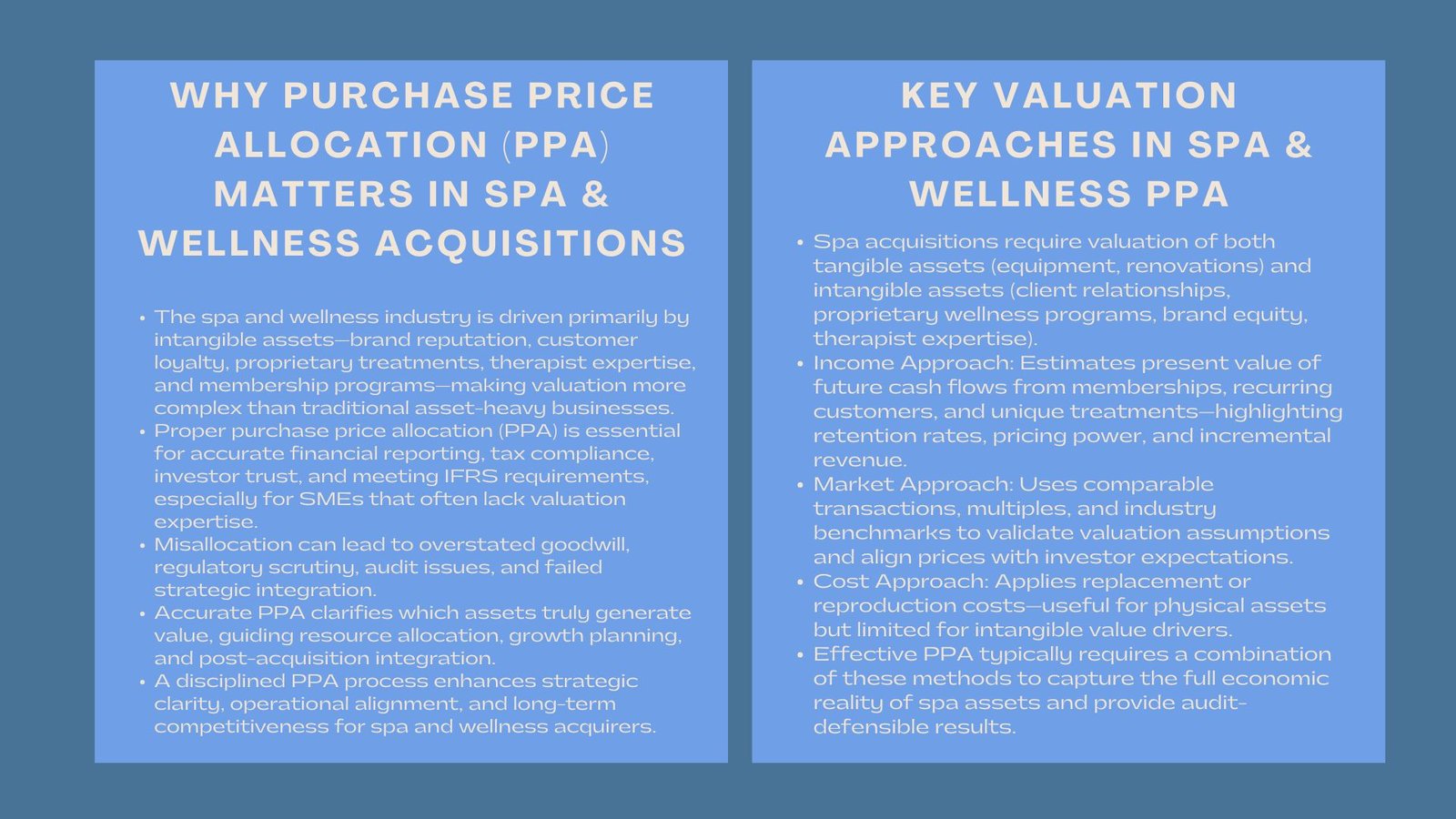

The Spa and wellness business has been booming over the recent years supported by the rising and growing consumer consciousness on health, sports and self-care. Due to this fact, mergers and acquisitions have emerged as a strategic instrument that companies are using in a bid to increase market coverage, strengthen service provisions, and broaden brand names. There are specific challenges of valuation in the case of acquiring a wellness spa. In comparison to traditional business where machines or a stock of goods and services are determinant of success, wellness and spa business is so dependent on the intangible or non tangible attributes such as brand name, customer loyalty, proprietary wellness packages, employee knowledge, and operating systems.

It is not only that the purchase price be properly allocated during a spa and wellness acquisition, but it is also necessary in order to adhere to accounting criteria and plan the business strategy. The distribution directs directly on financial reporting, tax, and investor confidence. In the case of the small and medium-size enterprises (SMEs), the compliance with the IFRS requirement of M&A reporting is of significant concern. Goodwill may be inflated, no accurate records of the value of the assets and regulatory examination is a likely possibility following the misallocation of purchase price which can compromise the long term strategic goals of the acquisition.

Correct purchase price allocation will enable the management to recognize which of the assets are the real drivers of value and thus, their integration may be successful as well as informed after the wellness spa purchase price allocation of resources, and sustainable development. It gives a clear picture of the economic input of every asset on the overall business and also gives transparency to all stakeholders of the business such as auditors, investors, and regulators.

Analyzing Purchase Price Allocation in Wellness Spas

The Concept of Purchase Price Allocation

Purchase price allocation (PPA) refers to the accounting of allocating the entire cost of an acquisition to the identifiable assets and liabilities being acquired. When it comes to selling wellness and spa, this process should take into consideration both the tangible asset, e.g. spa equipment, furniture, leasehold improvements; and intangible asset, e.g. client memberships, brand equities, proprietary wellness programs and skills of the highly qualified therapists.

The tangible assets are usually more readily valued as they can be easily estimated by the means of replacement cost, comparables in the market, or depreciation. Nevertheless, not every asset can be analyzed through the same method as is done with tangible property, in cases of overwhelming intangible assets, projections on future cash flows, client retention and the market impact of proprietary treatments or wellness programs need to be conducted in more sophisticated ways. Approper allocation of purchase price is crucial so that any assets can be recorded at fair value that is crucial in accuracy of the financial statements, strategic decision-making after the acquisition and compliance to the regulations.

Strategic Implications of Accurate Allocation

In addition to the compliance with the accounting standards, PPA also has significant strategic implications to the wellness and spa companies. The knowledge of the values of intangible items, like the proprietary wellness programs or high-valued client memberships enable the management to make wise decisions about the resources allocation, retention and development of the products and services. In other words, when a high percentage of purchasing price is spent to give membership to clients, the management can focus on loyalty programs and similar themed offerings to retain this important stream of money and expand it.

The proper allocation also fosters the negotiation and integration tactics in the process of acquiring. The valuing of most valuable assets enables the acquiring company to concentrate on retention of critical talent and retention of high-demand services and the safeguarding of the intellectual property that ultimately boosts the investment that may be made in long terms.

IFRS Reporting Considerations for Spa and Wellness Acquisitions

Applying IFRS 3 to Wellness Acquisitions

The IFRS 3 regulates the accounting treatment of business combinations that highlights the recognition of acquired assets and liabilities at fair value and the goodwill should be calculated properly. To this extent with wellness acquisition and spa acquisition, tangible assets like spa equipment and leasehold improvements are identified and valued, and intangible assets like client contracts, brand reputation, wellness proprietary treatments and staff specialization expertise are also identified and valued.

The excess of the purchase price (in excess of the fair value of the net assets) represents goodwill which is an indication of the synergies, future economic benefits, as well as possible growth of revenues as a result of the acquisition. Appropriate allocation will be making sure that the goodwill is not overstated otherwise this may result in impairment risks and misstated financial statements. The application of IFRS 3 also brings transparency to the investors and aids in regulatory inquiry, which will ensure that the reporting of the transaction is made with the international accounting regimes.

Challenges for SMEs

Small and medium sized spa enterprises would be plagued by lack of resources and expertise in applying IFRS compliant PPA. The correct amount of intangible asset should be valued with technical expertise of financial modeling, industry standards and business behavior. The lack of experience can increase the inability of SMEs to determine the fair value of the service of client memberships, proprietary treatments, or staff expertise. Valuation experts should be hired to offer the required rigidity and adherence particularly when the acquisition encompasses several intangible elements that make a considerable contribution to the overall price of the enterprise.

When SMEs adopt the adequate reporting using the IFRS, it is possible to indicate transparency, prevent future tax conflicts, and present the stakeholder with a decent picture of the financial status and performance of the business being acquired.

Importance Methodologies for Spa and Wellness Assets

Present Value Approach

The income-based approach is considered one of the most popular approaches to valuing intangible assets of wellness and spa through acquisitions. This approach helps to approximate the present worth of future cash flows related to use of certain assets including recurring client memberships or proprietary wellness programs or treatments required. A good example is a spa that provides a special facial treatment system where existing clients can be retained with the high retention rate can be estimated using incremental revenue created by the spa (discounted by considering the risk and time value of money).

Valuing based on income indicates the economic value of those assets that have direct linkages to the generated revenue and gives the management an understanding about what makes the business make a profit. This approach can also be used to determine possible risks, including defection of clients or shifts in the market trends, so that the management can strategize on retention plans and other ways of improving service.

Benchmarking Valuation Method

The market-based methods include the analysis of the last transactions made by the similar wellness or spa companies to determine the reasonable price of assets. Although it may be difficult to find direct comparables because of the peculiarities of an individual business, the analysis of such indicators as acquisition multiples, revenue-earnings relations, and client retention in analogical deals, will offer some idea of the valuation.

This approach supplements the income-based approach because it works to validate assumptions; that is, have the allocation of purchase prices that are dependent on market conditions and expectations by the investors. To illustrate, when acquiring similar spas is done considering that the acquired spa is multiple times the revenue of the annual contract to clients, then that data can help the acquiring company to validate its own estimate of values.

Cost-Driven Valuation Model

The cost-based method values the tangible and intangible assets in a manner that is dependent on the cost of replacing or reproducing. Although the approach is appropriate when the physical assets are involved and that is spa equipment or furniture, it tends to underestimate the value of the intangible assets, especially client connections, brand value, or proprietary wellness programs. As such, cost-based approach is normally accompanied with income- and market-based approaches to offer an overall evaluation of enterprise value.

Practical in Allocating Purchase Price for Wellness Spas

Valuing Client Relationships

Loyalty of the clients is one of the main sources of revenue in wellness and spa companies. To estimate the value of client memberships, it is necessary to analyze the patterns of visits in the past, the retention rates, costs, and an opportunity to sell some other services. The future behavior of the clients may be difficult to predict because of the competition in the market, shifting consumer tastes as well as seasonal differences. Proper valuation of client relationships is critical towards the determination of the extent of selling price that will go to these intangibles.

Valuing Staff Expertise and Proprietary Programs

Knowledge, skill and experience of wellness practitioners and therapists is very important asset of the spa business. Uniqueness of wellness programs, special treatment regimens and business procedures are what help to provide fame to the spa as well as earn income. To ascribe fair value of these assets, it will be necessary to consider their role in cash flow, customer satisfaction and brand differentiation. In addition, the staff turnover risk and training should also be taken into consideration so that the valuation would be dependent on the sustainability of these assets.

Integration and Accounting Challenges

Incorporation of intangible assets in post-acquisition accounting is somewhat a challenging undertaking that has to be planned and followed by the IFRS standards. These are recognizing goodwill rightfully, having proper schedules of amortization, and the tax awareness of revaluation of assets. SMEs might have challenges in applying complex accounting treatment in an absence of external expertise and therefore a sound PPA process is critical in order to be audit defensible and meet regulatory requirements.

Documentation and Transparency

Documentation is important in establishing transparency, auditability and confidence of the stakeholders. All the assumptions, techniques and data supported should be presented in a manner that explains the reasoning behind the valuation. A good documentation also means that auditors, investors and regulating agencies can comprehend and validate the process of allocating funds and enhance the reliability of the financial accounts.

The Role Importance of Accurate Purchase Price Allocation

Enhancing Operational Decision-Making

True PPA gives the management a better insight in the worth of the important assets and is able to make better operational and strategic decisions. The identification of the financial value of proprietary programs, client relationship and special staffing assists in prioritization of investments in areas with the greatest effect, service delivery, and client satisfaction.

Compliance and Risk Mitigation

The process of meticulous allocation will result in the adherence to IFRS standards, reduce the threat of audit controversies, and allow reporting proper taxation. Clear and well-recorded PPA also gives investors and other stakeholders an assurance that the acquisition is being done in the most responsible manner and financial statements will indicate the actual economic worth of the business acquired.

Long-Term Strategic Benefits

In addition to short term compliance and operations benefits, proper purchase price allocation will give long phase growth insight. Knowing which assets have the greatest impact on the revenue and profitability allows the management to undertake programs that will enable the company to gain competitive advantage, better customer retention as well as increased overall efficiency of the processes.

Conclusion

Purchase price allocation in spa and wellness acquisitions is a complicated process which involves accounting accuracy, strategic ability and compliance to IFRS M&A reporting guide standards. This is because both tangible and intangible aspects of the organization such as client relationship and staff expertise, proprietary programs, as well as brand reputation are to be properly valued so as to report financial interests clearly as well as be able to comply with regulatory standards as well as being successful in integrating after making an acquisition.

In the case of both SMEs and larger businesses, careful purchase price allocation will also make sure that purchase will have long-term value, operational and strategic decision-making as well as reserve investor confidence. PPA to a large extent is not an accounting process, but a crucial instrument towards the realization of long-term growth, competitive edge, and profitability in an industry where intangible assets are the core of the enterprise value.