Professional Small Restaurant PPA Training

How Small Restaurants Allocate Purchase Price

Introduction to Professional Small Restaurant PPA Training

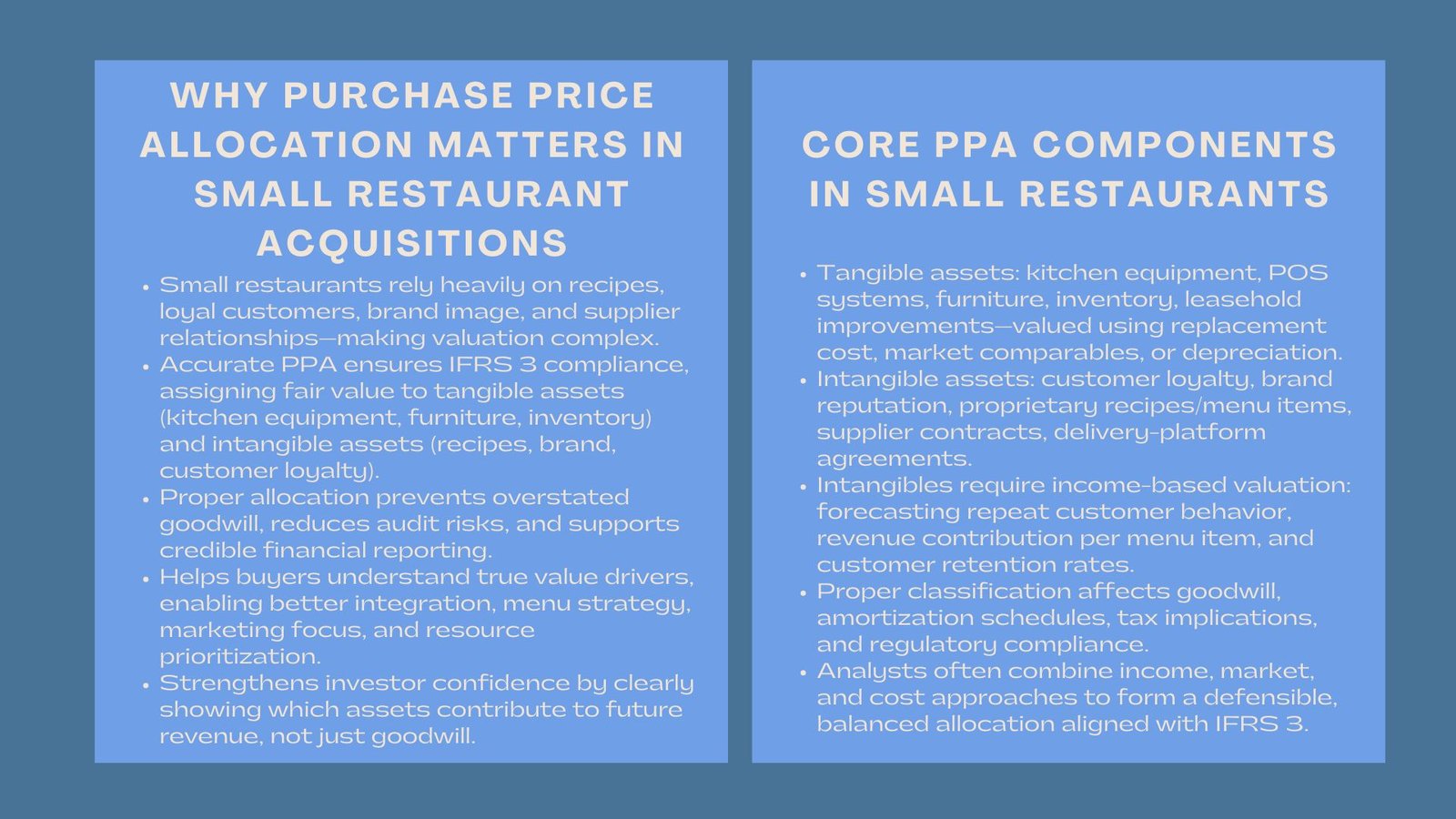

The food and beverage (F&B) business is a very competitive one. The small restaurants that depend on distinct recipes, an active customer base, and a localized brand recognition of their company are the most common sources of value. The purchase price has to be divided into tangible and intangible assets when acquiring these businesses and this task is a difficult and extremely important one. The allocation of the purchase price of the restaurant properly is not only required to ensure that accounting is done but also to facilitate strategies making, investor relations and operational planning.

In the case of small restaurants, adherence to the IFRS standards especially the IFRS 3 on business combinations will mean that all assets acquired by the restaurant will be valued accordingly. This involves tangible, e.g., kitchen equipment and furniture plus leasehold improvements, and intangible e.g. recipes, brand equity, customer relations among others, and supplier agreements. This thereby ensures that the purchase price is not overstated on goodwill, because of which a naked purchase price would avoid understatement of liabilities and ensures that the risk that may arise during audits or even regulatory inspections are taken care of.

Moreover, appropriate PPA gives the management of the restaurant a good understanding of the drivers of value, thus making it easier to integrate the acquisition posts, allocating resources appropriately and work more efficiently. Precise allocation is also in support of investor restaurant purchase price allocation confidence, since the stakeholders are able to know more the amount of the total purchase price being allocated to the assets that are capable of producing revenues in the future as opposed to goodwill or other intangible elements.

Review of Purchase Price Allocation in Small Restaurants

The Concept of Purchase Price Allocation

The process whereby the total cost of purchase of an acquisition is allocated to the identifiable assets and liabilities of the acquired business is known as purchase price allocation (PPA). In the restaurant environment, it comprises both tangible and intangible assets, including the presence of kitchen equipment, furniture, point-of-sale systems, and inventory, along with the presence of intangible assets, including the loyalty of customers, proprietary recipes, trade secrets, brand name recognition, and the ability to enter into a contract agreement with the suppliers or delivery partners.

Physical assets can be quite easily valued by replacement cost, market comparatives or accounting depreciation schedules. The intangible assets are more difficult as in most cases the worth of the asset is based on the possibility of future revenue, competitive edge and brand awareness. The proper identification of tangible and intangible assets is of great importance since it directly influences the determination of goodwill and the value of the assets after all the identifiable assets and liabilities have been identified and entered at fair value.

Strategic Implications of Accurate Allocation

Purchasing price is also strategically important, other than compliance in accounting. To illustrate this, when a large part of the purchase value is on customer loyalty or brand recognition, the management can focus their interest on the effort to retain important patrons, sustain their quality strength and ensure that brand image is still relevant in the market. On the other hand, underpricing the intangible assets could result in failure to invest in essential spheres to create more income and expansion opportunities after the acquisition.

A proper PPA process will allow management to see the most valuable assets of the business, optimize decisions during the operations and predict the predicted returns on the investment. In small restaurants, where the margins are usually very low, and the strategic approach to the operations is very important, this information may direct the hiring process and marketing approach, as well as menu creation plans, which will make the procured business achieve its maximum potential.

IFRS Reporting Considerations for F&B SMEs

Applying IFRS 3 to Restaurant Acquisitions

The IFRS 3 offers a model on how business combinations should be accounted for in terms of fair value and the fair measurement of goodwill. This is done in case of acquisitions in restaurants by carefully reviewing all the tangible and intangible properties and liabilities to make sure that the property is recorded at fair value.

Goodwill is the surplus of the purchasing price and fair of the net identifiable assets. The good will in small restaurants could consist of the value of a well-established range of clientele, a good location, reputation, and secret recipes that would yield revenue in the long term. Proper assignment of goodwill means that the financial statements will capture the economic goodwill of the acquisition process and the future impairments risk will be minimized.

Other issues that need to be recognized by the IFRS 3 are contingent liabilities and fair valuation of lease contracts, vendor contracts, employment contracts, etc. In the case of restaurants, a major part of tangible and intangible value is leasehold improvements and long-term rental contracts that are most of the time the key elements of the allocation procedure.

Challenges for Small F&B Businesses

Small restaurant owners normally experience challenges in carrying out IFRS-compliant PPA. The process may be complicated due to the limited internal resources, the absence of valuation skills, and the impossibility to quantify such intangibles like recipes, brand value, and customer loyalty. Secondly, small firms might have difficulties adopting accounting software, tracing five-year revenue trends, or using competitors in the market.

To overcome such issues, most of the small restaurants hire external valuation organizations that are specializing in the business combinations of F&B. These are the people who are equipping technical knowledge, industry experience, and are also equipped with knowledge about the IFRS 3 reporting requirements and this has ensured that the allocation process is credible, defensible and transparent. Involving this kind of expertise also enhances relations with auditors and regulators meaning that the risk of disagreements or changes is less probable.

Methods of Valuation for Restaurant Assets

Income Capitalization Approach

The income based strategy calculates values of intangibles assets using future presumed cash flows. In restaurants, this will be through the analysis of the past revenue, customer visit frequency, repeat business and expected profitability of recipes and unique products and services.

Analysts use relevant discount rates to represent market risk and uncertainty in the operations, in order to obtain the present value of these cash flows. As an illustration, customer loyalty can be analyzed through the determination of the likelihood of returning to patronage during a specified period and then multiplied by the estimated revenue per client. Proprietary recipes/menu service could have its value borrowed on its contribution to gross margin and incremental revenue growth.

Comparative Market Analysis Model

Market based valuation is comparison of the acquisition and the previous purchases of the same restaurant businesses. Although direct comparable is not a common approach in view of the uniqueness of small restaurants, the assumptions made by analysts can be tested by industry standards, which are revenue multiples, gross profits ratio, price/Revenue ratio and so on.

As an example, when a cafe with a large following of locals in a recent sale was sold at 1.5 times the annual revenue, this value can help garner the accounting of value on comparable intangibles in the purchased restaurant. Market-based valuation offers the external control to internally optimized income-based value, which would guarantee a realistic evaluation of an asset value.

Cost Reconstruction Approach

Cost-based-valuation determines the replacement of tangible and intangible assets and estimates its cost. Kitchen equipment, furniture, software systems and improvements to the leasehold are normally estimated at the current replacement costs. Although cost based techniques are easy to understand they tend to underprice the value of intangible resources like customer loyalty, brand recognition and proprietary recipes which form an important source of revenue generation.

A mix of cost-based, income-based, and market-based strategies presents a strong, justifiable approach to PPA, as tangible and intangible assets will be valued right and the goodwill will be considered a market value.

Barriers in Allocating Purchase Price for Restaurants

Estimating Customer Loyalty Value

One of the greatest intangible assets of the small restaurants is customer loyalty. The correct determination of its value takes into consideration historical patronage, frequency of customer visits and retention rates and market conditions. These factors include competition, shifting consumer preferences and the local economic conditions, which should be taken into account as well. The allocation can be skewed through over- and underestimation of customer loyalty resulting in false-stated goodwill and inappropriate strategic decisions.

Valuing Proprietary Recipes and Menu Offerings

Recipes and signature menu items are very important in earning revenues and brand identity. The worth of these assets is done by determining the profitability that they add to the company, market uniqueness and the possibility of being replicated by other competitors. The knowledge of the staff in the process of making these items should also be taken into consideration since the quality and customer satisfaction depends on the amount of knowledge they have concerning the products.

Integration and Accounting Complexities

Once an asset has been purchased, there is the need to integrate it into the accounting system of the company in which goodwill is recognized, amortization schedules, and tax implications have to be known. Small restaurants can be inferior in that aspect as they may not have the internal resources to guide such processes, but professional advice is needed. This is done by ensuring that it applies proper integration to guarantee adherence to the requirements of IFRS 3 in order to provide proper reporting, and to enable smooth continuity in its operations.

Documentation and Transparency

Making transparency, making the valuation assumptions, methodology, and supporting data information is critical to transparency, audit defensibility, and stakeholder confidence. Comprehensive reporting makes the auditors, investors and regulators perceive the reason the purchase price allocation is so and eliminates endearing the allocation decision as much as possible, thereby increasing credibility.

Core Benefits of Accurate Purchase Price Allocation

Informing Operational Decisions

An effective PPA gives the management the knowledge of the most important aspects of the business. The contribution of customer relationship, recipes, and brand recognition to revenue would help managers to make decisions of priority on investments, retention of key staffs and optimise marketing strategies.

Compliance and Risk Mitigation

Correct allocation will see to it that the IFRS 3 is being followed, auditing risk is minimized and accurate reporting of taxation. The presentation of the transparent financial statements can give the investors and other interested parties confidence that the acquisition has been evaluated to the latter, thereby building strong trust and confidence.

Long-Term Strategic Value

In addition to compliance, proper allocation of purchase price facilitates the strategy in the long-term. By defining the key value drivers, the management can prioritize the issue of maintaining the competitive advantages, retaining the loyal customers, and optimizing work. These insights increase profitability, efficiency in operations and growth prospects over time.

Illustrative Example of Restaurant PPA

Take a small restaurant which is bought at a cost of 2 million. Physical assets are cook and other kitchen equipment (400, 000), furniture and fixtures (100, 000) and inventory (50, 000). Intangible assets include customer loyalty which amounts to $300,000, brand recognition amounting to $ 200,000 and proprietary recipes amounting to 150,000. Two of the liabilities are lease obligations (100,000) and outstanding vendor payables (50,000). Goodwill or remaining purchase price would be in the form of a residual value summed to $750,000.

The example demonstrates that detailed allocation is an appropriate input to operation planning, amortization schedules and management decision making, which explains why a comprehensive PPA process can prove valuable in real world scenarios.

Conclusion

Differentiation of the purchase price in small restaurant acquisitions is a complicated procedure that includes the accounting rigour, strategic foresight, and compliance to IFRS. Fair valuation of intangible and physical assets such as equipment used in the kitchen, inventory, recipes, customer loyalty and the recognition of the brand is essential in the financial reporting, regulatory and successful integration.

Properly defined allocation of purchase prices in restaurants gives practical information on the key sources of value, can be used to make decision-making, and increases investor trust. PPA PPA done properly becomes a strategic resource, which guarantees acquisitions bring a sustainable value, operational effectiveness, and long-term growth of a competitive environment F&B IFRS reporting where non-physical resources are the key to business.