How Small Clinics Manage Purchase Price

How Small Clinics Manage Purchase Price Distribution

Introduction to How Small Clinics Manage Purchase Price

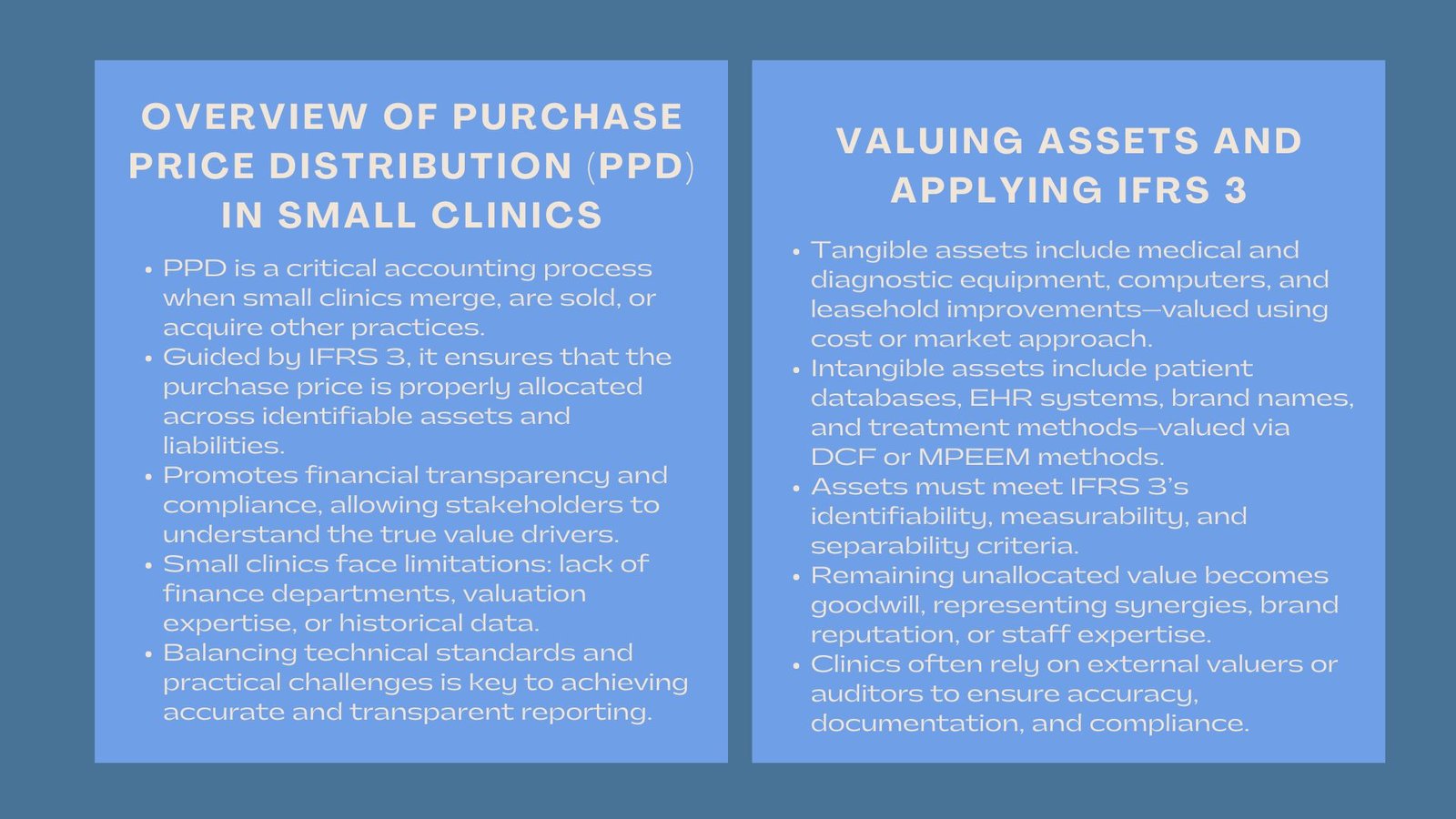

Purchase price distribution (PPD) is one of the first but most complicated accounting processes that a small clinic has to go through when it is merged, sold, or acquires another medical practice. This, under the supervision of IFRS 3, is done in such a way that the entire consideration paid on a transaction will be properly distributed among identifiable assets and liabilities of the acquired business. In the case of small healthcare organizations, the process assists in the development of financial transparency, compliance, and the ability to make stakeholders aware of the real value drivers of the transaction.

Small clinics tend to have no internal finance department or valuation experts, unlike large hospital groups that have significant resources. Proper allocation process management cannot be achieved without knowledge of the accounting standards as well as striking a balance between practical limitations such as limited data, historical records, and identification of intangible assets.

Purchasing Price Distribution in Healthcare.

In medical deals, purchase price should be applied on both tangible and intangible assets at their reasonable value. These can be medical equipments, leasehold improvements, computer systems and intellectual property such as patient database or unique treatment procedures. The unappropriated balance is the goodwill, which is the worth of reputation, future development prospect and cumulative human resource.

The small clinics have difficulties because they have to value special medical equipment which could be tailor-made or intangible resources like patient loyalty and brand recognition. A clear and structured healthcare purchase price allocation process ensures that each component reflects its true economic contribution to the business.

Tangible and Intangible Resource in Clinic Acquisitions.

It is generally easier to value tangible assets. Medical equipment, diagnostic equipment, and office equipment can be quantified on either the cost or the market approach based on their condition and the accessibility of similar market data. Unless it is under lease, real estate will normally be appraised by the licensed valuers alone.

Nonetheless, the significance of intangible assets is more common in small clinics. The relationships with patients, electronic health record (EHR) system, and clinic management software are also significant to sustainable income. The valuation of such assets is usually in the form of discounted cash flow or multi-period excess earnings method (MPEEM), especially when patient loyalty is in the form of repeat visits and consistent revenues.

It is critical to establish which of the assets should be recognized according to the IFRS 3 requirements whether they are identifiable, measurable, and separable. Assets that cannot be identified such as staff know-how or expansion potential that can occur in the future cannot be identified and are classified as goodwill.

Using IFRS 3 in transactions involving Small Clinics.

Under the IFRS3, all identifiable assets acquired and liabilities assumed by an acquirer at the acquisition date are recognized at fair values. Any remaining amount of purchase consideration and fair value of net identifiable assets difference will be the amount of goodwill that is to be realized. In case of small clinics, the implementation of this standard implies the fact that all elements of the practice such as equipment, leasing rights, licenses and databases of patients should be properly evaluated and recorded.

A detailed private clinic IFRS reporting process ensures that valuation assumptions are transparent and auditable. This comprises the process of spelling out how the critical assets were valued, how they were valued, and what the discount rates or growth assumptions were. The small clinics usually engage outside valuation consultants or accountants to make sure the documentation is consistent with the IFRS and local healthcare regulations.

Purchase Price Distribution Common Challenges.

A number of distinct difficulties are experienced when implementing purchase price distribution to the healthcare setting:

Inadequate Past Financial Information.

Most small clinics are likely to lack full or standardized financial statement and therefore the ability to predict the profits or determine the estimated life of the assets. When this happens, normalized earnings or adjusted cash flow projections have to be used by the valuers.

Regulatory Constraints

Licensing and accreditation requirements are usually stringent in the operation of healthcare businesses. The transfer of licenses or patient databases should not be against the privacy and healthcare legislation, which can influence the process of the recognition and valuation of assets.

Determining Intangible Assets.

It is a complicated process to determine the isolability and fair value of intangible assets such as the patient lists or trade names. As an example, in some jurisdictions, patient relationships can be deemed non-transferable and hence their identification as identifiable intangible assets.

Goodwill Allocation

The goodwill identified can be the perceived synergy between the acquiring and acquired clinics, including a common technology platform, cross-referral, or expanded service offerings. This goodwill, however, should undergo impairment test later on and this can have a great effect on the financial statements of an entity after the acquisition.

Appraisal Methods of Healthcare Assets.

In order to realize proper fair value measurements, there are several valuation methods that are frequently used together in small clinics:

- Market Approach: Applied where similar transactions or equipment sales records are known, which may be typical medical instruments.

- Cost Approach: Widely used with specialized equipment or equipment that is custom built, and replacement cost is estimated with depreciation.

- Income Approach: Best used with intangible assets such as patient lists or software, in terms of future income on such assets.

In the case of intangible assets, estimations should be made taking into consideration such aspects as patient retention rates, referral trends, and the competition environment of the local healthcare market. The outcomes of the research are also audit and regulatory inspections.

Paperwork and Audit Preparedness.

Clear documentation will be important as a defense to the PPA in case of audit or financial audit. Every asset must have a provided reason behind the valuation, and it must be backed by such evidence as the third-party appraisals, cash flow analysis, or similar data available in the market.

In the case of small clinics, it is beneficial to have an ordered working paper in order to facilitate post-acquisition reporting and subsequent impairment testing. Judgment of the management about the key estimates, including discount rates, growing forecasts, and useful lives should also be documented, as these are some of the assumptions that the auditors frequently examine carefully.

Monitoring and integration after the acquisition.

Once the allocation is done, the clinics will have to include the new entity that has been acquired in their financial reporting structure. These involve harmonization of accounting policies, consolidation of financial statements and the periodical initiation of goodwill impairment tests. After the acquisition, the management ought to track the achievement of the projected synergies such as cost reduction or the growth in the patient volumes. Otherwise, the goodwill impairment can be obliged to be noted.

Moreover, it is important to coordinate operational procedures and reporting guidelines in order to have a consistent and transparent financial management. Constant review of major assets will help the carrying values of the same to be representative of the true economic conditions.

Best Practices in Clinics of Small Scope.

To successfully control the process of distributing the purchase price, small clinics are advised to:

- Get skilled valuation experts on board early in the deal.

- Have a good documentation practice on all assumptions and fair value estimates.

- Make sure that the IFRS 3 requirements and local laws on healthcare are adhered to.

- Periodically examine the post-acquisition performance under the signs of impairment.

- Train internal finance department on reporting standards and concept of valuation.

These practices help the clinics to negotiate the challenges of healthcare acquisitions without fear and in an open-minded manner.

Conclusion

In the case of small clinics, balance between the technical and practical implementation is necessary when managing the purchase price distribution under IFRS. The clinics are able to make sure their transactions are fairly represented and in compliance with international accounting standards through structured healthcare purchase price allocation and rigorous reporting on thereof by the private clinic under the IFRS. Finally, a properly implemented PPD process boosts financial transparency, trust of investors and long-term viability in an increasingly competitive healthcare setting.