Learn How Purchase Price Accounting Works

Purchase Price Accounting Explained: Definition, Goodwill Treatment, GAAP Rules, and Practical Examples

Guide to Learn How Purchase Price Accounting Works

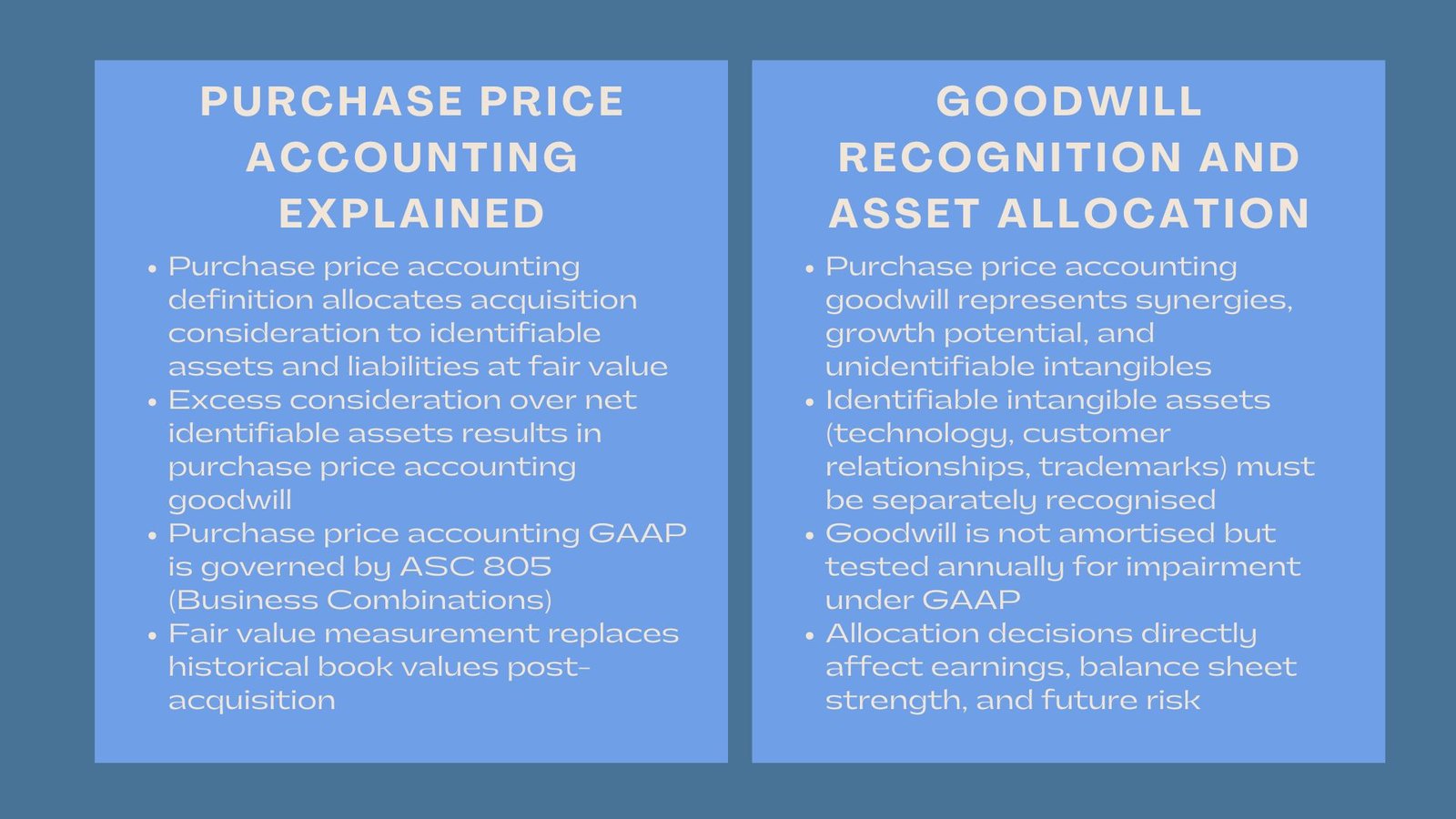

The financial success of a deal is not terminal in the end of a merger and acquisition. The purchase price accounting definition is one of the most important post-transactions processes that define the way the acquisition price will be divided among identifiable assets, liabilities, and goodwill. The implication of this process extends its effect on financial reporting, prospective earnings, regulatory adherence, and decision-making among the stakeholders.

To the finance leaders, auditors, investors, and valuation professionals, purchase price accounting is critical towards the interpretation of the performance of acquisitions. In this paper, the purchase price accounting is discussed in a detailed and well-organized manner with a clear definition of purchase price accounting, a detailed purchase price accounting example, purchase price accounting goodwill, and the role of purchase price accounting gaap that controls the whole process.

1. Purchase Price Accounting Definition and Its Strategic Importance

The purchase price accounting definition is the accounting method followed by an acquiring company to assign the total amount of consideration paid in a business combination to identify assets acquired and liabilities assumed in the business combination and measured at their fair values as of the acquisition date. Goodwill is recognised in respect of any amount by which the purchase consideration exceeds the net fair value of identifiable assets and liabilities.

This definition is the conceptual basis of acquisition accounting and holds the transactions to be recorded at the economic substance as opposed to historic book values. In purchase price accounting gaap, this procedure is obligatory to all business combinations that qualify to be termed as an acquisition.

Strategically, purchase price accounting definition is important as it has a direct impact on post acquisition depreciation, amortisation, impairments testing and reported earnings. The same deal value of two different acquisitions may allow entirely different financial results based on the purchase price accounting approach used.

2. Regulatory Framework: Purchase Price Accounting Under GAAP

Under the US GAAP, the regulations of purchase price accounting gaap are mostly stipulated in ASC 805, Business Combinations. The mandatory rules in this standard include the application of the acquisitions method by the acquirer, the date of the acquisition, the consideration transferred, recognising identifiable assets and liabilities at a fair value, and recognising goodwill in a bargain purchase or a gain.

Under purchase price accounting gaap, identifiable assets are both tangible and intangible assets, as long as they satisfy recognition requirements. The intangible assets like customer relationships, trademarks, technology, and non-compete agreements should be recognised separately of goodwill in case they can be identified.

GAAP focuses on the fair value measurement which in many cases necessitates valuation methods which may be income-based, market-based or cost-based methods. Therefore, purchase price accounting is directly related to valuation expertise and financial modelling.

3. Identifying Assets and Liabilities in Purchase Price Accounting

The step which comes after application of purchase price accounting definition in practice is identification of all assets purchased and liabilities incurred. This step is very vital since omissions or misclassifications may be of a material nature and can significantly affect the results of financial reporting.

The purchase price accounting gaap does not restrict assets to those that are listed in the balance sheet of the acquirer before the purchase. Unrecognised internal generated intangible assets including proprietary technology or customer contracts now have to be identified and isolated.

The outcome of this process is usually a large step-up of the asset values relative to the book values in the past. This step is among the most influential of purchase price accounting since the reason behind future amortisation and depreciation is remeasurement to fair value.

4. Purchase Price Accounting Goodwill: Concept and Treatment

Purchase price accounting goodwill occurs when the amount paid in total consideration is more than the fair value of identified net assets acquired. Goodwill is in terms of future economic benefits of assets which cannot be identified or recognised separately, that is, synergies and work force skill, brand reputation and future growth.

In purchase price accounting gaap, the goodwill is recorded as an indefinite intangible asset. It is not amortised as other intangible assets, but rather impaired or more often when triggering events take place annually.

Goodwill of purchase price accounting is a significant influence on the financial performance measures. Although goodwill has no impact on earnings by way of amortisation, impairment losses can be high and unexpected with resultant drastic slumps in the reported profits and trust.

It is therefore important that stakeholders who are evaluating the success of an acquisition understand how goodwill is determined and tracked.

5. Purchase Price Accounting Example: Step-by-Step Illustration

An example of purchase price accounting can be applicable in practical situations to assist in understanding how the theories apply to actual transactions. Take the example of an acquiring firm which buys a target firm at USD 100million in cash.

According to the definition of purchase price accounting, the acquirer determines and calculates the fair value of the target assets and liabilities. Suppose that tangible assets have a fair value of USD 40 million, identifiable intangible assets are worth USD 35 million and assumed liabilities are USD 15 million. The identifiable net assets are hence USD 60million.

The purchase identification of USD 100 million less the net identifiable assets of USD 60 million, will lead to purchase pricing accounting goodwill of USD 40 million. This goodwill is observed in the balance sheet of the acquirer and subjected to impairment during the later periods.

The given purchase price accounting example shows that the end results of valuation can have a direct effect on goodwill and future financial reporting.

6. Impact on Financial Statements and Performance Metrics

The use of purchase price accounting gaap redefines the post acquisition balance sheet and income statement. The assets are listed at fair value and not historical cost which escalates depreciation and amortisation costs in the future.

This distribution of identifiable intangibles and purchase price accounting goodwill is especially significant. Increased amortisable intangible assets establishment decreases short-term earnings, whereas an increased amount of goodwill balance could maintain short-term profit levels, but raises long-term risk of impairment.

Analytically, investors and analysts tend to manipulate reported earnings by adding amortisation expenses of acquisition, and therefore, disclosure of purchase price accounting is important.

7. Common Challenges and Judgement Areas

Purchase price accounting gaap involves a lot of professional judgement despite obvious guidance. The estimation of fair value of intangible assets involves assumptions of future cash flows, discount rates, life of the assets and future market.

Another area of complexity is to determine what should be included in purchase price accounting goodwill and what should be included in identifiable intangible assets. Excessive allocation of value to goodwill can be open to regulatory review and under-allocation may encourage manipulation of earnings by excessive amortisation.

Due to these, purchase price accounting analyses are carefully scrutinized by the auditors, and aggressive assumptions are also likely to be challenged by regulators, especially where large or transformative acquisitions are involved.

8. Best Practices for Robust Purchase Price Accounting

In order to implement the purchase price accounting definition, best practice entails early planning, inter-functional cooperation and involvement of skilled valuation specialists. Legal, tax, finance, and valuation teams should be oriented to make the management consistent in its assumptions and results.

Valuation procedures, assumptions, and findings are well documented that justifies adherence to purchase price accounting gaap and improves audit defendability. It is further enhanced by effective transparency in the disclosure of major judgements on purchase price accounting goodwill thus enhancing the confidence of the stakeholders.

9. Conclusion: Why Purchase Price Accounting Matters

Purchase price accounting is not just a technical necessity in contemporary M&A deals, but it is a strategic condition of post-deal financial success. The purchase price accounting definition is understood clearly, and the allocation of consideration of acquisition is done correctly, whereas a practical perspective on a purchase price accounting example brings the definition to its practical sense.

The goodwill of purchase price accounting determines the strength of balance sheet in the long term and the risk of impairment and the compliance to the purchase price accounting gaap is the foundation of credibility of transparency and compliance. With increasing complexity of deal structures and transaction value increasingly being comprised of intangible assets, purchase price accounting mastery is a critical skill set of professionals in the world of global M&A today.