Mergers Acquisitions PPA Valuation Training

Understanding Purchase Price Allocation: Comprehensive Guide for Modern M&A Transactions

Introduction to Mergers Acquisitions PPA Valuation Training

The accountability of arriving at the fair value of the assets and liability of the acquired business has become the foremost requirement in the contemporary context of merger and acquisition. Investors, decision-makers and transaction advisors are growing more interested in understanding purchase price allocation what is it, how it works in practice, and why it has a direct impact on post-deal financial reporting and long-run value creation. A properly carried out allocation is not only necessary to ensure accounting standards are met but also to allow the buyers to comprehend the actual motives behind the enterprise value, tax implications and subsequent income, among others.

This paper will describe purchase price allocation to the buyer in detail, discuss the classification method, intangible assets valuation, and purchase price allocation customer contract treatment, explanations of purchase price allocation analysis of deferred revenue, and obligations such as liability to contingency purchase price allocation. At the conclusion, the reader will have an overall picture of the influence of PPA on the strategic, financial, and operational performance.

Defining Purchase Price Allocation in a Modern M&A Context

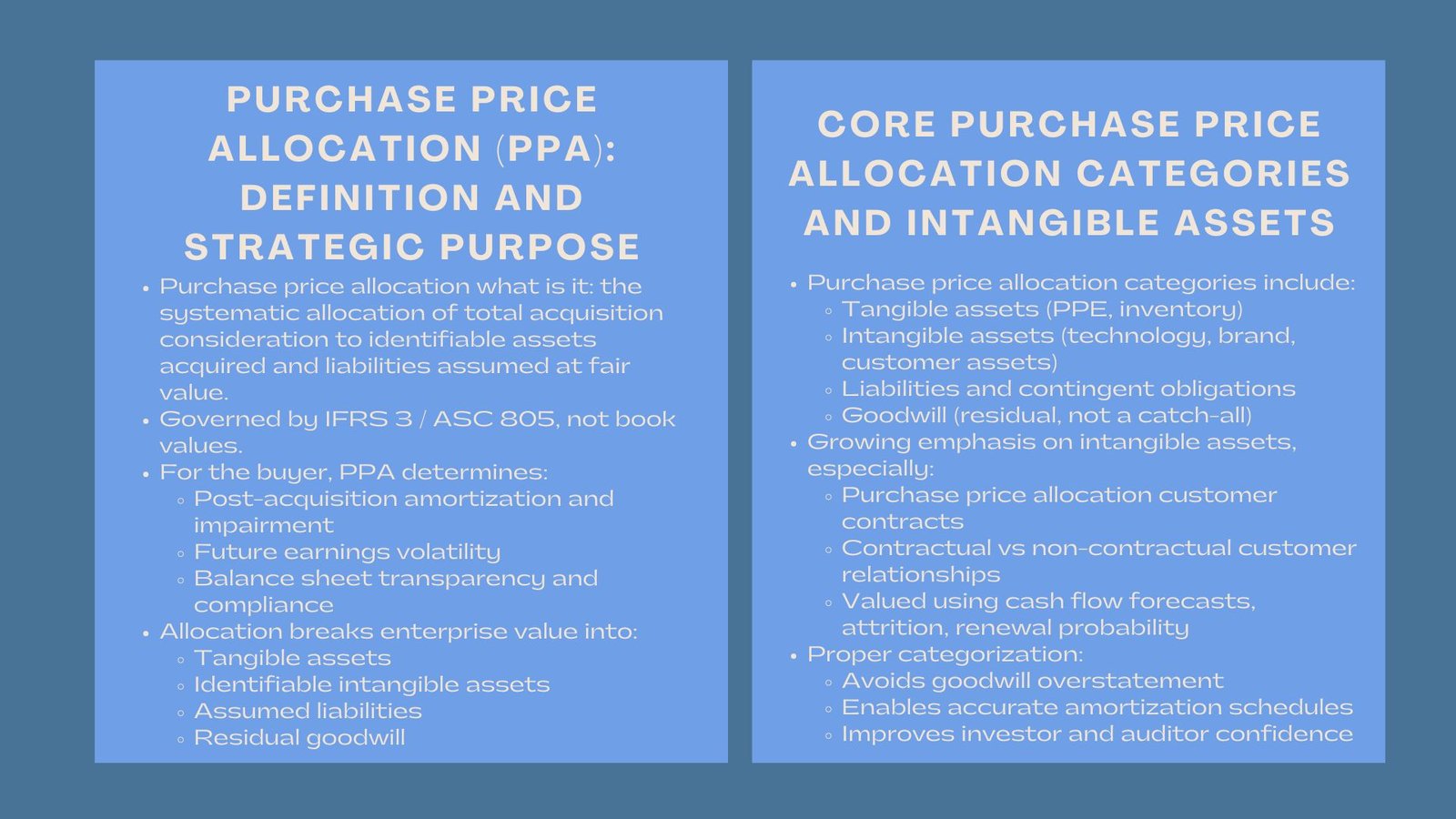

The initial query the stakeholders tend to ask themselves is purchase price allocation what is it and why does it matter? The term is defined as the methodical procedure of attributing the entire consideration paid in a business mix to identifiable assets gained and liabilities acquired at the purchase date. Accounting standards like IFRS 3 and the ASC 805 have stipulated that such allocation should be based on fair value as opposed to book value.

In the light of purchase price allocation to buyer, the process identifies how the transaction will be recorded in the financial statements, and more importantly, how future amortization charges and impairment charges can affect the reported profitability. The allocation step lends some sanity to the elements of the transaction, such that purchase consideration is linked to tangible assets, intangible assets, assumed obligations, and residual goodwill.

It is not only through this analysis that buyers become technically compliant, but it helps them to see where the real value lies in the entity that is acquired. It can be the relationships with customers, with technology, with trademarks, non-contractual, each of these categories is a part of the bigger story of revenue generation in the future and risk evaluation.

Understanding Purchase Price Allocation Categories and Their Strategic Impact

An important aspect of the process is the identification and assessment of purchase price allocation categories. Classification is not random; it has to have economic substance, legal rights and the power of assets to produce quantifiable benefits. The allocation usually starts with tangible assets, such as property, plant, equipment, inventory, and real estate, but in modern transactions, the focus is usually put on intangible assets.

With more modern enterprises gaining value through intellectual property, proprietary data, algorithms and customer related assets, intangible categories have increasingly grown complex in nature. This necessitates proper allocation among identifiable intangible assets instead of having excessive value in residual goodwill. Goodwill should not be overstated as this can result in subsequent impairment effort, whereas a well-developed identification of intangible assets helps to come up with better amortization schedules and more precise valuation models.

The classification phase further ensures the accounting outcome is consistent with the views of the management regarding performance drivers hence supporting strategic planning and communication with investors.

Valuing Customer Relationships and Purchase Price Allocation Customer Contracts

Customer Contracts Purchase price allocation Customer contracts are one of the most important intangible aspects in M&A dealings. These contracts are often forecasts of predictable revenue, long-term business relationships and retention, which impact the cash flow forecasts.

When it comes to the allocation process, the customer related assets are normally described as contractual agreements, non-contractual relationships, customer lists, and recurring subscription or service arrangements. The fair value of these assets will be determined on the basis of the number of years in contracts, likelihood of renewal, customer churn rate, the purchasing history, and economic advantages due to the continuity of the relationship.

Proper identification and appreciation of these contracts are very critical in buyers who are relying on reliability of future revenue. The failure to value these assets properly may result in misrepresentation of revenues, a misalignment in amortisation schedule or unexpected impairment charges. The idea of customer relationship valuation thus takes the centre stage in financial reporting and therefore strategic decision-making.

Analyzing Purchase Price Allocation Deferred Revenue in Financial Reporting

Another complex component of modern allocations is the treatment of purchase price allocation deferred revenue. Deferred revenue represents payments received in advance for goods or services that have not yet been delivered. Although recorded as liabilities, deferred revenue has economic implications for both valuation and future profit recognition.

When the acquisition occurs, the deferred revenue is supposed to be revaluated to fair value which is usually lower than the original deferred revenue that was recorded on the balance sheet of the seller. This change can lead to a reduced acknowledged liability since only the costs are considered to satisfy the remaining liabilities and not the entire contractual revenue as under fair value.

The fair-value adjustment directly affects the income statement of the buyer. The revenue of the acquired post-acquisition will also decrease in the short term because of the less deferred revenue liability. Knowledge of this dynamic can aid buyers to predict a change in reported earnings after deals and internal and external alignment of expectations.

To the analysts and strategic leaders, the assessment of the deferred revenue as part of purchase price allocation is a necessary move to proper financial modeling and forecasting.

Recognizing Obligations in Contingent Liabilities Purchase Price Allocation

There are also uncertain obligations that the acquirers need to analyse under contingent liabilities purchase price allocation. The liabilities can be frequently based on the unresolved court cases, warranty issues, or claims of employees, or environmental risks. They are potential outflows which rely on the future events, and hence, the fair-value measurement of such is complex in nature.

Under the accounting standards, contingent liabilities are to be recognized in a business combination at fair value regardless of whether or not the likelihood of outflow satisfies the normal recognition requirements. This rule provides transparency and avoidance of underestimation of the risks that may come in place on the acquisition date.

To the buyer, the interpretation and measurement of these obligations affect not only the valuation, but also the bargaining plan, indemnification plans and risk-reduction plans. Contingent liabilities can have an impact on the consideration being transferred as a whole, future cash flows and strategic choices involved in integration or restructuring.

Proper identification of contingent liabilities will therefore help in informed decision-making as well as cushion buyers against unanticipated financial risks.

Interpreting Purchase Price Allocation for Buyer Decision-Making and Post-Deal Strategy

In the view of the purchase price allocation for buyers the exercise of allocation goes beyond accounting requirements. It offers information that guides the management on its perspective of value drivers, risks, and long term financial path of purchased business. Value allocation among the asset types determines the amortization costs, tax performances, key performance indices, and even the design of the future financing.

Knowledge of purchase price allocation what it is in practice, gives buyers the ability to predict the effects of the deal on EBITDA, net income, and capital structure. Proper allocation aids internal budgeting, long term forecasting and integration planning. It also increases the level of transparency to outside stakeholders and makes economic reality when it comes to reporting results.

The strategically approaching buyers would have more information on the commercial logic behind the transaction to more effectively match operational strategy with the results of financial reporting.

Conclusion: The Strategic Importance of a Thorough Purchase Price Allocation

In a time where intangible assets and intricate agreements, as well as contingent liabilities, are the new order in the business dealings, the meaning of purchase price allocation what is it, has become imperative to organizations that plan to merge and acquire firms. The allocation process determines the distribution of values among assets and liabilities and determines financial outcomes years after the transaction is completed.

Involved analysis of purchase price allocation categories, sound valuation of purchase price allocation customer contracts, proper accommodation of purchase price allocation deferred revenue and a close analysis of contingent liabilities purchase price allocation all make a transparent, compliant, and strategically oriented allocation.

To buyers the purchase price allocation is not only merely a requirement in financial reporting but also a guide on how to tell exactly what the nature of the business acquired is. Having it done with accuracy and with a strategic vision, it aids in making superior decisions.