IFRS Tips for Business Valuation Allocation in Creative Agencies

IFRS Tips for Business Valuation Allocation in Creative Agencies

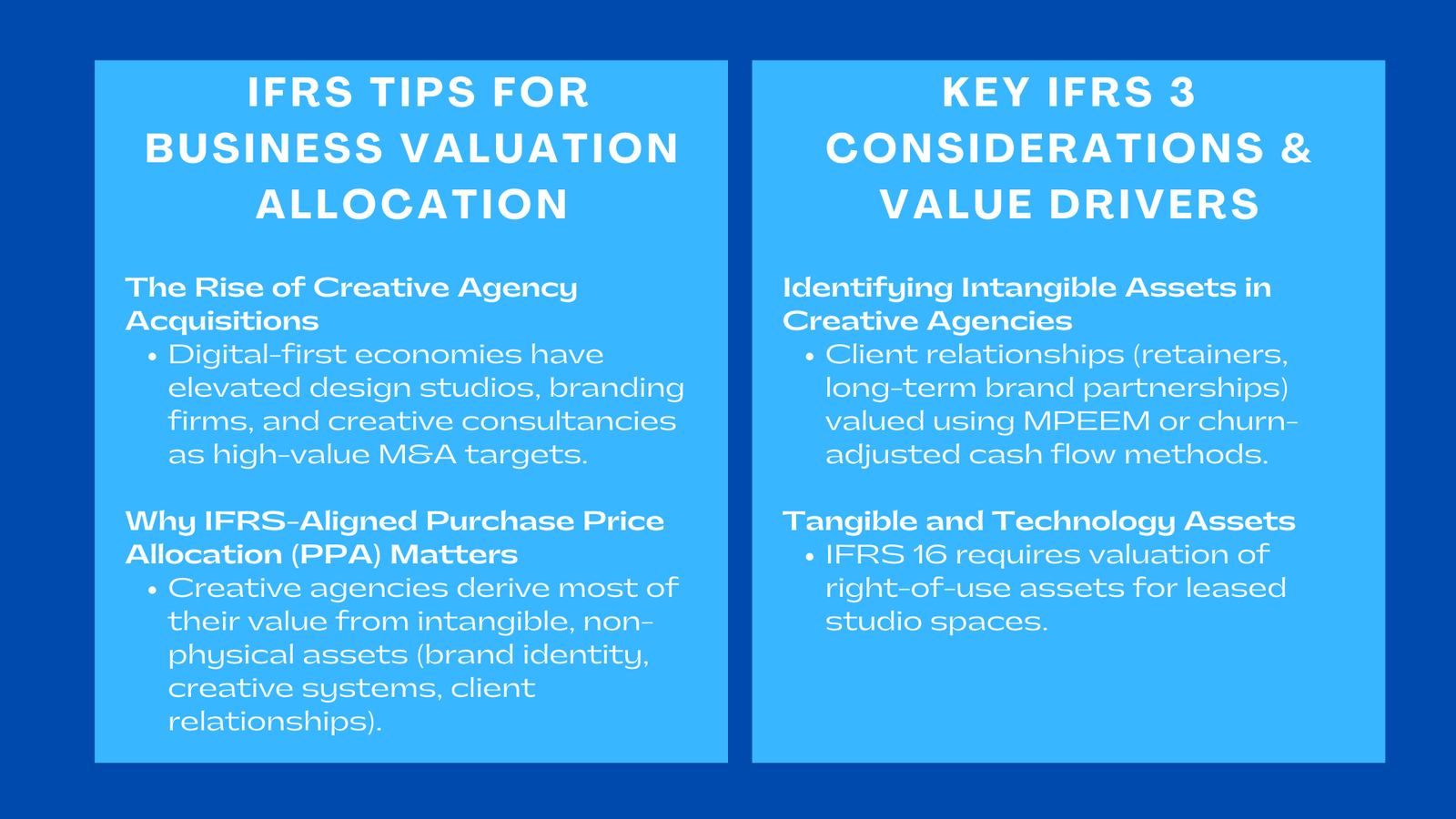

Increasingly popular targets of acquisition in the current digitally driven economies via content-based brand engagement and digital marketing agencies are now being taken by creative agencies, whether design studio, branding agency, digital marketing agency, or creative strategy consultancy. As companies in all industries strive to have greater online presence, creative agencies have turned into significant collaborators, influencing how companies speak, distinguish, and establish customer loyalty. This emerging economic salient has sparked the desire and attention of more private equity groups, hybrid consultancy firms, technology platforms and global marketing conglomerates that are actively seeking acquisition as a strategy to increase creative capacity.

The necessity to properly allocate the purchase price to IFRS requirements, achieved through creative agency acquisitions, is becoming highly urgent with the increase of M&A activity. In contrast to other industries where value is pre-determined by tangible resources, creative agencies base most of their value on non-physical factors which include brand identification, artistic-creative abilities, proprietary creative process, and relations with clients and reputation of their design procedures. These immaterial elements can be immersed in artistic culture and intellectual work and need to be identified and valued in line with the IFRS 3.

Purchase price allocation not only provides a creative agency purchase price allocation view of the financial reporting but also assists the ones who made the acquisitions to know what the elements of the agency value are realistically transferable, which is based on human capital, and which may hold strategic potential in the future. In the case of design studios, where creative, innovative and brand perception comprises the greatest share of economic value, informed approach of PPA is more than required to comply and integrate in the long term.

Understanding the Nature of Economic Value in Creative Agencies

Why Creative Agencies Present Unique Challenges for Valuation Allocation

Creative agencies adhere to business models that are based on talent and idea-driven. Their sources of revenue are through developing visual identities, digital content, brand strategy development, campaign development, and offering design-thinking. The very key to the economy is the potential to visualize and provide innovative solutions to satisfy the clients. This value is always in its pure form and commonly created via internal developed artistic procedures or communal creative tradition which implies that the worth of the agency is rarely taken into account in the Financial statements, making frameworks such as the business combinations accounting and valuation Singapore training course highly relevant for understanding how such internally generated value is treated during acquisitions.

The other characteristics of this industry are high client stickiness particularly where the agencies are characterized with excellent creative chemistry, reliability and understanding of strategies. Retainer client base Demand It has long-term retainer customers, proprietary creative tools, iconic brand portfolios and award-winning work to the tune of material value. Nevertheless, according to the rules of IFRS, only identifiable intangible assets, i.e. the ones that can be separated or identified as a result of a contractual or other legal rights, should be recognized separately. A good part of the creativity culture, talent synergy, and the quality of ideation is also put under goodwill.

Since creative agencies tend to be diverse in terms of specialization, be it in digital illustration, UX design, motion graphics, branding strategy, experiential design or advertising production, the intangible assets, in terms of nature and duration, should be evaluated diligently. The value of customer relationships can be higher in the case of agencies that have proven experience of keeping retailers stable whereas in the case of agencies that work on a project basis they might have a fluctuating cash flow. The reason behind this fluctuation is important in proper purchase price allocation.

Applying IFRS 3 to Creative Agency Acquisitions

Identifying and Measuring Intangible Assets in Design Studios

The IFRS 3 mandates that the acquiring entities record identifiable intangible assets at fair values. The creative agencies have these resources but usually in the form of client relations, brand names, proprietary creative systems, unique design templates, copyrighted properties, digital libraries, and technical resources employed in assisting workflow and production performance. A significant number of these assets are internally created and never existed in financial reports before, but they have to be valued upon acquisition when they satisfy the criteria of identifiability.

A benchmark of the relationship with a client is the significant portion of the intangible element. This is because creative agencies, which have a recurrent engagement i.e. retainer contract, long-term contract to partner with a brand or subscription-oriented design services, mean that a creative agency has a valuable intangible asset that generates predictable revenue. Such assets should be valued with the help of the methods of multi-period excess earnings or churn-adjusted discounted cash flow models which state the behavioral dynamics of the client portfolio.

The creative agency can have brand-related assets such as agency trademarks, visual identities system, proprietary design philosophy as well as reputational value in light of recognitions or awards. The high brand equity of design studios can also allow them to set high prices and appeal to the clients with high value, which should be measured in fair value.

Original, designed artwork, motion graphics assets, permanent catalogs of photography, proprietary illustration styles, etc. can also be considered identifiable intangible assets in the event that they are transferable and give rise to continuing economic advantage. They are based on their uniqueness, re-usability, potential to license, and help the agency to provide efficient services.

Considering Workforce and Creative Culture Under IFRS

The creative agencies are essentially talent-based organizations. Creative strategists, brand consultants, seniors in designing, writing and art direction have major power over the project. In spite of the fact that IFRS does not allow the recognition of assembled workforce as an intangible asset, the pool of talent, on the one hand, contributes significantly to the goodwill. This difference is essential in the valuation of creative agencies since most of the economic value will be essential to be captured under the goodwill in adherence to IFRS 3.

The distinctive creative culture of collective working patterns, style identity, design doctrines as well as the interaction and communication are not separable according to the IFRS, but fundamental to future cash flow anticipations. These cultural drivers have been plowed in goodwill and not as single intangible assets given the capability of the agency to be innovative and adaptable.

Key Components of Purchase Price Allocation in Creative Agencies

Tangible Assets in Creative Studios

Creative agencies tend to hold on to few tangible resources in relation to other industries. Their physical asset base usually consists of the office equipment, the high performance computers, digital drawing equipment, photography equipment, video production equipment, and studio furnishing. Although the assets are required in the conduct of operations, they constitute a small part of total value and they should be appraised in normal fair market valuation methods.

The leasehold improvements can comprise a bigger part of the tangible assets of agencies having their own dedicated studios that will stimulate creativity and ideas via teamwork and quality production. According to IFRS 16, the right-of-use assets of the leased premises have to be addressed and estimated in terms of a contractual agreement and economic profit.

Intangible Assets: The Primary Source of Creative Agency Value

The allocation of valuation is mostly done in intangible assets in creative agencies. The close relationships with clients tend to be the most effective part of it since design studios are based on long-term projects and brand management solutions. Risk valuation needs to address client concentration risk, the stability of retainers, client renewed, strategic client significance and matchage between clients and agency expertise and client requirements.

The brand identity of the agency is also another significant intangible factor. An excellent creative organization that has a high profile, many awards, or notable artistic identity has a greater presence on the market. The fair value of agendas brand assets can be determined by relief-from-royalty models which in its estimation suggest the hypothetical cost of licensing the same brand value.

Intangible assets may also be so-called proprietary creative processes, methodologies, frameworks, or production systems that are documented well and portable. Creative agencies frequently work out systematic branding systems, digital user experience principles, content creation platforms or exclusive storytelling systems that make them stand out in the market.

Software applications, online libraries, designed plug-ins, animation structure, available templates, and recyclable design blocks can also contribute quantifiable economic worth when decreasing the duration of development, or establishing a potential licensing.

Goodwill and its Relevance in Creative Agency Valuation

The residual value is then taken to be goodwill following the fair valuation of the identifiable assets. The amount of goodwill in a creative agency acquisition can easily constitute a significant portion of total acquisition consideration because of the great impact of creative culture, organizational synergy, artistic talent, and future growth potential on economics.

The goodwill identifies those that are not identifiable under IFRS e.g. creative intuition, team chemistry, management vision, agency positioning and the experience that the staff has had in dealing with different industries. Such non-monetary yet important traits are the cause of differentiation, customer retention and brand equity, whereby goodwill plays a crucial role in valuing creative agencies.

External Factors Influencing IFRS Valuation in Creative Agencies

Market Dynamics, Competition, and Industry Evolution

Creative agencies are under high energy conditions due to the ability to use technology, design trends, online revolution, and client demands. The trends toward usage of AI-supportive design, data-driven creativity, short-form content and immersivity impact revenue models and the value of an intangible asset. The level of competitive intensity is an issue. In markets that are well-saturated, the pricing pressure can be experienced by the agencies, whereas the availability of a niche studio where unusual skills or known styles of creative work are rare can be valued at a higher price.

Client Behavior and Revenue Stability

The cycles in the industry, marketing budget, brand priorities, and the capacity of the agency to produce work of high and consistent quality affect the client relationships in the creative agencies. Customers who can remain with the company long-term increase the customer relationship assets value, whereas customers who make their relationships based on projects will cause a higher uncertainty. The valuation models have to strike this dynamic by right discounting, retention assumptions and cash flow forecasts.

Integration Synergies After Acquisition

In cases where small agencies are sold to larger firms, planned synergies are achieved e.g. increasing the number of clients served, common technology base, cross-sales, greater brand exposure and marketing ecosystems adding to goodwill. Such synergies facilitate benefits in the future, and how much will stay in goodwill as opposed to identifiable assets.

Conclusion to IFRS Tips for Business Valuation Allocation in Creative Agencies

The allocation of purchase price according to the IFRS requirements of creative agency acquisitions is complicated, so that what is transmitted between the design, creativity, strategy, and artistic culture into the economic value requires profound knowledge of how the organization works. Most of the value of creative agencies comes in the form of intangible assets such as relationships with clients, brand name, proprietary process, digital libraries, and stylistic reputation whereas synergy and culture among talents also impact heavily on goodwill.

A stringent PPA method facilitates the acquisition decision makers to properly allocate purchase consideration, adhere to the reporting requirements of IFRS design studio reporting and also learn the key long-run value drivers which determine the growth potential. With creative services moving forward and enabling digital technologies, information-driven solutions, and immersive nature, effective ability to be evaluated transparently and through disciplined PPA methods, are critical to maintaining the trust of the investors and direct strategic decisions of M&A.