IFRS 3 Certified Language School Valuation

IFRS 3 Tips for Allocating Purchase Price in Language Schools

Introduction to IFRS 3 Certified Language School Valuation

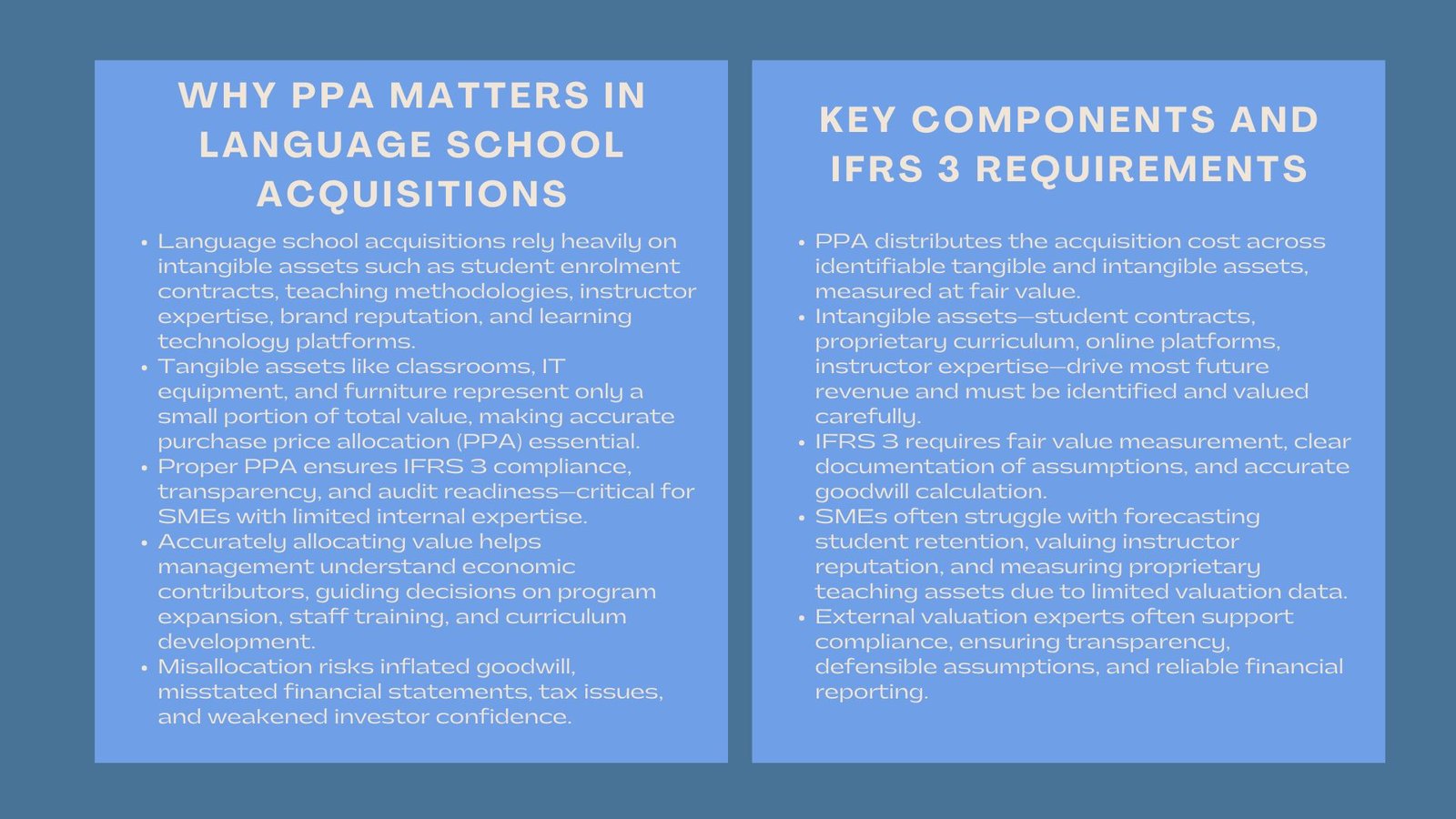

Acquisitions in the education sector, particularly language schools, present unique challenges when it comes to accounting and financial reporting. Unlike traditional businesses that rely heavily on tangible assets such as machinery, inventory, or real estate, language schools derive most of their value from intangible assets. These include student enrolment contracts, proprietary teaching methodologies, staff expertise, brand recognition, and learning technology platforms. Proper allocation of the purchase price is essential not only for regulatory compliance but also for gaining an in-depth understanding of the economic contribution of each asset to the school’s overall value.

For small and medium-sized educational institutions, aligning with education IFRS reporting standards ensures transparency, supports strategic decision-making, and mitigates the risk of disputes with auditors or tax authorities. Accurately allocating the purchase price allows management to identify the relative value of each asset, guiding resource planning, language school purchase price allocation post-acquisition integration, and long-term strategic initiatives. Furthermore, in competitive markets where reputation and student retention directly influence revenue, understanding the value of intangible assets becomes a critical driver for growth and sustainability.

A GuidePurchase Price Allocation in Language School Acquisitions

The Concept of Purchase Price Allocation

Purchase price allocation (PPA) is the process of dividing the total acquisition cost of a business among its identifiable assets and liabilities. In language schools, this involves both tangible and intangible assets. Tangible assets may include classrooms, furniture, computers, and IT infrastructure. However, the majority of the school’s value is embedded in intangible elements, such as student enrolment contracts, proprietary curricula, teaching methodologies, and the reputation and expertise of instructors.

Correct allocation ensures that each asset is recorded at fair value, reflecting both its current contribution and expected future economic benefits. Misallocation can distort financial statements, inflate goodwill, or result in inappropriate amortization schedules. In addition, inaccurate PPA can impact strategic decisions post-acquisition, including budgeting for teacher training, curriculum development, or marketing campaigns.

Identifying Tangible and Intangible Assets in Education

Tangible assets in language schools typically include classroom equipment, audiovisual systems, office furniture, IT infrastructure, and property improvements. While these are essential for the operational functioning of the school, they often represent a smaller proportion of the acquisition’s total value. Intangible assets, however, contribute significantly to future revenue streams and strategic growth.

Student enrolment contracts, for example, represent predictable revenue over a specified period. Proprietary curricula, lesson plans, and online learning platforms allow the school to differentiate itself in a competitive market. Similarly, experienced instructors enhance brand value and attract both new students and corporate clients seeking language training programs. Understanding the economic significance of each intangible asset ensures accurate recording and supports strategic planning for post-acquisition growth.

IFRS 3 Considerations for Language Schools

Key Requirements of IFRS 3

IFRS 3 provides the accounting framework for business combinations, requiring companies to identify and measure the fair value of all acquired assets and assumed liabilities. For language schools, this involves a meticulous review of tangible assets, intangible assets, and contingent liabilities. Proper identification of intangible assets such as student enrolment contracts, proprietary teaching content, and instructor expertise is crucial. The residual value, after allocating the purchase price to identifiable assets and liabilities, is recorded as goodwill, representing synergies and other unquantifiable benefits derived from the acquisition.

Compliance with IFRS 3 ensures that financial statements accurately reflect the school’s economic reality, providing stakeholders with reliable information for decision-making, planning, and reporting. Furthermore, following IFRS 3 allows management to assess the strategic contribution of acquired assets to future revenue, identify areas for operational improvement, and anticipate potential risks associated with intangible assets.

Challenges for SMEs in Education

Small and medium-sized educational institutions face unique challenges in implementing IFRS-compliant PPA. Limited internal resources and accounting expertise can hinder the identification, measurement, and documentation of intangible assets. Student enrolment contracts vary in length, renewal likelihood, and tuition fees, making revenue projections uncertain. Proprietary curricula or online learning platforms may lack comparable market transactions, complicating valuation. Similarly, the expertise and reputation of instructors are subjective but materially impact the school’s future performance.

External valuation experts or specialized consultants often provide guidance in these scenarios, offering methodologies to quantify the value of intangible assets. Properly documented assumptions and transparent reporting are crucial for audit defensibility, regulatory compliance, and strategic decision-making.

Strategic Benefits of IFRS 3 Compliance

Compliance with IFRS 3 provides both regulatory and strategic advantages. Accurate PPA allows management to understand which assets drive revenue and profitability, enabling more informed decisions regarding student retention programs, curriculum investments, staff training, and marketing initiatives. For example, if analysis shows that advanced language programs or online course platforms generate higher revenue per student, management can prioritize resources to expand these offerings.

Additionally, IFRS-compliant PPA enhances investor confidence by presenting transparent and reliable financial statements. Accurate recognition of intangible assets ensures that amortization schedules, impairment testing, and goodwill calculations reflect economic reality. This transparency strengthens the school’s credibility with auditors, investors, and regulatory authorities, supporting long-term growth and financial stability.

Asset Valuation Methodologies for Language School Assets

Earnings Projection Method

The income-based approach links asset value to expected future cash flows generated by each asset. In language schools, this involves projecting tuition revenue, considering student retention rates, contract renewals, and incremental revenue from specialized courses. Proprietary online platforms, additional learning materials, and franchise rights also contribute to future cash flows and are included in the valuation. Discounting projected revenues to present value reflects both the time value of money and inherent risks, providing a defensible framework aligned with IFRS reporting requirements.

Market Multiples Valuation

The market-based approach evaluates similar educational institutions or language schools that have been acquired or sold recently. While finding exact comparables may be challenging due to unique curricula and regional differences, benchmark multiples and transaction data from similar businesses help validate income-based valuations. Market-based approaches also enhance credibility with auditors, regulators, and potential investors by demonstrating external validation of valuation assumptions.

Investment Cost Estimation

The cost-based approach estimates the replacement or reproduction cost of tangible and intangible assets. Classroom equipment, IT infrastructure, and physical facilities can be valued based on replacement cost, while proprietary curricula or online platforms may be measured using development costs or licensing fees. While cost-based methods may undervalue certain intangible assets like student enrolment potential or instructor reputation, they provide a baseline for understanding tangible asset contributions and inform sensitivity analyses for overall valuation.

Integrated Valuation Model

Combining income-based, market-based, and cost-based approaches ensures a comprehensive and balanced assessment of purchase price allocation. Income-based approaches capture revenue potential, market-based approaches validate assumptions against external data, and cost-based approaches provide a practical perspective on tangible assets. Using a multi-method framework enhances transparency, supports audit defensibility, and aligns with IFRS 3 requirements, making the allocation both credible and strategic.

Primary Obstacles in Allocating Purchase Price for Language Schools

Valuing Student Enrolment Contracts

Student enrolment contracts are a primary revenue source but are inherently variable. Factors such as contract length, tuition rates, retention probability, and future growth potential must be carefully considered. Overestimating contract value can inflate goodwill and result in unrealistic amortization schedules, while underestimation may lead to undervaluing the acquisition and misinforming strategic decisions.

Assessing Instructor Expertise and Proprietary Curriculum

Instructor expertise and proprietary curriculum significantly affect student outcomes and revenue. However, quantifying these assets is challenging due to their qualitative nature. Reputation, experience, certifications, and ability to attract and retain students must be factored into valuation models. Properly assessing these contributions ensures that intangible assets are fairly represented in the PPA and supports long-term planning for talent retention and curriculum development.

Documentation and Audit Readiness

Maintaining thorough documentation of assumptions, methodologies, and calculations is essential for IFRS compliance and audit readiness. Transparent reporting reduces the risk of disputes with auditors, regulators, and potential investors. Failure to document the PPA process can result in regulatory adjustments, financial misstatements, or reputational damage, particularly for SMEs seeking credibility in competitive education markets.

Management Implications of Accurate Purchase Price Allocation

Supporting Operational and Strategic Decisions

Accurate PPA provides visibility into the true drivers of revenue and profitability, enabling informed strategic decisions. For example, identifying high-value programs or courses allows management to invest selectively in expanding offerings, improving marketing efforts, or enhancing teaching quality. Clear insights into asset contribution support better resource allocation and operational efficiency, ultimately improving student satisfaction and retention.

Reducing Regulatory and Audit Risk

Proper allocation of purchase price ensures that tangible and intangible assets are recorded at fair value, minimizing regulatory and audit risks. Accurate measurement of goodwill, amortization, and deferred taxes ensures IFRS compliance and prevents unexpected financial adjustments. Transparency in the PPA process reassures auditors, investors, and regulators of the institution’s financial integrity.

Enhancing M&A Negotiations and Investor Confidence

Defensible purchase price allocation strengthens negotiating positions during acquisitions or investment rounds. Highlighting the value of student contracts, instructor expertise, and proprietary curricula helps justify acquisition premiums and enhances investor confidence. Transparent valuations also facilitate post-acquisition integration, ensuring that financial planning and operational strategy align with the actual economic contribution of each asset.

Conclusion

Allocating purchase price in language school acquisitions is a complex yet essential process that combines accounting accuracy, strategic insight, and regulatory compliance. SMEs in the education sector must carefully identify, measure, and document both tangible and intangible assets—from classrooms and IT infrastructure to student enrolment contracts, proprietary curricula, and staff expertise. Accurate language school purchase price allocation not only supports education IFRS reporting but also enhances strategic planning, operational efficiency, audit defensibility, and investor confidence.

As language schools increasingly rely on intangible assets for revenue generation and competitive differentiation, proper PPA becomes a strategic tool, empowering management to leverage acquisitions effectively, maintain regulatory compliance, and drive sustainable growth in a knowledge-driven education economy. By education IFRS reporting integrating multiple valuation methodologies, documenting assumptions rigorously, and aligning with IFRS 3 standards, institutions can ensure that acquisitions reflect true economic value, support operational objectives, and create long-term stakeholder trust.