How to Review and Audit a PPA Report

How to Review and Audit a Purchase Price Allocation Report

Introduction to How to Review and Audit a PPA Report

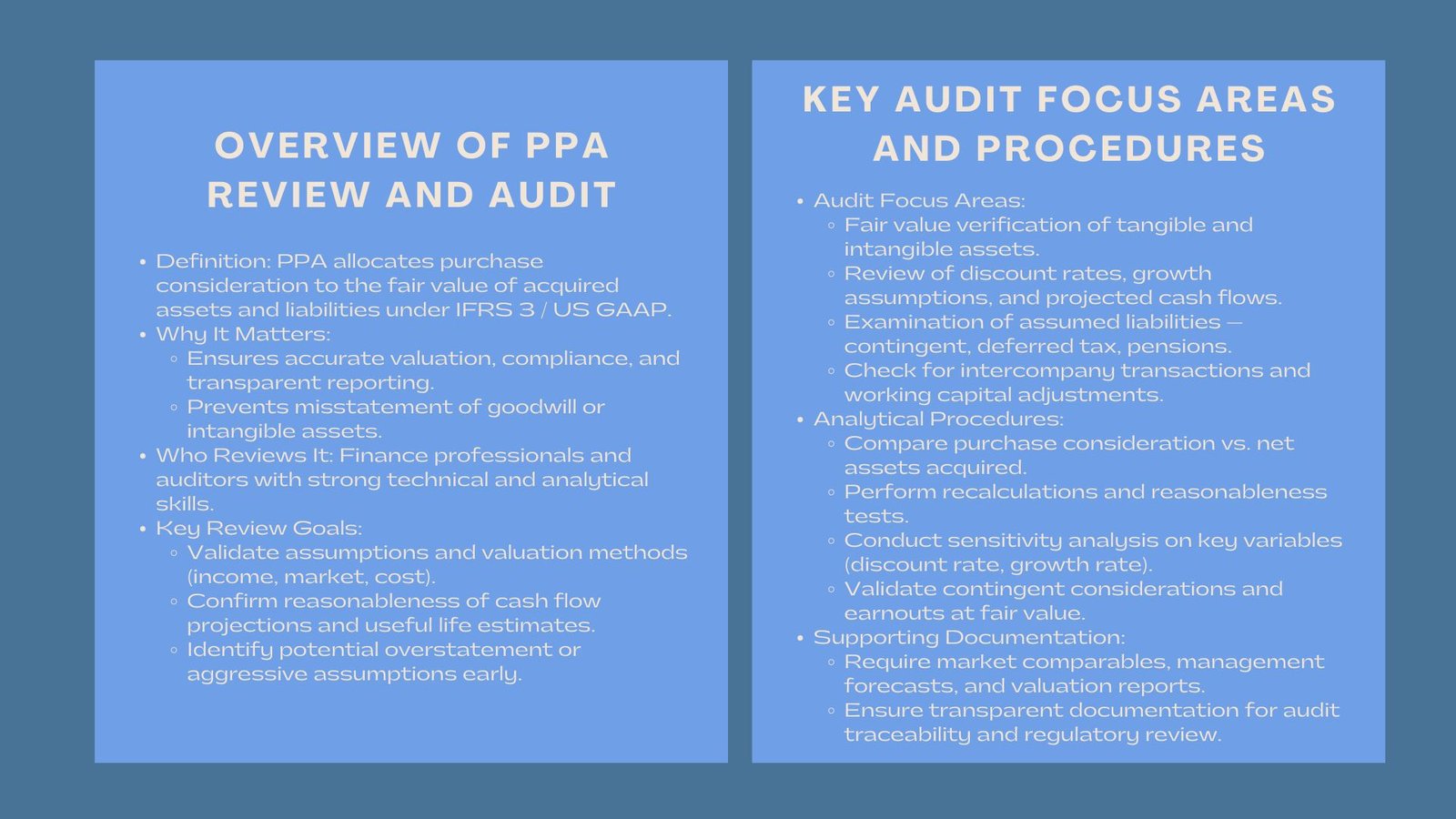

One of the key elements of merger and acquisition accounting is purchase price Allocation (PPA), which is the allocation of the consideration of purchase to the fair value of the assets and liabilities acquired. Being a complex task, a PPA report needs to be reviewed and audited by a person with technical and attention skills.

The finance professionals should warrant that all assumptions, valuations, and adjustments are substantiated and are in accordance with the IFRS 3 and the US GAAP. It is important to note that a strict purchase price allocation review process will assist in avoiding inaccurate allocation of purchase prices, aiding of sound financial reporting, and will offer transparency to the stakeholders and the auditors.

Interpretation of the PPA Report.

The initial task of examining a PPA report is to have a broad overview of the purchase and the process of determining the manner of distributing purchase consideration. A PPA report normally contains the information of tangible and intangible assets, assumed liabilities, contingent consideration and goodwill. The reviewers ought to look at underlying data such as financial statements of the business that is being acquired, past performance indicators, and market-based valuations.

It is essential that we evaluate the applicability of valuation methods that are used that is whether they are the right method used e.g. the income method, market or cost that are in line with the industry standards. In the case of intangible property or brands, customer relationship, or intellectual property, the assumptions about how cash flows are to be projected and useful lives determined must be well documented in the report. Testing these assumptions is one of the major tasks in the purchase price allocation process review since unfounded or excessive aggressive projections may lead to overstated values of the assets used and a misstatement of goodwill.

Key Focus Areas in PPA Audits

Auditing PPA report is a process that entails analysis of the qualitative and quantitative qualities of the report. The first step undertaken by the auditors is to ensure that independent appraisal or other credible proofs are provided to support the fair value of tangible assets such as property, plant and equipment. In the case of intangible assets, auditors examine the models used to estimate their value, the discount rates to be employed, the assumptions of growth, and the projected cash flows. Any non-conformities to normal methodologies should be well explained.

The liabilities that are assumed during the acquisition process including contingent consideration, deferred taxes, or pension obligation should be reviewed keenly as well. Auditors determine whether such liabilities have been properly measured and classified either under IFRS standards or under the US GAAP standards. The misclassification or omission of liabilities may result in distortion of net asset value which later results in the computed goodwill. The focus is also done on intercompany transactions, unusual balances as well as adjustments to working capital and net debt to ensure that the reported figures are reflective to the economic position of the purchased business.

Carrying out Detailed Analytical Procedures.

An in-depth audit of a PPA report comprises analytical processes in details. These processes entail the comparison of the consideration of purchase which is reported with the amount of identified liabilities and assets, calculations verification and the consistency with previous periods or corresponding transactions. Sensitivity analysis to major assumptions used by auditors may include discount rates, terminal growth rates or predicted cash flows to establish the impact of a change on the future value of assets and goodwill.

In the case of contingent considerations or earnouts, the audit is used to make sure that the estimates of fair values are adequately recorded and that the adjustments in subsequent measurements as may arise are made in accordance with the accounting requirements. Through substantive testing and reviewing the auditors are able to detect inconsistencies, possible overstatement, or mistakes that need to be rectified. The methodology is beneficial in terms of enforcement of comprehensive and defendable procedure of audit of PPA reports, which is a source of regulatory and stakeholder confidence.

Supporting Evidence and Documentation.

The important point in the process of review and auditing of PPA reports is the evaluation of the completeness and reliability of the documentation. Any valuation, assumption and adjustment should have relevant evidence in form of market comparables, independent valuations, past financial statements and management projections.

It is well documented that the PPA allocations are solid and reasonable especially when they are subject to an external audit or regulation inspection. The auditors also analyze the basis of allocation of decision including the allocation of purchase consideration between tangible and intangible assets and the goodwill. Transparent documentation of the purchase price allocation review process ensures that future stakeholders can understand the assumptions and methodologies applied, reducing the risk of post-acquisition disputes or restatements.

Common Pitfalls to Watch For

In the process of review as well as audit, some pitfalls must be observed. These have been over optimistic revenue recognition of intangible assets, poor use of discount rates in the various valuations, incomplete recognition of liabilities and inability to recognize deferred taxes properly. Also, the lack of reconciliation of working capital, as well as net debt, may lead to the occurrence of mismatches between the purchase price agreed upon and the net assets reported.

The auditors should also pay attention to the misclassification of assets or liabilities that may artificially inflate goodwill or misrepresent the amortization and depreciation schedules. Through the systematic approach to these areas, finance professionals will be in a better position to improve the trustworthiness of the PPA report and make sure that any changes that may be needed are determined at an early stage.

Cooperation between Finance and Audit Team.

Review and audit of PPA reports can be very effective in the tight cooperation of the internal finance team, external auditors and valuation experts. Finance professionals underlie the data and they justify the assumptions applied in valuation, and answer questions regarding both the classification of assets and the contingent liabilities. In their turn, auditors certify the methodologies, calculations tests, and adherence to accounting standards.

Integrating valuation experts into the process is also especially useful when dealing with complex or high-value intangible assets, which may have their knowledge be useful in supporting the reasonableness of cash flow projections, discount rates, and residual values. Establishing a clear communication and documentation process among all parties is a crucial component of the audit procedures for PPA reports, enabling a smooth and defensible review process.

Reporting and Recommendations.

Once the review and audit are concluded, the finance and audit teams should summarize their findings with or without any adjustment, suggestion on how to be more accurate or disclosures that must be made according to the IFRS or US GAAP. The end report must give a clear story on how the valuation of assets and liabilities was based, how goodwill was calculated and the uncertainties in the measurement.

The actionable recommendations that include the revision of the assumptions, the improvement of documentation, or even the revision of allocations can assist the management to optimize their PPA approach and facilitate the transparent financial reporting. Through strict standards, organizations are able to reduce errors and increase confidence among investors as well as meet the requirements of the regulations.

Conclusion

An audit and review of a PPA report is a very careful and technical task that involves careful consideration of assumptions, valuations, and calculations. Purchase price allocation review process is structured and is coupled with comprehensive audit procedures on PPA reports, which will help in ensuring that purchase consideration allocation is accurate, defensible, and that it is consistent with IFRS and US GAAP.

These pitfalls and similar issues can be prevented by proper validation of supporting evidence, ensuring clear documentation, and addressing common pitfalls, which will enable finance professionals to present quality, transparent, and reliable PPA reports, which can resist auditors, regulators, and other stakeholder scrutiny.