Global IFRS 3 PPA Certification Program

Case Study: PPA for a Cross-Border Acquisition under IFRS 3

Introduction: Global IFRS 3 PPA Certification Program

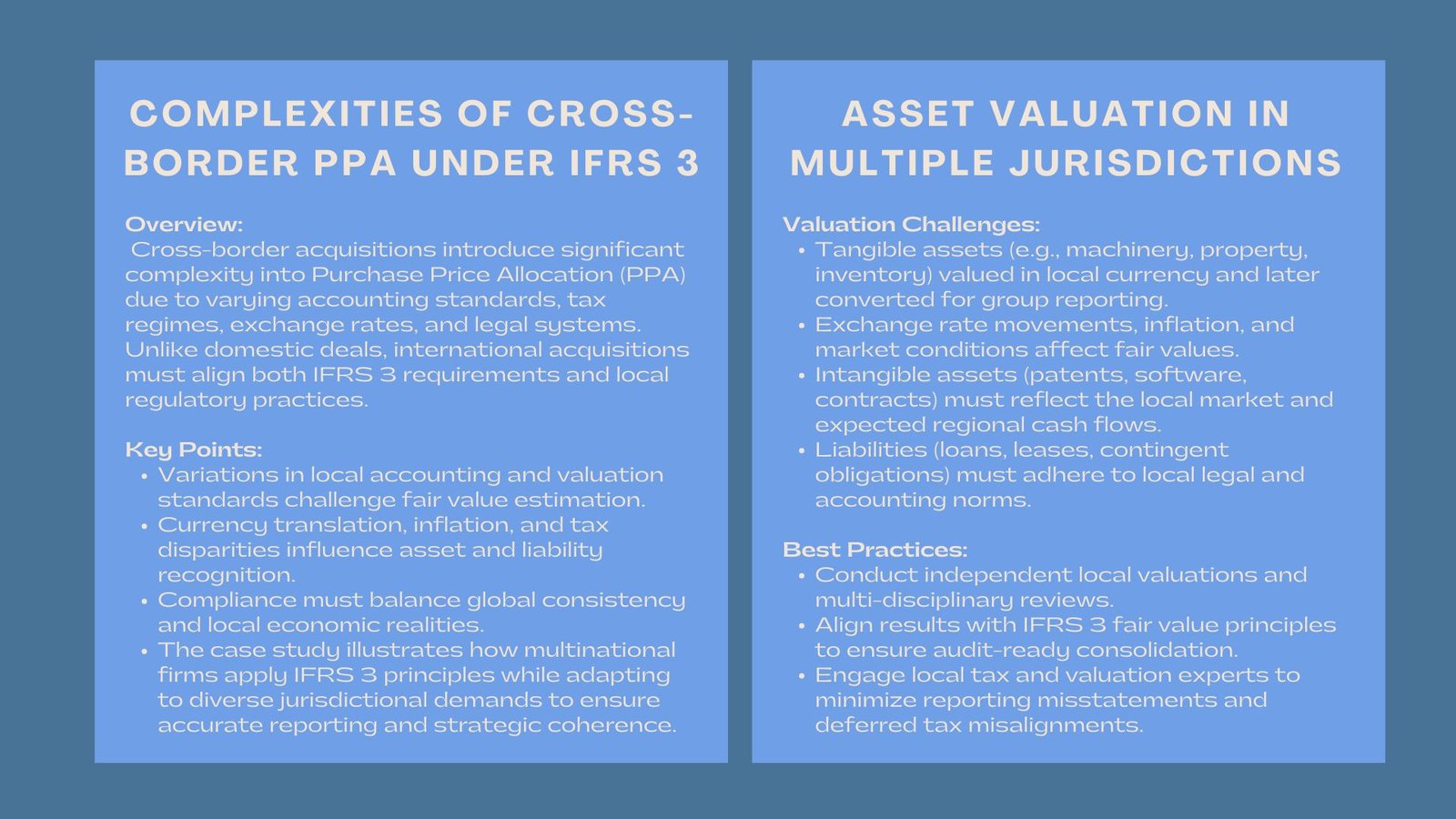

The complexities that are presented by cross-border acquisitions are beyond traditional PPA. The disparities in the accounting activities in the local areas, exchange rate, taxation systems, legal systems form hurdles in the establishment of reasonable values of such assets and liabilities. Unlike domestic transactions, Purchase Price Allocation (PPA) in cross-border mergers and acquisitions (M&A) involves dealing with multiple layers of complexity — from foreign exchange rate fluctuations and differing tax laws to variations in accounting standards and legal frameworks.

The guidelines on how to allocate purchase price are given in cross-border purchase price allocation under IFRS 3 these types of transactions but corporations should be keen to adjust such valuations which would show interests of both the local and global standards. The disparities in local accounting practices, valuation approaches, and market conditions can make it difficult to achieve fair and consistent valuations across jurisdictions. Companies involved in such transactions must balance compliance with both international financial reporting standards and the specific requirements of local regulators.

This case study explores how a multinational corporation conducted a PPA for a cross-border acquisition, emphasizing the methodologies, adjustments, and strategies necessary to ensure accurate financial reporting, tax efficiency, and strategic alignment between the acquiring and target entities.

Understanding the Objectives and Principles of IFRS 3

One of the most important standards of international financial reporting is the IFRS 3 -Business Combinations, which provides the way of accounting of mergers, acquisition, and other business combinations. The primary aim of the IFRS 3 is to make the acquisition of a business to be presented in a transparent, consistent, and comparable manner across jurisdictions. It mandates that entities represent the economic substance of an acquisition, and not its legal form creating a clear image of the effect of a combination on financial performance and position to the users of financial statements.

In its essence, the IFRS 3 requires the application of the acquisition method of accounting. In this method; the acquirer is identified, date of acquisition is recognized and identifiable assets acquired and liabilities assumed are determined at fair values and goodwill or increase or loss of a bargain purchase. These principles are made to achieve that the financial statements reflect the value transferred and assets gained.

The other important principle of IFRS 3 is the fair value measurement that facilitates transparency and comparability. The asset valuation and liability valuation of assets and liabilities through fair values of such assets and liabilities at the acquisition date will enable stakeholders to better appreciate the actual financial impact of such a transaction.

On top of this, IFRS3 has reiterated full disclosure whereby companies should disclose all the details concerning the nature of the acquisition, the financial impact on the company and the basis upon which the acquisition has been valued. This increases the investor accountability and confidence.

Essentially, IFRS 3 is an international standard of business combination reporting that harmonizes accounting practices across the world. It is the medium between financial reporting, valuation and strategic management and is therefore necessary in the people who are involved in mergers, acquisitions and financial analysts.

The Role of PPA in Business Combinations

A basic operation that is involved in the application of IFRS 3 is that of purchase Price Allocation (PPA), so that the full purchase consideration paid in business combination is properly allocated among identifiable assets acquired and liabilities assumed based on its fair value at the acquisition date. This process will be a clear and accurate reflection of what the acquirer has actually bought.

PPA is mainly used to separate identifiable assets (tangible and intangible) and residual goodwill. As an example, a part of the acquisition price can be associated with identifiable intangible assets (customer relationships, technology or brand value) whereas the other part, the goodwill, is the future economic benefits expected to arise due to synergies or strategic advantages.

Proper PPA would be needed as it influences post-acquisition financial reporting, such as depreciation, amortization and future testing of impairment as required by the IAS 36. The misallocation will distort profit margins, return on assets among other performance measures. As a result of fair value measurement, PPA improves the effectiveness and reliability of financial statements by investors, regulators, and management.

In addition to financial reporting, PPA is also important in the tax compliance and decision-making process. The purchase consideration allocation affects the tax deductions, deferred tax liabilities (IAS 12) and future cash flow projections. It is also beneficial in cross-border mergers to make sure that there is consistency between the IFRS and local tax laws.

Strategically, PPA is a good source of information to understand what creates value in an acquisition, which is to expose which assets could form the greatest part of future performance and which areas could be strategic focus areas after the merger.

To sum up, PPA helps to reduce the complexity of an acquisition to a transparent, organized financial framework that helps with accountability, compliance, and informed decision-making. Both a technical and strategic exercise, it forms the basis of the integrity of financial reporting of business combinations that are under the IFRS 3.

Asset Valuation in Multiple Jurisdictions

The tangible assets including the machinery, real estate, and inventory should be estimated using local currency of the target company and then transferred to the reporting currency. The local inflation, exchange rate movements and market conditions are the major determinants of fair value. Assets which are not tangible, such as patents, technology and customer contracts have to be subjected to localized evaluations in order to reflect anticipated cash in that particular economic setting.

The liabilities in terms of loans, leases and contingent obligations also have to be based on local accounting and legal requirements. Aligning such values to the IFRS 3 will mean that the consolidated international M&A valuation and deferred tax implications financial statements will reflect a decent and true image of the merged entity.

Such valuation complications are commonly multidisciplinary in cross-border acquisitions between local experts and auditors and corporate finance teams. The jurisdictions will individually determine tax incentives, depreciation regulations or they may have some legal meanings which may affect recognition and measurement of the asset. Hence, it is important to perform thorough due diligence and get independent valuations to preclude the misstatements and make sure that they comply with international standards.

Goodwill and Post-Acquisition Considerations

Benevolence in the acquisition between the countries demonstrates synergies, access to the market, and strategic benefits. The companies should be aware of the foreign exchange risks, cultural integration, and compliance with regulations when considering how well goodwill can be sustainable. The correct documentation of PPA will reduce conflicts, aid audit preparations, and give the stakeholders the certainty of the reported values.

Goodwill in practice symbolizes also a faith that the management took in the long-term potential of merging two businesses to attain high level operational efficiency and profitability. Nevertheless, the anticipated synergies might not be achieved as anticipated unless proper post-acquisitions planning is done and hence the goodwill could be impaired. This is what requires continuous monitoring of the performance indicators and continuity of integration. The organizations should also reconsider the assumptions that were employed in valuation, and they should be realistic because market conditions and realities in the operations change.

Conclusion

Purchasing power procedures across borders is an imperative practice which balances accounting ethics and strategic instinct. Proper allocation reflects currency fluctuations, legal diversities and domestic market risks such that assets and liabilities are fairly stated and that the companies facilitate proper integration after acquisition.

Recorded methodologies, assumptions and cross-border adjustments improve transparency, and aid in good post acquisition integration. Strict PPA gives strength to the confidence of the investors, it reduces the audit risk, and it gives a base of creation of values which is long term in any international transaction.

Practically, the cross-border PPA would require the synchronization of the work of the financial, legal, and working teams in different jurisdictions. Regions might be of different tax structures, regulatory environments and even valuation benchmarks which will affect the recognition and measurement of assets. The companies need to therefore modify their PPA approach that shows the local economic realities without jeopardizing the IFRS 3 and international reporting standards. This balance will make the financial reports reflect the short-term and long-term economic value of the acquisition.