Purchase Price Allocation Basics for Professionals

Guide on Purchase Price Allocation Basics for Professionals

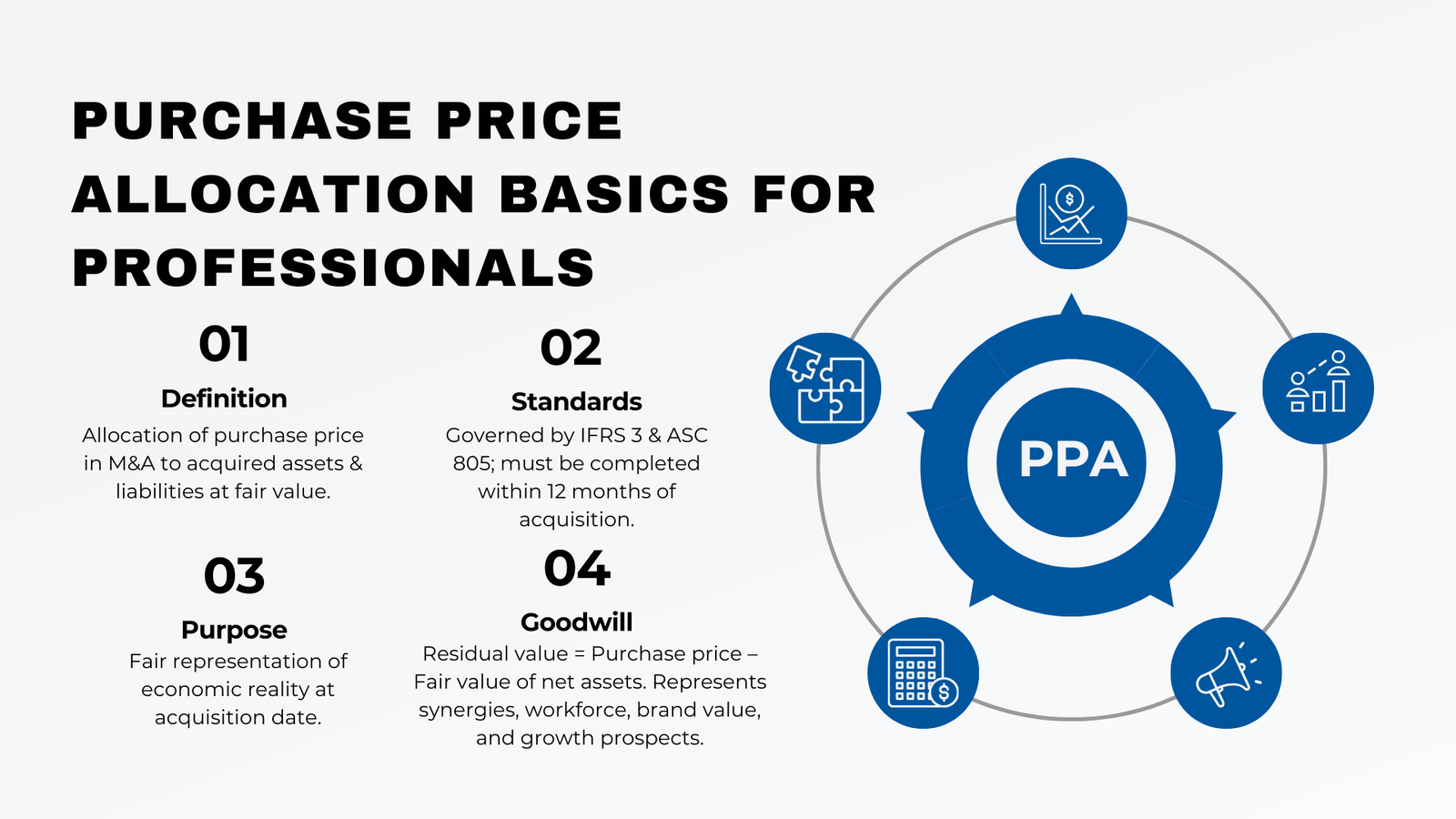

Within the context of mergers and acquisitions, Purchase Price Allocation (PPA) is a very significant process whereby the costs incurred in an acquired business are apportioned to the acquired assets and liabilities. To individuals with a career in the field of finance, accounting, or business valuation, getting familiar with the basic principles of PPA is not merely convenient; it is indispensable.

Regardless of whether you are on the buy-side or sell-side of a transaction, or advising a client through a tricky acquisition process, an excellent understanding of how PPA is applied in-line with the accounting rules such as IFRS 3 and ASC 805, would spell the difference between a compliant, intelligent report, and a report that may cause long term headaches. For this reason, many companies rely on experts who follow the best PPA valuation practices in Singapore and offer specialized purchase price allocation valuation services Singapore to ensure both compliance and strategic accuracy.

The Essence of Purchase Price Allocation

Purchase Price Allocation is the technique used whereby a purchasing company assigns the purchase price paid in purchase business combination to the assets acquired and liabilities taken according to their fair value. The accounting standards require this step and also gives a fair and true representation of the economic reality of the acquired company on the day of the acquisition. The acquisition accounting provides that after calculation of the total consideration paid, the acquirer should identify both tangible and intangible assets and also determine the liabilities that they will assume.

The difference between the purchase price at fair values and the allocations are thus noted into the goodwill column. Goodwill denotes various aspects that are synergies, value of workforce, rep of brand, and future expansion prospect, which are not individually identifiable or quantifiable.

Recognizing Intangible and Tangible Assets

Among the highly technical, and sensitive activities of PPA, is the process of identifying and valuing intangible assets. This can be the customer relationships, trademarks, intellectual property, patents, proprietary technology and non-compete agreements. Identification and valuation of these assets would entail valuation methodologies, which would include the income method and market method or the cost method all of which need serious judgment coupled with financial modelling. In this context, adopting the best PPA valuation practices in Singapore becomes critical to ensure accuracy and compliance.

Property, plant and equipment (which is tangible) is generally easier to identify yet still needs up-to-date fair values. Having physical assets at historical cost may not be the actual market value and so in numerous acquisitions it is not possible where the business has used it years past or those of such a specialized nature. Equally, the liability implied like warranties, leases, and contingent liabilities should also be measured on terms of fair value on the acquisition date.

The Accounting and Reporting Requirements

According to International Financial Reporting Standards (IFRS 3) and the U.S. GAAP (ASC 805), the acquirer must perform the purchase price allocation within a one year period that must not be shorter than the reporting date of the acquisition. In the process, the acquirer will need to conclude the fair value estimates and enter justifiable journal entries to capture the allocation both in the balance sheet and the statement of income.

Full disclosure is also required in these accounting standards. There should be a narrative and analysis of how the assets were acquired, what were the liabilities taken, and how was the obtained goodwill, as to be reported financially. Any revision to the original estimates in the course of the duration of the measurement should be given retrospective attention and accrual of changes on prior period balances might be required. Such transparency provisions are necessary to the stakeholders such as investors, auditors, and tax-authorities who rely on the quality of the financial statements regime.

Goodwill vs. Identifiable Intangible Assets

One of the other issues that the professionals encounter in PPA is the question of balance between goodwill and identifiable intangibles. The greater the distinguishable assets that can be identified and be valued, the less the residual goodwill. This has implications on the tax, amortization and impairment. Under IFRS generally all intangible assets are amortized over their useful life but an intangible asset with an indefinite useful life is not amortized but is tested to ascertain potential impairment which is annually tested.

When a large proportion of the purchase price is apportioned to goodwill without the evidence of valuations, then it can be questioned during audit procedures or tax examinations. Conversely, there is a danger of overallocation to intangible assets based on flimsy grounds which would add amortization costs, hence net income in future periods. The valuation by experienced valuation professionals as well as professional judgment is thus essential in preserving defense and parity in the PPA process.

Tax Considerations and Compliance

PPA has significant implications that extend beyond financial reporting-it has significant tax implications as well. In countries such as the United States, the Internal Revenue Service (IRS) insists on the filing of form 8594 by the acquirers and sellers with regards to reporting their purchase price allocation as a taxation measure. In this type, the total price of purchase is divided into different asset classes by which both sides have to agree on the division in order to avoid dispute or audit in future.

When individually identified and valued, any of the assets may be depreciated or amortized, which will grant the purchaser future tax advantages. Nevertheless, not every jurisdiction permits goodwill or some intangible asset to be deductible as taxes. Consequently, professionals are also expected to harmonize their PPA strategy to the requirements of financial reporting and local taxation policies to derive utmost advantage as well as remaining compliant.

One other matter of concern is transfer pricing. In the case of the cross-border entities or intra-group transfer, the allocation exercise further becomes more complicated as PPA must also meet the arm-length principles in OECD guidelines.

Strategic Implications for Business Leaders

Strategic value; aside from accounting and tax, PPA has strategic value to business leaders. An effective purchase price allocation would divulge important information regarding the purchased business. As an example, having a high ratio of value assigned on customer relationships might be evidence of a loyal and long-term profitable client base, whereas high intellectual property has the connotations of innovation and sustainable competitive advantage. These lessons are capable of advancing the planning, budgeting, and performance measurements of integration.

Furthermore, monitoring the amortization and impairment of the identified post-acquisition intangible assets should enable the management to determine whether synergies are being achieved and whether the strategic logic behind the transaction remains operative in the future. Accordingly, PPA cannot be considered as something necessary to be completed at the cost of some other consideration, rather, as something essential in post-merger corporate strategies and financial planning.

Conclusion: A Core Competency for Professionals

The purchase price allocation is an unavoidable skill that any finance, accounting, and tax practitioner that is engaged in transactions should understand the basics of. It is a synthesis of technical accountancy, financial modeling, strategic acumen and compliance, all under strict deadlines and extreme scrutiny.

The intricacy of transactions and the attention regarding the monetary disclosures will only expand as M&A keeps unfolding and rising in its scope on the global construction. Those professionals who have a strong background in PPA will not only feel confident about handling the regulatory requirements, but also will offer meaningful strategic ideas in the process. In advising clients, in internal management of acquisitions, and in preparing financials ready to be audited, it is important to know the basics of purchase price allocation in order to deliver precise, informative and value adding results.