Professional PPA Course for Accountants

Purchase Price Allocation for Accounting Firms

Introduction to Professional PPA Course for Accountants

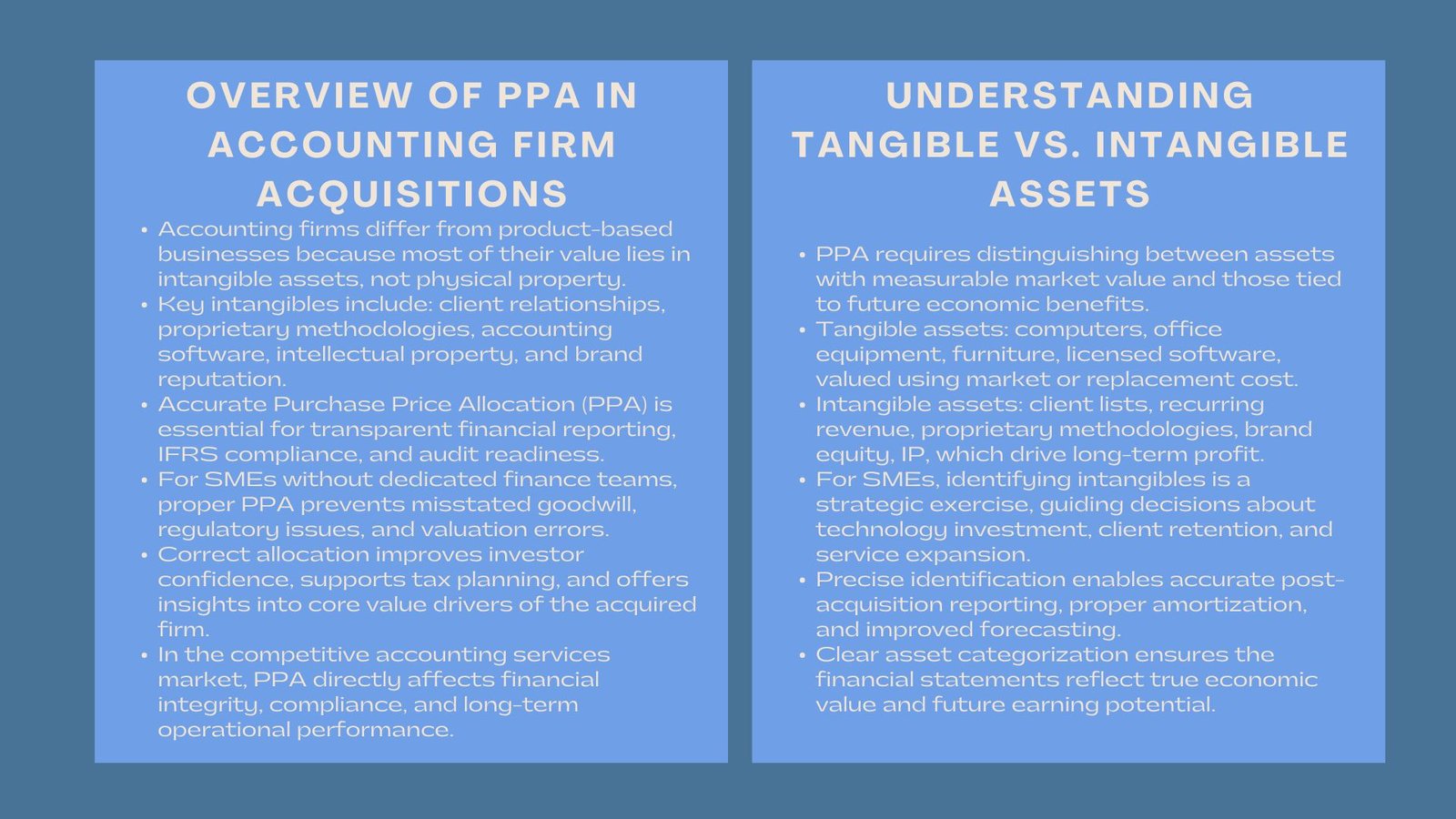

In the realm of mergers and acquisitions, accounting firms present unique challenges when it comes to valuation. Unlike product- or asset-heavy companies, such as those in manufacturing or retail, the majority of an accounting firm’s value lies in intangible assets rather than physical property. These intangible assets include client relationships, proprietary methodologies, specialized accounting software, intellectual property, and brand reputation. Correctly allocating purchase price in this context is not merely a technical accounting requirement but also a strategic necessity, especially for small and medium-sized enterprises (SMEs) that may lack dedicated finance or valuation teams.

Ensuring compliance with IFRS reporting for finance SMEs is critical, as the allocation of the purchase price directly impacts financial statements, taxation, investor confidence, and future decision-making. Accurate accounting firm purchase price allocation allows the acquiring firm to distinguish between tangible and intangible value, ensures transparency, mitigates regulatory and audit risks, and provides management with insight into the firm’s key value drivers. In the competitive accounting services market, where client loyalty and specialized expertise drive revenue, failure to properly execute PPA can have long-lasting consequences on operational performance and financial integrity.

The Concept of Purchase Price Allocation in Accounting Firms

Definition and Purpose of PPA

Purchase Price Allocation (PPA) is the accounting process of distributing the total acquisition cost of a business across its identifiable assets and liabilities. For accounting firms, this process requires special attention because a significant portion of the firm’s worth resides in intangible rather than tangible assets. Tangible assets, such as office equipment, computers, software licenses, or office furniture, are relatively straightforward to measure and value. In contrast, intangible assets—including client lists, recurring revenue streams, proprietary methodologies, and firm reputation—carry substantial economic value, yet they are difficult to quantify in objective terms.

The purpose of PPA is to ensure that all acquired assets are recorded at fair value in the acquirer’s books. This allows accurate post-acquisition financial reporting, supports tax planning, and informs strategic decisions related to the integration of acquired assets. Misallocation can result in inflated goodwill, misrepresented asset values, and potential complications during audits, regulatory reviews, or investor scrutiny. For SMEs, which often rely heavily on intangible assets, a clear and methodical allocation of purchase price is essential to maintaining transparency and fostering confidence among stakeholders.

Identifying Tangible Versus Intangible Assets

The process of identifying assets involves separating items that can be objectively valued from those whose value is largely derived from future earnings potential. Tangible assets, such as computers, office equipment, and furniture, are typically measured using market prices, replacement costs, or depreciated values. Intangible assets, however, include client contracts, recurring revenue streams, proprietary accounting methodologies, and intellectual property. These assets are crucial to an accounting firm’s ability to generate future profits, yet they lack a physical presence.

For SMEs, understanding the distinction between tangible and intangible assets is more than a compliance requirement. It is a strategic tool that informs decisions about which areas of the business are most valuable. For instance, client retention strategies, technology investments, and brand management initiatives can all be guided by a precise understanding of intangible asset value. Properly identifying these assets ensures that financial statements accurately reflect both current worth and future earning potential.

IFRS Reporting Considerations for Finance SMEs

Compliance with IFRS 3 in Accounting Firm Acquisitions

The International Financial Reporting Standard 3 (IFRS 3) provides the framework for accounting for business combinations. It emphasizes fair value measurement for all identifiable assets and liabilities and mandates the recognition of goodwill for any excess of purchase price over fair value. For accounting firms, this standard requires meticulous assessment of each asset, particularly intangible assets like client contracts, intellectual property, and proprietary software systems. The accurate application of IFRS 3 ensures that financial statements present a fair, comprehensive, and transparent picture of the firm’s financial position following a merger or acquisition.

Challenges Faced by SMEs

SMEs often encounter difficulties implementing IFRS reporting requirements due to limited internal expertise, smaller finance teams, and fewer resources for external valuation support. Valuing intangible assets, particularly client relationships and proprietary methodologies, can be especially challenging. Accurate valuation may require engagement of external experts, market research, and detailed cash flow modeling. Despite these challenges, adherence to IFRS reporting for finance SMEs ensures that financial statements comply with legal and regulatory standards, supports investor confidence, and minimizes the likelihood of disputes with auditors or tax authorities.

Strategic Benefits of IFRS Compliance

Beyond meeting regulatory requirements, IFRS-compliant PPA provides management with a strategic lens through which to assess the value of acquired assets. By understanding which assets are key revenue drivers, management can prioritize investments, optimize resource allocation, and make informed decisions about client retention strategies. Additionally, accurate recognition of intangible assets allows for proper amortization and impairment testing, ensuring that future financial reporting reflects the economic reality of the firm rather than arbitrary accounting assumptions.

Valuation Methodologies for Accounting Firm Assets

Income-Based Valuation Approach

The income-based valuation approach links asset value to the expected future cash flows generated by that asset. In accounting firms, client relationships, recurring billing streams, and proprietary methodologies are key drivers of revenue. This approach involves forecasting expected income from these sources over their useful life and discounting it to present value using an appropriate risk-adjusted rate. It provides a direct link between the economic benefits of intangible assets and their valuation, making it particularly suited to service-based businesses where revenue is tied to ongoing client engagement.

Market-Based Valuation Approach

The market-based approach relies on data from comparable transactions to establish benchmarks for asset value. While direct comparables may be scarce for accounting firms, examining recent acquisitions of firms of similar size, client profile, or specialization can provide valuable guidance. This approach allows SMEs to validate income-based valuations and ensures that assumptions align with market realities. Additionally, market-based approaches help in negotiating acquisitions by providing objective reference points that can be used to justify purchase price allocation decisions.

Cost-Based Valuation Approach

The cost-based approach estimates the value of an asset based on the cost to reproduce or replace it. This method is particularly effective for tangible assets like computers, office equipment, and furniture. However, it often undervalues intangible assets because it does not capture the revenue-generating potential of client relationships, proprietary methodologies, or brand reputation. Nevertheless, it can serve as a useful cross-check to ensure that valuations are reasonable and defensible.

Combining Valuation Approaches

The most reliable purchase price allocations incorporate multiple methodologies. Income-based approaches capture revenue potential, market-based approaches provide comparative validation, and cost-based methods verify the baseline value of tangible assets. For SMEs, this triangulation approach ensures a comprehensive, defensible valuation that can withstand regulatory, audit, and investor scrutiny. Combining methods also enhances the credibility of the allocation, particularly in cases where intangible assets constitute a significant portion of enterprise value.

Challenges in Allocating Purchase Price for Accounting Firms

Quantifying Client Relationships

One of the most difficult aspects of PPA in accounting firms is determining the value of client relationships. Clients differ in loyalty, contract duration, and revenue potential. Forecasting future revenue from these clients requires analysis of historical billing, attrition rates, contract terms, and potential for cross-selling additional services. Misjudging the value of client relationships can result in either overstatement or understatement of goodwill, affecting future amortization and impairment testing.

Assessing Proprietary Methodologies and Expertise

Proprietary methodologies, software tools, and specialized expertise are intangible assets that provide competitive advantage. Assigning value to these assets requires evaluation of their contribution to revenue, cost savings, or client retention. Additionally, the expertise of senior partners, managers, and niche specialists must be considered, as human capital is often a key driver of client satisfaction and firm reputation.

Documentation and Defensibility

SMEs must document all assumptions, methodologies, and data sources used in the valuation. Proper documentation ensures audit defensibility and regulatory compliance. Without thorough records, valuation allocations may be questioned by auditors or regulators, creating potential financial and reputational risk.

Strategic Importance of Accurate Purchase Price Allocation

Informing Business Decisions

Accurate PPA allows management to identify which assets generate the most value. For SMEs, this insight informs investment decisions, resource allocation, and client retention strategies. It also provides guidance for long-term strategic planning and operational improvements, ensuring that capital and human resources are directed to areas that maximize enterprise value.

Reducing Regulatory and Audit Risks

Proper allocation supports transparency in financial reporting, mitigating risks of misstatements, audit adjustments, or disputes with tax authorities. SMEs with smaller finance teams can rely on accurate PPA to demonstrate compliance, reducing exposure to penalties and reputational damage.

Enhancing M&A Negotiations and Investor Confidence

A credible purchase price allocation strengthens negotiation positions in mergers and acquisitions. Buyers are more likely to pay a premium when intangible assets are clearly identified and defensibly valued. Conversely, sellers can justify asking prices with well-documented allocations, enhancing investor confidence and supporting successful post-acquisition integration.

Conclusion

Purchase price allocation for accounting firms is a multifaceted exercise that combines accounting compliance, financial strategy, and regulatory oversight. For SMEs in the finance sector, adherence to IFRS reporting for finance SMEs is essential to accurately value both tangible and intangible assets. A properly executed PPA provides transparency, audit defensibility, and strategic insight into the firm’s core value drivers. As accounting firms increasingly rely on IFRS reporting for finance SMEs intangible assets to generate revenue and maintain competitive advantage, accurate allocation of purchase price becomes a critical tool, enabling management to leverage acquisitions effectively, ensure regulatory compliance, and drive sustainable growth in an increasingly knowledge-driven economy.